Jon’s story.

Jon’s story.

Some financial planning techniques for retirement at age 55.

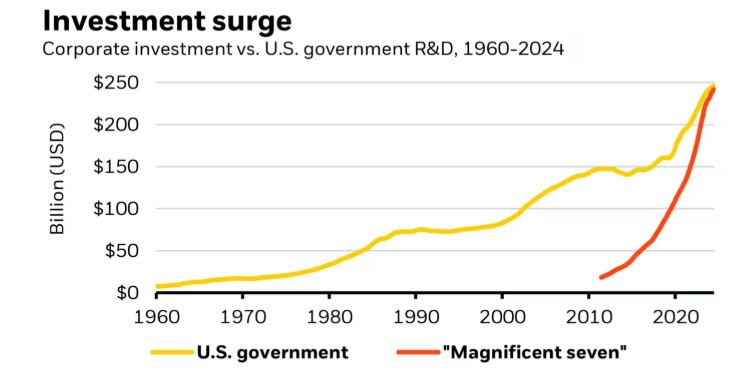

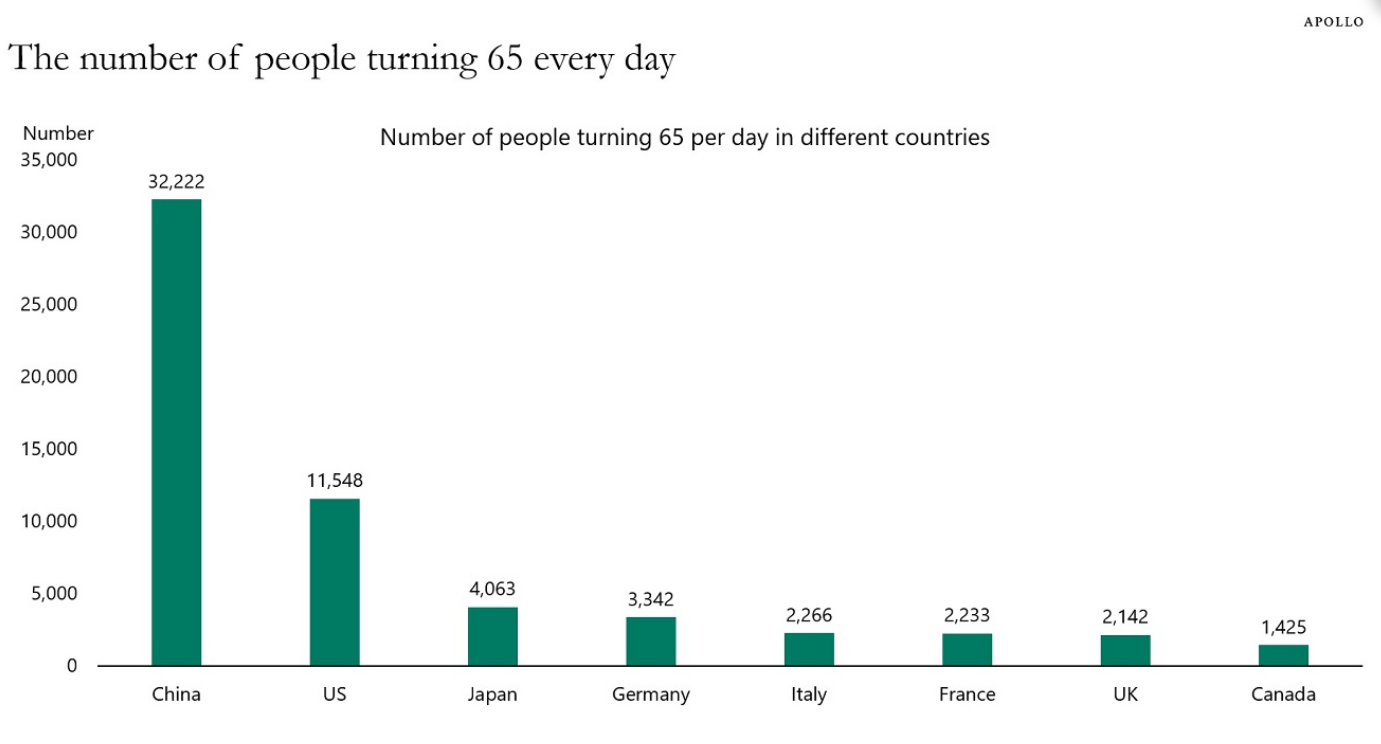

On today’s show we discuss the shrinking number of small businesses, the stock market chart of the decade, why excess capital investment in technology leads to booms/busts, the tech sector will lead to the next financial crisis, making the case for European stocks, baby boomers still rule the day, the relentless bid from 401k investors, timing the housing market, $1.2 million in credit card debt and much more.

Some thoughts on 401ks and rich baby boomers.

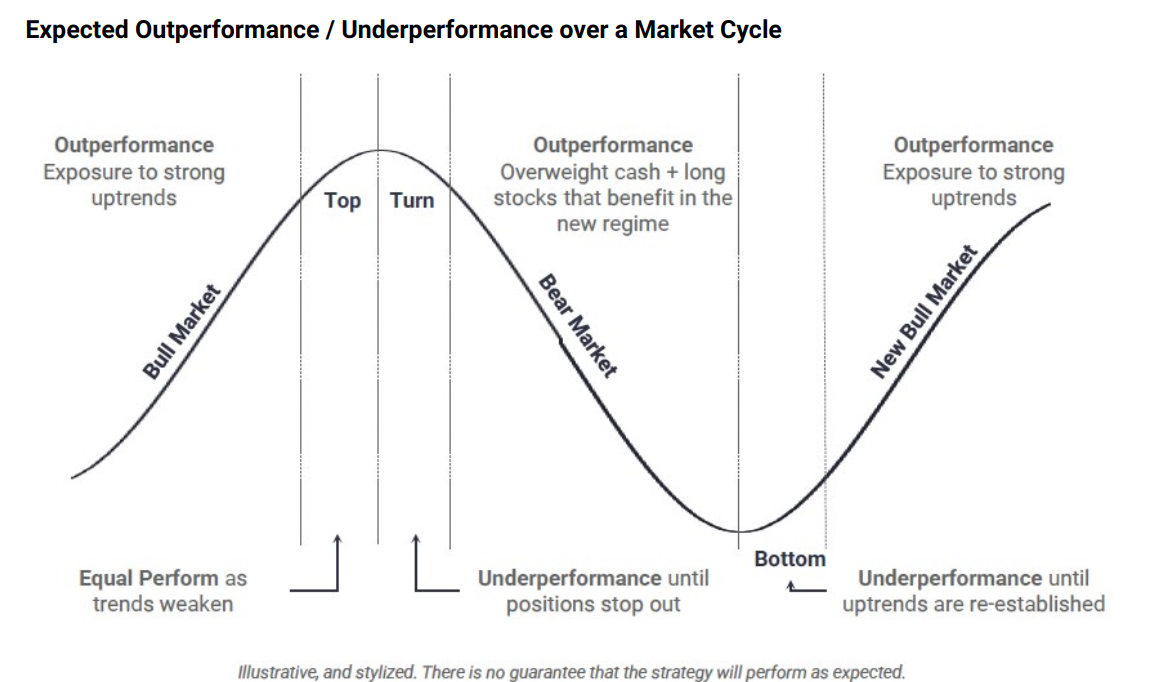

On today’s show, we are joined by Cole Wilcox, Founder and Chief Investment Officer of Longboard Asset Management to discuss if trend following still works for stocks, how to set the expectations for investors using trend following, positioning alts within a portfolio, and much more!

A random assortment of things I’ve been thinking about, reading about and watching of late.

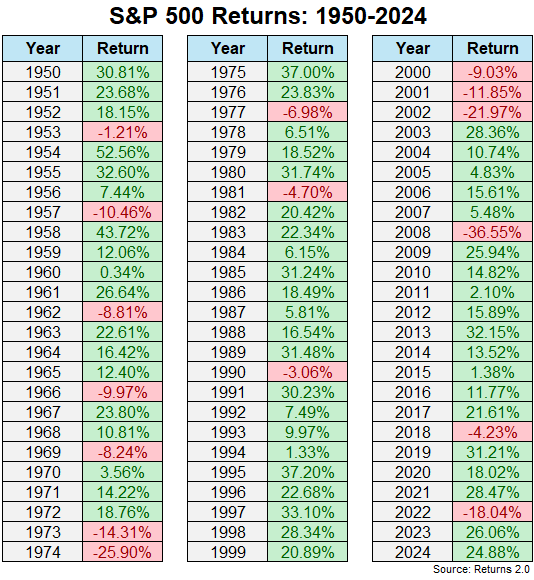

A closer look at the long-run returns on the stock market.

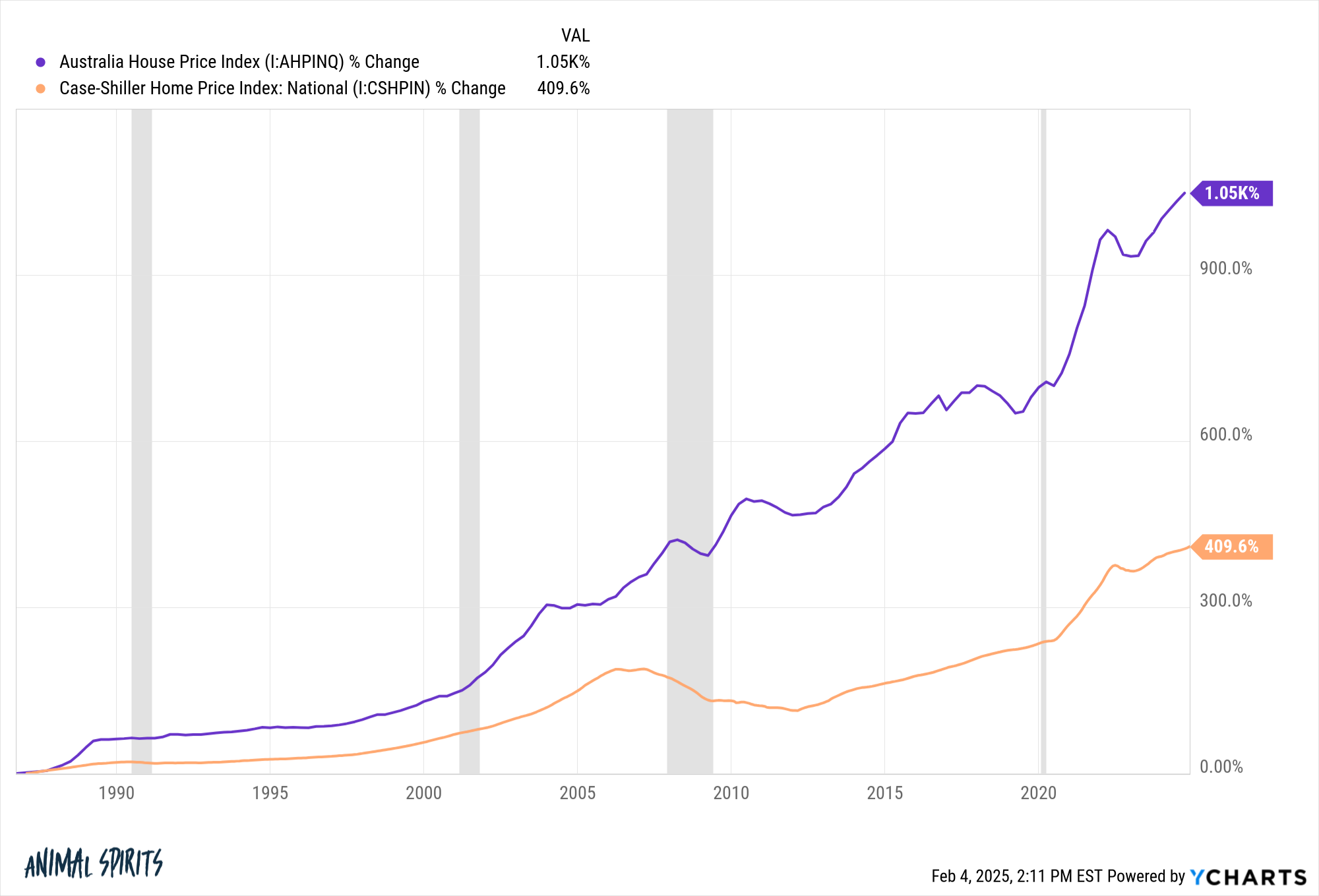

A closer look at Australian housing prices.

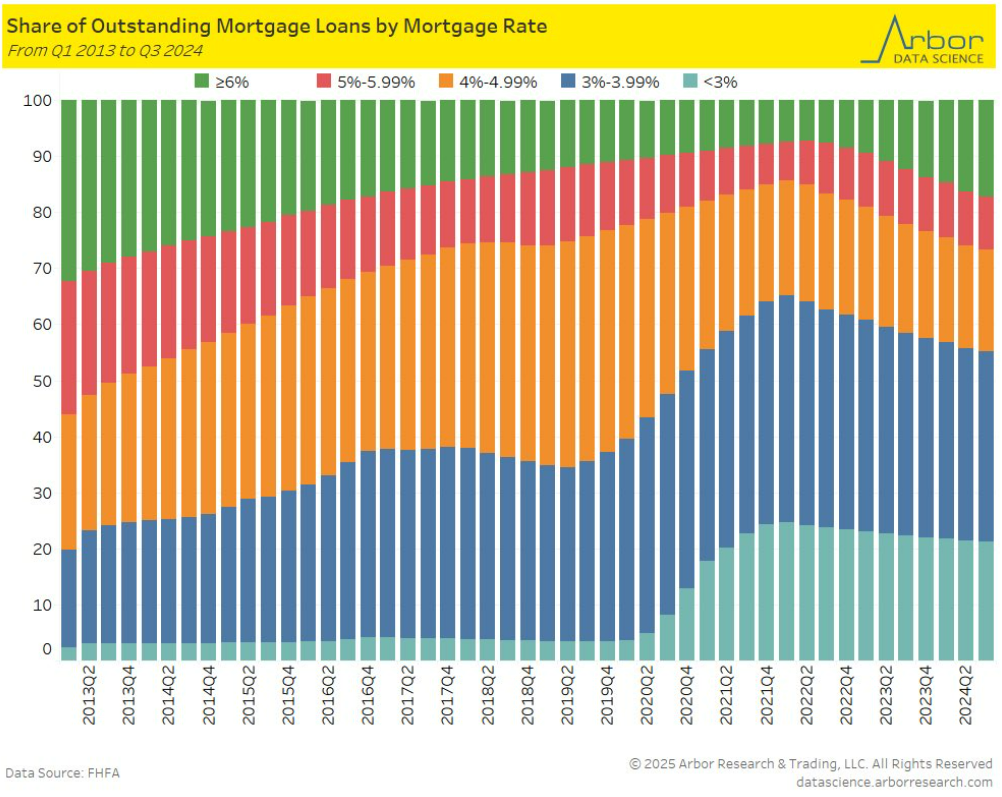

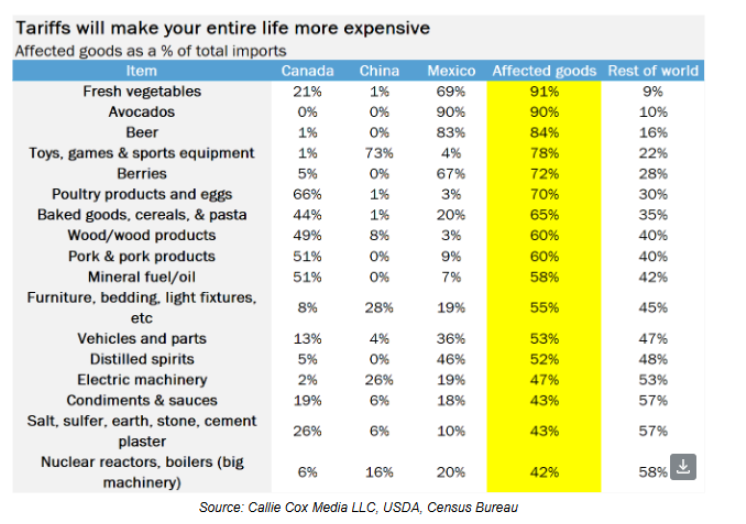

On today’s show we discuss the financial impact of tariffs, why AI could save the stock market, market return assumptions for the next decade, the Vanguard Effect, levered ETFs, AI Ben, crypto is not a tariff hedge, using Bitcoin instead of a 529 plan, the remodeling boom, peer pressure from friends to go skiing and much more.

Some thoughts on tariffs and Apollo 13.