“Stocks are a piece of ownership in a firm. Taken together, stocks represent the collective wisdom of the business world. And they represent the promise of future technological advances and future profits from those innovations.” – Ken Fisher

There will always be two sides to every argument in the financial markets. And most of the time both sides are wrong and the market just does what it wants to do. No matter what the actual numbers tell us there is always a spin you can put on the outcome based on your positioning.

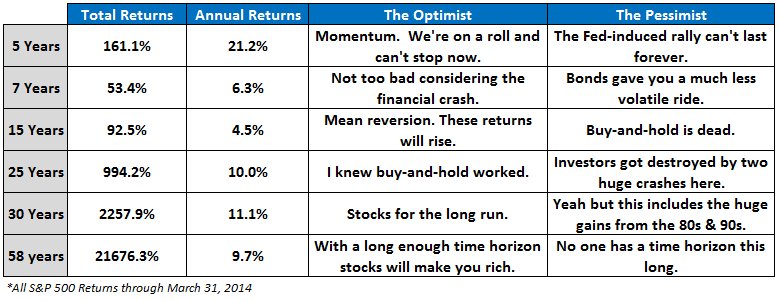

Here is some longer-term S&P 500 performance data with the typical arguments from both the glass-is-half-full and the glass-is-half-empty crowds depending on the numbers and thought process (click to enlarge):

Although each of these performance figures has the same exact end date, you could conceivably build a pro or con case depending on your agenda or your thoughts on the markets based on the starting point.

I definitely lean to the optimistic side of the aisle, but that doesn’t mean I’m a perma-bull nor do I think anyone else should be. That’s how overconfidence can cloud your decisions and ruin a good process.

These numbers do tell a good story though. Over the very long-term, things have worked out extraordinarily well for equity investors. But over shorter time frames anything can happen and there are periods of below-average performance. If you have decades in which to invest, you have to be able to balance a sense of rational optimism with the reality of the current time and place in the markets.

And remember that there will always be asterisks, caveats, ifs, buts, footnotes, grains of salt, howevers and having-said-thats when dealing with the complexities of the financial markets. Intelligent arguments can always be made in both directions depending on your time horizon, perspective, portfolio positioning, experience in the markets and your reference point.

Any argument can sound intelligent coming from the right source at the right time depending on your mood. Some of these arguments could be the reason for market movements at times. The problem is that no one really knows what’s moving the markets, especially over the short-term.

It makes us feel more comfortable if we are able attach reason to market moves as it relates to our own portfolios. Part of the allure of the stock market, beyond the obvious wealth creation capabilities, is the fact that there is always something to argue about and debate.

The funny thing is both sides can be “right” in their line of thinking depending on the time horizon used and perfect hindsight using historical data. It’s the future that tends to make things messy.

Subscribe to receive email updates and my monthly newsletter by clicking here.

Follow me on Twitter: @awealthofcs

[…] The Argument […]

well done, is there a spot in the middle for the “realists” among us that choose to play only when one of these camps is in retreat from an overplayed hand?

I would say the realists that play in the middle have the biggest opportunities because of the fact that so many are focused on the extremes at both ends. Those that don’t get swept up by the euphoria and fear are in the best position to take advantage.

[…] Which Side of the Argument Are You On? (A wealth of Common Sense) […]

[…] Side of the Argument Are You On? (Ben Carlson with A Wealth of Common Sense) “There will always be two sides to every argument in the financial markets. And most of the time […]

[…] Side of the Argument Are You On? (Ben Carlson with A Wealth of Common Sense) “There will always be two sides to every argument in the financial markets. And most of the time […]