When we purchased our new home in 2017 our realtor suggested we use a local credit union for the loan since he had a solid relationship with them in the past.

I had never used a credit union before but knew they were competitive with their rates.

So I was excited to learn Lake Michigan Credit Union offered a checking account that pays 3% interest.

At the time, yields were more competitive everywhere else but earning 3% for money just sitting in your checking account is a pretty good deal.

And it is a pretty good deal but not as great as I originally thought. There are some stipulations:

- You have to set up direct deposit that hits your account monthly

- You need a minimum of 10 debit card transactions per month

- You need a minimum of 4 logins to your online banking per month

- You must sign up to receive your statements online

- Interest is not paid on balances over $15,000

Despite these stipulations, I figured it was still worth it so I signed up and gave it a try. After a few months, I quickly learned it was not worth it.

I use my credit card for every purchase I can to receive rewards points so throwing in the 10 debit card purchases turned out to be a pain. I found myself going to the grocery store more than once to buy 10 packs of gum in separate transactions just to hit my limit.

More than once I had to call customer service to learn why my monthly interest payment wasn’t paid out. One time they told me my direct deposit hit the account a couple of days late because it came in on a weekend. Another time one of my debit card purchases didn’t settle in time. Or I forgot to log in to the online banking portal enough times.

Once you realize 3% on the $15,000 limit is $450 a year in interest, jumping through all of these hoops was more trouble than it was worth. Now $450 is not nothing but I found it wasn’t worth going through a checklist every month to ensure I had enough transactions and logins to earn it.

The reach for yield here wasn’t worth it for me because the reward wasn’t worth the inconvenience. So I stopped using this account and just keep that money in my online savings account instead.

This is true for those who are constantly changing their savings account to the place with the highest yield. A 1% increase in your savings account is worth an extra $100 a year in interest paid on every $10,000 you have in savings. And finding that extra 1% in today’s low yield environment is not easy. The best you can do in most cases is an increase of 20-30 basis points which isn’t worth the hassle of opening and closing accounts over and over again.

You’ll save far more money and headaches over time by refinancing your mortgage to a lower rate or taking on a lower car payment than constantly changing your savings account based on the one with the best yields that particular week.

Len Kiefer had this great chart recently where he showed borrowers cut their interest rate by 25% on average when refinancing in the 2nd quarter of this year:

In the second quarter of 2020, mortgage refinance borrowers cut their interest rate by 25% on average

For example, going from a 4% note rate to 3% pic.twitter.com/ALFR9g2QCI

— 📈 Len Kiefer 📊 (@lenkiefer) September 28, 2020

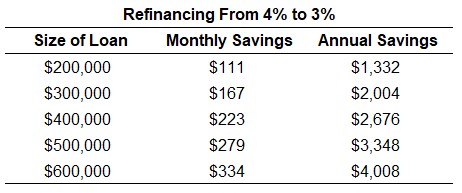

If you have a $200,000 mortgage balance that’s a savings of $111/month or more than $1,300/year by going from 4% to 3% on a 30 year loan. The savings get bigger the higher the loan value:

This is real money and worth far more than chasing yields by hopping from savings account to savings account just so you can tell all of your friends you have the highest yield out of every option on the market.

If the Fed is serious about keeping short-term rates at zero until 2023 at the earliest, you better get used to earning next to nothing in your FDIC-insured liquid savings account for some time.

There will be people and firms making promises about the ability to pay you higher yields. Those higher yields will always come with a side of higher risks, inconvenience or false promises.

Unfortunately, it’s going to be very difficult to earn income on assets you would like to keep safe in the years ahead.

It’s worthwhile to perform a cost-benefit analysis before trying to earn higher yields elsewhere. Your time will likely be better spent focusing on other big picture items in your financial life.

Further Reading:

Interest Rate Chasing in You Savings Account