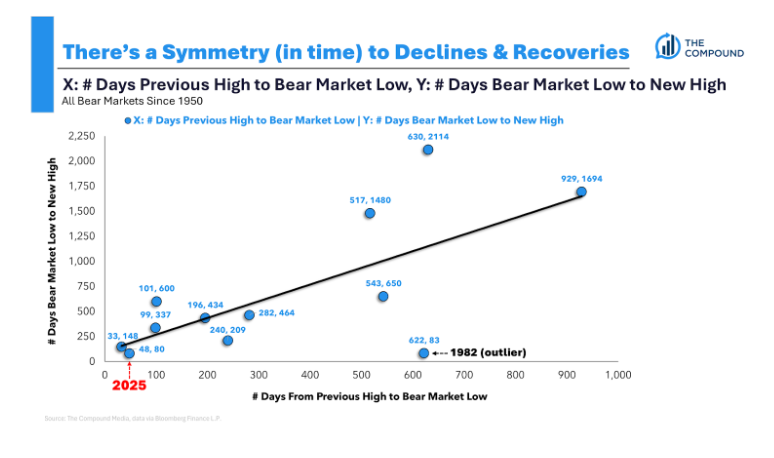

How does this cycle come to an end?

How does this cycle come to an end?

Some thoughts on the CFA vs. CFP.

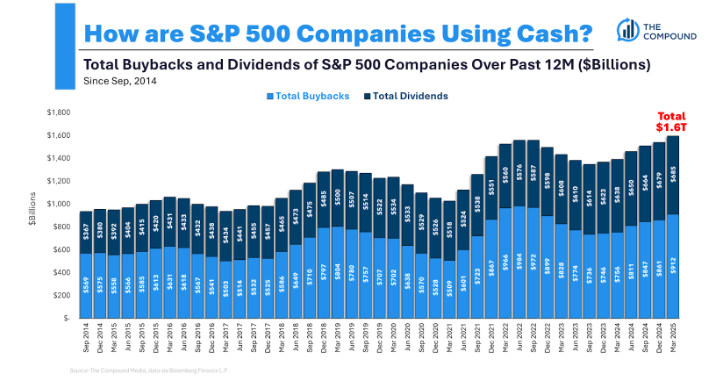

On today’s Animal Spirits we discuss a nervous stock market rally, U.S. corporate exceptionalism, how the stock market bottoms, the worst decade ever for bonds, rich people who don’t feel rich, Apple vs. Meta, Bitcoin’s market cap, the upper middle class is getting too crowded, private equity vs. youth sports and more.

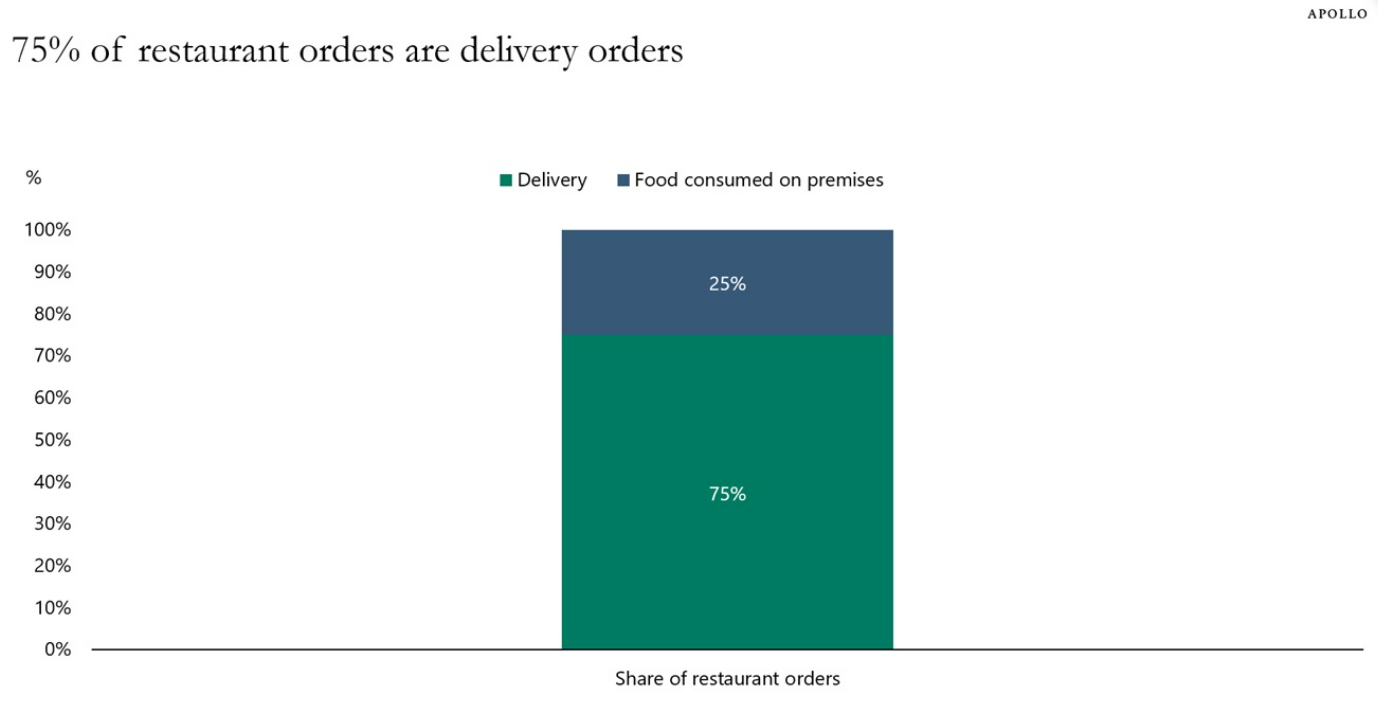

Some questions about AI, Doordash, Blockbuster, baby boomers in the housing market, $50k cars and more.

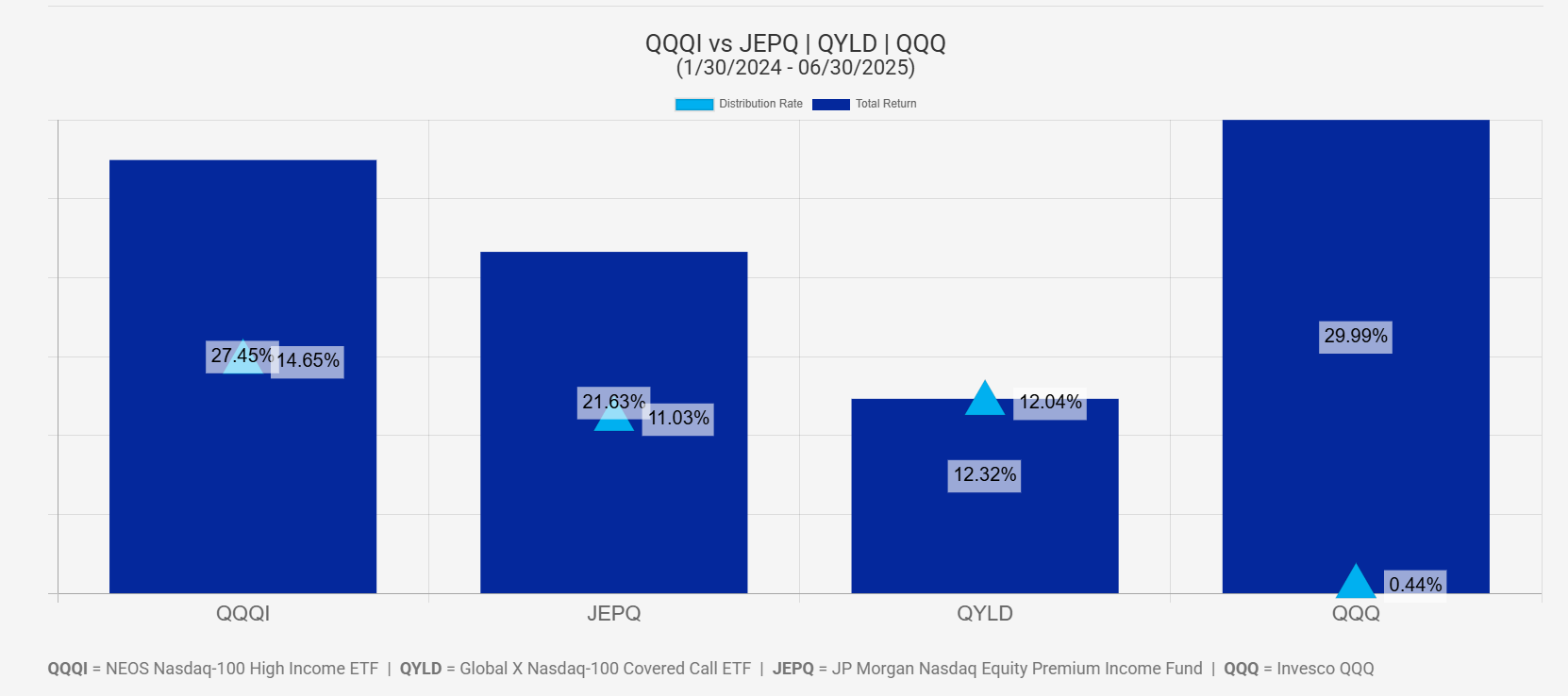

On today’s show, we are joined by Garrett Paolella, Co-Founder and Managing Partner of NEOS Investments to discuss losing upside to cover downside, surviving bull markets, volatility across indices, fitting these strategies within a portfolio, and much more!

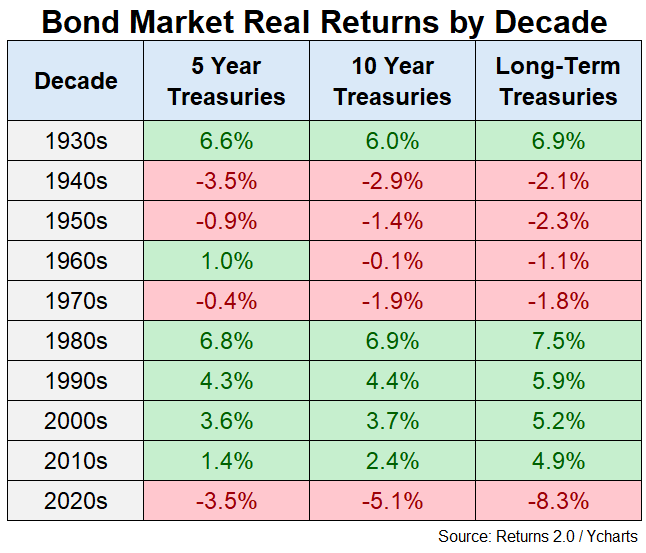

The 2020s have been a terrible time for fixed income investors.

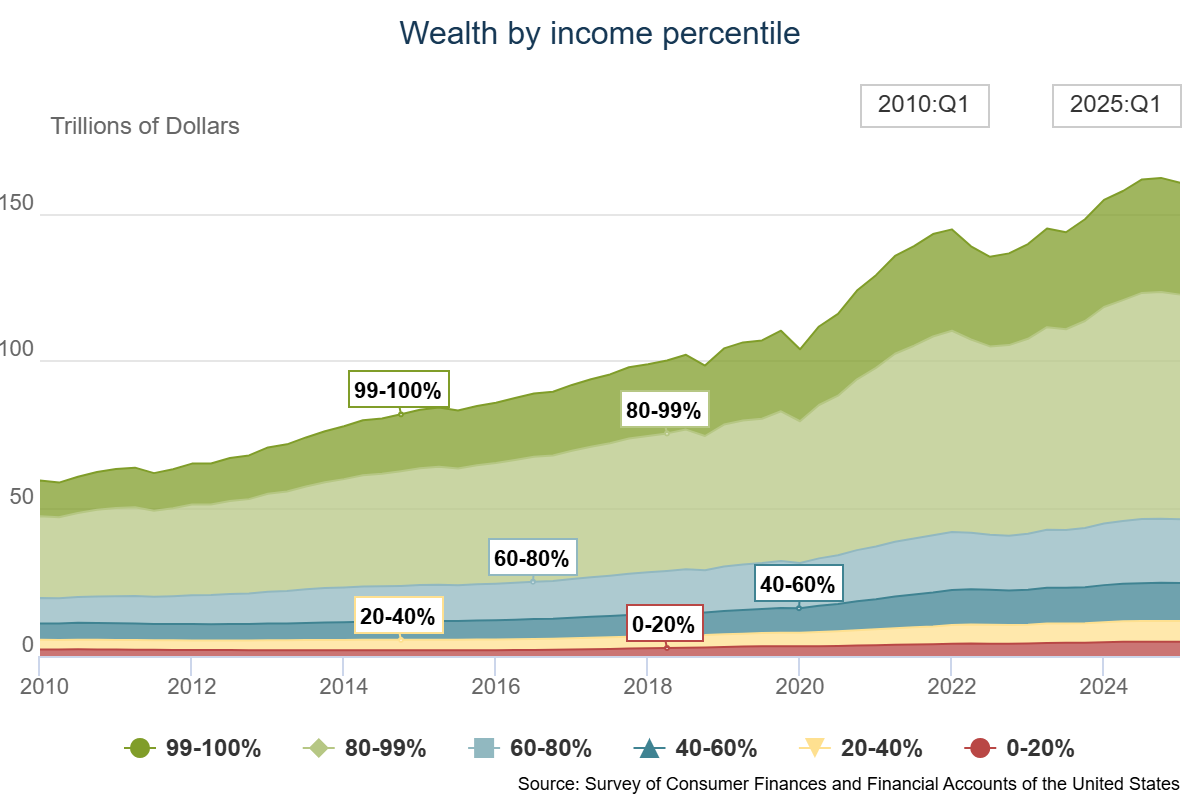

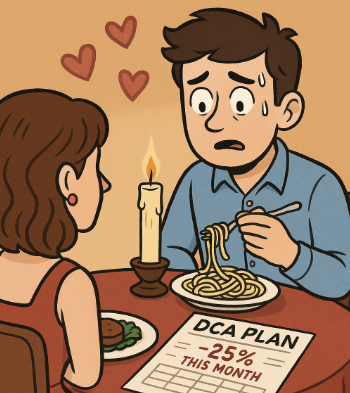

Rich people who don’t feel rich.

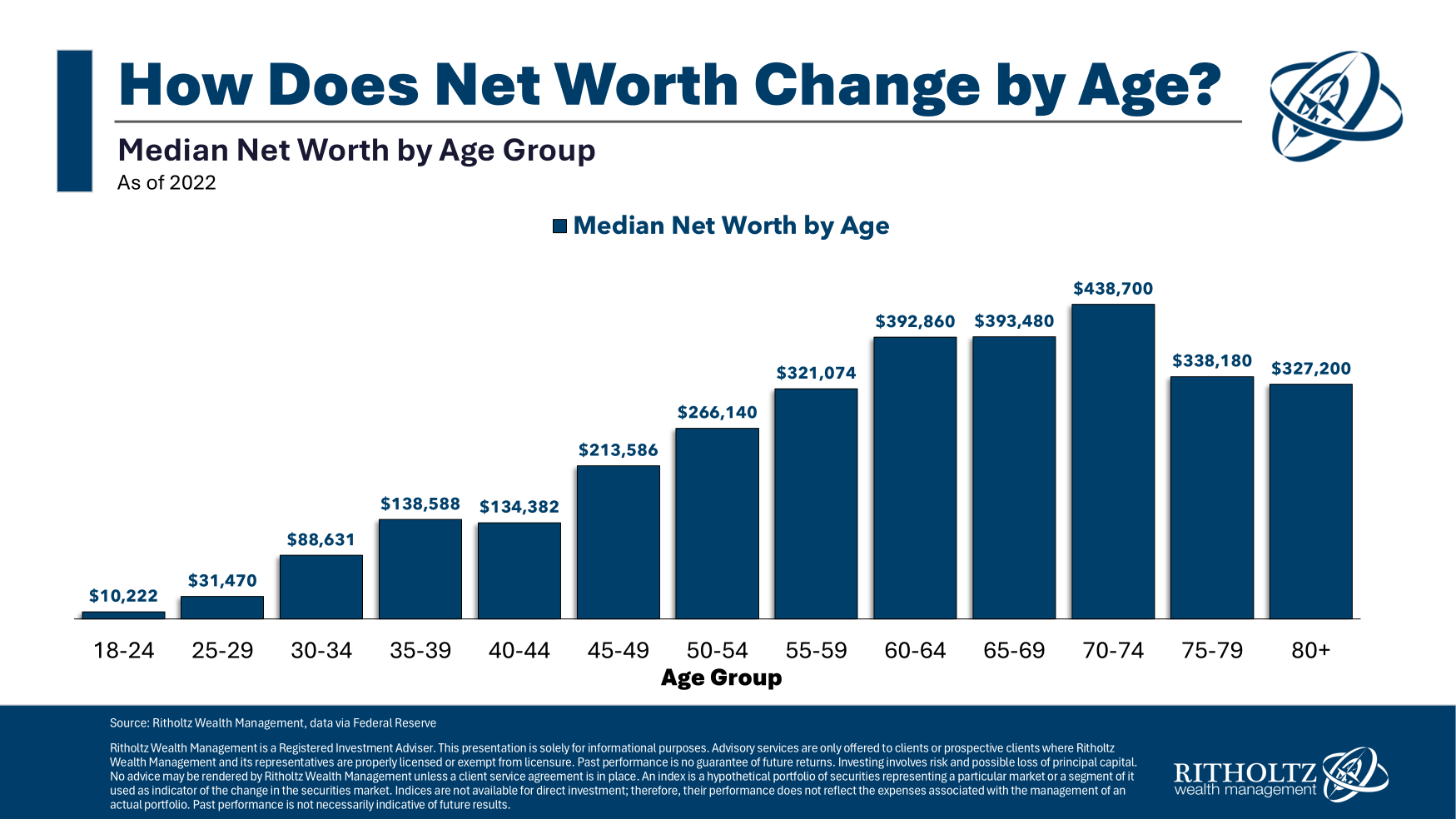

How to set the right benchmarks for your savings.

On todays’ show we discuss faster recoveries in the stock market, the potential for an even longer bull market, pros and cons of deregulation, zooming out on the dollar, why taxes never rise, a weak jobs market for college grads, life in 1776, making $250k a year and still not feeling rich, the worst housing market in America, $1,000 car payments and more.

There has never been a better time to be an individual investor than right now.