During the Gilded Age, the place to summer if you were a member of the elite class was Newport, Rhode Island.

Rich people back then loved to party. And those parties cost a lot of money.

A newspaper at the time wrote of the wealthy class in Newport that they “devoted themselves to pleasure regardless of expense.” A member of the elite class corrected the story by pointing out that, no, what they did was”devote themselves to expense regardless of pleasure.”

Arthur Vanderbilt wrote about these parties in his book Fortune’s Children:

Bessie Lehr remembered Mrs. Pembroke Jones telling her “that she always set aside $300,000 at the beginning of every Newport season for entertaining. Some hostesses must have spent even more. A single ball could cost $100,000, even $200,000. No one considered money except for what it could buy.”

Mind you, this was back in the late-1800s. This would be millions in today’s dollars.

At one dinner party guests ate on horseback in the ballroom (with the horse hooves covered in rubber pads to protect the floors, of course).

Another party served oysters stuffed with black pearls as party favors. Then there was the soiree that brought in a pile of sand filled with rare gems that required guests to dig with toy shovels to find them.

My favorite anecdote of disgusting excess was the party host who handed out cigarettes rolled in one hundred dollar bills. Literally lighting money on fire!

If I’m being honest, these parties sound amazing.

Today’s wealthy class flaunts their money for sure but you don’t get the same sense of fun when it comes to spending.

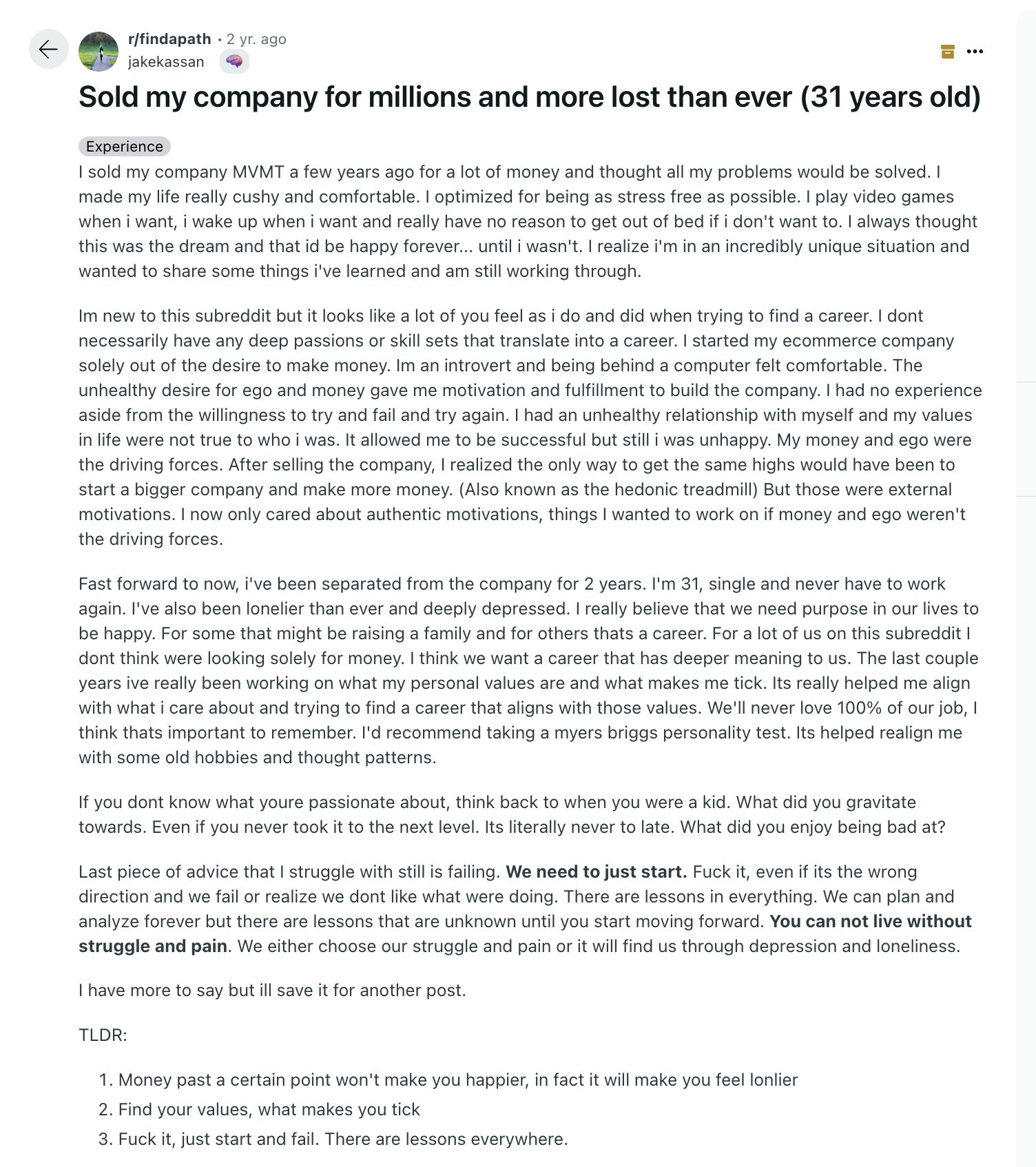

The founder of MVMT1 sold his company for $100 million at age 27. I just came across his Reddit post about what that money has done to his life:

In summation, getting fabulously wealthy did not make this guy happier. In fact, it sounds like all of that money made him slightly miserable.

It doesn’t seem like he’s having nearly as much fun as the Newport crew back in the day.

I know, I know, the world’s tiniest violin.

Loom co-founder Vinay Hiremath wrote a blog post called I am rich and have no idea what to do with my life recently with similar thoughts about what it’s like to make more money than you could spend in 10 lifetimes:

Life has been a haze this last year. After selling my company, I find myself in the totally un-relatable position of never having to work again. Everything feels like a side quest, but not in an inspiring way. I don’t have the same base desires driving me to make money or gain status. I have infinite freedom, yet I don’t know what to do with it, and, honestly, I’m not the most optimistic about life.

His company sold for $975 million. I guess it’s good to know once and for all money will not fill a hole in your heart. Money can make you more comfortable but not content.

It sure seems like uber-rich people of the Gilded Age had it figured out. They spent extravagantly and had a good time. Isn’t that what money is for? OK, not really but surely they weren’t so anxious about their giant piles of money, right?

Actually…

William Vanderbilt was the son of the great Cornelius Vanderbilt. When his father died, Cornelius was the richest person on the planet. Billy took his father’s wealth and almost immediately doubled it with some shrewd business maneuvers.

Being the richest rich person didn’t make him any happier:

The sheer magnitde of his fortune, he told Chauncey Depew, gave him no advantages over men of moderate wealth. “I have my house, my pictures and my horses, and so do they. I can have a steam yacht if I want to, but it would give me no pleasure, and I don’t care for it.” On another occasion he spoke of a neighbor saying, “He isn’t worth a hundredth part as much as I am, but he has more of the real pleasures of life than I have. His house is as comfortable as mine, even if it didn’t cost so much; his team is about as good as mine; his opera box is next to mine; his health is better than mine, and he will probably outlive me. And he can trust his friends.”

Being the richest person in the world brought him, he said, nothing but anxiety.

I like to say there is always someone richer than you but that wasn’t true with him. And he was still anxious!

In my money management career I’ve worked with people who have thousands of dollars, hundreds of thousands of dollars, millions of dollars, tens of millions of dollars, hundreds of millions of dollars and billions of dollars.

I’m overgeneralizing here but the sweet spot for being really rich but not feeling overwhelmed by the pressure of the wealth is somewhere in the $7-10 million range.2

The problem is every strata of wealth on the spectrum inevitably wishes they were in the next rung up. It’s never enough.

The perfect level of wealth is the one you’re content with.

Unfortunately, many people never reach true contentment, no matter how much money they have.

Further Reading:

Creating Generational Wealth

1I like MVMT. I’ve purchased both watches and sunglasses from them. Quality stuff and not too expensive (wait for the sales).

2I would love a study on this but feel like my estimate here is correct.