Personal finance was my first love in the money world.

I was a saver before I ever knew what investing even was. Yet my relationship with personal finance has evolved as I’ve aged and changed my habits.

Many of the personal finance rules written in stone will always apply.

Live below your means. Pay yourself first. Stay out of credit card debt. Save for emergencies.

However, there are other personal finance commandments I don’t completely agree with anymore.

You don’t have to agree with me either but here are some personal finance ideas I’ve changed my mind about over the years:

Paying off a mortgage early is a bad idea. I see the appeal of paying off your house free and clear.

More flexibility. Freed up cash flow. Freedom from mortgage debt.

I get it from a psychological perspective. Money is more about emotions than spreadsheets, blah, blah blah.

It still makes no sense to me, especially if you locked in a 3% mortgage.

After refinancing the mortgage on our first house I made double payments for a number of years. After selling the house I realized that money was just sitting there in my illiquid house doing nothing.

It was pointless. A concentrated opportunity cost over my head.

I took out a bunch of debt when rates were at 3%. I wish I would have taken out more.

I know some people can’t handle debt responsibly. But tax-advantaged debt on the best inflation hedge available sounds like a wonderful deal to me.

As long as it’s paid off by the time I retire that’s good enough for me.1

Frugality is overrated. I subscribe to living below your means. How else are you going to build wealth if you don’t spend less than you earn and save the difference?

But most personal finance experts take this to the extreme.

They make you feel bad for spending money. They want you to live a pitiful existence now to save money for your future self. Except once you become your future self you can’t force yourself to actually spend the money so you save for the sake of saving.

I’m over that line of thinking.

Yes, you need to delay some level of gratification to get ahead in life. But I don’t see the point in delaying all gratification to live like a cheapskate.

Being frugal can only take you so far in life.

True personal finance experts realize earning more money is how you actually get ahead with your finances, not obsessing over every little purchase.

A higher income can take you further than frugality when it comes to supercharging your finances.

Buying stuff is OK. There are plenty of personal finance books about getting out of debt, saving money and investing.

No one ever talks about how to spend money. Spending is always frowned upon.

I used to adhere to this line of thinking.

I don’t anymore.

Don’t get me wrong — I’m still not a fan of wasting money. There are certain things I refuse to spend a lot of money on — fancy restaurants, luxury clothing, high-end furniture, expensive watches…stuff like that.2

But there is stuff I enjoy spending money on. Experiences still have a bigger bang for the buck but there are material possessions that bring me joy.

I like buying new clothes and jackets and shoes. Sprucing up the house too. I got a new TV recently and it *gasp* made me happier! I love watching TV shows, sports and movies on a gigantic HD screen.

Spending money isn’t going to fill some hole in your life but you shouldn’t feel bad about spending money on things you enjoy.

The whole point of earning money is to spend it someday. You just have to prioritize the things that matter to you.

No one knows what their enough is and that’s OK. The people who say they have enough are probably lying to you.

The ever-elusive balance between now & then is a pipe dream. No one ever completely figures it out.

That’s why even retirees who amass a healthy nest egg have trouble spending their money in retirement.

No one is ever happy with their station in life either.

The Wall Street Journal recently shared research on how much money people need to make to be happy:

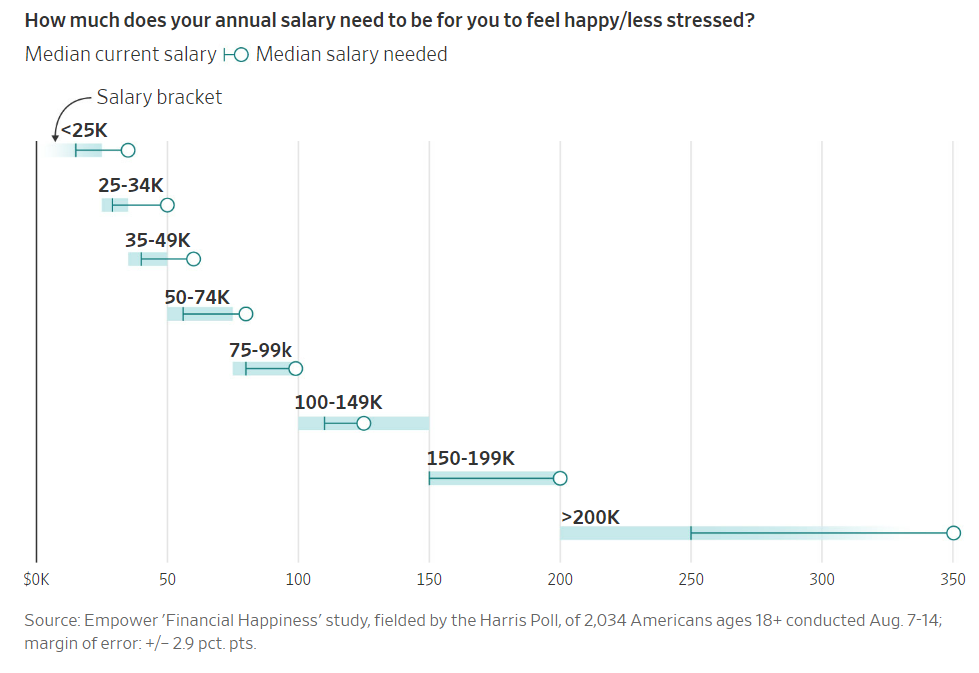

In the survey, most people said it would take a pretty significant pay bump to deliver contentment. The respondents, who had a median salary of $65,000 a year, said a median of $95,000 would make them happy and less stressed. The highest earners, with a median income of $250,000, gave a median response of $350,000.

This chart is equal parts tragic and bullish:

It’s tragic because it shows contentment is basically impossible to find. Regardless of how much you make, you’ll always want more. The goalposts just keep moving.

While it’s tragic on an individual level it makes me bullish on us as a species.

No one is ever happy so we keep striving. We keep innovating, making progress, producing profits, spending more and doing our damnedest to earn more.

The fact that no one is ever comfortable with their level of income or wealth is long-term bullish for humanity.

Michael and I talked about paying off debt, buying stuff and why no one is ever happy with how much they’re making on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

You Probably Need Less Money in Retirement Than You Think

Now here’s what I’ve been reading lately:

- The downsides of diversification (Dollars and Data)

- RIP Goldman Sachs (Business Insider)

- The cost of progress (Young Money)

- The most important investment decision you’ll ever make (Safal Niveshak)

Books:

1And it’s possible I’ll decide even that doesn’t make sense if rates are low enough in the future.

2I’m not judging these spending categories either. As long as you’re saving money, spend on the stuff you want.