A reader asks:

I am roughly 100% equities, a mix of S&P and global stock indices. I have now ridden out the GFC, COVID and other downturns and trust myself not to sell in the downturn. My wife and I have had good returns but I was wondering if holding a portion of stock in bonds as dry powder to invest in downturns wouldn’t be a better strategy. With fixed income earning decent returns now it may make more sense. Would the following strategies be better:

-

- Hold 10-20% in bonds and convert to stocks when they are down 20%

- Hold 10-20% in bonds and convert to stocks when they are down 10%

Would an investor be better off in these situations than just sitting in 100% equities all the time?

In theory this strategy seems to make sense.

Buy the dip when there is blood in the streets and be greedy when others are fearful and all of the sayings. My only concern in the implementation of this strategy.

Let’s look at the historical drawdown numbers to see how often you would have been able to implement such a strategy in the past.

This is how often the S&P 500 has been below all-time highs from different thresholds since 1950:

Roughly one-third of the time since 1950 the S&P 500 has been in a drawdown of 10% or worse. My findings also show two-thirds of all years experience a 10% peak-to-trough correction at some point during the year. Historically there have been plenty of opportunities to buy the dip.

Hitting the 20% threshold doesn’t happen quite as often – more like one out of every 6 years.

The S&P 500 has experienced a double-digit correction in 6 out of the past 10 years. Two of those years (2020 and 2022) were bear markets with losses of 20% or worse.

So let’s say you move 20% of your portfolio into bonds and decide to buy every time the stock market falls 10%. It’s a rules-based approach, which is nice, but it requires two different rules — when to buy and when to sell.

If you stick with your plan and use your 20% in fixed income as dry powder to buy when stocks are down 10% that’s going to feel pretty good. Buying when stocks are down is a pretty good long-term strategy.

Buying is the easy part. Now what? When do you move back into bonds? Timing the market requires both buying and selling — you have to be right twice.

The problem is that although corrections are a normal part of a functioning stock market, there are environments where corrections don’t occur for a very long time. Take a look at the time in-between 10% corrections for the S&P 500 going back to 1928:

There have been more than 20 instances when there was more than a year between corrections. On nine different occasions it was two years between corrections. And there were five times when there was a drought of three years or more before another correction. The longest period was from 1990-1997, a full seven years without a single correction!

Would you be able to handle a situation like that? Would your rules change? Would you be able to stay invested in fixed income that whole time when there isn’t an opportunity to buy the dip?

Coming off the pandemic lows the S&P was up well over 100% before experiencing another double-digit correction.

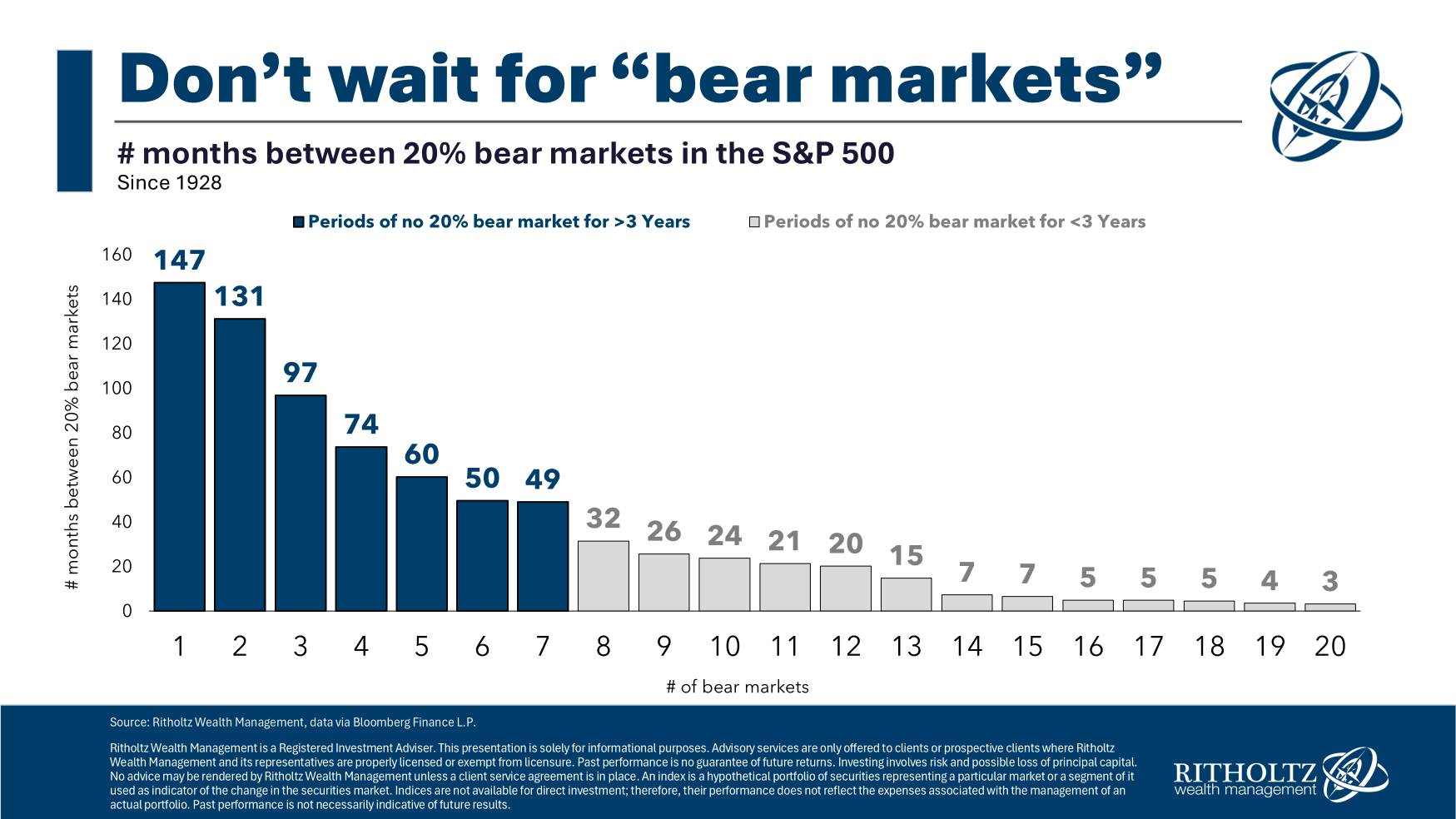

Waiting for a bear market can take even longer:

There have been seven different time frames where there with more than three years between bear markets. The longest such period was more than 12 years!1

That’s the scenario that worries me when the stock market doesn’t cooperate.

Sure, you could add more rules that give you more leeway in either direction but I’m not a fan of making the investment process more and more complex.

This is the kind of strategy that will play head games with you because it requires an iron will to follow.

I much prefer picking an asset allocation — 90/10, 80/20, 70/30, etc. — occasionally rebalancing and sticking with it come hell or high water.

Fixed income still acts as your dry powder in this scenario but there’s far less brain damage along the way.

Buy the dip sounds great and all but there are a lot of landmines with this kind of strategy.

I covered this question on this week’s Ask the Compound:

Callie Cox joined me to discuss questions about when to sell Nvidia, how strong the U.S. economy is, how AI could impact the stock market and what to do when you become too emotional about your stocks.

Further Reading:

What Does a Healthy Correction Look Like?

1This was in the late-1980s and 1990s.