One of my favorite ongoing economic stats is the fact that the U.S. economy has been in a recession for just two months out of the past 15-and-a-half years.

We’ve been in a recession just 1% of the time since the end of the Great Financial Crisis in the summer of 2009.

Sure, there have been some bumps along the way but the U.S. economy has been remarkably resilient throughout the 2010s and 2020s.

Recessions used to be far more prevalent in the United States.

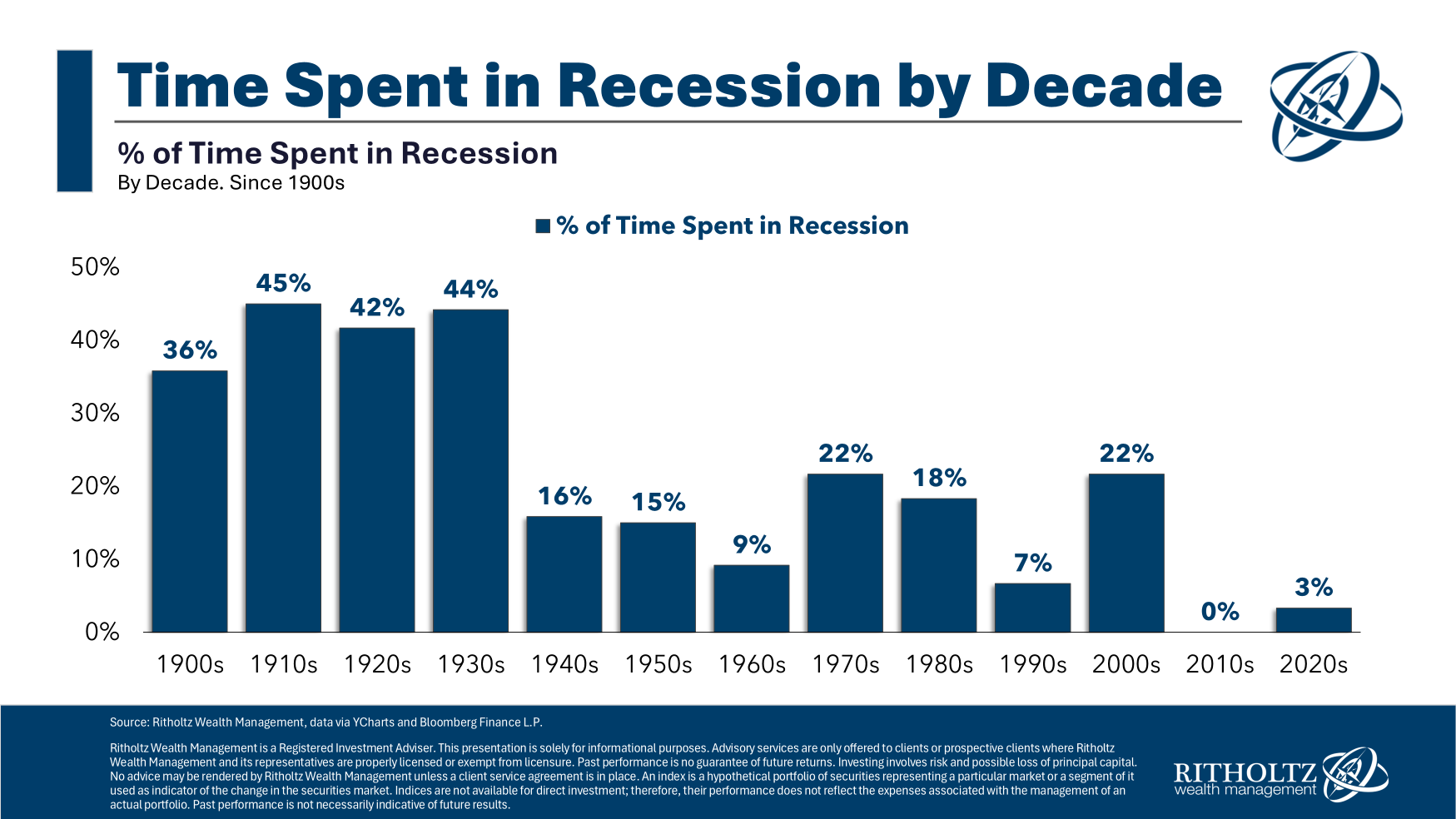

Using data from the National Bureau of Economic Research, I calculated the percentage of time we were in a recession in every decade going back to the 1900s:

The U.S. economy spent a lot of time in a recession during the first four decades of the 20th century. It basically took World War II to change the economic landscape.

Some people might quibble with economic data from 100+ years ago and that’s fair but this makes sense when you think about it. The U.S. economy is far more dynamic and mature these days. We were still more or less an emerging economy back then. There are more checks and balances in place today that didn’t exist in the old days.

But the trend is clear — our economy is contracting at a far lower rate than it did historically. This is progress.

The stock market isn’t the economy but bad economic times are typically bad for the stock market.1

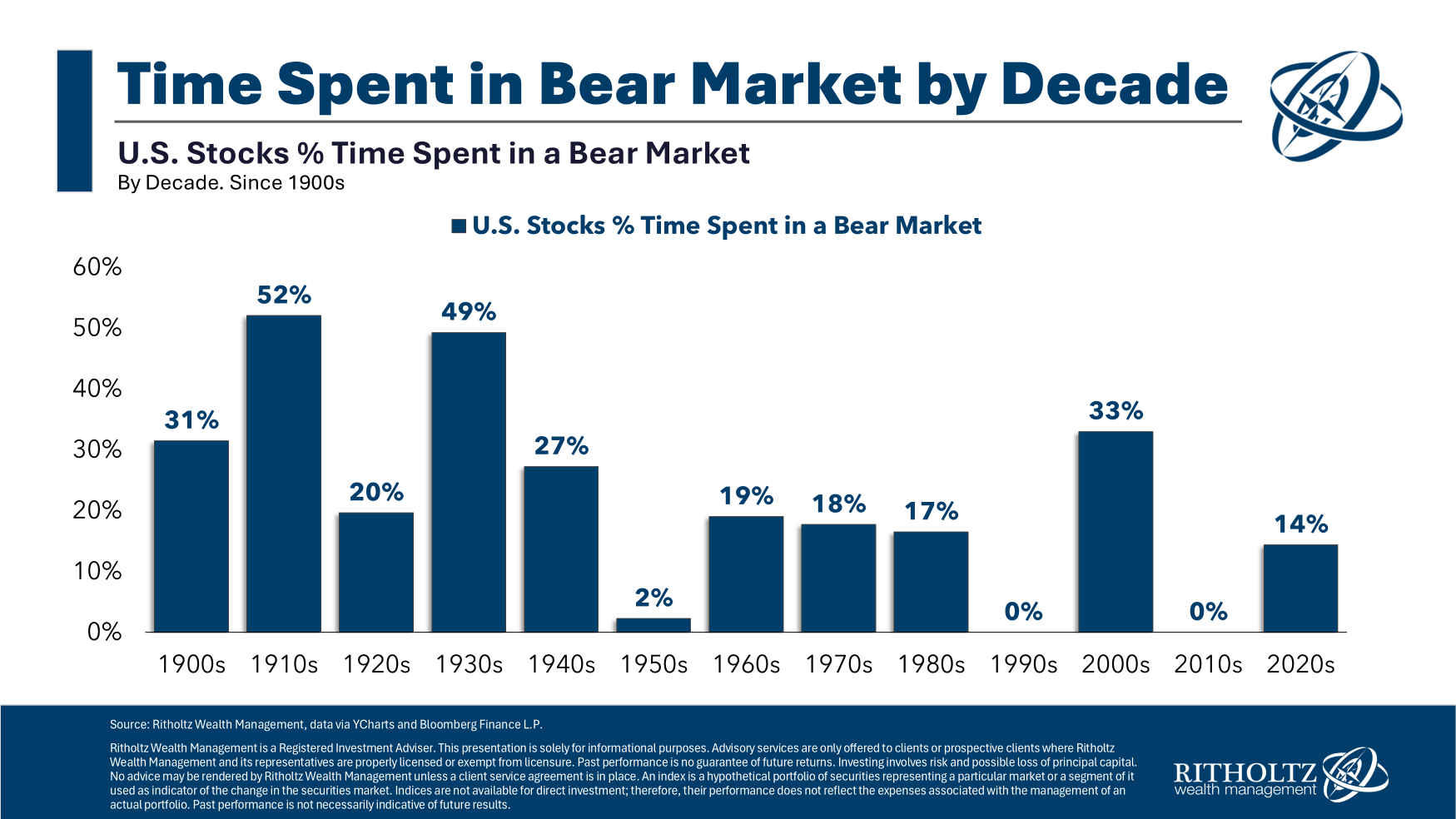

Here’s a look at how often the U.S. stock market has been in a bear market by decade:

As far as I can tell, the 2010s were the only decade in history where we didn’t have a recession or a bear market.2 That’s incredible!

So what does this mean for the future?

While it’s true the overall economy is more diversified and durable than it was in the past, there will be certain areas that experience their own recession even if NBER doesn’t declare one for everything.

The tech industry went through a minor recession in 2022. The housing sector is going through their own recession as we speak. The energy sector has experienced a handfuls of booms and busts over the past decade or so.

NBER doesn’t have to officially declare we’re in a recession for there to be pain felt in different parts of the economy. And although we haven’t outlawed recessions, it does make sense that they aren’t as frequent as they were in the past. Monetary and fiscal policy allow policymakers to have more control.

My only worry is that we could trade this relative stability for worse outcomes when the inevitable recessions finally hit. What if the crises are more severe if we keep putting off the slowdowns for longer and longer? We shall see.

Bear markets were also far more prevalent in the early-20th century too. There are calm times like the 1950s, 1990s and 2010s but even if we see fewer recessions it’s impossible to outrun volatility in the stock market. Recessions typically lead to bear markets but you don’t need a recession for a bear market. There wasn’t a recession in 2022 yet there was still a nasty stock-bond bear market.

It’s wonderful we don’t experience as much economic pain as we once did but it also means people will overreact when we do have a downturn. A catch-22 of leading a more comfortable existence is we’re not hardened like previous generations to bad times.

Downturns might not occur as frequently as they did in the past but you can’t ignore recessions and bear markets when planning ahead.

Even if we don’t have as many recessions going forward you always have to be prepared for your own personal economic contraction.

Further Reading:

How to Predict a Recession

1Thanks Captain Obvious.

2In 2018 there was a drawdown of 19.8% so it was pretty darn close. Some thoughts on defining bull and bear markets here.