The bull market of the 1980s and 1990s is the stuff dreams are made of.1

The S&P 500 was up nearly 18% per year over the course of those two decades.2

It’s one of the great bull markets in history.

But if we want to get picky, the bull market didn’t truly start until 1982. There were back-to-back recessions in 1980 and 1981-82. You had a 17% correction in 1980 along with a near-30% bear market that bottomed in 1982.

From the August 1982 bottom, which coincides with Paul Volcker declaring inflation was finally kicked, through the end of 1999, the S&P 500 was up an impressive 20% per year.

Now here’s the crazy part — the current bull market isn’t that far behind that epic run!

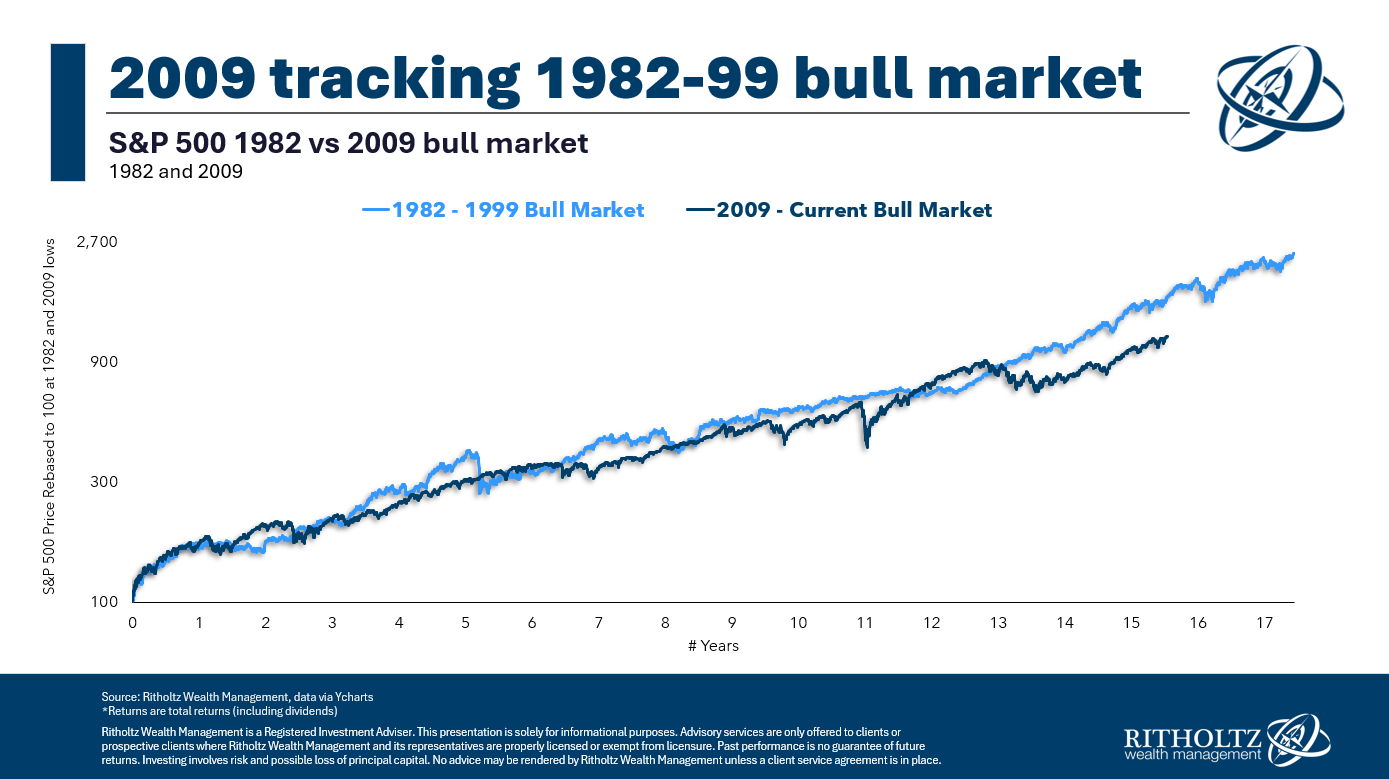

Take a look at how the bull market from the bottom in March 2009 stacks up against the 1980s and 1990s rager:

It’s much closer than you thought, right? I’ll admit, it’s closer than I expected.

From the GFC lows, the S&P 500 is now up almost 17% per year. So it’s not quite there but an AI-induced bubble could certainly get us there.

That previous bull market finished with a bang as the dot-com bubble took off at the end of the 1990s. From 1995-1999, the S&P 500 was up 37%, 23%, 33%, 28% and 21% in successive years.

That helped take it from a bull market to ludicrous speed.

Could we see that again if AI is as big as all of the tech luminaries claim? Maybe.

There are other similarities as well.

The 1987 crash saw the stock market fall 34% in a week. The Covid crash saw the market fall 34% over the course of a month.

And there was a soft landing in 1995 after the Fed initially rapidly raised interest rates.

I’m not always one for repeating and rhyming when it comes to the markets, but the magnitude and length of this bull market are getting more impressive each year.

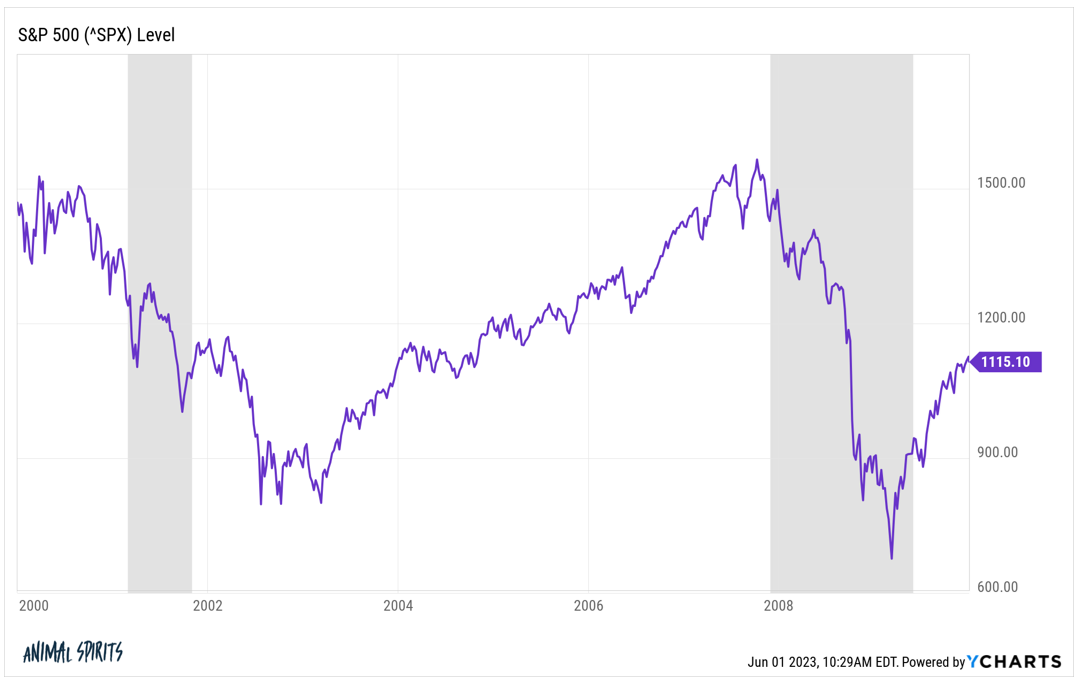

Of course, it’s also worth noting what came after that bull market:

There was a lost decade from 2000-2009, book-ended by two of the biggest market crashes in history. Investors in the S&P 500 lost 10% in total over the first decade of the 21st century.

The U.S. stock market has a history of extended bull markets followed by lost decades.

The Roaring 20s ushered in one of the biggest booms in history.

That was followed by a lost decade in the 1930s and beyond.

From the end of World War II through the mid-1960s, there was an extended bull market (with some hiccups along the way).

From the late-1960s through the early-1980s, the stock market went nowhere again (after inflation).

Then came the 80s and 90s bull run, which was followed by a lost decade, which was followed by the current bull market.

Are we due for another period where the stock market goes nowhere?

Maybe. It wouldn’t surprise me.

Just know that we’re living through an epic bull market.

Enjoy it while you can.

Michael and I talked new all-time highs, bull markets and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Could We See Another Lost Decade in the U.S. Stock Market?

Now here’s what I’ve been reading lately:

- Are we too impatient to be intelligent? (Behavioral Scientist)

- The Mr. Beast memo (Kyla Scanlon)

- A high savings rate covers up a lot of financial sins (Whitecoat Investor)

- Retirement ages by country (Flowing Data)

- “I have less than zero interest in that” (Downtown Josh Brown)

- Are demographics destiny in the stock market? (Of Dollars & Data)

- How Can’t Hardly Wait became a teen cult classic (The Ringer)

Books:

1The best book ever written about this two-decade-long run is Bull: A History of the Boom & Bust by Maggie Mahar. I highly recommend it for any other armchair market historians out there.

2The biggest difference between that bull market and this one is bond market returns. Ten year treasuries were up a ridiculous 9.6% per year from 1980-1999. From the bottom in 2009, treasuries are up more like 2.5% per year.