Three things I’m thinking about during the stock market correction:

This is why I love markets. Everything was calm. There was no volatility to speak of this year. Then BAM!

Stocks are tumbling around the globe. Investors are recalibrating on the fly.

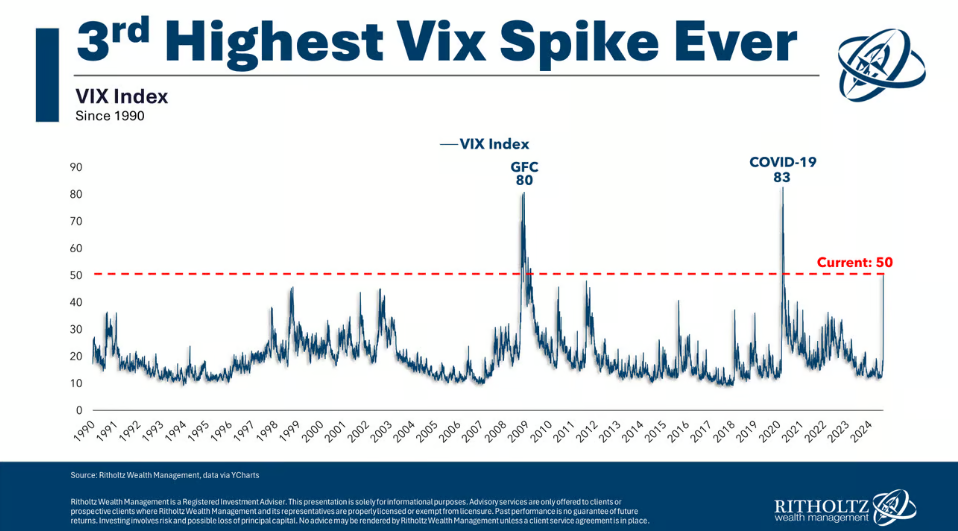

People are worried about a recession, an AI bubble bursting, the Fed’s inaction, the labor market, the Yen carry trade and a whole lot more. The VIX went parabolic out of nowhere:

The S&P 500 is still only 7-8% off its all-time highs. We’re not even technically in correction territory yet there was a real sense of panic in the markets on Monday.

I am endlessly fascinated by the human element of financial markets. It’s a constant cycle of fear, greed, envy, panic, and euphoria. The financial markets are like a laboratory for testing human emotions and behavior on a grand scale.

Things can go from boring to exciting in the blink of an eye because human nature never changes.

I love the stock market.

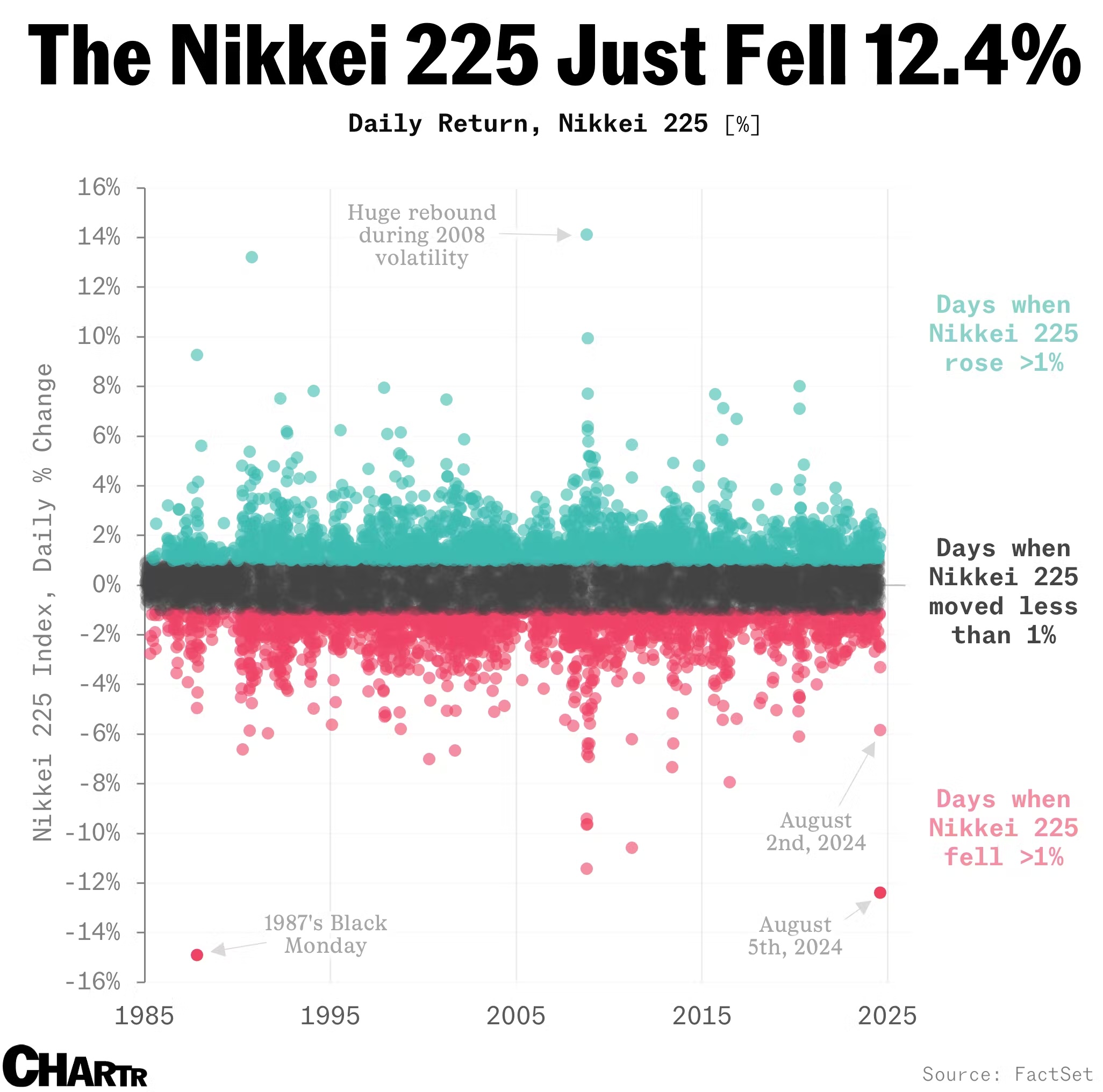

The stock market is not the economy but sometimes it is. There was a 1987-like crash in Japanese stocks on Monday (via Chartr):

It was the worst day for the Nikkei since Black Monday in October of 1987.

Worse than 2008. Worse than 2020. Worse than anything in the 1990s after the biggest financial asset bubble in history popped.

That’s no joke.

Markets around the globe followed Japan’s lead as stocks shellacked.

It’s possible the stock market is pricing in a recession or some calamitous financial crisis. These things are rare but do happen.

It’s also possible that this was a case of investors becoming too complacent, using too much leverage and getting caught offsides on a carry trade.1

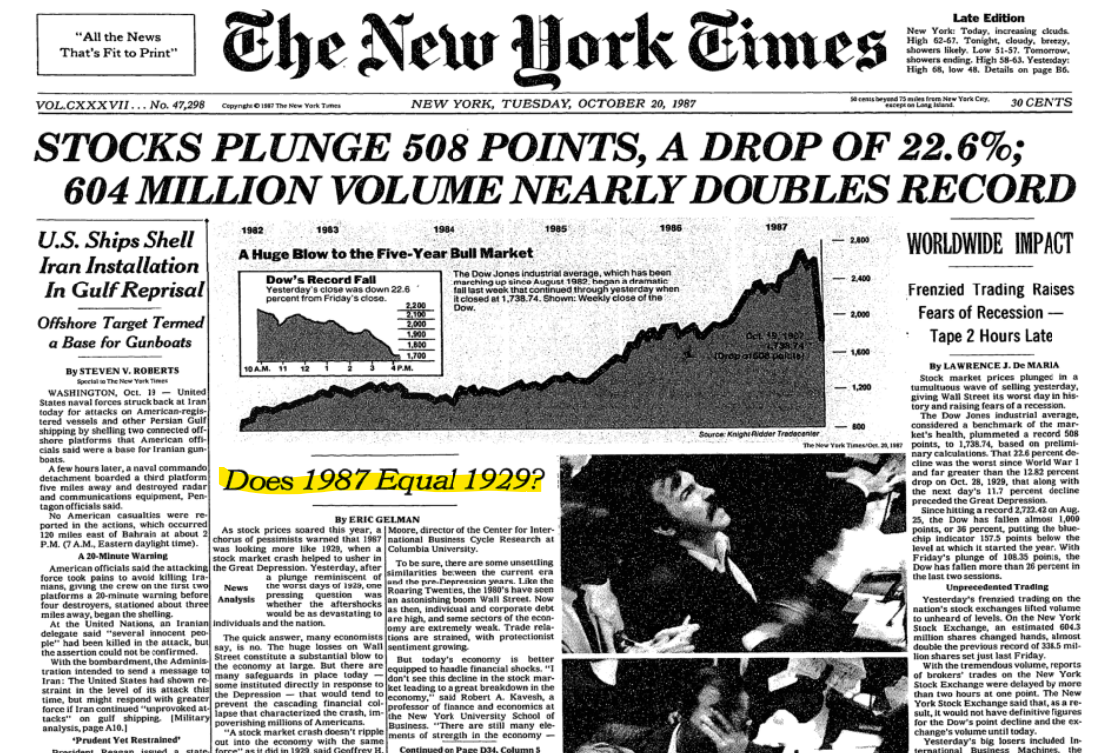

When the 1987 crash happened and the stock market fell more than 20% in a single day, some people were worried about a second coming of the Great Depression:

Many investors assumed a stock market crash of epic proportions all but guaranteed a recession was coming.

It never did.

Sometimes the stock market gets ahead of these things and “predicts” a recession but it’s not always right. The 2022 bear market is a perfect example of the stock market predicting 9 out of the last 5 recessions.

Sometimes the economy impacts the stock market.

Sometimes the Yen carry trade blows up, forcing overleveraged traders to liquidate their positions, causing a cascade of selling pressure and a flash crash on one of the biggest stock markets in the world.

Sometimes ‘I don’t know’ is the best answer. Is Monday’s turmoil a precursor of worse things to come or will it merely be a blip on the radar?

I don’t know!

The Nikkei fell more than 12% on Monday but rallied more than 10% on Tuesday.

Was it simply a flash crash? We shall see.

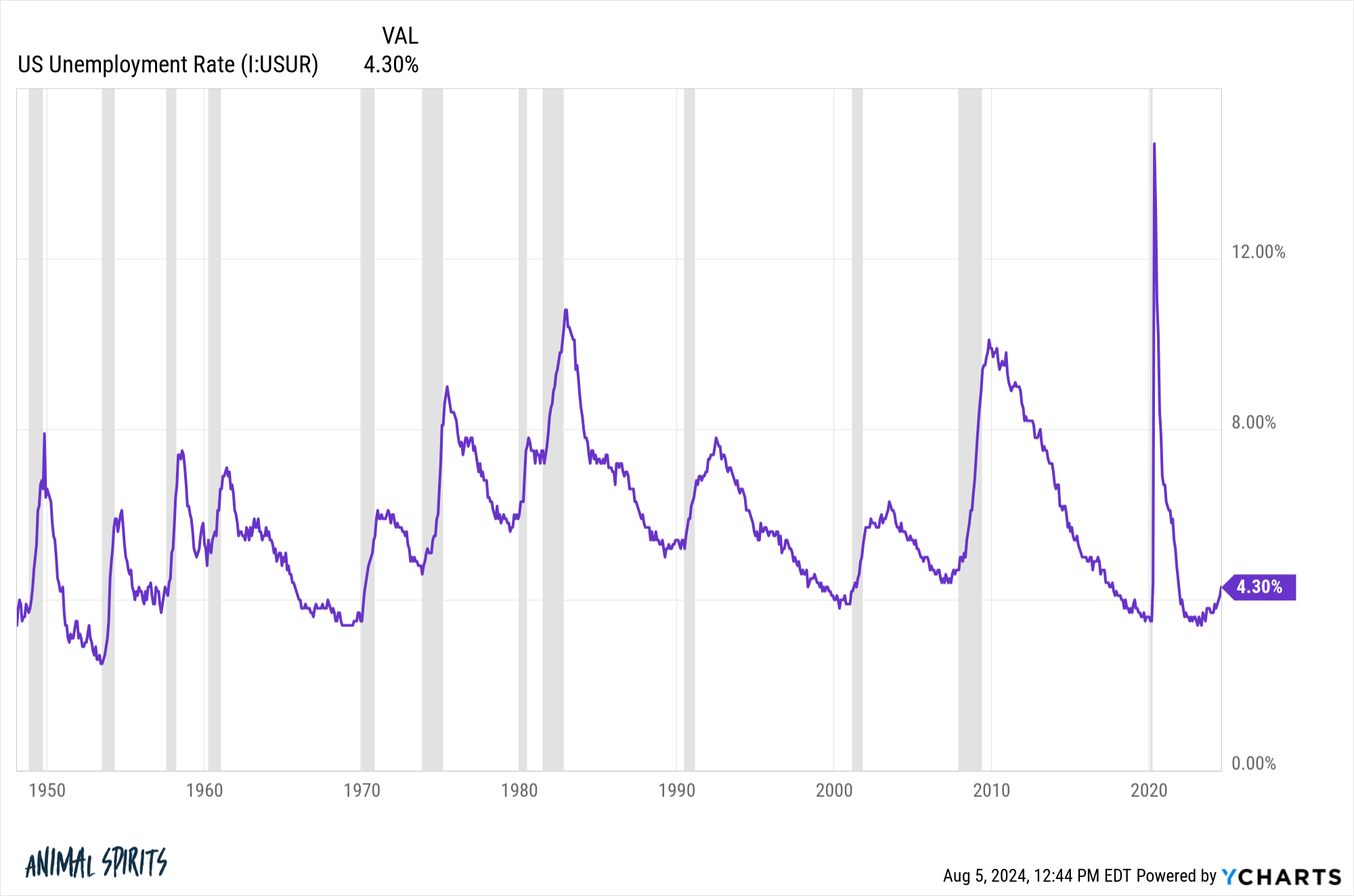

I also don’t know if the economy will deteriorate enough to cause a recession. If you look at the history of the unemployment rate, it tends to trend:

It’s pretty rare to see a spike in the unemployment rate that doesn’t continue to move higher. Historically, when that happens, a recession is soon to follow.

Wage growth is falling, hiring is slowing and job openings have fallen. The labor market is cooling off.

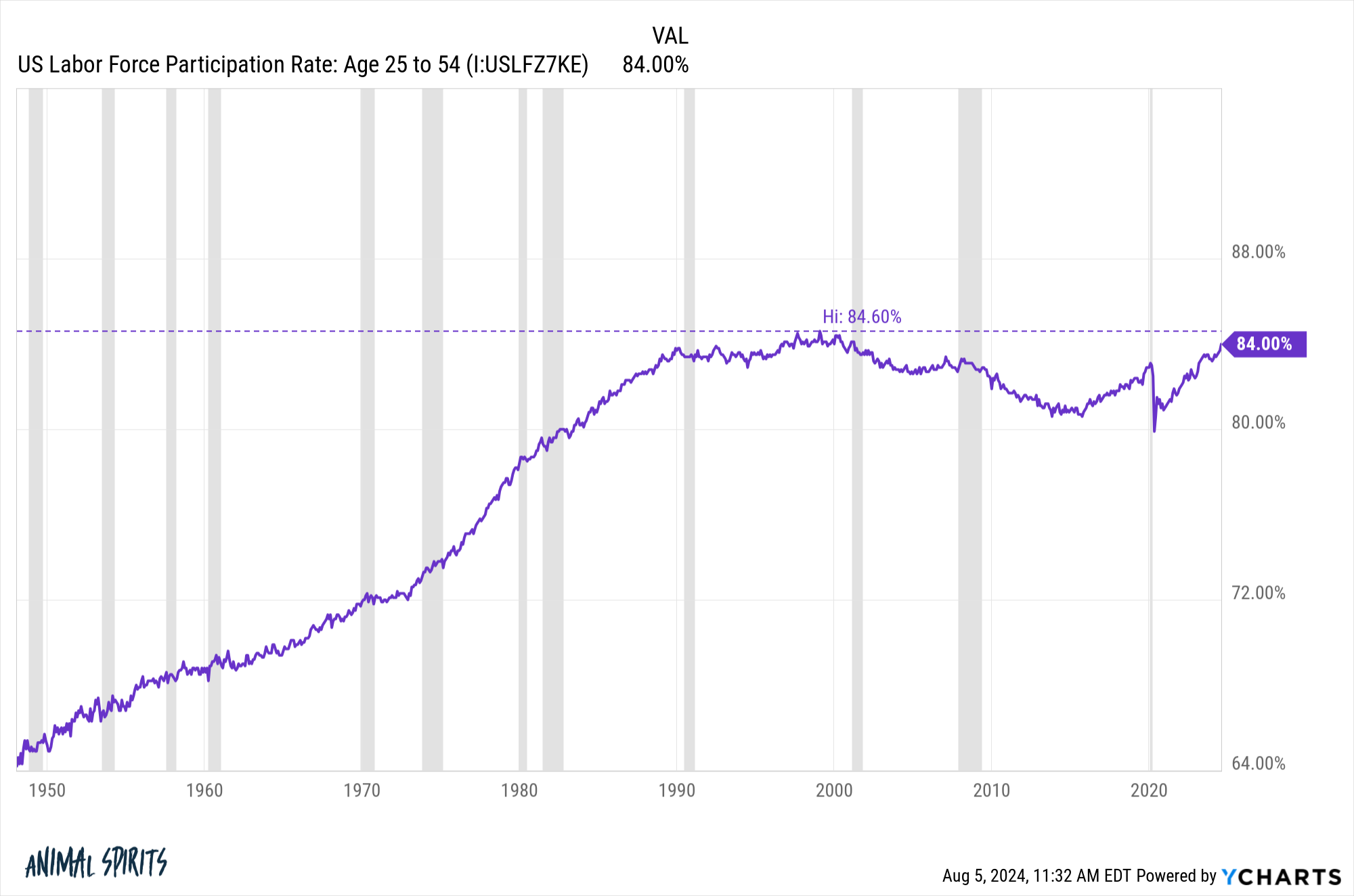

However, the prime age labor force participation ratio just keeps rising:

We’re closing in on a record for the highest labor force participation ratio for 25 to 54-year-olds ever.

What if we were simply at full employment and the labor market had nowhere else to go but down? What if this is just a case of things normalizing?

You could make a strong case for either story right now.

You could also make the case that the Fed has the ability to come in and fix the problems if they lower rates and make it cheaper to borrow money. Interest rate sensitive industries like housing would certainly welcome lower borrowing costs. So would people buying automobiles, those with credit card debt and small business owners who need to borrow to fund operations.

This could turn out to be a short-term head-fake flash crash caused by complacent investors who were over-levered.

It’s also true that big up days and big down days tend to occur during downtrends, not uptrends.

I’m willing to say ‘I don’t know’ about the current economic and market worries because it’s hard to predict markets, especially in the short run.

Vince Vaughn was on Smartless this week and they asked him why he used to be scared of the ocean. He said, “I respect the ocean. It’s a powerful entity.”

I feel the same way about the stock market. I respect the stock market. It’s a powerful entity.

But I still go swimming in the ocean and I still invest in stocks.

I bought stocks yesterday when they tumbled. But I wasn’t trying to buy the dip or make a macroeconomic forecast.

I bought stocks in my brokerage account because I do that every two weeks. It happens automatically regardless of what’s going on in the markets or the economy.

My financial plan respects volatility and uncertainty because they are two irreducible components of the investing landscape.

My plan does not require that I have the ability to predict what comes next in the markets because no one knows what comes next.

Further Reading:

This is Normal

1The simple explanation here is rates remained low in Japan. So people were borrowing money in Japan at low rates to invest elsewhere. They were doing so with borrowed money. When rates fell in the U.S. and rose in Japan this trade didn’t make nearly as much sense.