Seven questions I’m pondering at the moment:

1. Why doesn’t the Fed just cut now? Inflation is under control. The labor market is cooling off. The housing market is a mess.

I know people who lived through the 1970s are worried about a replay but this is not that.

If the Fed waits too long the economy is going to roll over and they’re not going to be able to stop the unemployment rate from rising.

What are they waiting for?

Let’s get this show on the road and cut rates already.

If inflation picks up again they can always raise rates or stop cutting.

2. Do Americans realize how rich they are? Jacob Kirkegaard from the Economic Innovation Group published an interesting report that compares U.S. workers with the rest of the world.

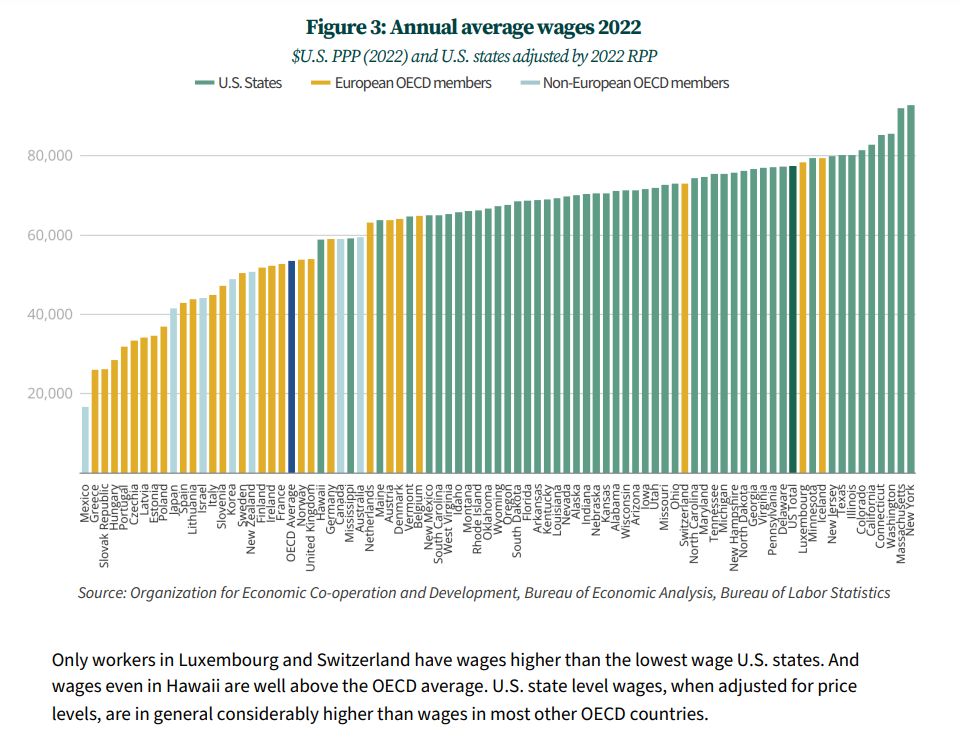

Here’s a look at average wages across different states and countries:

U.S. workers make a lot more money than people in most countries.

Mississippi has higher average wages than Germany and Canada. Oklahoma, West Virginia and South Carolina have higher average incomes than Belgium, Denmark and Austria.

Of course, it’s also true that one reason for this disparity is that Americans work longer hours than people in other countries. However, it’s striking how many states have higher wages than some of the world’s biggest developed economies.

Many Americans make more money than you think.

3. Did young people even have a chance? I’ve written a lot about the the U-shaped curve in happiness over the years.

The idea is you are typically happier when you’re younger, go into a happiness bear market during middle age and then enter a bull market of happy times in your older years.

New research shows social media may have broken the U for young people:

Across a variety of datasets and measures, the finding of a midlife low has been consistently replicated. The U-shape has been apparent across a whole range of well-being metrics, including life satisfaction, financial satisfaction, worthwhileness, and happiness. Every U.S. state had a U-shape.

But not anymore.

Now, young adults (on average) are the least happy people. Unhappiness now declines with age, and happiness now rises with age–and this change seems to have started around 2017. The prime-age are happier than the young.

I can’t imagine growing up in the fishbowl of smartphone cameras, social media and never-ending news alerts.

I don’t know the answer since the internet is not slowing down anytime soon.

4. Are fireplaces underrated? I often wonder how boring life used to be for humanity before electricity, sports, TV, the internet, streaming services, movies and smartphones. My guess is people mostly stared at the fire that was keeping them warm.1

We took a family trip this past weekend and the cabin we stayed in was off the beaten path. It had a huge porch with a really nice outdoor fireplace.

We spent all three nights sitting around the fire, drinking beer, listening to music and telling stories.

There is something mesmerizing and calming about sitting around a fire in the summertime.

I’ve never had a bad time sitting by the fire on a nice evening.

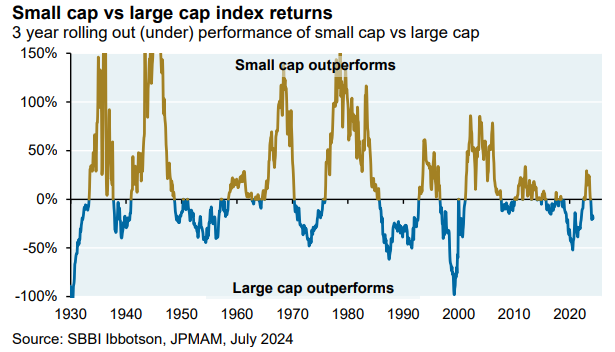

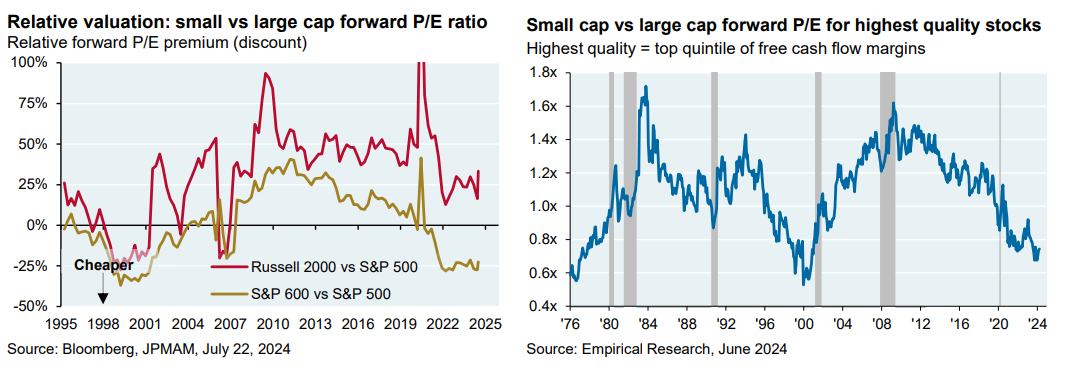

5. Are small caps cheap for a reason? JP Morgan’s Michael Cembalest shared some great charts in a recent piece in his Eye on the Market newsletter about small cap stocks:

The performance of smaller stocks relative to larger stocks is cyclical.

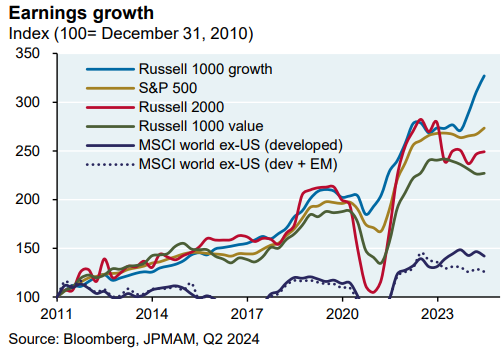

The current cycle happened for a reason. Large caps have grown their earnings at a higher clip:

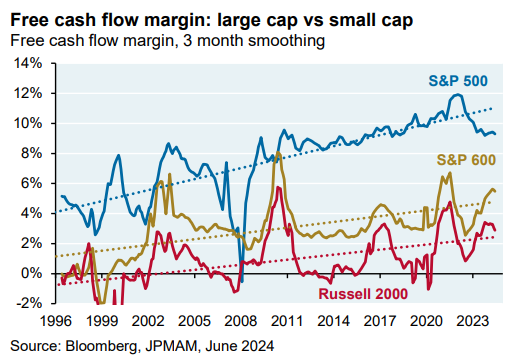

They have better margins:

Now small cap stocks are much cheaper than large cap stocks:

The million dollar question is this: Are the valuation differences going to provide a tailwind for small caps and a headwind for large caps in the years ahead?

6. Why do hotels keep trying to make steamers a thing? The last two hotels I stayed at had steamers instead of an iron.

Steamers are nice because they don’t require an ironing board. The problem is that they don’t get out the wrinkles!

That’s a problem because your clothes tend to get wrinkled after being in a suitcase and rolling around an airplane.

Steamers are useless!

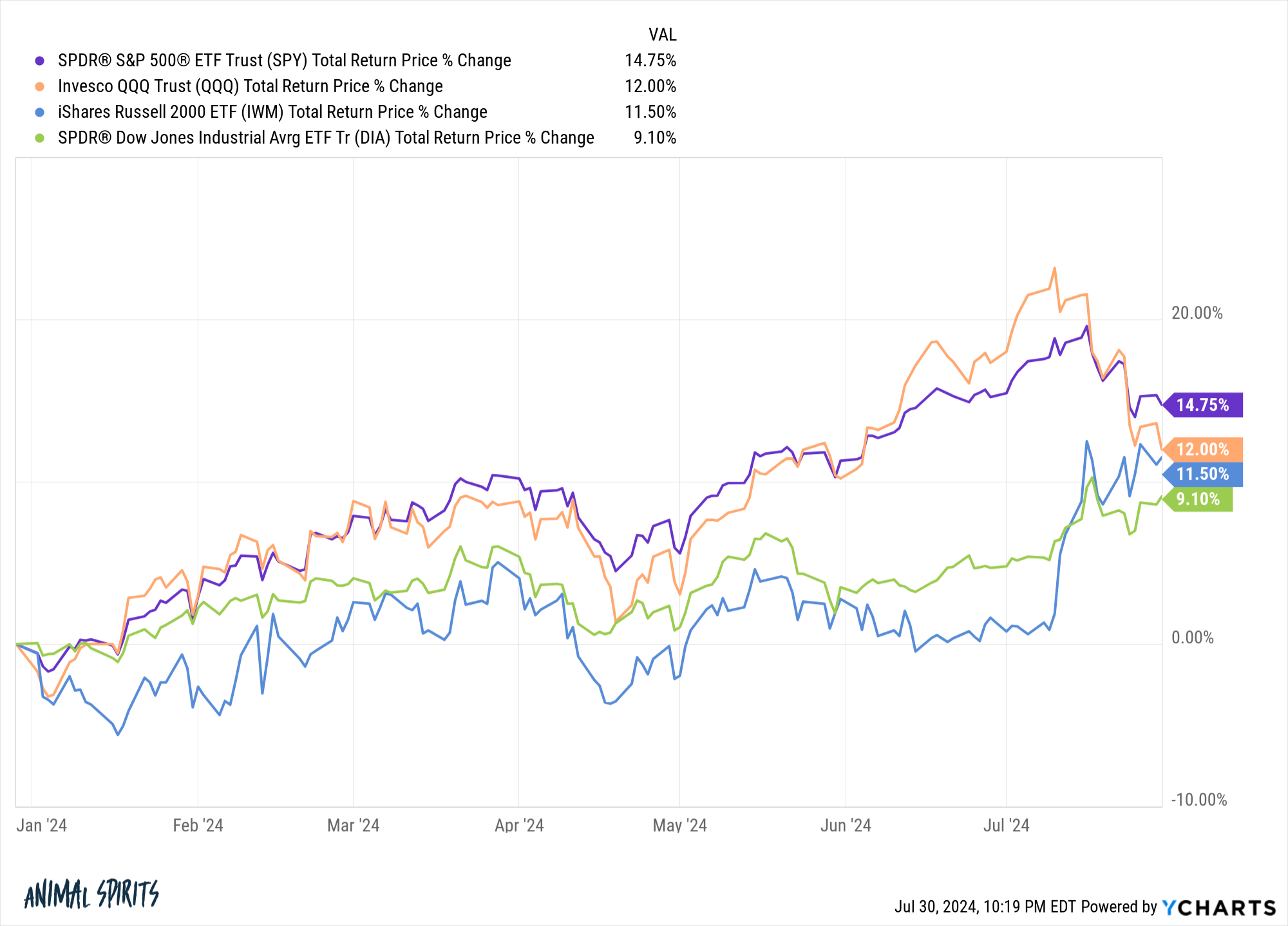

7. Is 2024 going to be an “average” year for the stock market? Historical stock market data shows returns in a given year are typically nowhere near the long-term averages.

Over the past 100 years or so, the U.S. stock market has only ever experienced returns in the 8% to 12% range five times. Roughly half of all years since 1928 have seen double-digit losses (12 times) or 20%+ gains (35 times) for the S&P 500. Two-thirds of the time stocks finish negative or up 20% or greater.

Is this finally the year we see returns close to the long-term averages?

Here are the year-to-date total returns for the S&P 500, Nasdaq 100, Russell 2000 and Dow Jones Industrial Average:

There are still five months remaining in 2024 so it’s still possible we will see a big move in either direction.

But so far this year, returns are looking normal-ish.

Things don’t stay normal for long in the markets but you never know.

Further Reading:

Waiting For the Coast to Clear on Inflation

1Is it really a…hot…take to say fire is underrated? I’ll see myself out.