Today’s Animal Spirits is brought to you by Texas Capital Management:

See here for more information on The Texas Small Cap Equity Index ETF

RWM is coming to LA!

- Reach out to us at info@ritholtzwealth.com subject line “LA” to set up a time to meet!

On today’s show, we discuss:

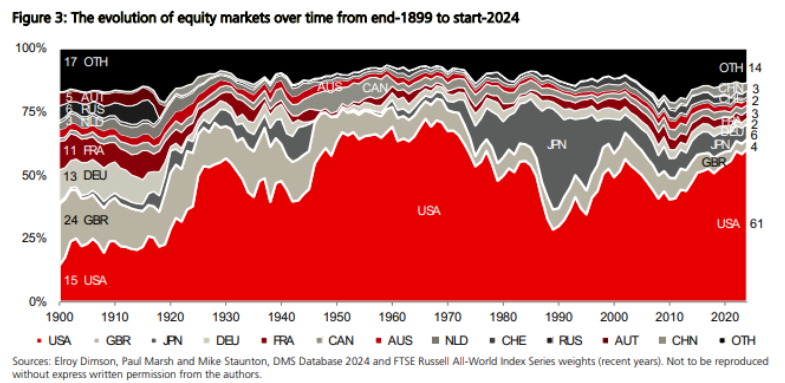

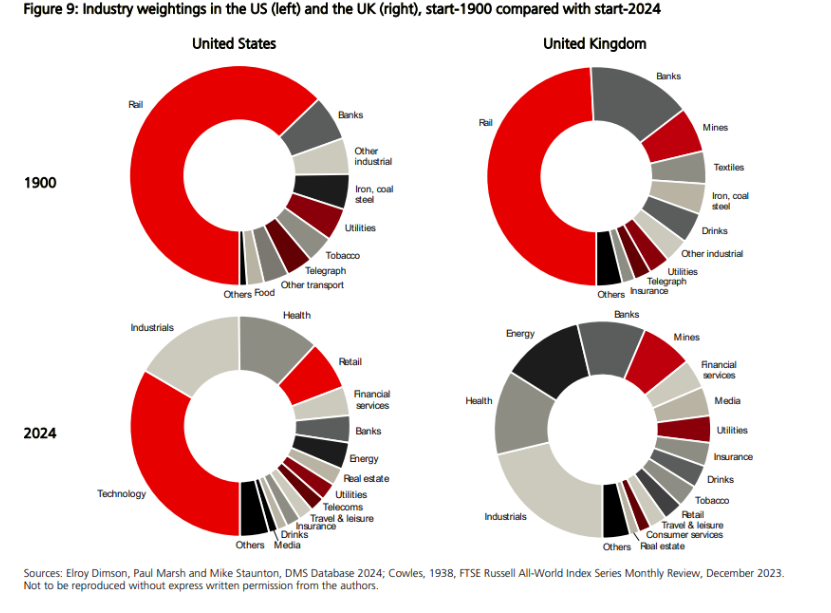

- Global Investment Returns Yearbook 2024

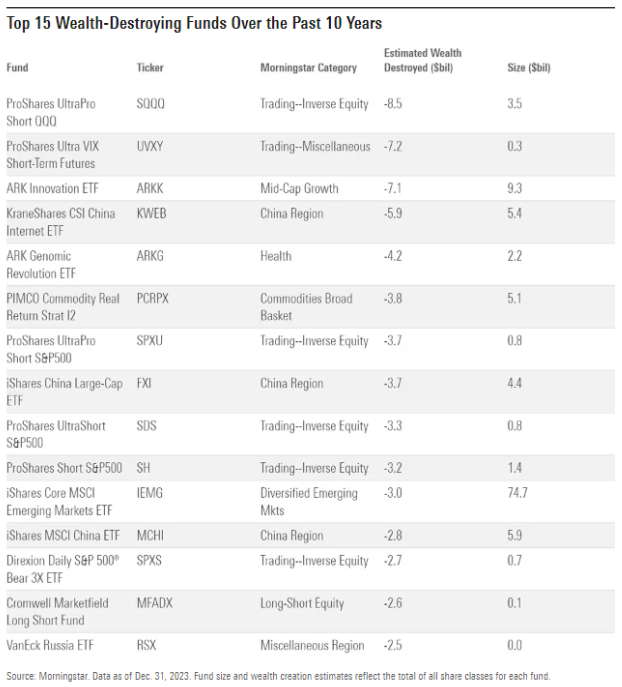

- 15 funds that have destroyed the most wealth over the past decade

- Cliff Asness: AI is ‘still just statistics’

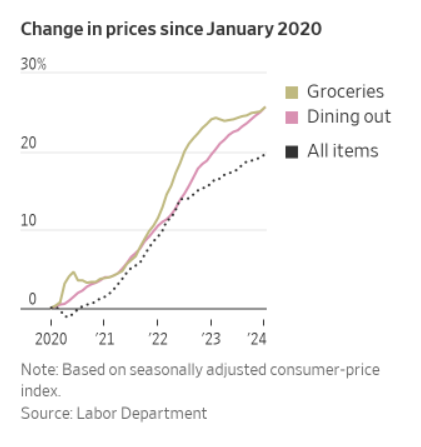

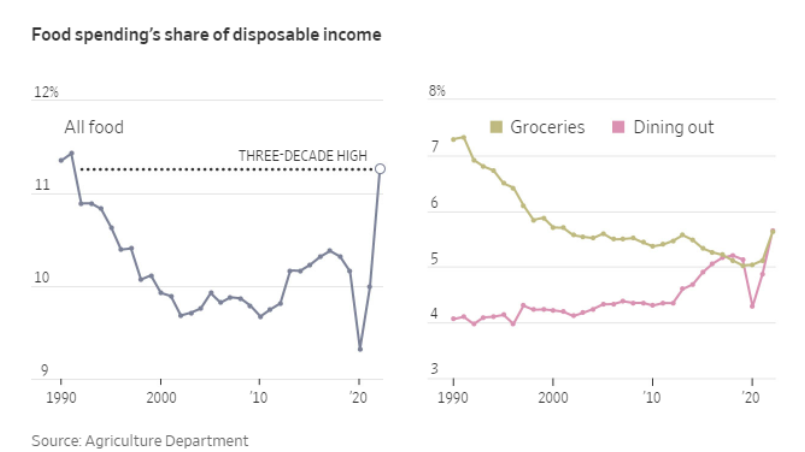

- It’s been 30 years since food ate up this much of your income

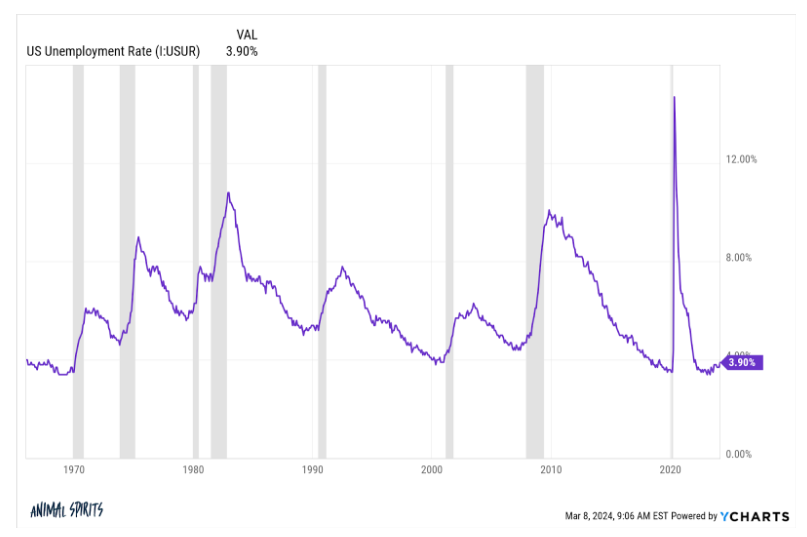

- Jamie Dimon warns US Recession ‘not off the table’ yet

- 2024 Exchange: Blueprint for Growth

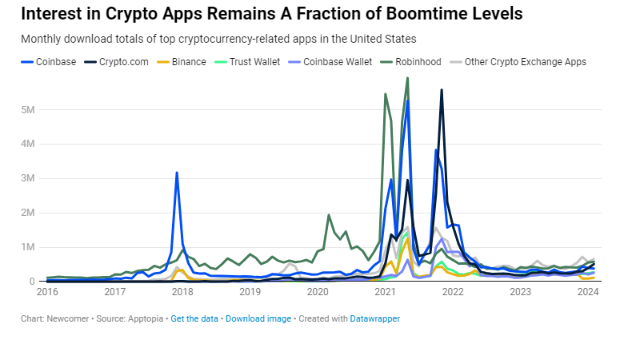

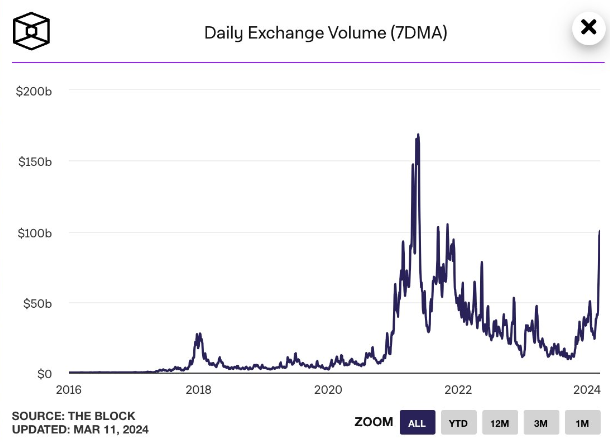

- Bitcoin is surging, but crypto investors are staying cautious

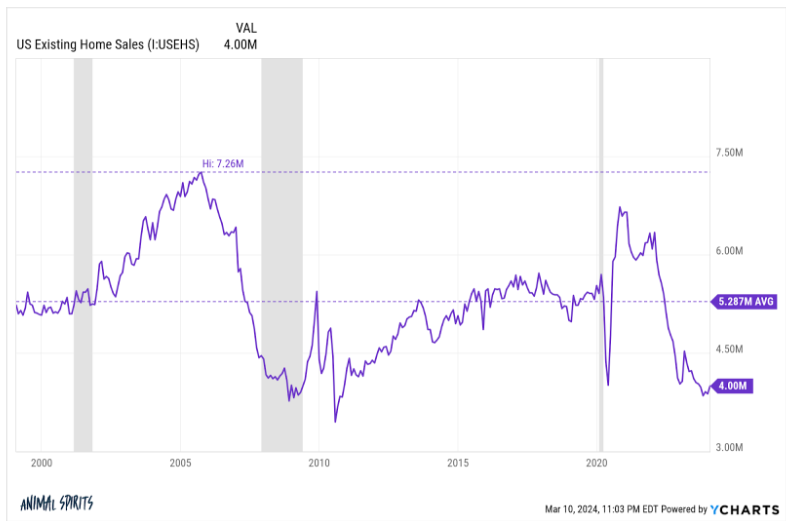

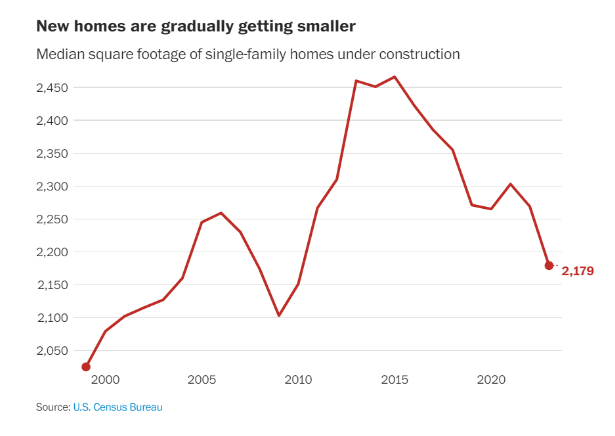

- Less money, less house: How market forces are reshaping the American home

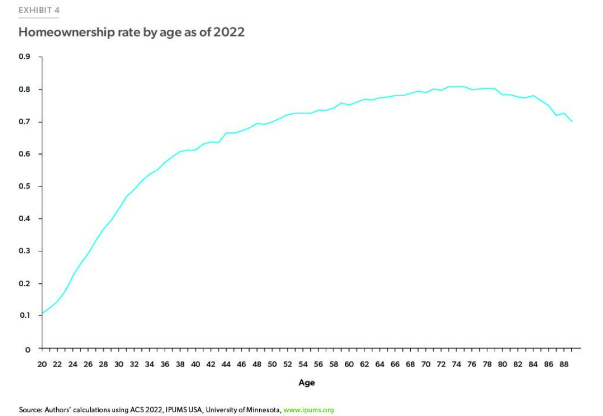

- U.S. Economic, housing, and mortgage market outlook – February 2024

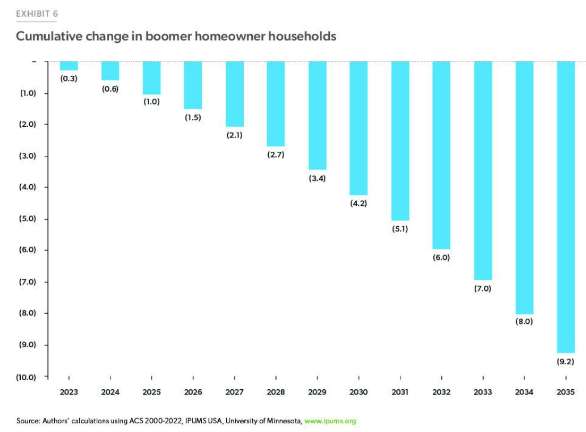

- Baby boomers aren’t going to crash the housing market – they’re powering it

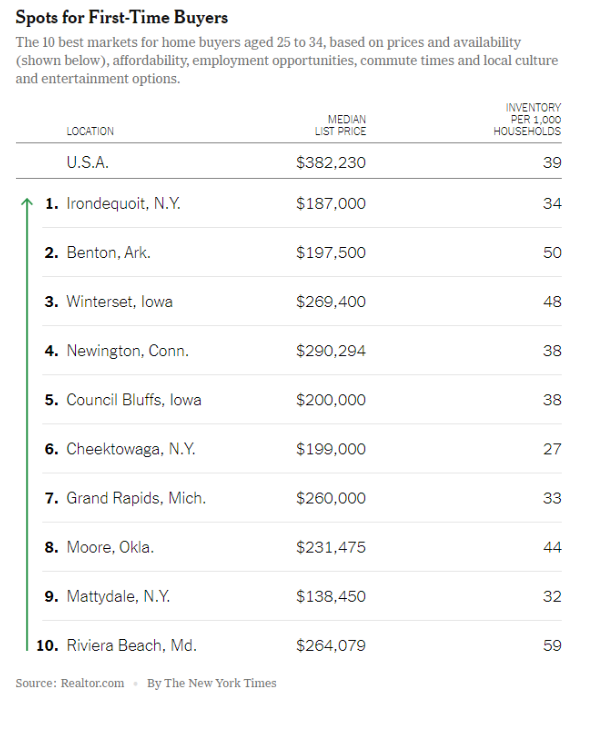

- The best markets for first-time homebuyers

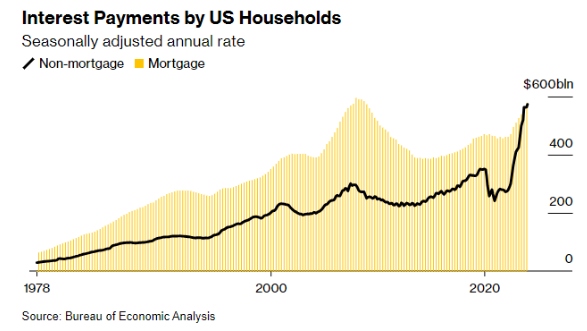

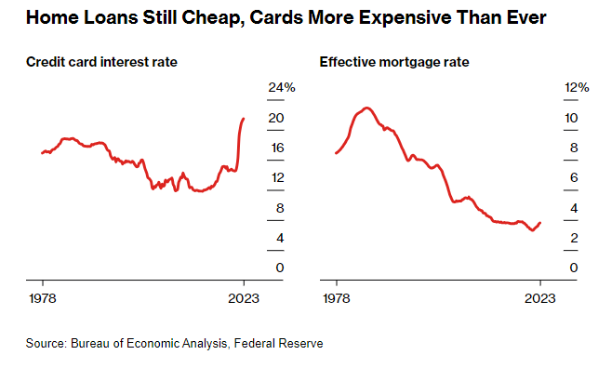

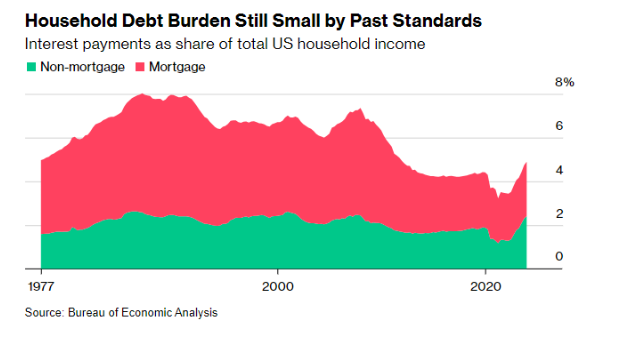

- Americans now pay as much interest on other debt as on mortgages

Listen here:

Recommendations:

Charts:

Tweets:

The S&P 500 has now hit new all-time highs on 35% of all trading days this year

Seems high

— Ben Carlson (@awealthofcs) March 7, 2024

Current market mentality:

1. Nvidia Stock is UP: S&P 500 goes to new all time high

2. Nvidia Stock is FLAT: S&P 500 goes to new all time high

3. Nvidia Stock is DOWN: S&P 500 falls just 30 points

Yesterday, Nvidia marked its largest percentage drop since May 31st, 2023.

It…

— The Kobeissi Letter (@KobeissiLetter) March 9, 2024

"I just got back from the grocery store"

"Am I the only one that feels like they just can't do it anymore?"

"I bought the cheapest stuff"

"This is all I purchased. That's it"

"Take a guess at what it costs and you're probably wrong"

"$123 with all my discounts for barely two… pic.twitter.com/WyrtJZbiSe

— Wall Street Silver (@WallStreetSilv) March 6, 2024

❖ Redfin Reports Asking Rents Climb 2% in February, Biggest Gain in Over a Year

The Northeast and Midwest were the biggest gainers, with asking rents rising roughly 5% from a year earlier. Rents in the West and South were roughly flat.

— *Walter Bloomberg (@DeItaone) March 11, 2024

* DELTA AIR LINES CEO SAYS HAVE HAD 9 OF THE TOP 10 SALES DAYS IN OUR HISTORY ALL WITHIN THE LAST 10 WEEKS@Reuters $DAL

— Carl Quintanilla (@carlquintanilla) March 12, 2024

New listing data this week

2011 362,248

2024 59,243— Logan Mohtashami (@LoganMohtashami) March 9, 2024

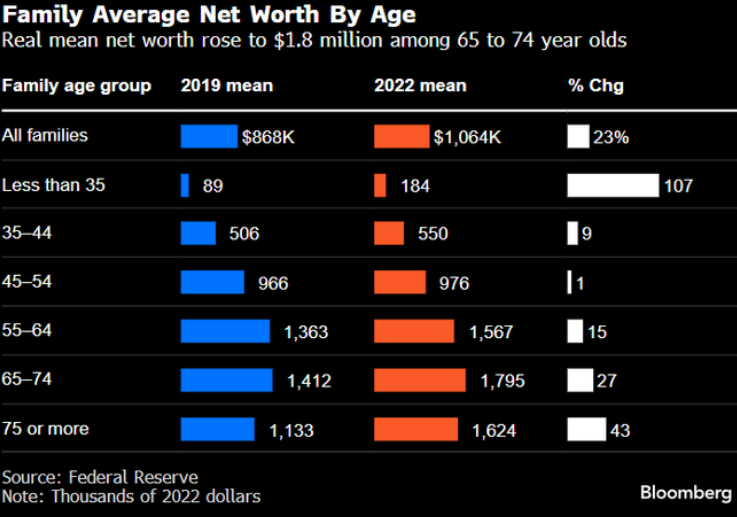

Household net worth jumped by $4.8tn in 4Q 23 and is up a staggering $39.3tn (140% of GDP) since the pandemic. pic.twitter.com/ydDbwsCxs3

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) March 8, 2024

This is pretty mind blowing. The Fed just released its quarterly Flow of Funds report and household/NPO assets stand at $176.7 trillion (blue line), far exceeding their liabilities of $20.5 trillion (white line). America is truly a rich country pic.twitter.com/qLX2VgtOYa

— Robert Burgess (@BobOnMarkets) March 7, 2024

"Retail isn't here yet"

Yes they are, they just aren't in BTC and ETH pic.twitter.com/nEYvH5KFqu

— eric.eth (@econoar) March 11, 2024

Bitcoin ETF inflows have absolutely blown Gold's out of the water. Not even close, utterly dwarfed, decimated. Thanks for playing, non-fixed supply boomer rock enjoyoors. pic.twitter.com/k9uLybGxoJ

— Will (@WClementeIII) March 2, 2024

First two months officially in the books (it's felt like six) and the ten bitcoin ETFs now have over $55b in assets with exactly double that in volume at $110b. If these were the numbers at the end of year I'd call them a success. To do it in eight weeks is simply absurd. pic.twitter.com/8YvzQZdYyJ

— Eric Balchunas (@EricBalchunas) March 11, 2024

INTERESTING: Grayscale launching $BTC, a mini-me low fee version of $GBTC which investors in GBTC will be able to get into w out tax hit (I believe) via a special dividend. @JSeyff called for this months ago in a note. No brainer in our opinion. Don't know exact fee yet tho. https://t.co/rYn2Q1m3jC

— Eric Balchunas (@EricBalchunas) March 12, 2024

Contact us at animalspirits@thecompoundnews.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound, Inc., an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.