Today’s Animal Spirits is brought to you by YCharts:

Go to User Preferences here to see YCharts Dark Mode feature

Go to User Preferences here to see YCharts Dark Mode feature

Welcome to the dark side🌒📈 #YCharts has officially released the highly-anticipated Dark Mode feature! Take your account customization to the next level for a new sleek look to your data analysis experience.

Head to User Preferences here ➡️ https://t.co/N7OQCS0lI1 pic.twitter.com/UxHnYwN6SW

— YCharts (@ycharts) June 9, 2023

On today’s show, we discuss:

- Big Tech’s Biggest Bets (Or What It Takes to Build a Billion-User Platform)

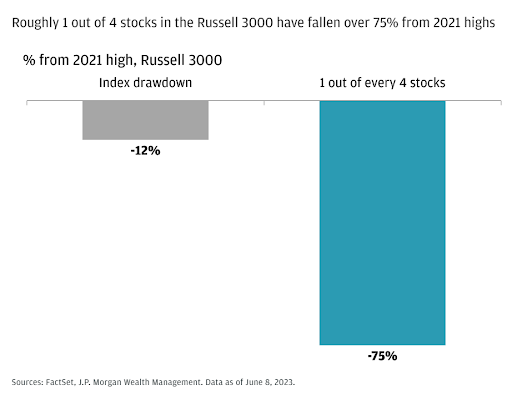

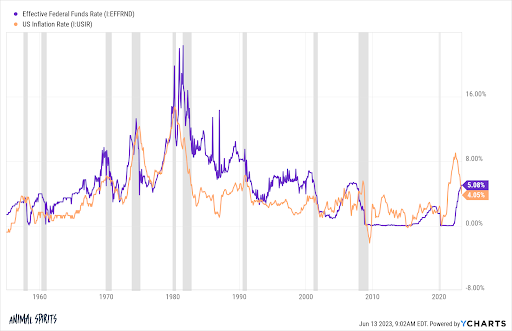

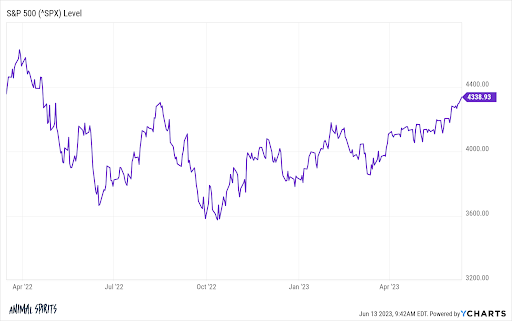

- New Bull Market?

- Stocks Down Big

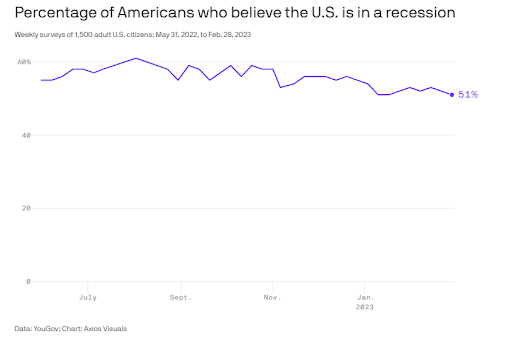

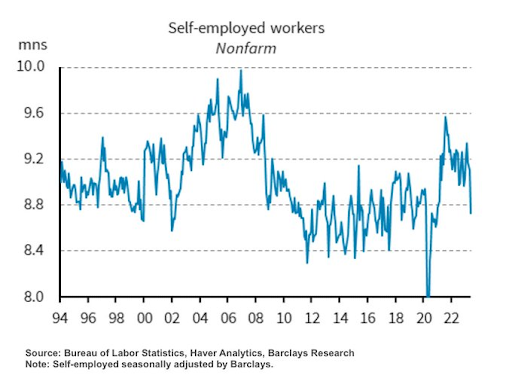

- The permanent recession that never arrives

- Why AI Will Save The World

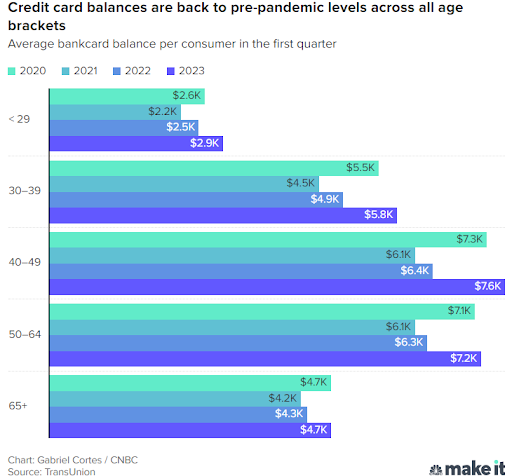

- Credit Card Debt

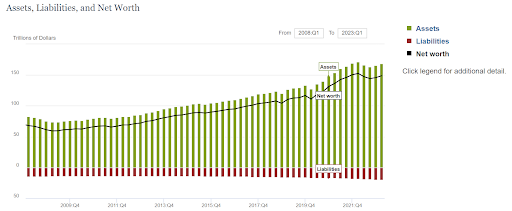

- Financial Accounts of the United States

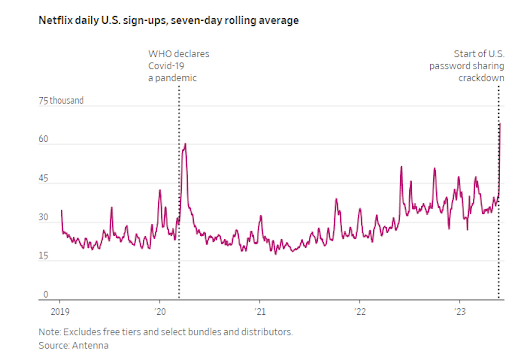

- Netflix Subscriptions Jump as U.S. Password-Sharing Crackdown Begins

Future Proof:

Tropical Bros Shirts:

Listen Here:

Recommendations:

Charts:

Tweets:

Whereas the largest stocks by market cap were previously the only area of the market to see significant gains, so far in June, small caps have massively outperformed.

Read more in tonight's Closer: https://t.co/osztuaclYK pic.twitter.com/iADlbXgLMp

— Bespoke (@bespokeinvest) June 8, 2023

Woof pic.twitter.com/58eHbWu3nU

— Quiet Prosperity (@QuietProsperity) June 7, 2023

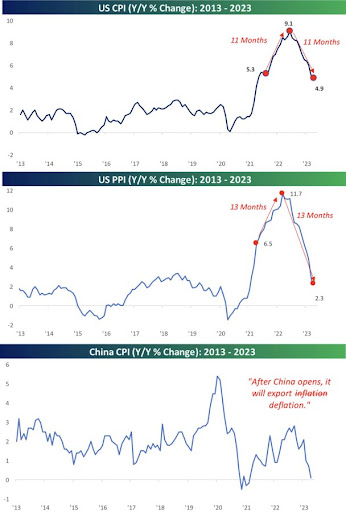

Woah.

Longest streak of deceleration in y/y CPI since 1921. #Inflation pic.twitter.com/4vEE5oxrRd

— Bespoke (@bespokeinvest) June 13, 2023

Heavy truck sales continue to increase.

Before the past 7 recessions we saw this decline well before the recession started.

You want to talk about leading indicators of a recession? I'll take this every time.

Yet another clue a recession isn't imminent like we keep hearing. pic.twitter.com/blLm0bLgiT

— Ryan Detrick, CMT (@RyanDetrick) June 8, 2023

$BAC: "from our own vantage point, certainly credit statistics still look really strong..from a credit perspective, we still look at the consumer as being very healthy still having borrowing capacity & still demonstrating good behavior as it relates to their card patterns" pic.twitter.com/AU9jCw9S8g

— The Transcript (@TheTranscript_) June 12, 2023

America is undergoing a factory construction boom.

H/t @IrvingSwisher @Noahpinion pic.twitter.com/bQ2yUbhaZ7

— Steven Rattner (@SteveRattner) June 6, 2023

The US manufacturing construction boom is massive—I keep having to raise the Y-axis on this chart!

Historic increases in computer/electronic manufacturing thanks to the CHIPS Act, and massive increases in transportation equipment (read: cars/electric vehicles) thanks to the IRA. https://t.co/wxsZi6cvvE pic.twitter.com/YGd2Gko6qN

— Joey Politano 🏳️🌈 (@JosephPolitano) June 6, 2023

The LMI (logistics manager index) hit an all time low – down to 47.3 in May from 50.9 in April – highlighting a quiet implosion of activity occurring in the freight sector as the economy slows down. pic.twitter.com/108C74FSd0

— Don Johnson (@DonMiami3) June 6, 2023

3 stats for the nostalgists who think the American Dream is dead:

– Wages for typical workers are up by a third since 1990

– 73% of Americans in their 40s have higher incomes than did their parents

-Among kids raised in the bottom 20%, 86% have higher incomes than their parents pic.twitter.com/n2c8TE4fxQ— James Pethokoukis ⏩️⤴️ (@JimPethokoukis) June 8, 2023

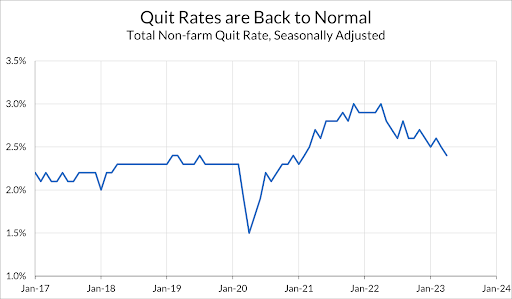

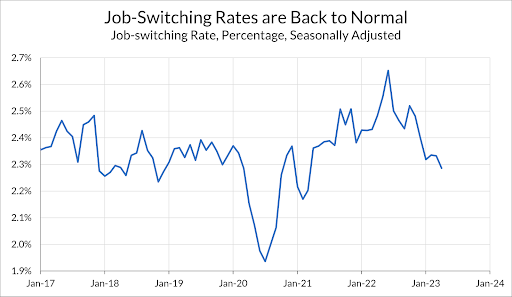

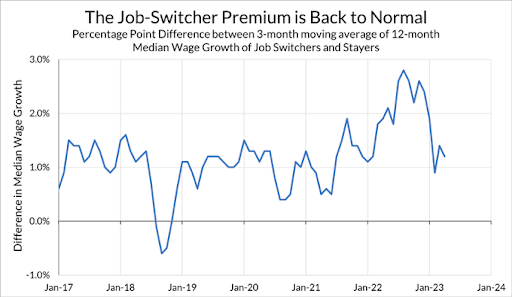

The return to job-switching has also fallen from its highs back down to "normal" levels. pic.twitter.com/yDH1qPD9E5

— Preston Mui (@PrestonMui) June 5, 2023

The @AtlantaFed's Wage Growth Tracker continues to very, very gradually slow down, coming in at 6% in May.

It's down from its peak of 6.7% in summer 2022, but still elevated compared to the pre-pandemic range of 3.5% -4% https://t.co/HC9FtadlZl pic.twitter.com/0A0OgDwb4K

— Nick Bunker (@nick_bunker) June 8, 2023

*GRUBHUB TO LAY OFF ABOUT 15% OF STAFF: WSJ

*GRUBHUB TO CUT ROUGHLY 400 POSITIONS: WSJ

— zerohedge (@zerohedge) June 12, 2023

Bitcoin's market cap is now the largest percentage of crypto's total market cap since April 2021 pic.twitter.com/jnvDfyz0tY

— Will (@WClementeIII) June 10, 2023

Well, this is unusual.

Yesterday, someone opened new $COIN $50 weekly puts for $107,000. They were 19% OTM and expired in four days!!!

Today, the SEC sued Coinbase, $COIN.

Those positions are up big, nearly 2572%.

They turned $100K to millions.

Someone always knows. pic.twitter.com/keRzszieZn

— unusual_whales (@unusual_whales) June 6, 2023

Look at this chart of VC capital raised for crypto firms

This is genuinely so fucking awesome and sick and good for society

Like this should be celebrated. Market realized crypto is literally worthless. Stopped funding it. Capital deployed elsewhere

God bless America pic.twitter.com/TN4wrl6Ibe

— BuccoCapital Bloke (@buccocapital) June 6, 2023

RIP Bozos pic.twitter.com/GobA5F7g8n

— zerobeta (@zerobeta) June 6, 2023

So far, national home price growth in 2023 looks, well, like a normal year. pic.twitter.com/27g7hMny8q

— Lance Lambert (@NewsLambert) June 8, 2023

For the first time since 2014, Baby Boomers are buying more homes than Millennials @awealthofcs pic.twitter.com/xBxLCgAVwN

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) June 8, 2023

As the 'official' May housing data trickles in over coming weeks, the divergence between new home and resale market should get even more glaring.

May new home sales +18% YOY per our builder survey. Housing starts on the upswing too as builders step on the gas.

— Rick Palacios Jr. (@RickPalaciosJr) June 8, 2023

B of A: “Monday marks the 25th time that the $SPX has scored a new 52-week high after a long pause of 300 or more calendar days .. The SPX is up 92% of the time 250-trading days after this signal with an average return of 15.5% .. suggests SPX 4900-5000 into June 2024.” pic.twitter.com/hd1fj3Lmwb

— Carl Quintanilla (@carlquintanilla) June 13, 2023

Universal and Illumination are close to signing a deal to make a 'Legend of Zelda' Movie

via @TheInSneider pic.twitter.com/y4DfzRhW0m

— ScreenTime (@screentime) June 8, 2023

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Wealthcast Media, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.