On Friday, the S&P 500 finished at an all-time high.

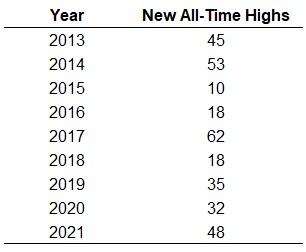

It was the fourth all-time high in as many days. This year alone the S&P has hit 48 new highs.

Since we finally broke through the 2007 pre-GFC highs in the summer of 2013 we’re now looking at more than 320 new highs in this bull market:

That’s more than 15% of all trading days in this time. So for the past 7 years the U.S. stock market has reached a new high once out of every 7 days or so.

Historically, the stock market makes new highs on 5% of all trading days but it would make sense that number is higher during a bull market.

There wasn’t a single new high from October 2007 through the tail-end of the summer in 2013. There was a similar drought from the highs in early-2000 through 2007. In fact, from the turn of the century through the new highs in 2013, there were just 13 all-time highs.

So nearly 14 years with just 13 new highs and then 7 years with well over 300.

The 21st century has been defined by all-or-nothing market cycles.

From January 2000 through early-March 2009, the S&P 500 was down more than 45% in total.

A lost decade bookmarked by two huge crashes.

Then it took off like a rocketship.

On a total return basis, it took the S&P 500 less than two years to double off the March 2009 lows. From that level, it doubled again in 6 years. In less than 4.5 years, it doubled again from those even higher levels.

From the March 2009 lows, you have nearly a 9-bagger on the S&P 500.

Ten grand invested in the S&P 500 on March 9, 2009, would now be worth around $85k. That same $10k invested in a total bond market fund would be worth around $11.6k.

Performing this same exercise from 2000-2009 would have netted just $9k in the S&P and $18k in the bond fund.

Feast or famine.

But even the current bull hasn’t always been easy.

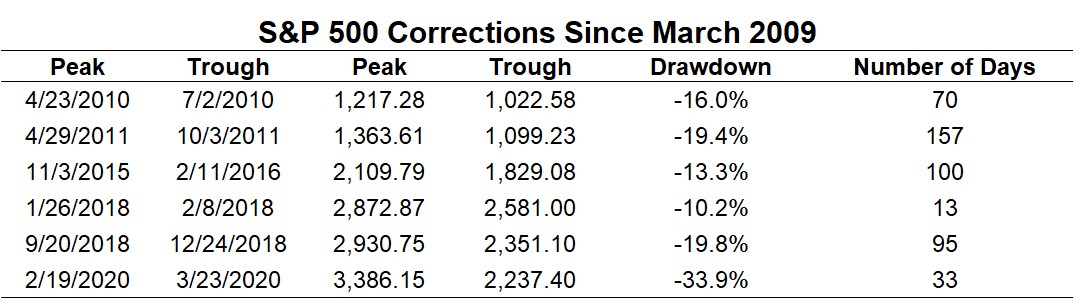

Remember the double-dip recession talk in 2010? Or the European debt crisis of 2011? Or that random bear market that bottomed on Christmas Eve 2018?

The S&P 500 has experienced plenty of corrections during this bull market:

I count six double-digit corrections with an average decline of nearly 19%. The difference between this cycle and the last is these corrections didn’t last very long while the crashes in the early-2000s were measured in years instead of months.

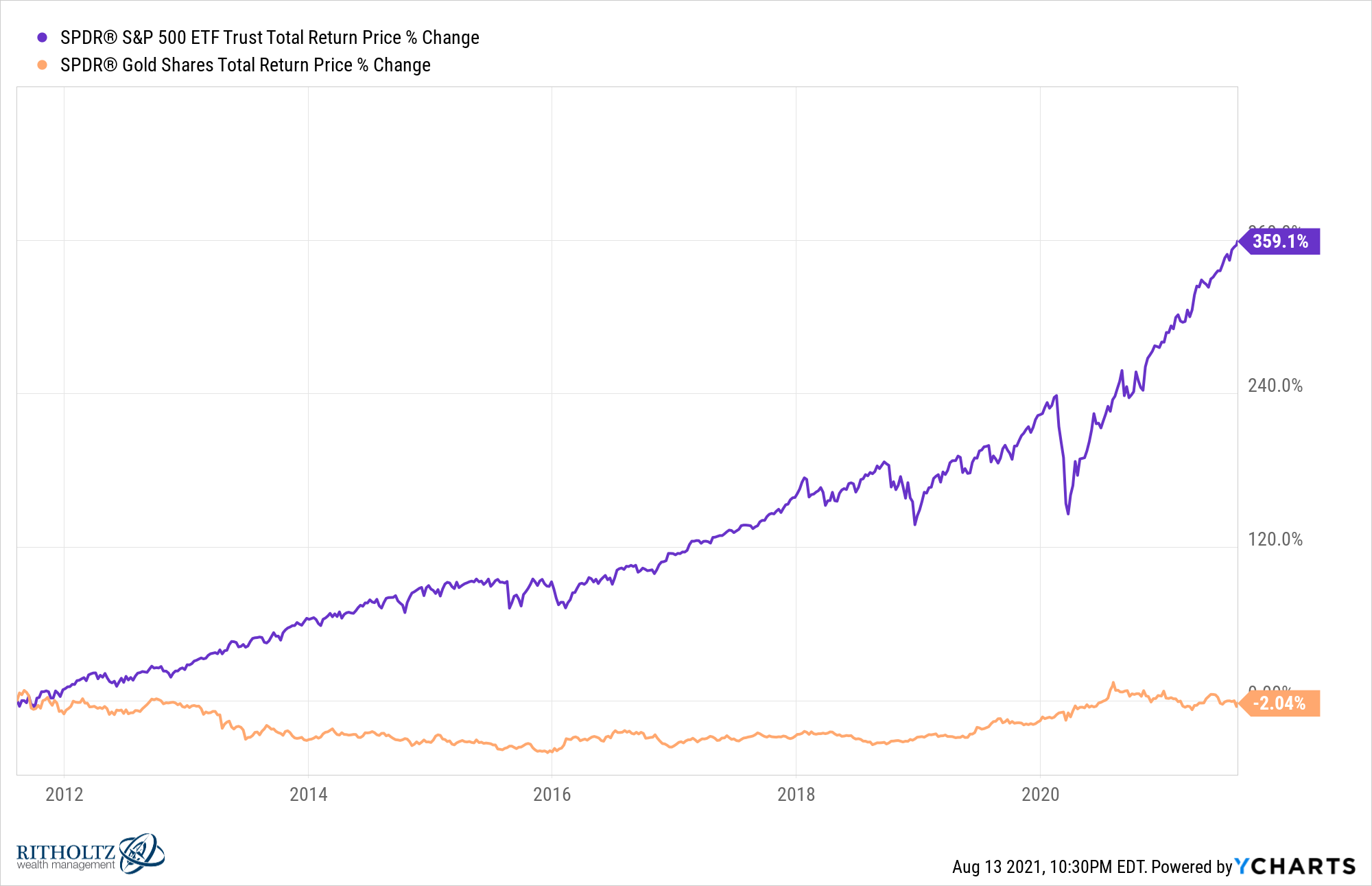

Here’s another way to tell we’re in a bull market — the stock market is crushing gold:

Over the past 10 years, the S&P 500 is up almost 360% while gold is down 2%.

That’s a lost decade for gold, even after it was up 25% in 2020 and 18% in 2019.

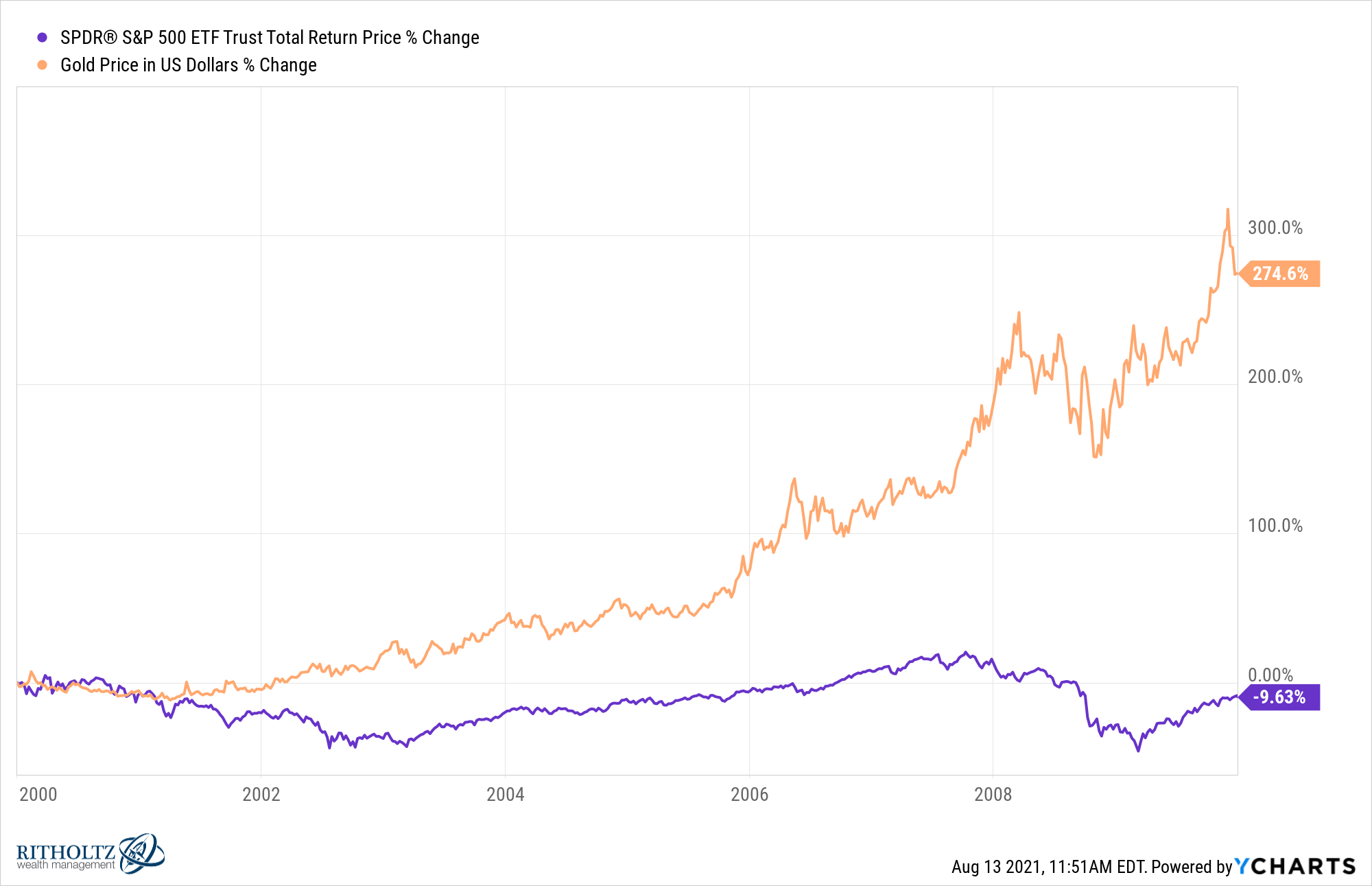

To be fair to the yellow metal, the stock market had a lost decade of its own to kick off the 21st century while gold did quite well:

There’s a theme developing here.

I could continue but you get the picture.

I don’t know what this means for markets going forward but market extremes such as these are sure to play games with investors’ psyches.

After the dot-com blow-up and Great Financial Crisis, investors were conditioned to expect a bone-crushing market crash at all times. People have been predicting the biggest crash in history ever since the last one ended. It never came.

And now investors are conditioned to expect markets to bounce back in a hurry any time they fall. Buy the f*cking dip is the best investing strategy of the past 10+ years.

Setting the right expectations is imperative for survival as an investor over the long-term so thinking in either extreme is going to eventually come back to bite you.

Market crashes are inevitable but you can’t expect them to happen every year. And most corrections are short-lived but not always. Sometimes stocks go down way more than you think they can.

Maybe the next 10 years will be like the last 10 years and every downturn will be over faster than the career of a Detroit Lions head coach.

Or maybe we’ll see another lost decade follow the strong gains of the current cycle.

It’s also possible we’ll see something else entirely different than the market environments of the 2000s and 2010s.

Regardless of what comes next, thinking in extremes will eventually lead to disappointment as an investor because the good times or the bad times never last forever.

Further Reading:

As Good as it Gets?