A reader asks:

Does rebalancing essentially lock in losses? I have a robo advised Roth IRA that rebalances seemingly every other day. Will I ever get back to break even? And when do I stop buying the stock market on sale?

Diversification is the process of spreading your bets among different asset classes, strategies, geographies and holdings to reduce risk in your portfolio.

Asset allocation is the process of distilling that diversification into target weights.

Rebalancing is the process of systematizing your purchases and sales to stick to that asset allocation so you can earn the benefits of diversification.

Diversification doesn’t work without a coherent asset allocation and asset allocation doesn’t work without a coherent rebalancing process.

They all work hand-in-hand.

Rebalancing is when you trim some of your winners to buy some of your losers which is a countercyclical form of investing.

Some people are more comfortable with this strategy than others but I don’t see the point of creating an asset allocation in the first place if you don’t rebalance back to target weights using pre-established guidelines.

Let’s look at an example to see how rebalancing can help your portfolio in practice.

These are the annual returns for stocks (S&P 500) and bonds (10 year treasuries) from 1928-2022:

- S&P 500 +9.6%

- 10 year treasuries +4.6%

If you simply took 60% of the stock market return and 40% of the bond market return, that would get you 7.6% as a 60/40 proxy.

We all know that market returns are anything but average in a given year so it can be instructive to see how rebalancing a 60/40 portfolio would have worked using actual returns.

Using these same two asset classes, if you were to rebalance back to 60/40 target weights on an annual basis, the 60/40 return over this same timeframe would’ve been 8.2%.

So how do we square the difference between 8.2% annual returns when rebalancing and 7.6% using simple averages?

It’s the rebalancing bonus.

It doesn’t always work like this but it makes sense if you think about it. Yes, stocks have higher long-term average returns than bonds but that doesn’t always hold in the short-term.

Over the past 95 years the stock market has outperformed the bond market in a given year 60 times meaning bonds have outperformed stocks in 35 of those calendar years.

Those years when stocks do better than bonds you’re trimming gains in the stock market to redeploy into bonds.

And when bonds do better than stocks you’re using bonds as dry powder to buy stocks while they’re down or underperforming.

This is not a perfect strategy by any means but it’s a nice way to keep yourself honest as an investor.

Is daily rebalancing overkill?

Probably.

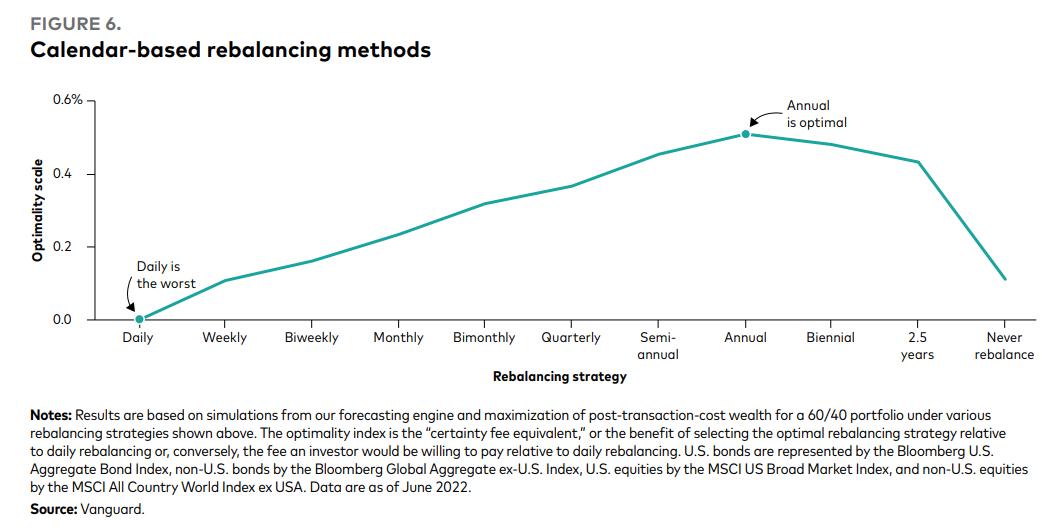

Vanguard did a deep dive on various rebalancing intervals last year using a global 60/40 portfolio:

They found rebalancing too frequently or too infrequently are suboptimal strategies.

The optimal interval from a risk control perspective was an annual rebalance.

The thing is you want some drift in the portfolio to allow the assets that are working to continue working, at least for a time.

Rebalancing once every 6, 12 maybe 18 months seems reasonable to me.

If you’re not comfortable with a periodic only rebalancing schedule, you could also do some sort of threshold levels where if an allocation gets too far out of whack then you rebalance back to target.

Or there could be some combination of periodic rebalancing with thresholds in-between if markets get into a crash or melt-up situation.

My view on this is that it’s horseshoes and hand grenades — close enough does the trick. The most important thing with rebalancing is that you have a plan of attack, stick to that plan and automate it if you can to take yourself out of the equation.

As to the question of when you should stop buying stocks on sale — my initial answer is never.

Sure, if we’re talking about individual stocks, some of them are never coming back from the dead.

But if we’re talking about a more diversified subset of stocks like an index fund then I feel pretty comfortable is saying that losses are temporary and present a wonderful buying opportunity.

I can’t offer any 100% guarantees here but if index funds crash and don’t come back we have much bigger problems to worry about than your portfolio.

Another simple way to rebalance is by putting new contributions into your underweight positions.

And if you’re still making contributions, doing so when stocks are down is a good thing.

You don’t want stocks to recover yet as long as you continue plowing money into them.

You should be thrilled to be buying stocks on sale.

We discussed this question on the latest edition of Ask the Compound where I was coming live from beautiful Montreal:

Tax expert Bill Sweet joined me again to discuss questions on making changes to your asset allocation, gifting money to your children, tax consequences from a pay raise and how taxes impact early retirement.

Further Reading:

The Mental Accounting of Asset Allocation

Podcast version here: