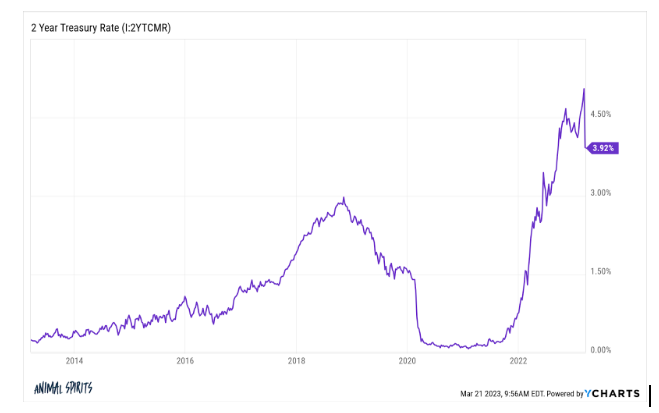

Today’s Animal Spirits is brought to you by YCharts:

Enter your information here to get 20% off YCharts (new clients only)

On today’s show, we discuss:

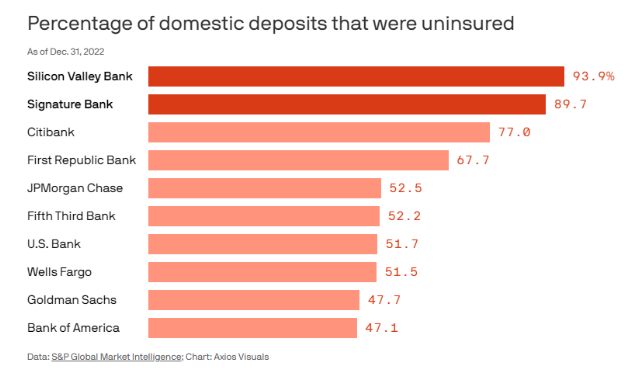

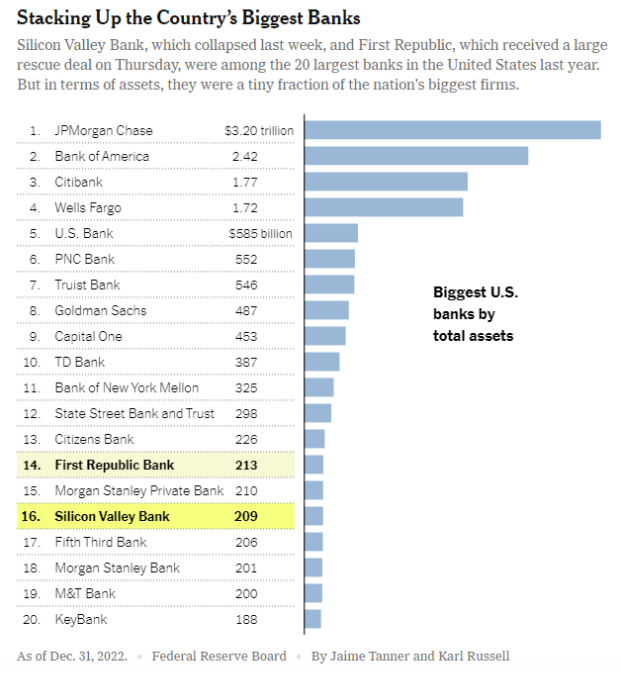

- The 72-hour scramble to save the United States from a banking crisis

- Why failed Silicon Valley Bank was an outlier

- The bank panic should not exist

- Prescriptive View: Three layers of Fed failure

- What gets lost when you rescue markets

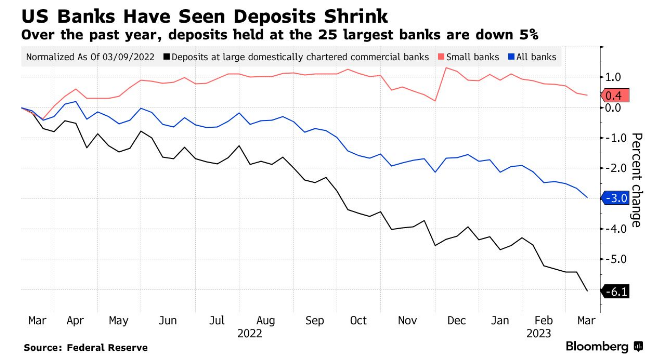

- US Bank deposits fell $54B in week before SVB collapse

- Wall Streets biggest banks rescue teetering First Republic

- Smaller banks’ critical role in economy means distress raises recession risks

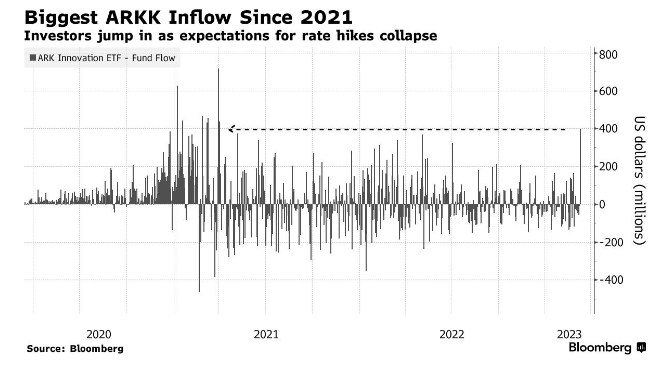

- Cathie Wood’s ARKK lures biggest inflow since 2021 glory days

- A better AEI graphic of inflation over the past 20 years

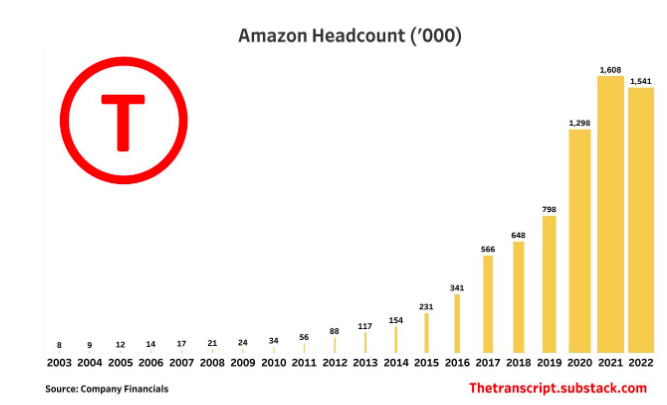

- Update from Amazon CEO Andy Jassy on Amazon’s operating plan and additional role eliminations

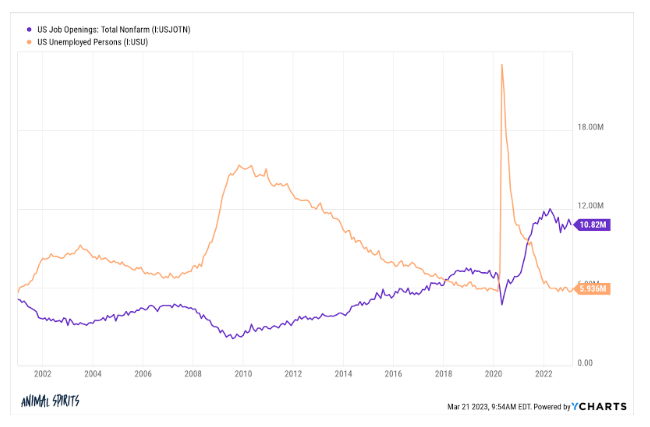

- Job listings abound, but many are fake

- Golf at 3pm Thursday? Sure, it’s the afternoon fun economy

- Home prices fell in February for the first time in 11 years

- Savers pile money into bank CDs as rates top 5%

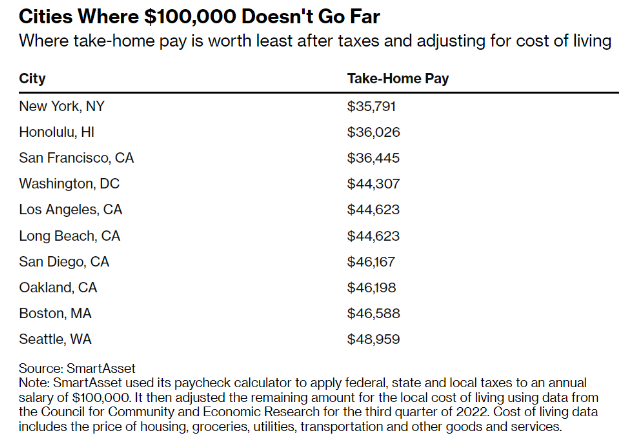

- In New York City a $100,000 salary feels like $36,000

- Good news: ChatGPT would probably fail a CFA exam

Future Proof:

YCharts x Animal Spirits Webinar on March 23rd at 2:30 Eastern

Listen Here:

Recommendations:

- Hunt For Red October

- Lock, Stock, & Two Smoking Barrels

- The Fugitive

- Sicario: Day of the Soldado

- Ferris Buellers Day Off

Charts:

Tweets:

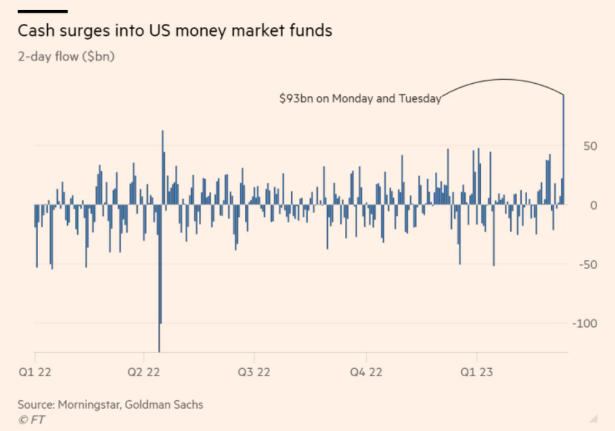

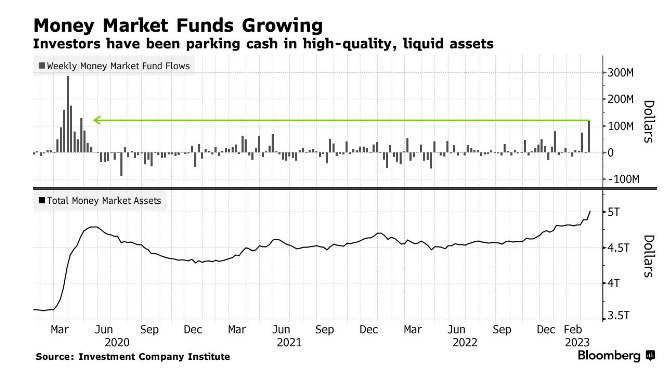

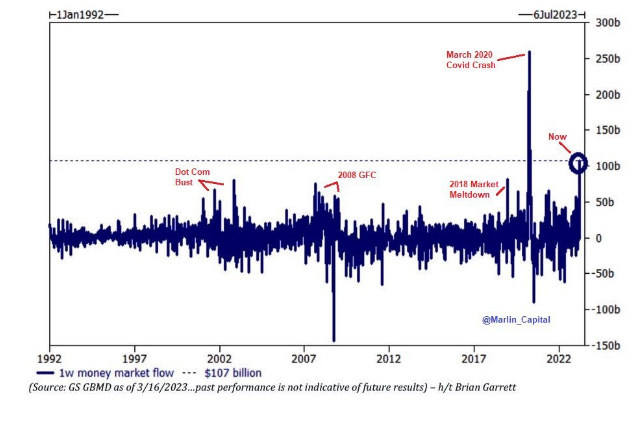

“Since the Fed began to raise interest rates a year ago, the amount of money in money market funds has increased by roughly $400bn, and the inflows increased by more than $100bn last week” @apolloglobal pic.twitter.com/hyDlIX8Tpv

— Sam Ro 📈 (@SamRo) March 20, 2023

A record high $152.85B borrowed from the Fed’s discount window this week…

Prior all-time high was $111B in 2008.

(Chart @zerohedge) pic.twitter.com/sRBh96qxXL— Geiger Capital (@Geiger_Capital) March 16, 2023

The majority of America has no idea about the banking crisis happening on Twitter.

— Chris Powers (@fortworthchris) March 18, 2023

The media’s position on bank runs: Their reporting of huge unrealized losses at a bank in no way contributes to a run. If you react to their reporting by wanting to withdraw your money, you’re panicking. But if you stay in the bank and it fails, you deserve to lose your money.

— David Sacks (@DavidSacks) March 18, 2023

Not normal. pic.twitter.com/uCMCT7e6bS

— Bespoke (@bespokeinvest) March 17, 2023

Takeaway: fixing a "banking crisis" is a lot easier than fixing inflation.

— Jesse Livermore (@Jesse_Livermore) March 20, 2023

“Small banks account for 30% of all loans in the US economy, and regional and community banks are likely to now spend several quarters repairing their balance sheets.”

-Torsten Slok, Apollo, on the coming credit crunch— Edward Harrison (@edwardnh) March 15, 2023

JP MORGAN APPROXIMATELY ESTIMATES SLOWER LOAN GROWTH BY MID-SIZE BANKS COULD DEDUCT A HALF TO A FULL PERCENTAGE-POINT OFF THE LEVEL OF US GDP OVER THE NEXT YEAR OR TWO.

— FinancialJuice (@financialjuice) March 16, 2023

4/6 – Target-maturity bond ETFs are getting more popular by the day and have brought in more than $15 Bil in cumulative inflows over the past year. pic.twitter.com/kQqMBM6I39

— Ben Johnson, CFA (@MstarBenJohnson) March 16, 2023

Amazon announces another round of layoffs affecting 9,000 employees on top of the 18,000 announced in Jan. Small compared to their workforce of 1.5 million, but likely a more significant % of their corporate staff.https://t.co/WXqqphridq pic.twitter.com/WharcYMYCW

— Daniel Zhao (@DanielBZhao) March 20, 2023

.@KellyCNBC Delayed answer to your on-air question (didn’t trust my recollection on the spot):

80% of job openings are at small businesses with fewer than 250 employees right now, up from around 72% in 2019.

50% are in those with fewer than 50, up from 41% in 2019.

— Julia Pollak (@juliaonjobs) March 16, 2023

BTC spot volumes are sky-high: Under my favorite metric (trusted exchanges from @coinmetrics, 3-day ma), BTC spot volumes hit the highest print since May 2021.

Do you think these high volumes are here to stay? pic.twitter.com/MMNBlchWpg

— David Lawant (@dlawant) March 17, 2023

Per 2020 #IRS figures:

The top 1% of individual filers paid 42.31% of all US Income #Taxes up from 38.77% in 2019. They accounted for 22.19% of total Adjusted Gross Income AGI.

You needed an AGI of $548,336 to make it into this club. pic.twitter.com/8GkWeXCezZ— George Papadopoulos (@feeonlyplanner) March 21, 2023

🚨Breaking:

Microsoft just launched 365 Copilot, and it's insane.

It's essentially ChatGPT for:

-Word

-Excel

-Powerpoint

-Outlook

-TeamsCheck out the demo👇 pic.twitter.com/ATW0mfPwhC

— Rowan Cheung (@rowancheung) March 16, 2023

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Wealthcast Media, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.