Today’s show is sponsored by Invesco QQQ:

See here for more information on investing in the Nasdaq 100

On today’s show, we discuss:

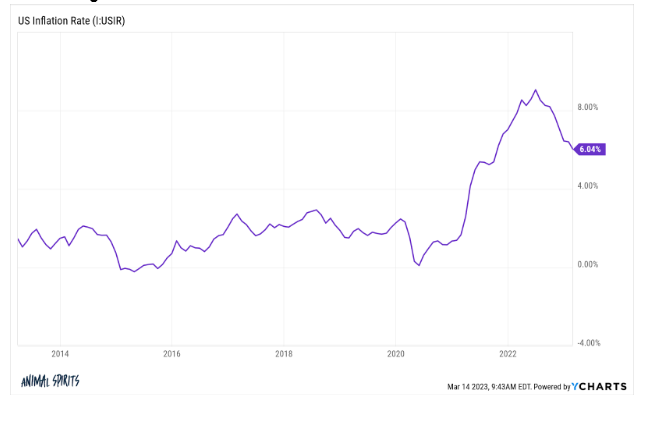

- The demise of Silicon Valley Bank

- Thoughts on the bank bailouts

- NYPD called to Silicon Valley Bank branch as depositors attempt to pull cash

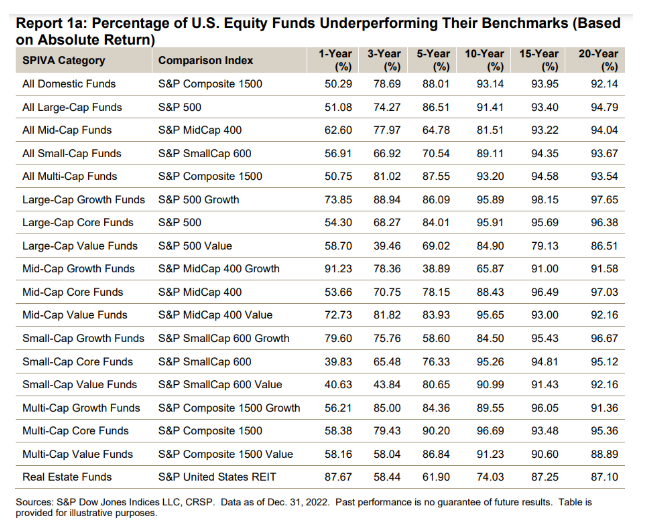

- S&P SPIVA US Scorecard

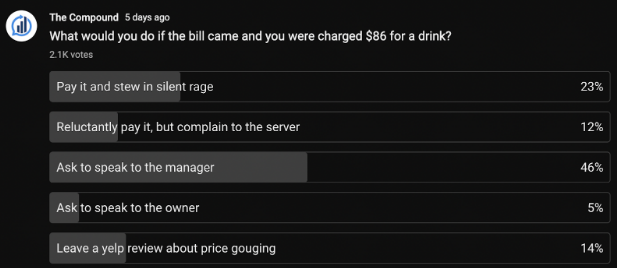

- The hotel cabanas that cost more than most rooms

- Three million US households making over $150,000 are still renters

- Fear over Social Securities future leads some to claim retirement benefits early

Future Proof:

YCharts x Animal Spirits Webinar on March 23rd at 2:30 Eastern

Listen Here:

Recommendations:

Charts:

Tweets:

SVB was founded in 1983.

Its birth and death bookend a distinct 40 year period of economic history.

— Joe Weisenthal (@TheStalwart) March 10, 2023

$42 billion in deposits fled SVB yesterday pic.twitter.com/TxzOJehhDk

— Deirdre Bosa (@dee_bosa) March 10, 2023

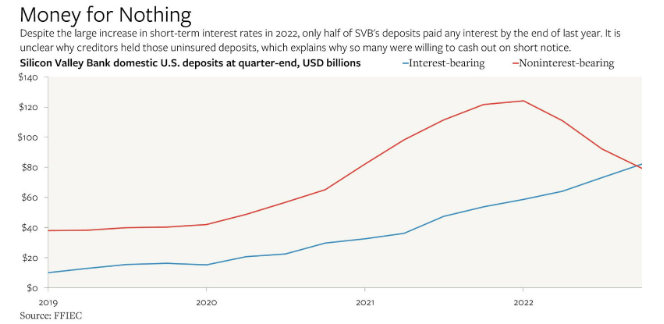

At Silicon Valley Bank, north of 93% of the bank's $161 billion in deposits are uninsured per a recent regulatory filing, @MaxJReyes writes.

Follow our live blog for the latest developments on SVB https://t.co/rXLJQRLgMC pic.twitter.com/7T3r0YqoYt

— Bloomberg (@business) March 10, 2023

Feels like fall of 08 a little. But with much less panic. These regulators have had 15 years working on this. There is a lot more expertise and experience. The stakes are better known. All that is a likely positive for how this gets resolved svb depositors and the system.

— Bob Elliott (@BobEUnlimited) March 10, 2023

This can't be good pic.twitter.com/9bPY4qGmSo

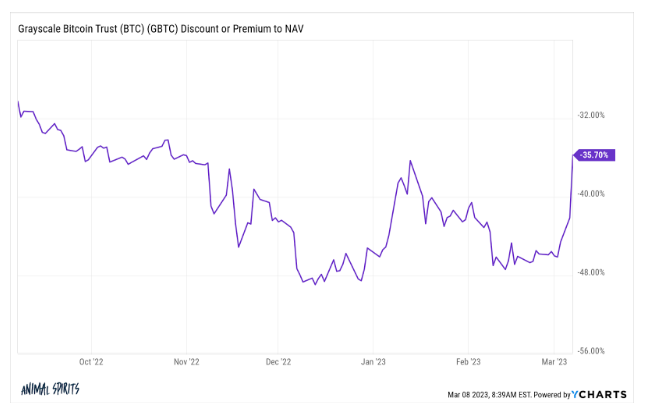

— Eric Balchunas (@EricBalchunas) March 13, 2023

I have been advocating for CFO's to keep some cash in #Bitcoin for a while now as a hedge against bad government and the banking system. The Silicon Valley Bank crisis might keep companies who didn't buy at least some #BTC from making payroll on Monday. This is a Main St. problem

— Tim Draper (@TimDraper) March 11, 2023

If markets closed now, the 2-day move in 10-year US Treasury futures (going back to 1982) would be 99.9th %-ile.

What’s your catalyst narrative?

— Corey Hoffstein 🏴☠️ (@choffstein) March 13, 2023

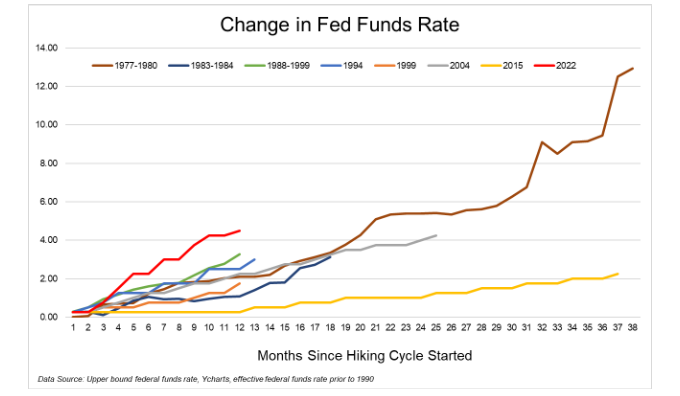

The market is now projecting a Fed Funds rate of 4.10% by the July meeting, or just under 50 bps of cuts from current levels. This was at 5.66% last Wednesday. That's 150 basis points of looser policy in less than a week. pic.twitter.com/tk4JmTDJsF

— Bespoke (@bespokeinvest) March 13, 2023

Treasury rate volatility: highest since the GFC $MOVE pic.twitter.com/Px6iMcLZfa

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) March 13, 2023

Put options volume hit a record today pic.twitter.com/FqDDmcqt08

— Gunjan Banerji (@GunjanJS) March 11, 2023

Traffic to home builder websites hit an ALL TIME high on March 7th. Yep – even way beyond any time in 2020-2022.

— Kevin Oakley (@koakley81) March 9, 2023

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Wealthcast Media, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.