Today’s Animal Spirits is brought to you by American Century Investments:

See here for more information on American Centuries Short Duration Strategic Income ETF

On today’s show, we discuss:

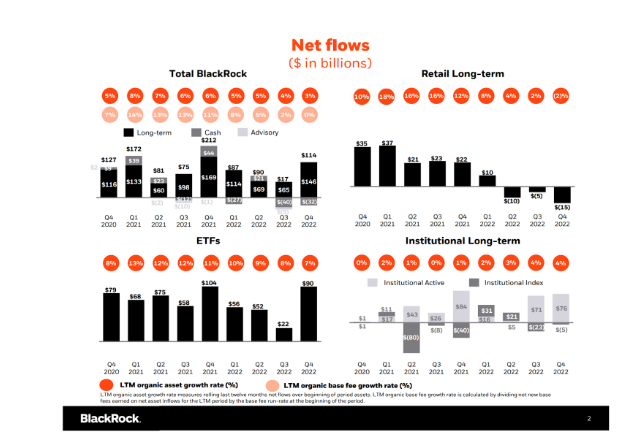

- BlackRock vs. Goldman in the fight over 60/40

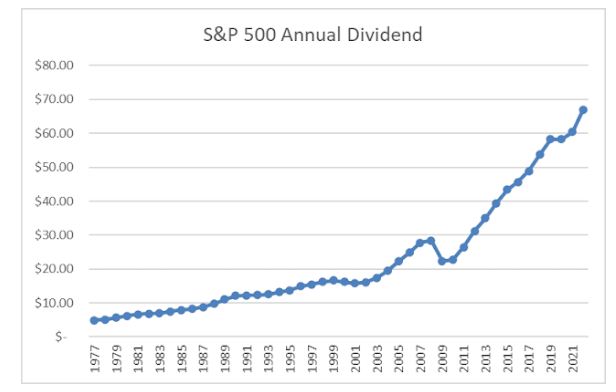

- 2023 was a record year for US dividends

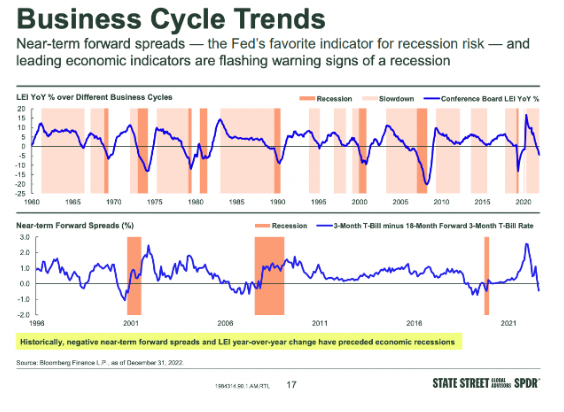

- Neil Dutta and Conor Sen on the chances of a US soft landing

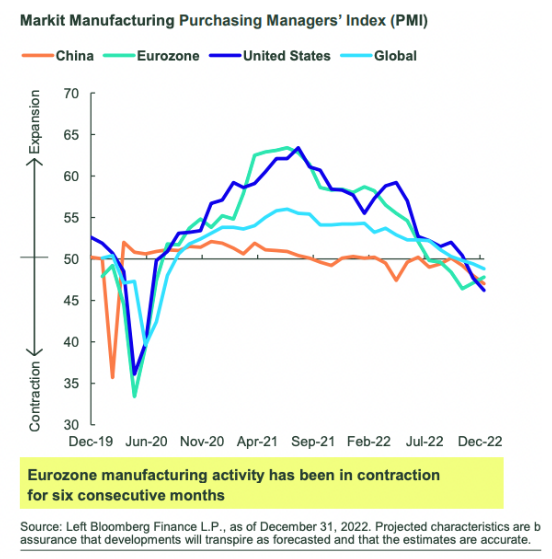

- New York manufacturing activity plunges to lowest since May 2020

- Egg prices haven’t come down with inflation, here’s why

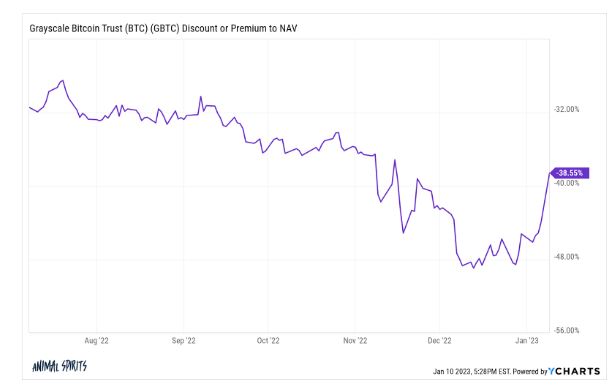

- A message from CEO and Co-Founder, Brian Armstrong, to Coinbase employees

- BlackRock earnings

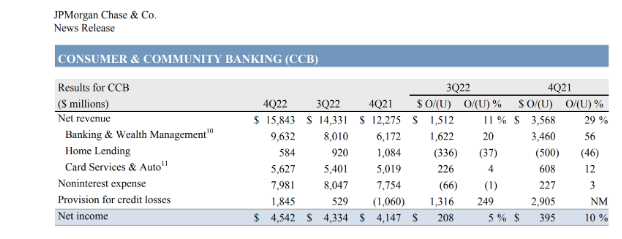

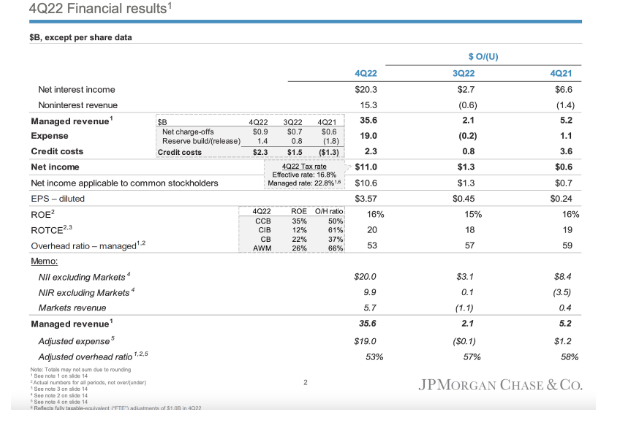

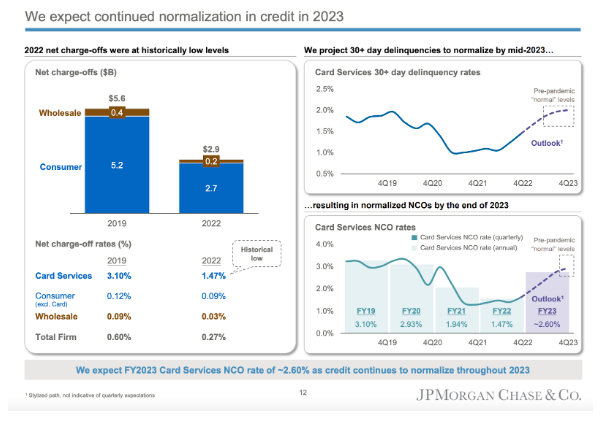

- JP Morgan earnings

- The January inflation bump Americans should welcome

- 27 people on the streets of New York talk about how much money they make

- Money rich and time poor: life in two-income households

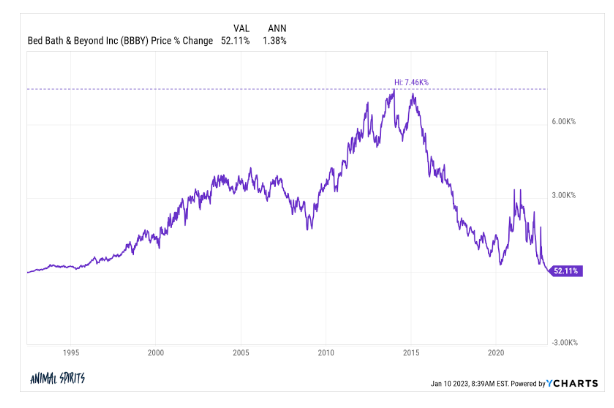

- Bed Bath & Beyond shares plummet after company warns of potential bankruptcy

Listen Here:

Recommendations:

Charts:

Tweets:

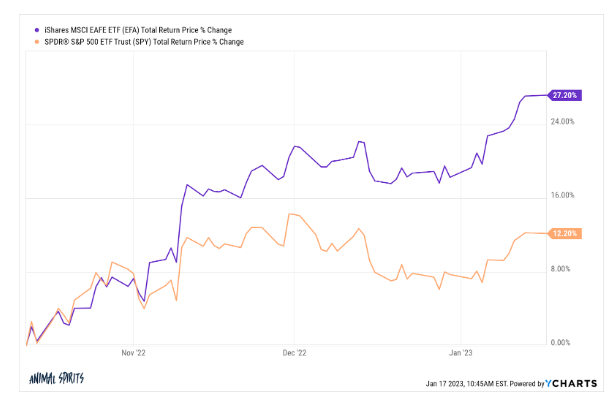

The MSCI World ex USA index is outperforming the S&P 500 by ~14 percentage points on a rolling 50-trading-day basis, the widest margin since **2009**–Dow Jones Market Data.https://t.co/JsWf54nTKT pic.twitter.com/yutBescVju

— Gunjan Banerji (@GunjanJS) January 10, 2023

While economists are still predicting that GDP was negative in Germany in Q4 and will be again in Q1, this real-time indicator from the OECD is pointing to continued growth. pic.twitter.com/uNLPyttSk6

— Jeffrey Kleintop (@JeffreyKleintop) January 10, 2023

Bond funds drew $17.5 billion of inflows over the past week, the most in *18 months* —DB pic.twitter.com/4TS0zmN8A6

— Gunjan Banerji (@GunjanJS) January 14, 2023

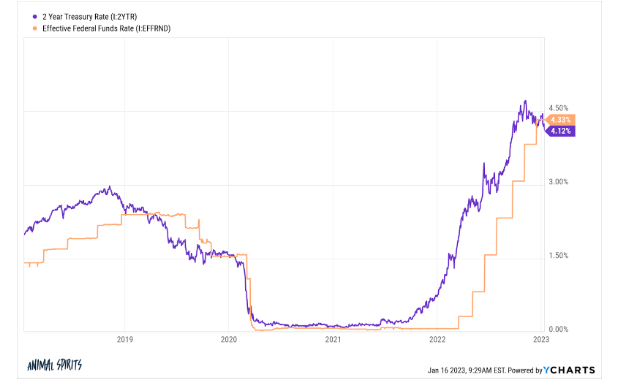

.@TruthGundlach on investor webcast says “it is obvious the bond market is in control” and the Fed usually follows the two-year Treasury note #2023

— Jennifer Ablan (@jennablan) January 10, 2023

"In his [2011] commentary Andreessen discussed 17 then or-since listed digital disruptors, more than 1/3 of which have subsequently declined in market value…he also referenced 10 old-economy laggards, all of

which have delivered positive real returns."https://t.co/BiImnl1MHx pic.twitter.com/n4Fpt9UB2z— Lawrence Hamtil (@lhamtil) January 13, 2023

“Investors are running for the hills, away from our strategy.”https://t.co/xMZWDzIS8a

— Avi Salzman (@avibarrons) January 6, 2023

U Mich consumer sentiment current conditions rose to its highest level since April. Gas prices down, unemployment at a 50-year low, 3-month inflation very low, back half of 2022 3%+ real GDP growth. pic.twitter.com/fQYqlbax3i

— Conor Sen (@conorsen) January 13, 2023

Philadelphia Fed President Pat Harker says it's time to put more weight on surveys and other soft data.

"Candidly, an overemphasis on hard data can lead to policy errors." https://t.co/yXqxSIx8Om pic.twitter.com/j3dNW6FQcs

— Nick Timiraos (@NickTimiraos) January 13, 2023

Rolls-Royce CEO: "We haven’t seen any slowdown or downturn. We haven’t seen any negative impact. I’m not saying we’re immune from recessionary tendencies. We have seen years when our business was affected…I’m cautiously optimistic about us delivering another strong year in '23"

— The Transcript (@TheTranscript_) January 10, 2023

The most important inflation number currently is core-CPI ex-shelter. This was negative month-to-month for the third consecutive month and is now only up 4.4% YoY. pic.twitter.com/tToNJeDIYP

— Bill McBride (@calculatedrisk) January 12, 2023

It really is astonishing that core CPI is back at 3.1% on a 3-month annualized basis from a peak of 10.0% in June 2021 (still up moderately from 2.5% in Feb 2020) and the unemployment rate is at 3.5%. That is some seriously good news

— Julia Coronado (@jc_econ) January 12, 2023

Everyone keeps complaining about eggs being too expensive now but I'm gonna zag on this one

A dozen eggs for $3.60 is still ridiculously cheap

That's basically 3-4 meals of high-quality protein for <$4

My take:

Eggs have been underpriced for years and remain relatively cheap pic.twitter.com/WWjyJZyGKz

— Ben Carlson (@awealthofcs) January 11, 2023

Let Batnick go on CNBC with this take

— Devin Bronson (@TheRealDevinB) January 11, 2023

New Mannheim used car prices just dropped. Chart is from 1990. Yeah never seen it before – 14.9% pic.twitter.com/p11pVulawv

— Tom Hearden (@followtheh) January 10, 2023

B of A: $COIN volume in December (first full month post-FTX collapse) "were just $34B, less than half of COIN’s 1Q22-3Q22 monthly average of ~$76B. .. we think consensus revs for ’23 could be way too high. Lower PO to $35 .."

Cuts to Underperform

— Carl Quintanilla (@carlquintanilla) January 11, 2023

— RYAN SΞAN ADAMS – rsa.eth 🦄 (@RyanSAdams) January 16, 2023

Larry Fink from Blackrock just said on CNBC: "I look forward to the day when all stocks and bonds are tokenized so we know every beneficial owner of every stock and bond"

Surprising coming from Blackrock! Seems to acknowledge that we don't know BOs today – too much obfuscation.

— Dave Lauer (@dlauer) January 13, 2023

Fed economists: Home price gains over the last 2 years could have produced a wealth effect for homeowners that drove one third of the increase in the CPI (non-shelter prices) https://t.co/NyGi3KnNMN pic.twitter.com/rabLjhNkMG

— Nick Timiraos (@NickTimiraos) January 11, 2023

Counterpoint: Strategists at BCA Research note that home price gains were so swift in 2020-21 that consumers probably "did not fully adjust their spending patterns to incorporate their newfound wealth."

That would imply less of a negative wealth effect as prices decline. pic.twitter.com/hwKnhmMKW1

— Nick Timiraos (@NickTimiraos) January 11, 2023

Buyers are getting more from sellers. Last month 51.5% of all sales in Sacramento County had some form of a concession. Sellers are tending to give things like credits for closing costs, credits for repairs, rate buydowns, etc… Not a shocker to see this rising since May. pic.twitter.com/cfPPli7xx5

— Ryan Lundquist (@SacAppraiser) January 13, 2023

Even though the US homeownership rate has been rising since 2016, the mortgage debt service ratio of Americans remains near record lows. Homeowners as a cohort have likely never been less burdened by their monthly payments. pic.twitter.com/YO4PGJTWKT

— Conor Sen (@conorsen) January 14, 2023

A single percentage point decline in rates has the same impact on affordability as an 11% decline in house prices. https://t.co/C6rQgL3z14

— Mike Simonsen 🐉 (@mikesimonsen) January 12, 2023

Almost 90% of mortgage refinance volume in 2022Q3 came from cash-out transactions @awealthofcs pic.twitter.com/YEsIqodpDq

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) January 12, 2023

This also can create a demand problem when rates rise very fast like saw in 2022. pic.twitter.com/2bVpFv6ugU

— Logan Mohtashami (@LoganMohtashami) January 16, 2023

A Seattle real estate agent tells me:

"For what it is worth. The first two weeks of the year have been busier with buyer activity than the last 3 months combined were."

— Lance Lambert (@NewsLambert) January 16, 2023

$BBBY 😳

The stock is down -24.41% this afternoon — or $1.82/share. https://t.co/nRo7LGgYiJ pic.twitter.com/Jb4CjhIKW6

— Gnome One (@gnomeoneuknow) January 5, 2023

Not a good sign for Mastoden.

The past two months represented one of the best environments for the service to get new users. Data shows few joined (relatively speaking) and a large portion of those who did join are now losing interest. pic.twitter.com/CT037MK4Fb

— Neil Cybart (@neilcybart) January 9, 2023

When the Chargers went up 27-0, a bettor bet $1.4 million on them to win the game to net $11,200.

Jacksonville came back and won 31-30.@DKSportsbook has confirmed that this bet was indeed made. pic.twitter.com/TvwCNyEjyr

— Darren Rovell (@darrenrovell) January 15, 2023

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Wealthcast Media, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product