In his latest monthly missive, Bill Gross shares some thoughts on financial market returns from the past four decades:

Since the inception of the Barclays Capital U.S. Aggregate or Lehman Bond index in 1976, investment grade bond markets have provided conservative investors with a 7.47% compound return with remarkably little volatility. An observer of the graph would be amazed, as was I, at the steady climb of wealth, even during significant bear markets when 30-year Treasury yields reached 15% in the early 80’s and were tagged with the designation of “certificates of confiscation.”

The path of stocks has not been so smooth but the annual returns (with dividends) have been over 3% higher than investment grade bonds as Chart 2 shows. That is how it should be: stocks displaying higher historical volatility but more return.

But my take from these observations is that this 40-year period of time has been quite remarkable — a grey if not black swan event that cannot be repeated. With interest rates near zero and now negative in many developed economies, near double digit annual returns for stocks and 7%+ for bonds approach a 5 or 6 Sigma event, as nerdish market technocrats might describe it.

You have a better chance of observing another era like the previous 40-year one on the planet Mars than you do here on good old Earth.

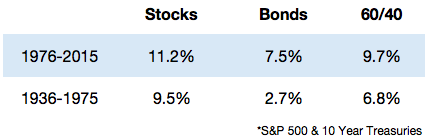

I ran the numbers for the past 40 years through the end of 2015 along with the prior 40 year period to illustrate the Bond King’s point here:

I’m skeptical that many investors of this glorious period of market performance were able to earn these types of returns, but Gross is right nonetheless. Investors can’t expect to earn the same level of returns going forward as we’ve seen over the past 40.

Bonds are a perfect example of this. In 1975 the 10 year treasury yield was was 7.5%. At the start of 1936 it was 2.7%. Remarkably — or not so remarkably — the ensuing annual returns from 1975 on were 7.5% annually while the returns from 1936 on were 2.7% annually. The 10 year currently yields around 1.8%. There’s not always a perfect 1-to-1 correlation on the starting yield and the ensuing performance, but it’s pretty close.

I have no problem with Mr. Gross alerting investors to the potential for lower returns in the future.

My problem is that many professional investors, strategists and portfolio managers are using these numbers to scare investors. Fear-mongering isn’t very helpful in my eyes, especially when it’s being used as a sales tactic in some cases. Bond managers know that the wind isn’t at their back anymore so you’re seeing more of them talk about stock picks, market valuation, all sorts of macro variables and even politics to try to divert the attention away from the fact that bonds are going to see lower returns with higher levels of volatility from current interest rate levels.

People seem to automatically associate lower returns with a system-wide crash. A market crash is always a possibility but they are low probability events by historical standards. There’s no need for investors to freak out over the potential for lower returns. This is a reality every investor will have to deal with. And shouldn’t we all expect lower returns after a period of higher returns?

Many investors are now asking themselves if the current reality requires a change in strategy. It seems that many investors are looking to liquid and illiquid alternative investments to bail them out. What most don’t realize is that alts are operating in the exact same lower return environment, just through different strategies.

Before a complete portfolio overhaul, here are a few questions investors need to ask themselves when thinking about the current situation:

- Am I diversified beyond traditional U.S. stock and bond holdings?

- Am I diversified globally?

- Should I be saving more money?

- Are my current spending habits out of whack with my future spending needs and desires?

- What are the risk and return expectations for my portfolio?

- Are my expectations realistic?

- Do I understand that higher returns require accepting volatility?

- How will I balance my need to take risk with my appetite for risk and volatility?

- Does it really make sense to pay a portfolio manager higher fees in a lower return environment on the off-chance that they can outperform?

Source:

Bon Apetit (Janus)

Further Reading:

Did Bill Gross Tip the Pop Machine Over?

Now here’s the stuff I’ve been reading lately:

- Check out the Abnormal Returns t-shirt deal which helps support a great cause (Abnormal Returns)

- 20 common investing mistakes (Morningstar)

- Winners average losers (Pension Partners)

- RWM is coming to Cleveland in July. Details here (TRB)

- Investing by design (Broyhill Asset Management)

- Diversification will always disappoint (Newfound Research)

- The greatest cost of all (Fortune Financial)

- Say yes to the financial advisor who will tell you no (Washington Post)

- Marc Andreessen’s advice for business owners (Reformed Broker)

- The golden years (Irrelevant Investor)

- Why everyone disagrees about the economy (Motley Fool)

- You will never have enough money (Nocturne Capital)