There are generally three reasons to trade options:

1. Earn some income. If you own shares in a stock you could sell puts or write calls to earn some income while you hold it. If the stock moves past the strike price by expiration that could cause you to have to sell (or buy) the stock but either way you get to keep the options premiums. Those premiums are effectively income paid by the buyer of the options.

2. Hedge some risk. Options can be used to set risk parameters around your holdings. Instead of putting in a stop-loss order on a stock, you could always buy put options to define your downside protection. And if you understand options pricing models, you can also place trades based on the volatility profile of the underlying stock or the market overall. You can never completely eliminate risk in any position but options can be used as a form of insurance if you know what you’re doing.

3. Speculate. Trading options also allow you to use leverage, bet on moves in any direction (upside, downside, sideways) and offer the opportunity for bigger gains (and losses). One of the reasons many traders prefer to use options is because they don’t require nearly as much capital to see big gains. People use options for big gains but also because it’s entertaining and involves a bigger dopamine hit than other strategies.

It’s impossible to perfectly segment trades by motivation because traders and investors all have different goals, opinions, positioning and reasons for making trades. But let’s be honest, the majority of small investors right now are using options to speculate:

This is beyond optimism, euphoria, or even bubble.

It is an all-out mania.

Despite the largest losses in months, small options traders nearly DOUBLED the amount of money they spent on buying calls to open last week.

That's more than $44 billion this month alone. pic.twitter.com/DAmywEug4f

— SentimenTrader (@sentimentrader) January 30, 2021

Is there some new user adoption here now that you can trade options for free on many platforms? Sure.

And are some of these options traders using them for risk management purposes? Of course.

But is there an army of people out there who are bored and using options to gamble on a raging bull market? Absolutely.

And when you see how some of these trades are executed it’s hard to blame them.

Online sports betting became legal in Michigan the Friday before the NFC and AFC championship games. I’ve written about sports gambling in the past. I think it has the potential to be huge.

In the interest of due diligence, and since they were all offering enticing promos, I signed up for a handful of the sports betting apps1 to place some bets.

I even won some money during championship weekend. Then I doubled down and lost most of it betting on the Chiefs to win the Super Bowl.2

Ah well.

Being a total noobwhale when it comes to online sports gambling, I was blown away by the sheer number of different bets you can place. It’s not only the outcomes of the games you can bet on with a point spread but over/unders, prop bets galore, futures, live betting and more.

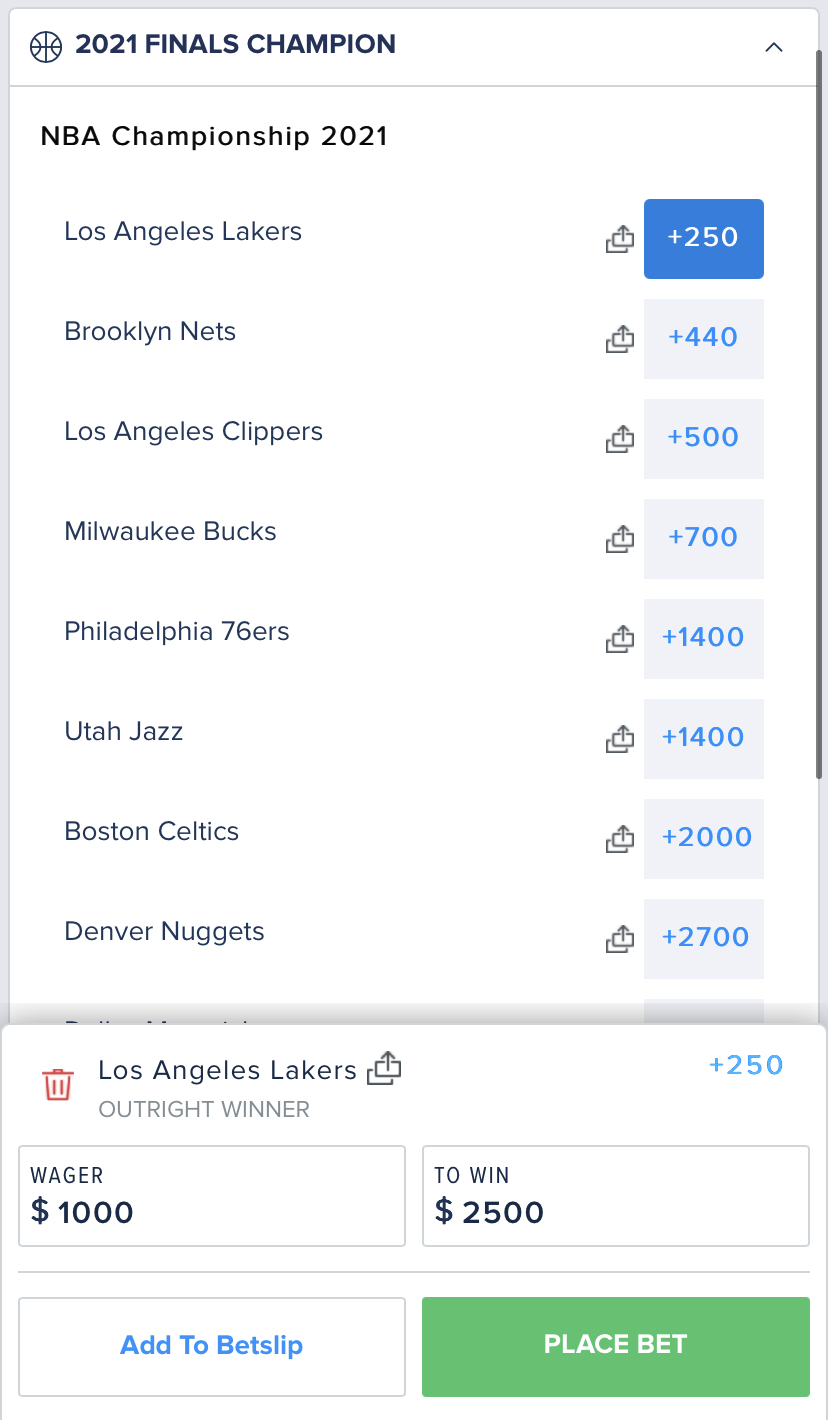

And the apps are slick. For instance, this is what it looks like to bet on the future 2021 NBA champion:

You put in the amount you’re willing to bet and they let you know how much you can win. The best and worst part about sports betting is the outcome is an all-or-nothing prospect. Either you win the entire amount or you lose the entire amount.

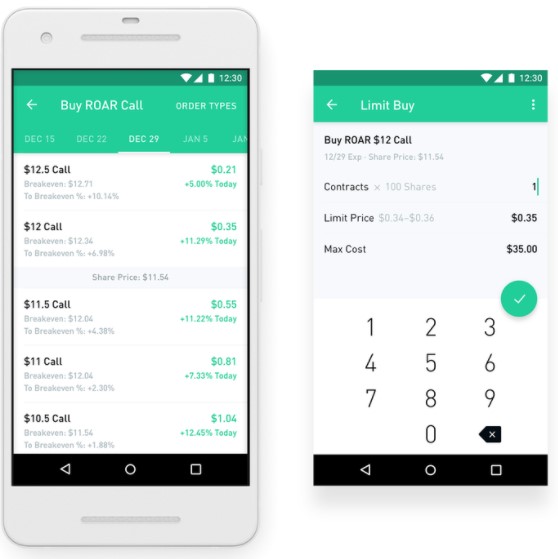

The same is true when speculating with options. Here is a look at the options interface on Robinhood:

It looks eerily similar to the sports betting apps in that you put in your parameters, how much you’re willing to bet and then it spits out your potential payout.

And just like sports betting, it’s an all-or-nothing proposition at expiration.

When sports were completely shut down in March and April, one of the theories as to why so many speculators dove headfirst into the markets is because many gamblers had nothing else better to do with their time.

Maybe there was some truth to this theory. But sports eventually came back and speculation has kept right on climbing.

People are probably still bored to some degree. When more people start going back to the office (next year?) I would assume some of this will die down.

But the ability to place trades on your smartphone has made it easier than ever to speculate, so I’m guessing many speculators are multitasking and betting on both options and sports. You can do both with the click of a few buttons and be on your way.

The barriers to entry are basically gone when it comes to speculation. This is a double-edged sword and one side of that sword is very sharp.

Michael and I discussed the gamification of options trading along with SPACs, tail risk strategies, why the Philadelphia 76ers are like Robinhood traders and much more in this week’s Animal Spirits video:

Don’t forget to subscribe to The Compound for more of these videos.

Further Reading:

Two Big Trends I’m Thinking About For the Future

Now here’s what I’ve been reading lately:

- 7 lessons from the FIRE movement (Mr. Stingy)

- How to get rich slowly (Grow)

- How to gauge your own success (Retirement Field Guide)

- The U.S. vaccine rollout is world-beating (Noahpinion)

- Compounding has a branding problem (Abnormal Returns)

- The beach bum who beat Wall Street and made millions on GameStop (The Ringer)

- The big long (Reformed Broker)

- The relationship between money and happiness (Incognito Money Scribe)

- Why are Covid cases dropping so fast? (The Atlantic)

1I tried out Barstool Sports, FanDuel and MGM. Barstool and FanDuel gave me the best user experience.

2As always, never bet against Tom Brady.