This week’s Animal Spirits with Michael & Ben is supported by YCharts:

Mention Animal Spirits and receive 20% off your subscription price when you initially sign up for the service.

We discuss:

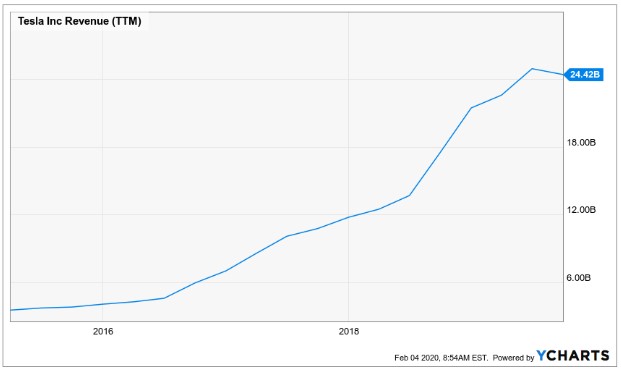

- The insane run in Tesla’s stock price

- Understanding base rates when thinking about the future

- Bill Miller and Ray Dalio

- Why sports gambling is the new stock-picking

- Why there can’t be a Barstool for finance

- Should we care that Zero Hedge got banned from Twitter?

- Do we need recessions for the system to work?

- Why facts don’t change people’s minds

- Re-thinking personal finance education

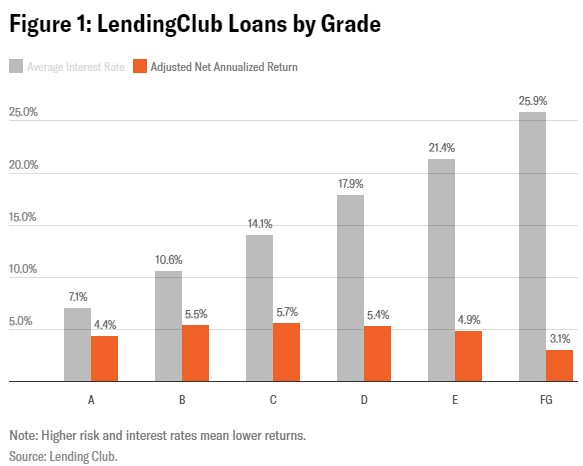

- Why risk and return aren’t always perfectly linked in the fixed income space

- Pros and cons of high-frequency trading

- People lie on surveys, exhibit 2,943

- Would you be better off investing in private equity companies or funds?

- How uncorrelated is bitcoin and much more

Listen here:

Stories mentioned:

- Ron Baron sees $1 billion in revenue for Tesla

- The base rate book

- Ray Dalio is still driving his hedge fund machine

- The WSJ’s fake and distorted news

- The race to be first

- Do recessions need to happen

- Why facts don’t change minds

- Rethinking financial education

- High yield was oxy. Private credit if fentanyl

- Bill Miller was up 120% last year

- Americans to inherit $764 billion this year, mostly tax-free

- Sports gambling will be a huge opportunity

- HFT costs investors $5 billion a year

- The subsidies will continue

- The Apple effect

- Americans went to the library more often than the movies

- The biggest lie in personal finance

- How to not get scammed

Books mentioned:

Charts mentioned:

Video mentioned:

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, stickers, coffee mugs, and other swag here.

Subscribe here: