There are a number of periodic research pieces I read whenever they come up — JP Morgan’s Guide to the Markets, the Credit Suisse Yearbook, and the Investment Company Institute’s Fact Book to name a few.

The ICI’s annual Fact Book provides a deep dive on past trends and where things currently stand in fund industry. The most recent report looks at things through the end of 2018.

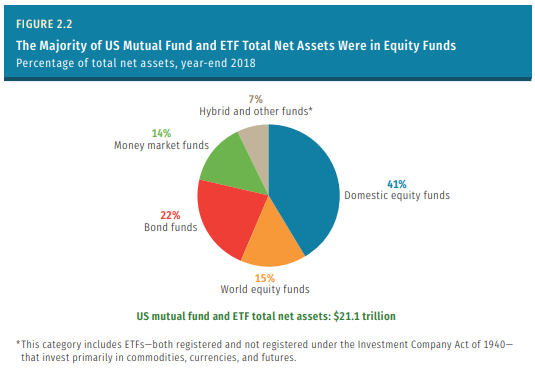

This is the total assets by fund type in the United States:

Since 1999 assets overall are up threefold but ETF assets alone are up 100x.

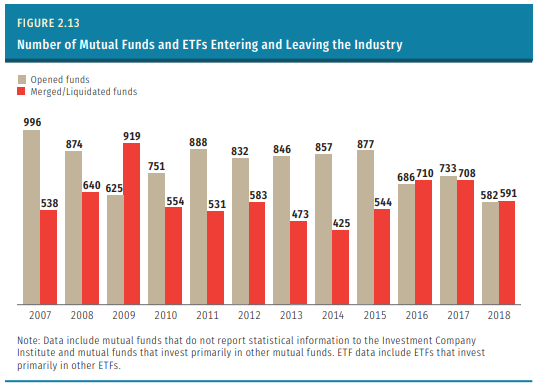

The shocking thing about this growth is the fact that so many of these funds go out of business every year:

The mutual fund/ETF graveyard is bigger but the fund maternity ward is pretty busy most years. So the number of fund choices is growing even faster than it looks from the overall total number of funds.

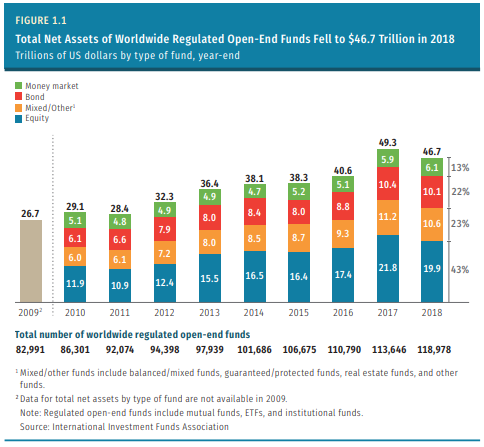

The total number of funds is staggering when you look worldwide:

As of the end of 2018, there were not only 118,000+ open-end funds around the globe but nearly $47 trillion in assets in these funds.

The sheer number of choices available is mind-boggling.

Almost $50 trillion in assets is why index funds will never completely put the active management industry out of business. There’s way too much money sloshing around for people to leave this industry.

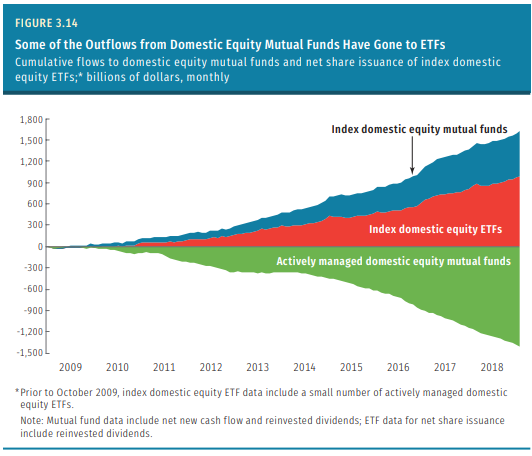

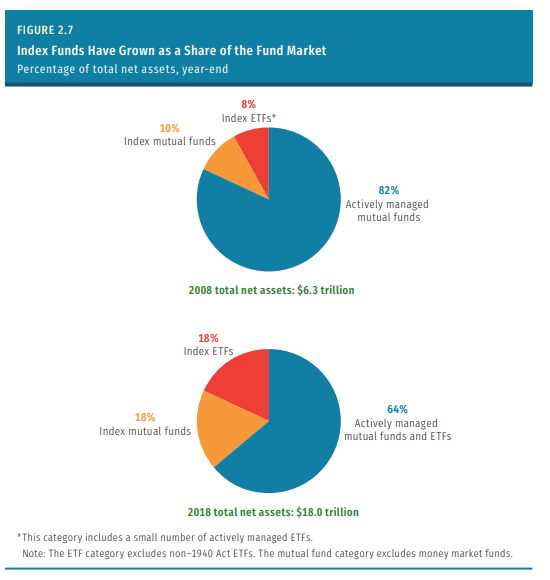

The biggest trend in the fund space over the past decade or so is the explosive growth in index funds and ETFs and the commensurate outflows from the active mutual fund space:

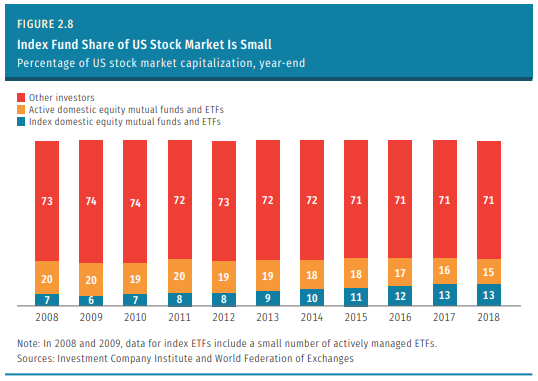

As crazy as this chart looks, index funds are still relatively small in the grand scheme of things when compared to the overall stock market:

Now here’s the breakdown for the fund industry as a whole:

It’s important to remember that while the fund industry is large, the entire market of securities is much larger. So index funds are becoming a larger chunk of the fund industry but are still a small slice of the overall pie.

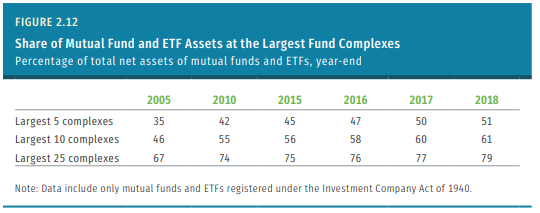

The other big shift is the growing concentration in who controls the fund industry:

Growth in the top 5 fund providers since 2005 has been substantial. Big fund companies like Vanguard, Blackrock, Fidelity, State Street, and Charles Schwab are taking over the fund industry.

The U.S. fund industry is relatively diversified:

Maybe the biggest category that sticks out from this chart is how much cash resides in money markets.

John Bogle talked about the importance of money markets in his last book. These cash equivalent funds were basically non-existent until the early 1980s. During that decade mutual fund assets in total went from $241 billion to $1.45 trillion. A huge chunk of that growth came from money market funds, which went from $2 billion to $570 billion, accounting for nearly half the increase in the fund complex.

Further Reading:

The Real Estate Market in Charts

Now here’s what I’ve been reading lately:

- Money can buy happiness (A Teachable Moment)

- A conversation with Aswath Damodaran (Elm Funds)

- Why advice to your younger self wouldn’t have worked anyways (Irrelevant Investor)

- Why don’t men have more friends? (Bone Fide Wealth)

- Why saving helps offset future disasters (Monevator)

- “Not recognizing that you’re overpaid means you won’t have the funds to avoid your parents’ basement when shit gets real.” (One Zero)