This week’s Animal Spirits with Michael & Ben is sponsored by YCharts:

Mention Animal Spirits and receive 20% off your subscription price when you sign up.

We discuss:

- Steve Mnuchin’s bizarre statement on the banks.

- Big up and down days in the market.

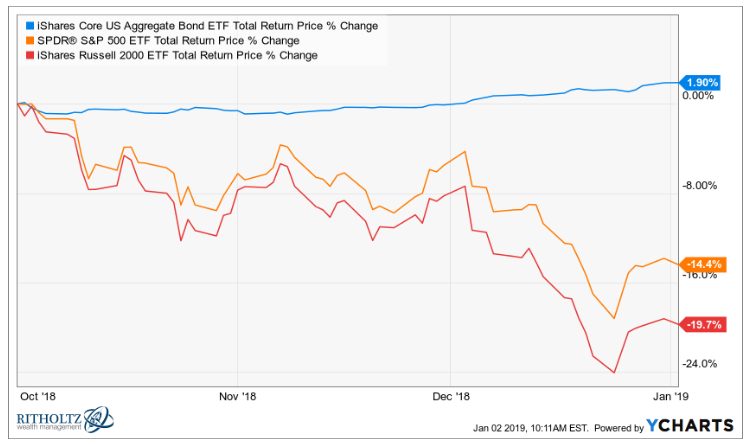

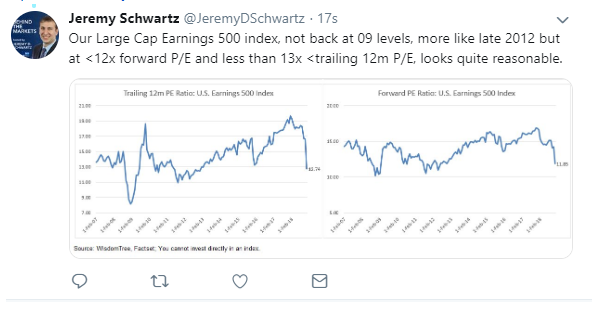

- What’s the biggest cause of the market’s downturn?

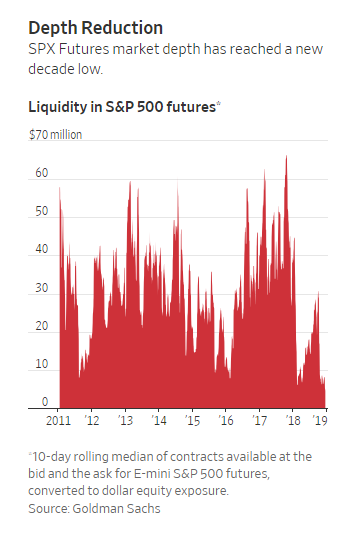

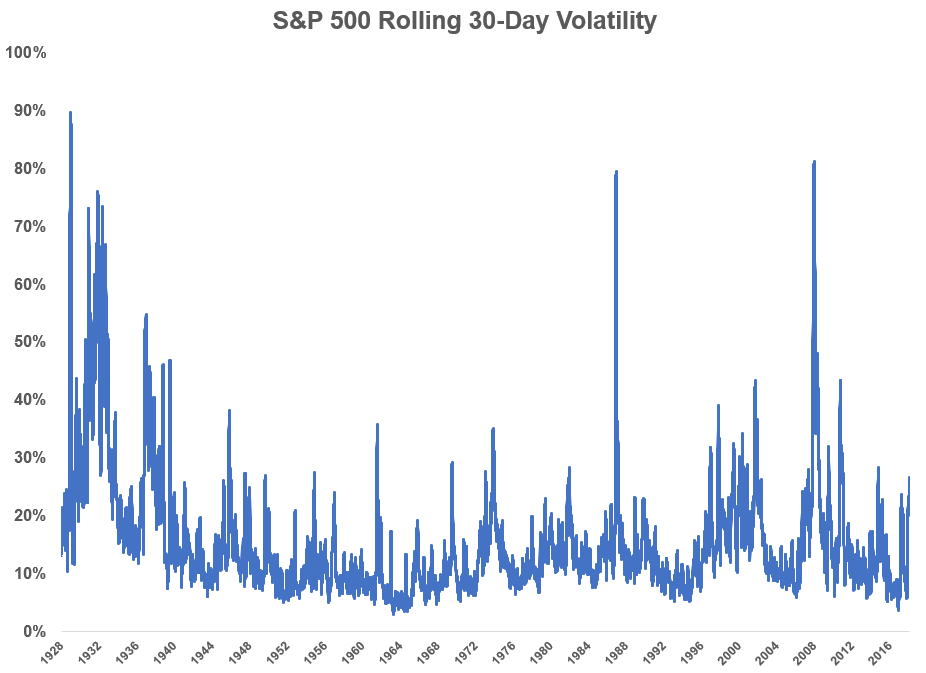

- Are algos really to blame for increased volatility?

- How much liquidity does the market need to function during a downturn?

- Huge outflows from mutual funds and ETFs.

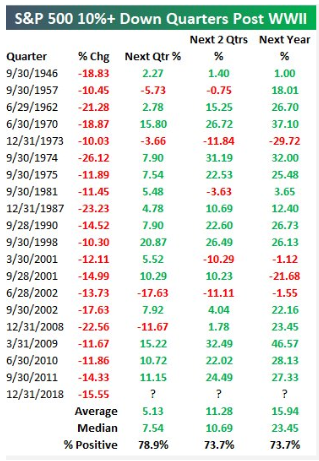

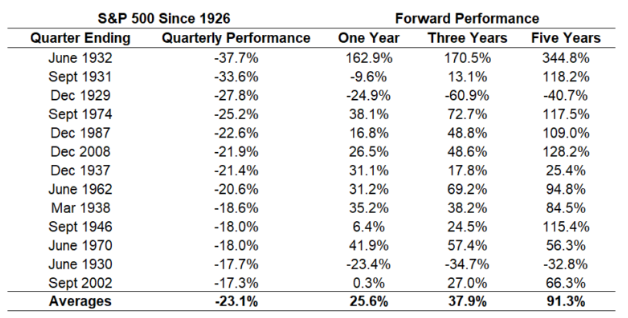

- Historical performance after huge down quarters

- We investigate: Is technology speeding up market cycles?

- Why does the S&P 500 have 505 stocks?

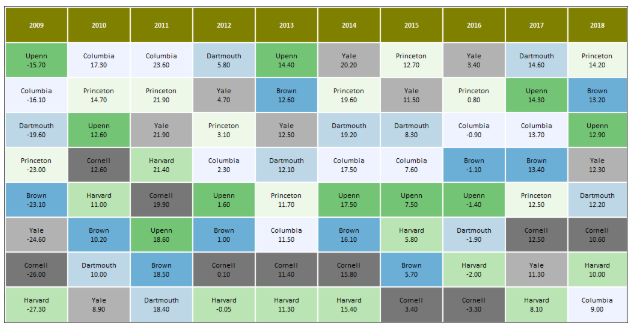

- Does investment performance even matter for Ivy League endowments?

- What stocks are millennials buying on Robinhood and why?

- Manufactured crises from the media.

- Why we got rid of our minivan.

- Our joint review of Bird Box on Netflix and much more.

Listen here:

Stories mentioned:

- The herdlike behavior of computerized trading

- ETFs, mutual funds see sudden drop in money flowing in

- Buying when stocks are down big

- 5 thoughts on the market downturn

- A history of bear market bottoms

- 504 stocks rose and one fell

- Measuring the Ivy 2018

- Millennials piled into these 9 stocks in 2018

- How much should you sell your home for?

- My 2018 Recommendations

Books mentioned:

Charts mentioned:

Email us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook.

Subscribe here: