I do a lot of reading and research during the week which brings me into contact with lots of graphs, charts and tables. Here are four that stood out this week along with some comments.

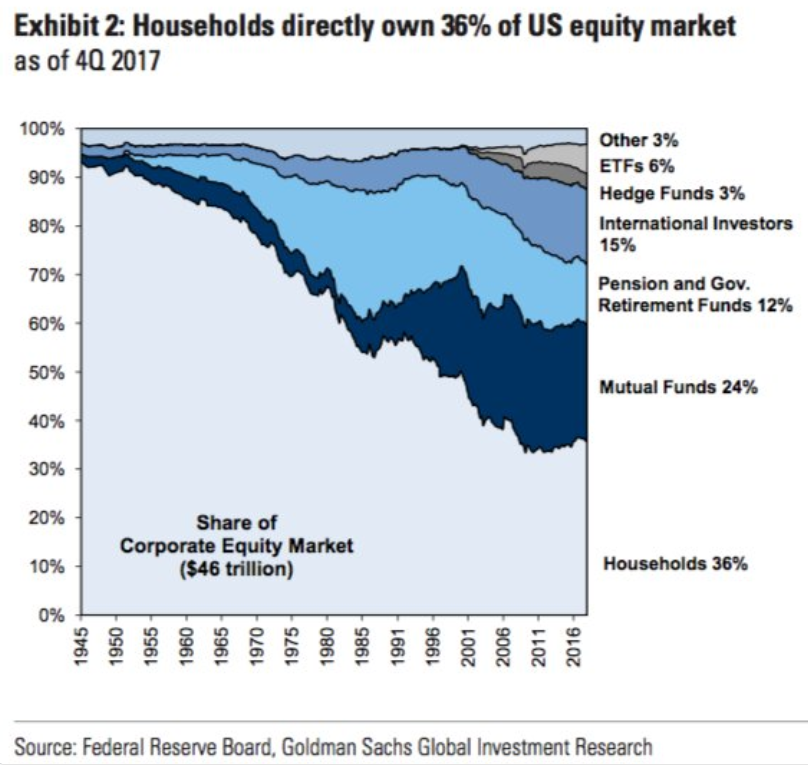

This chart from Goldman Sachs (h/t Sam Ro) shows how ownership of the U.S. stock market has evolved over the years:

The most glaring figure here is the fact that ETFs still make up just 6% of equity ownership. People like to talk about ETFs creating a bubble but that’s absurd when you look at it through this lens.

But the other one that jumps out at me is just how institutionalized the market has become over the years. Back in the 1940s and 1950s, more than 90% of the stock market was owned by households and individuals. This is still the largest group but you can see where the trend has been going ever since then. This means the majority of investing and trading taking place is now done by professionals, not individuals or retail investors.

I think this has a lot to do with the fact that it seems like it’s becoming harder to outperform the markets over time. When there are fewer suckers at the poker table, it becomes harder to take advantage of them, leaving the pros to compete against one another.

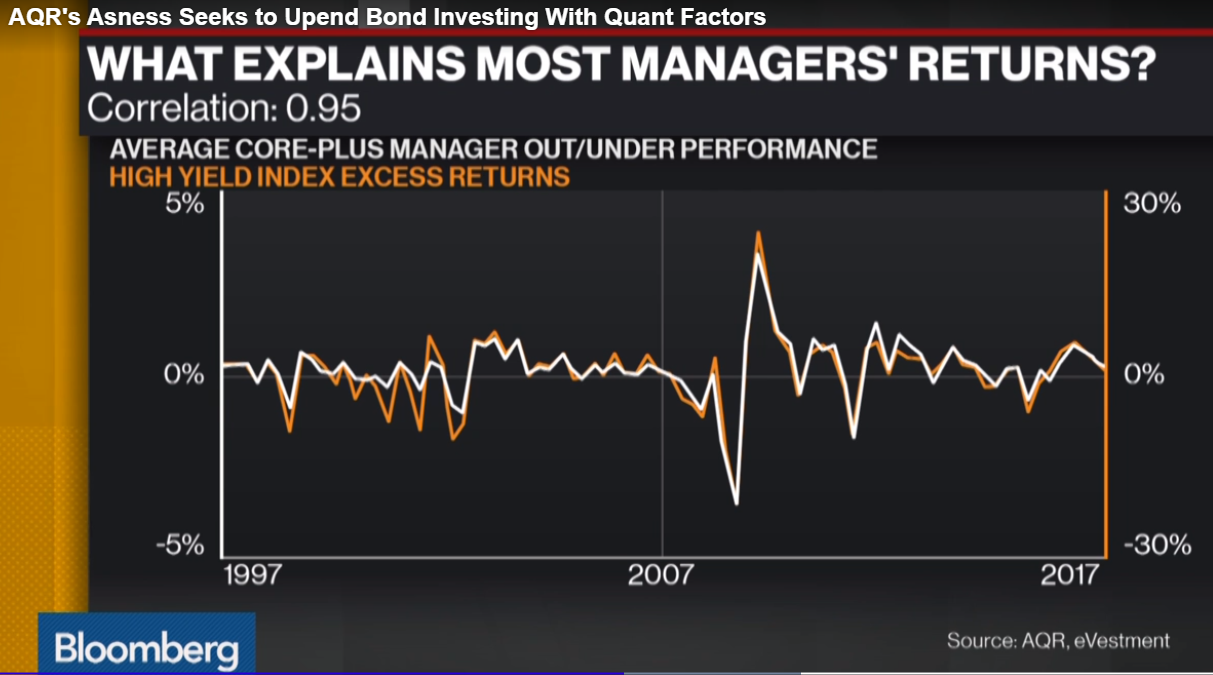

One area where active managers have had more success is in the bond market. Cliff Asness was on Bloomberg this week discussing quantitative factor investing in this space but he brought up a great point about outperformance in bonds. This chart tells the story:

One of the reasons it’s a little easier to outperform fixed income benchmarks is because bond returns are much more heavily reliant on starting yield as a way to predict future returns than stocks (there is a relationship with stocks and valuations but it’s not as clearcut). What Asness is showing here is there’s a strong correlation between bond fund manager outperformance and credit risk.

High yield bonds come with…wait for it…higher yields. But they also come with higher risks. So the managers who are outperforming in this space are doing better than the index by being different, but they’re also changing the risk profile in the process. There’s certainly nothing wrong with being different if you understand the risks involved.

But Asness brings up a great point, which is taking more credit risk actually makes your bonds more equity-like in nature since high yield bonds are more like stocks than higher quality bonds. So you could be losing the diversification benefits of bonds simply to outperform the index.

The question is: Why do you own bonds in the first place — to beat a benchmark or diversify your stock market exposure?

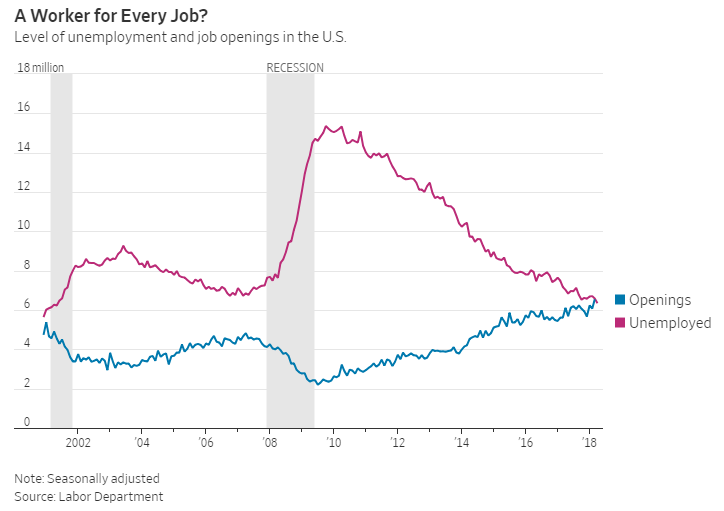

This chart from the Wall Street Journal on the job market is pretty remarkable:

The number of job openings in the U.S. is now in-line with the number of unemployed people actively looking for employment. This gives anyone with the necessary skills more leverage when looking for a job in America right now. It’s amazing this is the case considering we were staring at a double-digit unemployment rate just a few short years ago. This won’t last forever but it’s about time labor actually had the upper hand for once.

Finally, Scott Galloway had an awesome video this week about the algebra of happiness. It’s full of wisdom but I loved his definition of being rich:

Galloway stated:

My dad and his wife receive about $50,000 from dividends, pension, and socials security and spend about $40,000 a year. They are rich. A number of my friends earn between one and three million dollars, have several children in Manhattan private schools, an ex-wife, and a lifestyle fitting of a master of the universe. They spend most, if not all of it. They are poor.

The gist of this is that you’re rich if the amount of money you bring in is greater than your burn or spending rate. This is a fairly obvious statement about personal finance that a lot of people don’t truly grasp.

Your neighbor down the street who makes a ton of money, lives in a beautiful house, and owns a bunch of toys is not rich simply because they have all these things. If they don’t actually save any of their income or if they’re borrowing money to make all of these purchases they’re not truly wealthy.

Salary is not the same as savings. Luxury does not always equate to wealth. To get ahead, no matter how much money you make, requires you spend less than you earn.