On this week’s Animal Spirits with Michael & Ben we discuss:

- My recent trip to Disney.

- Has the Fed been punishing savers through low interest rate policies?

- What’s a retiree to do when yields are so low?

- Is there a fair valuation for the stock market? Has it changed over time?

- Are investors holding too much or too little cash in their brokerage accounts?

- Do different cultures have different feelings about risk?

- Why it was so difficult to invest in stocks in 2009 and 2010.

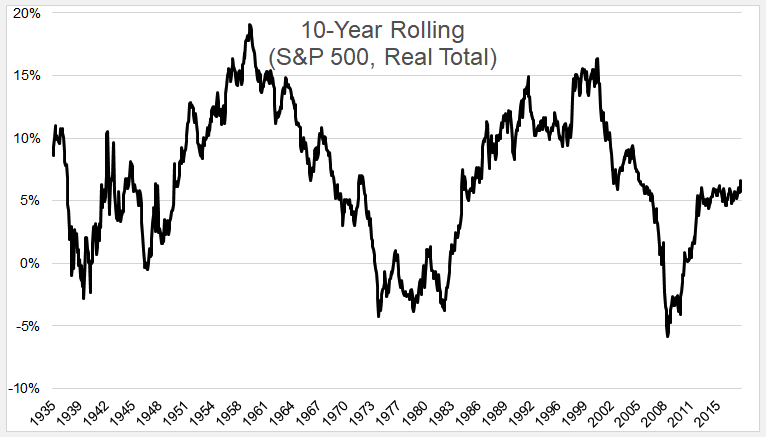

- How unique this stock market run has been.

- What’s the best insurance for a black swan event?

- Will podcasting kill conferences?

Listen here:

Stories discussed:

- Move to the beach and live off the interest?

- What if risk-free returns slowly go away?

- Slumbering bear holds a lot of answers

- Could a Trump presidency lead to a stock market bubble?

- The ignorance of the future

- Larry Fink joins Ray Dalio in warning against sitting in cash

- Dalio says bonds face biggest bear market in almost 40 years

- By most measures stocks no longer look cheap

- US stocks surge back towards bubble territory

- The energizer market

- Even with low returns bonds still have their use

- Will podcasting kill the conference?

Books mentioned:

- The Idea Factory: Bell Labs and the Great Age of Innovation

- Savage Harvest: Tale of Cannibals, Colonialism, and Michael Rockafeller’s Tragic Que

- Red Notice: A True Story of High Finance, Murder, and One Man’s Fight for Justice

- Traffic: Why We Drive the Way We Do (and What it Says About Us)

Podcasts mentioned:

Charts mentioned:

Cartoons mentions:

I gave a speech to a very large group of advisors who worked for a bank in Italy a few years ago. It was an awesome experience. This was the intro they created for my speech (which I mention in a story on this episode).

Email us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Subscribe here: