First of all let me say this — no one knows what’s going to happen based on last night’s election outcome.

The people who have been wrong about this outcome for so long will be the same ones who will tell you exactly how it will play out from here. They will be wrong again. The people who were right about this outcome, but for the wrong reasons, will do the same.

Surprises are a fact of life. The trick is to try to not to be surprised that you’re surprised.

Half the country is obviously hurting today from this result, so it seems trivial to discuss the potential market outcomes, but we have to play the hand we are dealt. Regardless of how you lean politically, it’s never a good idea to allow politics to cloud your judgement in financial matters.

Many are saying that a Trump presidency could lead to a recession or a market crash. These outcomes are always in the realm of possibility, so you can never rule them out. It’s very possible we’ll see some increased volatility in the months ahead as investors try to deal with the ramifications of this.

Since I have no idea what’s going to happen I always like to perform a scenario analysis to consider a wide range of potential outcomes. You’ll never nail the implications perfectly on something like this, but the point here is not to predict, but to prepare.

The recession/crash scenario is certainly one to consider. But here’s one scenario not many people will be talking about — it’s possible that within the next couple of years we could see a melt-up in the markets.

No one really knows what Trump’s policies will be (possibly not even him yet) but he has stated numerous times that he plans on doing massive infrastructure spending. He’s always promised tax cuts and isn’t afraid of large budget deficits. If anything like this were to happen, we could see much higher corporate profits and higher inflation.

If this were to occur I think it’s possible that we could see a massive shift in investor allocation preferences which could potentially take the stock market into bubble territory.

Allow me to explain.

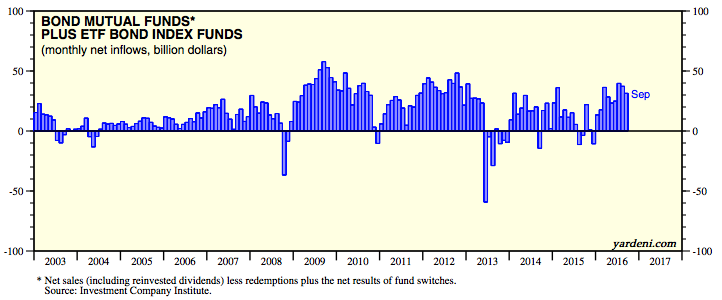

Bond funds have seen massive inflows since the end of the financial crisis. In fact, more money has gone into bond funds than stock funds since the start of this recovery, even though we’ve been in the midst of one of the great stock market uptrends ever.

With some help from my friend Jeff Ptak at Morningstar, I looked at the total fund flow data going back to the end of March 2009. Through the end of October 2016, there has been $1.34 trillion that has gone into U.S. equity funds. In that same time, there has been $1.55 trillion that has flowed into bond funds. So there’s been well over $200 billion more money that has gone into bonds than stocks during one of the greatest bull markets of all-time. The scars from the financial crisis still run deep.

And in that time the only period when we really saw a massive outflow from bonds was during the taper tantrum in 2013, which saw fixed income markets freak out about the potential for the Fed to raise interest rates. It’s clear on this fund flow chart from Yardeni Research when this happened:

So here’s the bubble scenario — Trump implements a massive infrastructure program, inflation finally takes off, interest rates rise, bond investors lose money (remember that interest rates and bond prices are inversely related), money flows out of bond funds and finally that money finds a home in stocks.

The phrase “cash on the sidelines” doesn’t really make any sense because for every buyer there is always a seller. But if we see allocation preferences shift because investors become nervous if and when they see some losses in their bond funds, it’s possible that the stock market would be a huge beneficiary. With valuations already above average this could even take us into the bubble territory that people have been talking about for many years now.

Will this happen? I have no idea. But you can’t rule it out.

There will be a lot of predictions and posturing over the coming weeks and months and much of it will be wrong. Pundits and “experts” alike will be telling you what is going to happen but they are merely guessing and these people are wrong more often than a flip of the coin.

I just wanted to throw out a potential scenario that most people probably aren’t considering at the moment. These things never work out as you would expect so try not to put to much faith in anyone’s assessment of what the future holds (mine included).

It’s also worth noting that one political party or elected official does not and cannot control the giant complex adaptive system that is the U.S. economy or the worldwide financial markets.

I’m not making a prediction, just trying to prepare for a wide range of outcomes, which I view as healthy behavior in a world where everyone knows far less than they let on.

Further Reading:

No One Knows Whats Will Happen