In a paper written for the Journal of Portfolio Management called The Myth of Risk Attitudes, psychologist Daniel Kahneman explains why human nature makes it so difficult to succeed as an investor:

A central claim of prospect theory is that people are not consistently risk averse. Yes, they are much more sensitive to losses than to gains. But they are also risk seeking, both in their attraction to long shots and in their willingness to gamble when faced with a near-certain loss. To complicate things further, we know that people do not have a global view of their assets. They hold separate mental accounts and are much more willing to gamble from some of the accounts than others. To understand an individual’s complex attitude toward risk, we must know both the size of the loss that may destabilize them and the amount they are willing to put into play for a chance to achieve large gains.

Basically, we humans are a walking contradiction. We are affected by both loss aversion and overconfidence. We have both a fear of missing out on future gains and a fear of taking part in future losses. And risk tolerance can be tricky to get right for investors.

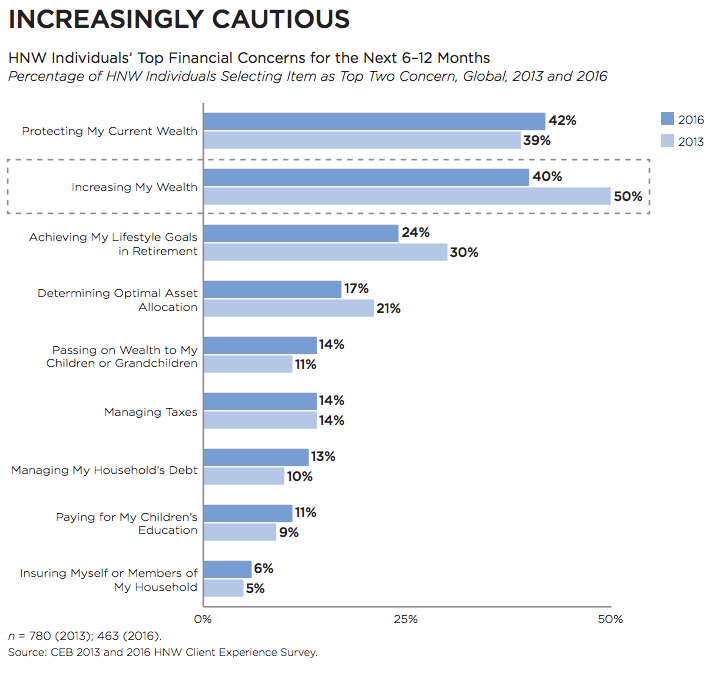

CEB performed a survey of high net worth individuals that shows how this conflicting mindset can affect client concerns when thinking about their investments:

You can see the top two financial concerns are both protecting wealth and increasing wealth. They’re competing worries. It’s a constant tug of war between the opposing forces of trying to grow your capital and trying to preserve it.

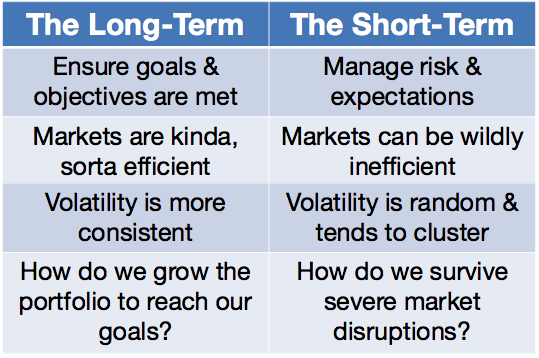

At my firm, we like to say that we have a dual mandate when it comes to managing our client’s assets:

- Help them survive severe market disruptions in the short-to-intermediate-term.

- Help them achieve their long-term goals and desires.

The long-term is the only time frame that matters, but you have to have enough liquidity and shock absorbers in your portfolio to be able to survive when markets have their inevitable downturns. Here’s a simple way to view this dynamic:

Fulfilling these two mandates can be challenging, for both advisors and clients alike. When markets are rising, people don’t worry as much about the preservation of capital. And when markets are falling, people spend all their time worrying about the preservation of capital. Volatility can be a source of opportunity or risk, depending on your reaction to it. Turbulent markets can have a huge impact on performance but it generally fades over time. The question is how do you make it through those tough times?

Balancing a client’s appetite for risk with their capacity for risk along with their need to take risk is not always an easy task.

The thing is that if you have enough assets to retire on then you’ve really already won the game. You’re better off than a large majority of people out there. So the first rule should always be to do no harm.

The next piece of the puzzle here to remember is that while portfolio management is important, this is really more of a behavioral issue than anything. Kahneman has also said that, “the long-term is not where life is lived.” The best advisors understand that long-term returns are the only ones that matter, but their clients will never see those returns if they can’t create (and implement) a plan that ensures they can make it through the time it takes to get there.

Getting the risk profile and time horizon right is imperative, but that’s just the beginning. The process of implementing a comprehensive plan involves the following:

- Setting realistic expectations

- Clarifying and reminding people of their goals

- Making changes to the portfolio or plan when circumstances dictate

- Ongoing communication and education

- Acting as a behavioral counselor to ensure no huge mistakes are made

It’s not enough to preach about the benefits of a long-term mindset. Anyone can do that. It’s about proactively helping people get to the long-term that counts.

Source:

CEB

Further Reading:

The Bedrock of Portfolio Management

Learn more about Ritholtz Wealth Management here.

Now here’s what I’ve been reading lately:

- A massive reading list of books from some sharp people (Above the Market)

- You can’t have the creative without the destruction (Fortune Financial)

- The only way the 99% should invest (Chris Perruna)

- Figuring out who to ignore is half the battle (Irrelevant Investor)

- Act as if what you do makes a difference. It does (A Teachable Moment)

- A two-fer from Josh this week: stay hungry, not thirsty (TRB) & Simple vs Complex (TRB)

- Why indexing doesn’t mean settling for average returns (Boomer & Echo)

- “Investing in speculative assets is a social activity.” (Evidence-Based Investor)

- Smart things people do to increase their tax refund (Big Picture)

- Stick with a simple investment strategy (FMD Capital)

- The NFL’s personal finance course (MarketWatch)

- The finance industry is having its Napster moment (Bloomberg) and Active management is far from dead (EconomPic)

- Why you should ignore the “best” timing signal on Wall Street (Cordant)

Something I might specifically set forth in your planning list is helping clients to understand what a sustainable draw down on their assets might look like. Too often, clients assume they will be able to spend far more than their portfolios can reasonably generate over the long run. They assume their portfolios can magically produce earnings that will offset excessive spending and blame their portfolio managers when failure occurs. This is especially important in terms of retirement income, when time horizons are diminished and it becomes ever more difficult to “earn back” losses.