Investors often spend much of their time thinking tactically instead of psychologically. They want to know how to handle the next week or month in the markets without ever planning for the next year or decade.

They often confuse security selection or opportunistic investing with portfolio management. These micro concepts are unhelpful if you don’t have the correct macro framework in place to see them through. The two most important components to portfolio management are:

- Portfolio Construction

- Risk Management

The decisions within your portfolio are unlikely to matter very much if you don’t involve these two factors in your plan. Investors who follow a carefully planned set of guidelines have a higher success rate than those who act on their emotions or make frequent changes based on the events of the day.

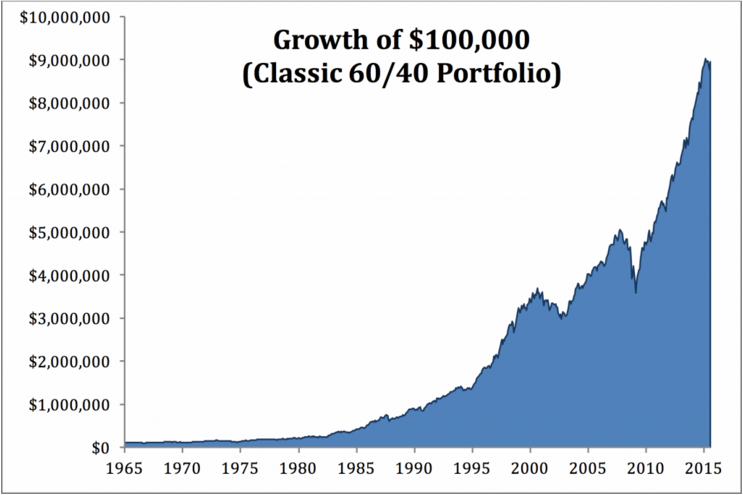

Thinking and acting for the long-term is paramount to an investor’s success. As you can see from this chart, the markets have been good to investors in the long-term:

The hard part is designing an investment approach that allows us to capitalize on the long-term, while not allowing temporary activity in the markets to interfere with our decision-making process in the short-term. As Daniel Kahneman famously said at his Nobel acceptance speech, “the long-term is not where life is lived.”

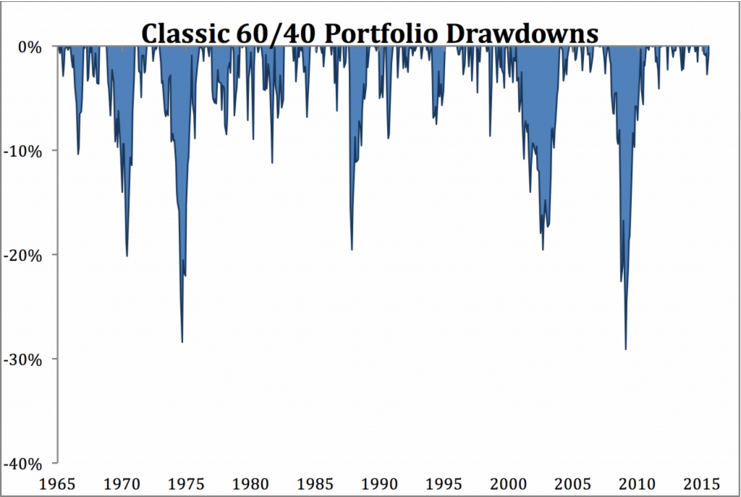

For instance, see the flip side of the first chart here:

Even with a decent allocation to bonds, investors have still seen fairly large declines in the value of their portfolio over the years. So while portfolio construction can help you achieve great results in the long-term when combined with a disciplined process, risk management is necessary to survive severe market dislocations.

I’ve seen many iterations of risk management techniques throughout my career in the institutional investment world. The problem is that the majority of them rely on precise risk models that don’t take into account the irrational behavior of market participants during a panic. Many are also illiquid, high cost and difficult to understand.

I’ve always felt that the best risk controls an institution or individual can implement to survive serious market disruptions exist within a simple, transparent and sufficiently liquid portfolio. If you don’t understand how the various investments in your portfolio are likely to act and how they fit together it’s going to be very difficult to see a plan through a panic in the markets. And illiquid investments take away one of the main benefits to diversification, which is the ability to rebalance into those areas that have been hit the hardest.

Investors like to think in terms of extremes — active or passive, tops or bottoms, all-in or all-out. This line of thinking works great in a soundbite but not in the real world with actually money at stake. A more intellectually honest approach is being able to blend different factors and strategies together to create a portfolio that takes into account a wide range of risks and scenarios.

Severe market drawdowns are one of those risks. As I said last week, the reason most investors fail is because they don’t have the psychological tools in place to make it through a bear market. At my firm, we have a constant focus on risk management, because you always have to balance those shorter-term fears and liquidity needs with an individual or organization’s longer-term goals and objectives.

This is why we created a proprietary, low-cost, systematic risk management strategy to ensure that investors can handle periodic volatility without abandoning their investment plan. We look at this strategy as something of a diversification across time and investment strategy. It’s not perfect (no strategy is), but we feel it helps our clients survive serious market drawdowns.

Every investor handles losses differently. It’s not necessarily your actions that will see you through periods of market volatility and loss, though; it’s your reactions. The best way so ensure that you won’t overreact when these periods flare up is through intelligent portfolio construction and proper risk management.

Learn more about our firm here:

Ritholtz Wealth Management

Ben – thank you for sharing your wisdom and advice through this blog. I have read and re-read (and re-read) your book! You’ve been successful in making me a slothful, lethargic, emotion-free investor who specializes in doing absolutely nothing. Haha! I’m really grateful for your words and wanted you to know what a terrific help you have been, and continue to be to my family and I. A thousand thank you’s!

Thanks JC. Much appreciated.

Dear Ben, apart from liquidity and rebalancing what else does risk management means for you? do you apply stop losses for example?

A clear, concise description of what is needed in a successful investment program, but which so few investors either grasp or can manage to follow. Especially now, when the sirens of doom and gloom are in full voice, I fear too many investors will be convinced to go to cash or make some major change in their portfolios, with little understanding of what the long term consequences will be. Thanks.