I’ve received hundreds of questions over the years that are some variation of the following:

I have a question about saving vs investing right now. I am a 26-year-old medical student and my wife and I are looking to buy a house in the next year or two. She is a teacher and makes $50k pre-tax. I will be a resident next year and make about $55k pre-tax. We currently have about $5k in a Roth, and 11k in Marcus. My wife has about $7k in her 403b. We have no kids currently. Should I risk more of the savings in Marcus and invest it, given how low rates are? Maybe a higher dividend ETF short term?

It’s understandable this is a recurring question. Interest rates for savers have been flatlining for years. People wouldn’t be asking this question if you could earn 4% or 5% in a savings account or money market fund.

Instead, my online savings account at Marcus is currently yielding 0.5%. That’s about as good as you’re going to get in an FDIC-insured savings account these days.

It feels counterproductive to just let your savings sit there earning nothing while you wait to deploy capital.

As with all investment decisions, this boils down to your risk profile and time horizon.

If you put your entire down payment fund into stocks there is a good chance you’ll make money. There is also a small chance you could lose a lot of money.

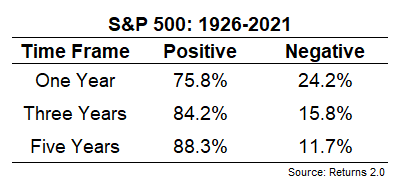

I looked at the U.S. stock market going back to 1926 to see how often it was positive over rolling one, three and five year periods:

That’s a pretty good winning percentage.

Unfortunately, if you have some bad luck and happen to need that money in the midst of a market crash, you could be out of luck.

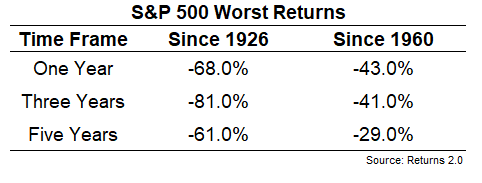

These were the worst returns over the same time frames:

The reason I looked at returns from both 1926 and 1960 is because those disastrous returns in the first column were caused by the Great Depression. But even in more modern times, there have been environments that were unkind to stock market investors even going out 5 years.

What if we looked at a more diversified approach?

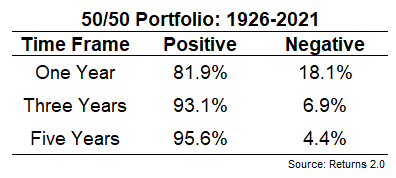

Here are the numbers for a 50/50 portfolio consisting of the S&P 500 and 5 year treasury bonds:

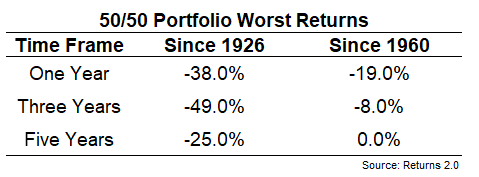

A more diversified approach has improved your winning percentage historically. And adding high-quality bonds to a portfolio has also dampened the largest drawdowns:

Things were still pretty bad for returns on a 50/50 portfolio during the depression (an 85% stock market crash will tend to have that effect) but not too shabby in modern times. The worst return over a 5 year window for a 50/50 portfolio since 1960 was breaking even on your money.

You just have to ask yourself the following: Is it worth the risk of potentially having a lower down payment if the stock market takes a dive at the exact moment I need to spend the money?

Some people are comfortable taking that risk. Others prefer to play it safe.

I’m a play-it-safe guy myself. If I have a large purchase to make in the next 3-4 years, I don’t like having that money at risk in the market. Other people have a higher risk tolerance for this stuff.

You also have to consider how much money you can really add to your down payment by taking on more risk. You don’t have nearly as much time to allow compounding to do the heavy lifting for you when saving over a handful of years.

An extra 5% on $10k is $500 per year. Yes, that’s real money but not life-altering money. If you want life-altering money over the short-term, you’re moving from investing to speculation. People can and do make money speculating but far more people lose money on this endeavor.

There are some other options to look into. Series I Savings Bonds are now paying more than 7% annualized for the next 6 months or so but that’s capped at $10k per person. Many people are also looking more and more at stablecoins for higher rates.

This could be the type of environment where diversification of yield sources can help you earn some more yield while spreading your risks for those who have the appetite for it.

On this week’s new Portfolio Rescue we talked about where to save for your down payment along with the following:

- Will baby boomers crash the stock market when they’re all retired?

- The differences between interest-only and fixed-rate mortgages.

- The biggest factors when determining how to handle employee stock options.

Here’s the latest episode:

And don’t forget to subscribe to see these videos every week.

If you missed last week’s inaugural episode go here to watch.

Further Reading:

Why Do Stablecoins Offer Such High Rates of Interest?