Some thoughts on what’s going on in private markets.

Some thoughts on what’s going on in private markets.

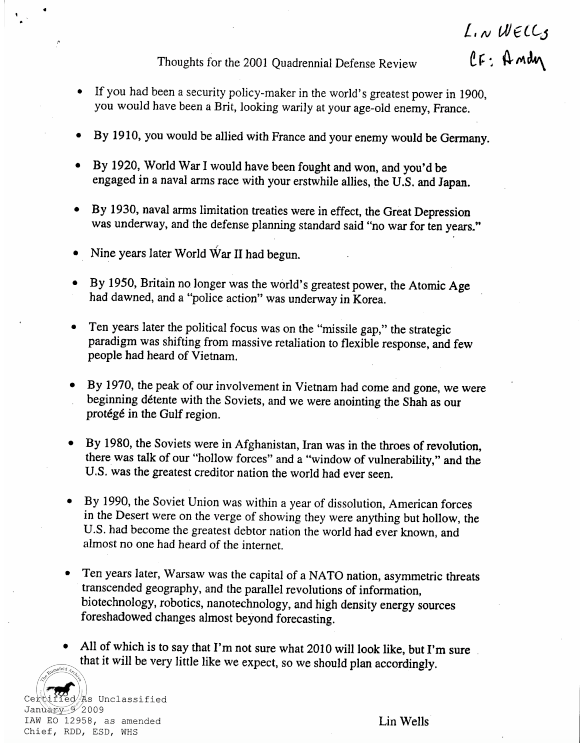

Some thoughts on how to create an investment plan for an unknown future.

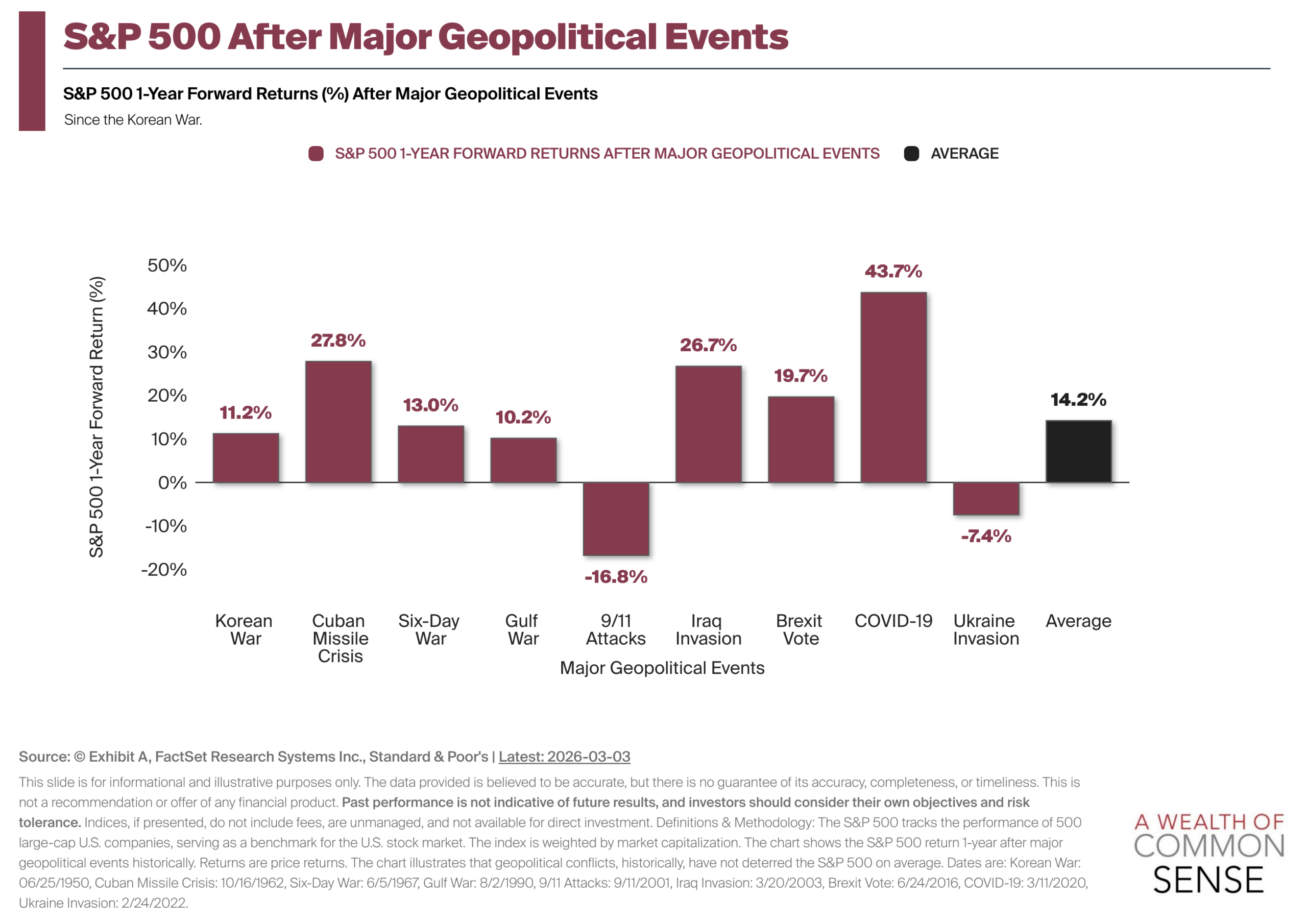

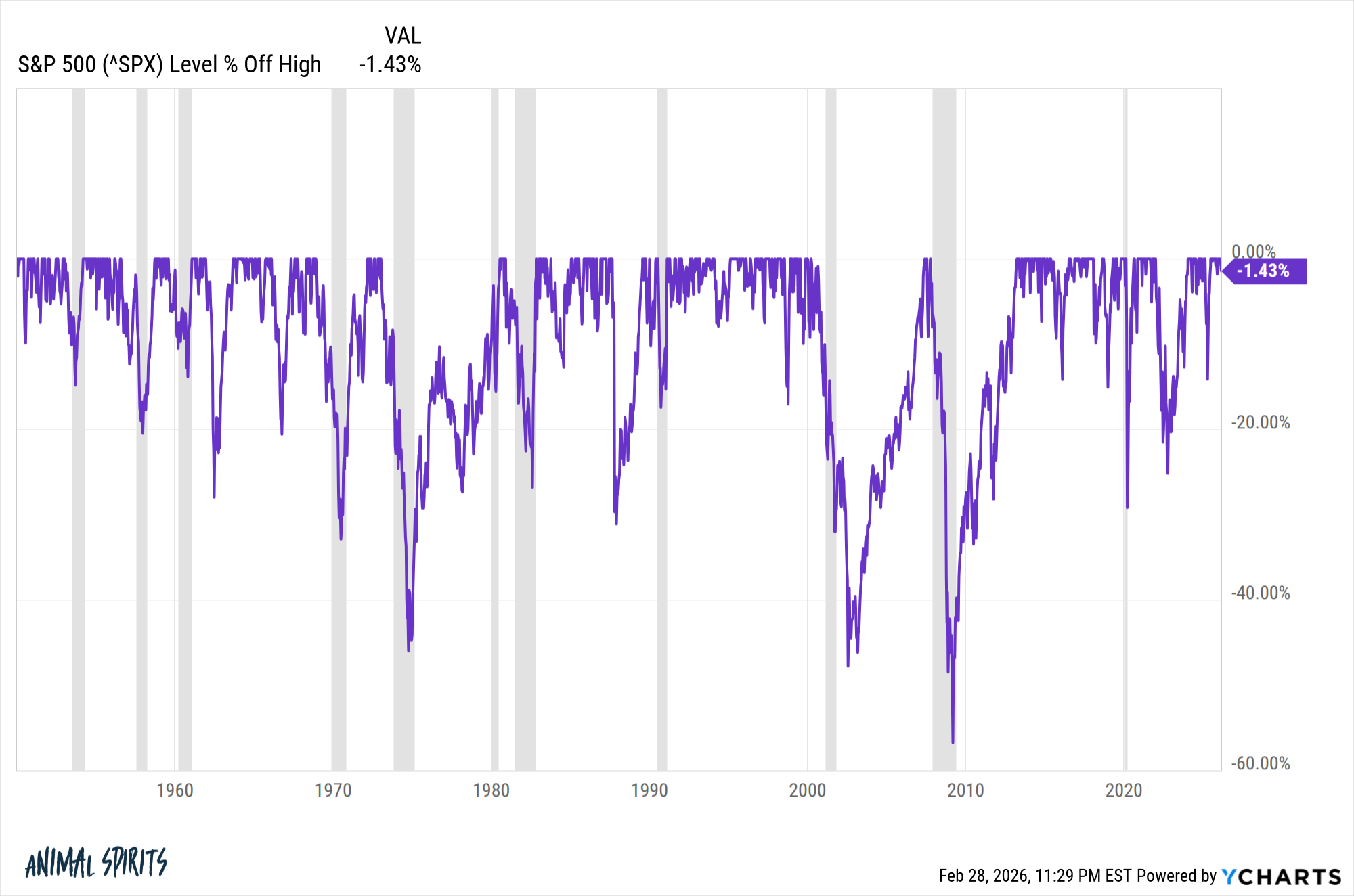

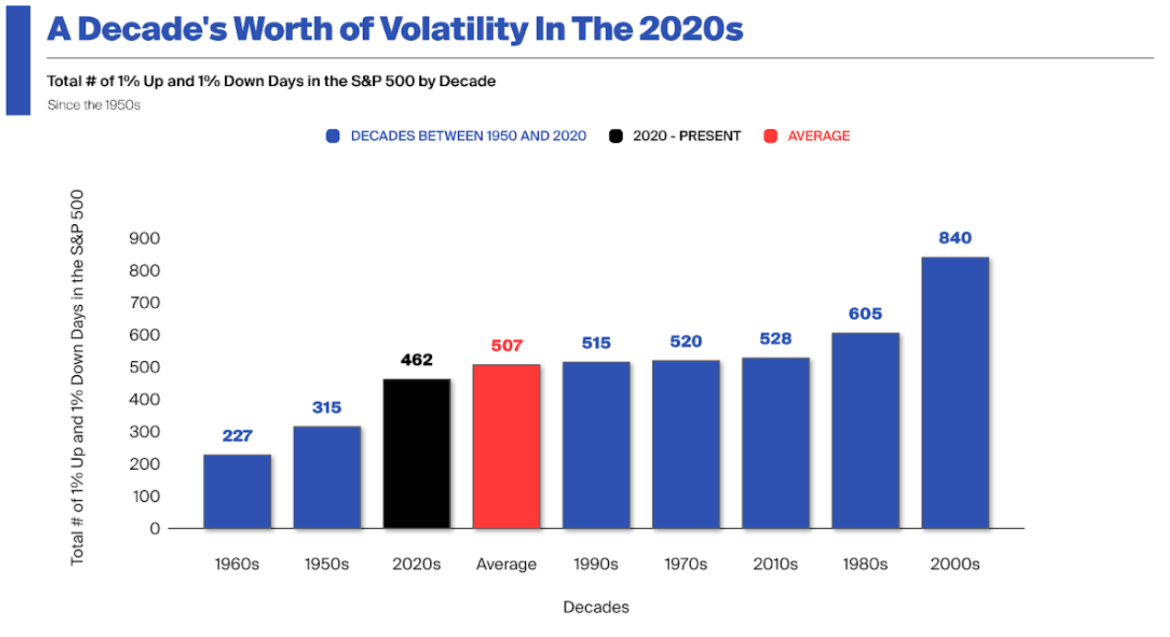

On today’s show we discuss the geopolitical impact on markets, inflationary risk, when risk goes off, concentration risk, AI vs. white collar workers, the optimistic case for AI, falling and rising bond yields, inheriting a house from your parents, the private credit crisis of confidence, the loneliness epidemic and more.

How markets respond to geopolitics.

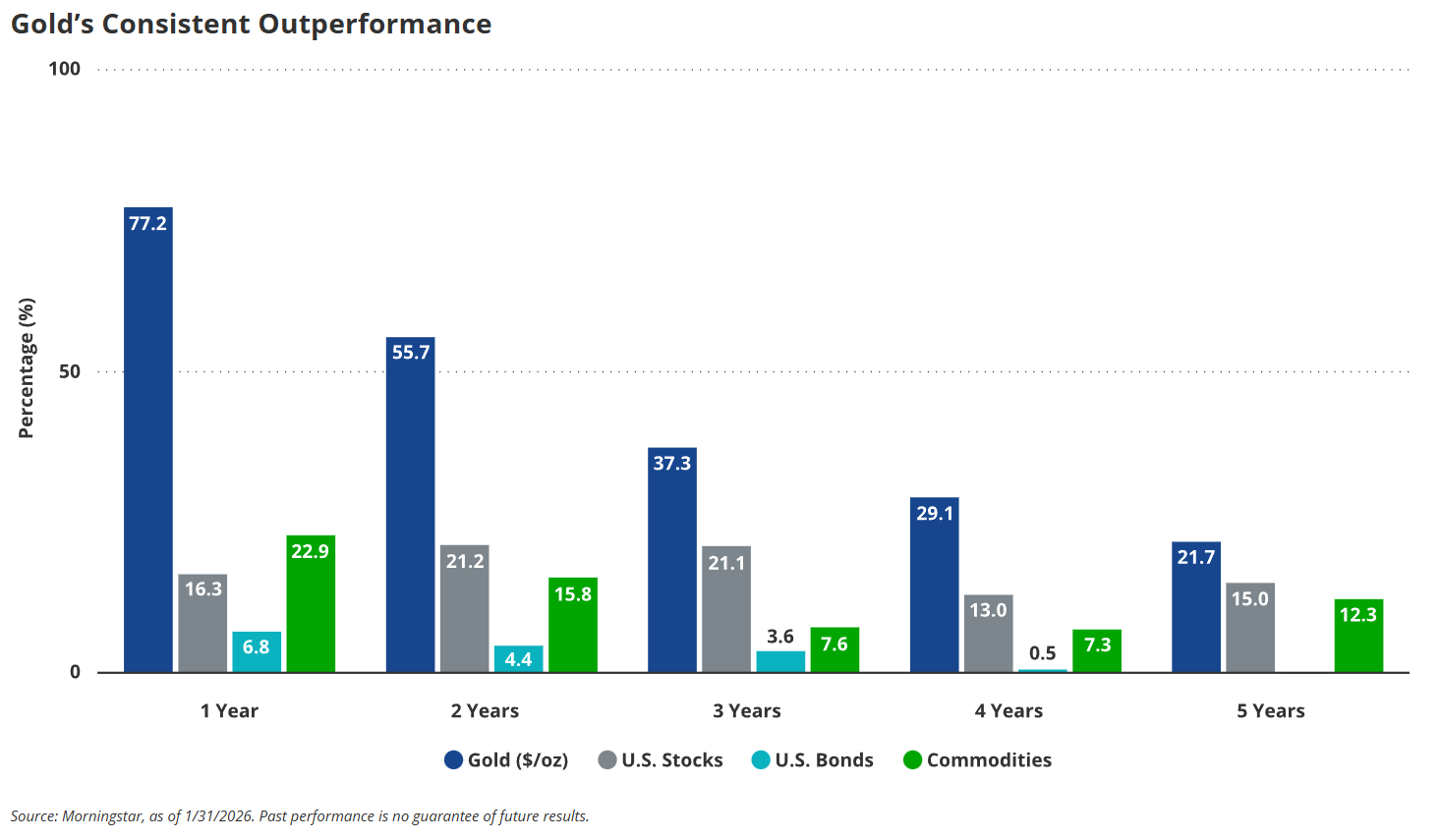

On today’s Talk Your Book we speak with David Schassler from VanEck about the case for owning real assets, the gold bull market, how AI is fueling the demand for energy and materials and how the world will look different going forward.

How to think deal with AI and geopolitics.

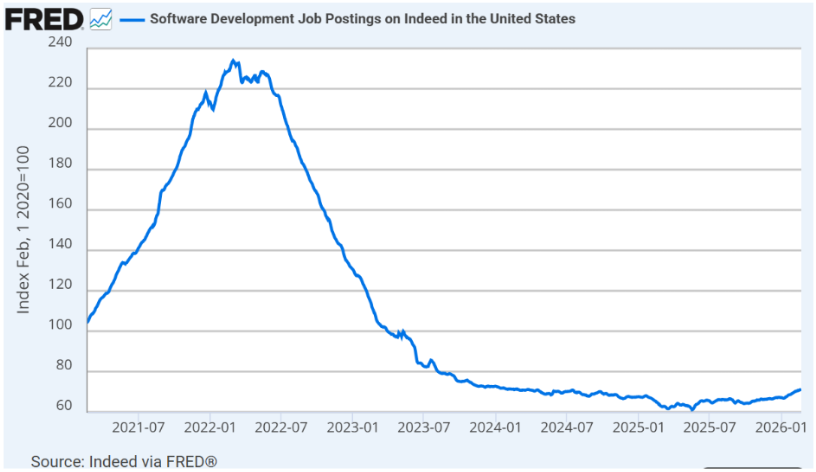

AI: Utopia, dystopia or something in the middle?

A 42 year old worth $2 million wants to retire and live off the dividends.

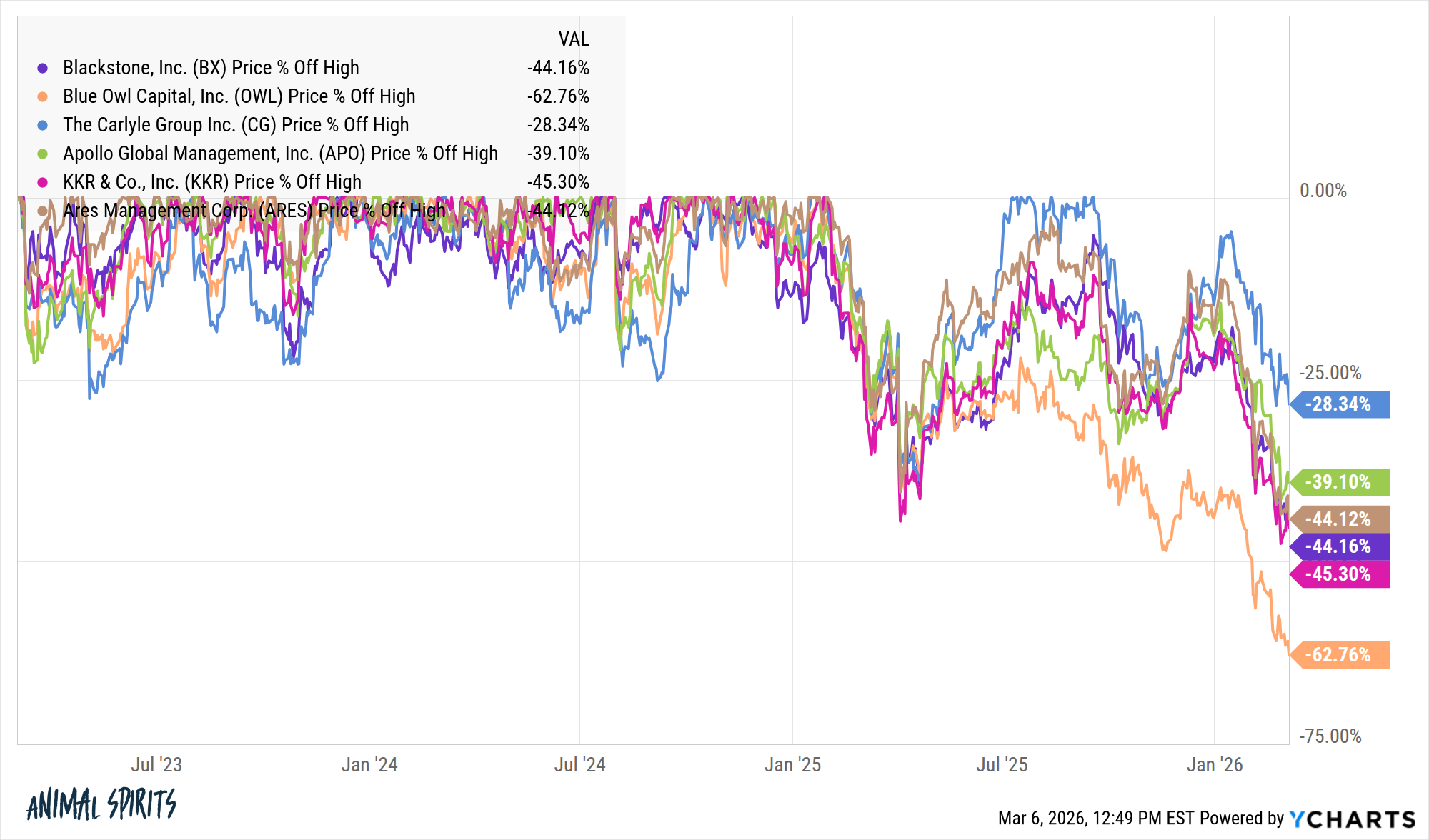

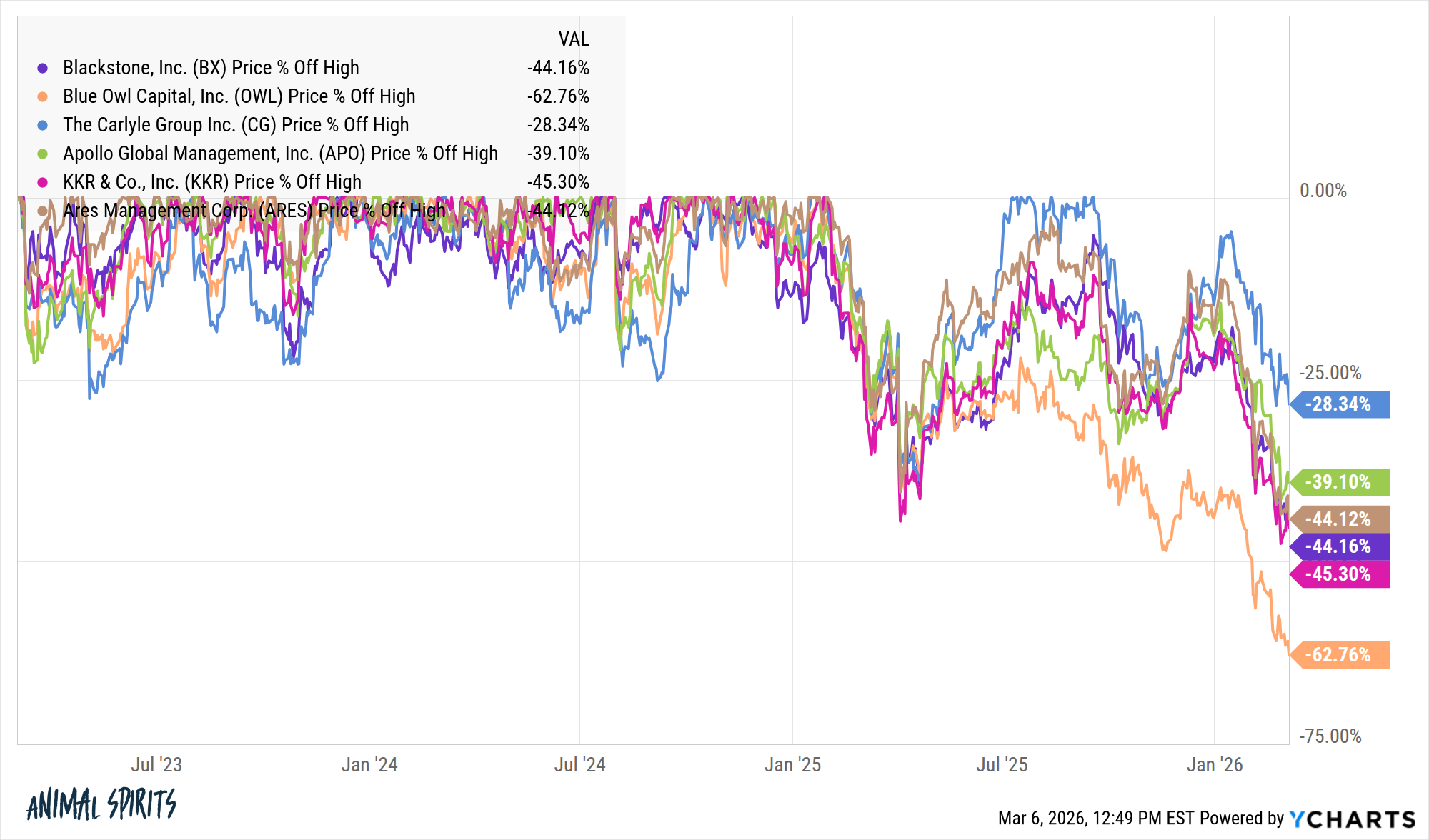

On today’s show we discuss the AI doom scenarios, the value of human relationships in a digital world, housing as an AI hedge, the AI backlash, a very weird stock market, the global bull market, consumers keep spending money, Bitcoin is a software stock, the Blue Owl fiasco, the perfect movie run time and more.

Some thoughts on AI doomerism.