A reader asks:

Would love to hear your thoughts on AI & deflation and if that could be a concern going forward.

JP Morgan’s Michael Cembalest recently said on Odd Lots that AI is the stock market “bet of the century.”

I think he’s right but let’s talk about the potential economic implications first.

There are two big long-term macro worries right now:

On the one hand, people are worried that excessive government spending, tariffs and deficits will cause inflation.

On the other hand, people are worried that artificial intelligence will make jobs disappear and cause deflation.

Maybe AI will balance out all of the government spending. We’ll see.

But let’s focus on the risk of deflation because it presents both a risk and a benefit to society.

Let me preface all of these statements with the caveat that no one really knows how AI will impact the world. The outcomes from technological innovations are notoriously difficult to predict in advance. This is one of the reasons we almost always have a bubble from technological advances because people get overly excited thinking about the possibilities and how the world will change.

Expectations get taken too far which causes prices to disconnect from fundamentals. And often these outcomes are counterintuitive and have unintended consequences.

Having said all that, there is a strong possibility AI could replace many entry-level or mid-level white-collar service jobs — customer service, data analysts, programmers, administrative assistants, bookkeepers, IT support, copywriters, news reporters, tutors, and more. As AI makes tasks more efficient, we could see lower demand for these types of workers.

If that happens, the supply for this work will increase massively, bringing down costs. Eventually, we will also have AI robots to automate even more of the work we do.

These developments would be deflationary.

Obviously, it’s not great for millions of people who are employed in these areas or looking for new jobs.

In this sense deflation is a huge risk to the labor market. I think there is a very real possibility that the next recession will see some job loss where those jobs simply don’t come back as companies replace headcount with AI tools and models.

This is a very real concern and it’s something governments will be forced to contend with. Ironically enough, this could actually lead to more government spending as unemployment benefits rise and entitlements become even more important.

The good news is that the U.S. economy is dynamic. We’ve lived through large-scale shifts in the labor market before, and new jobs will likely be created that we’re not even considering right now.

Even if that’s the case, the transition period will likely be painful for a lot of people.

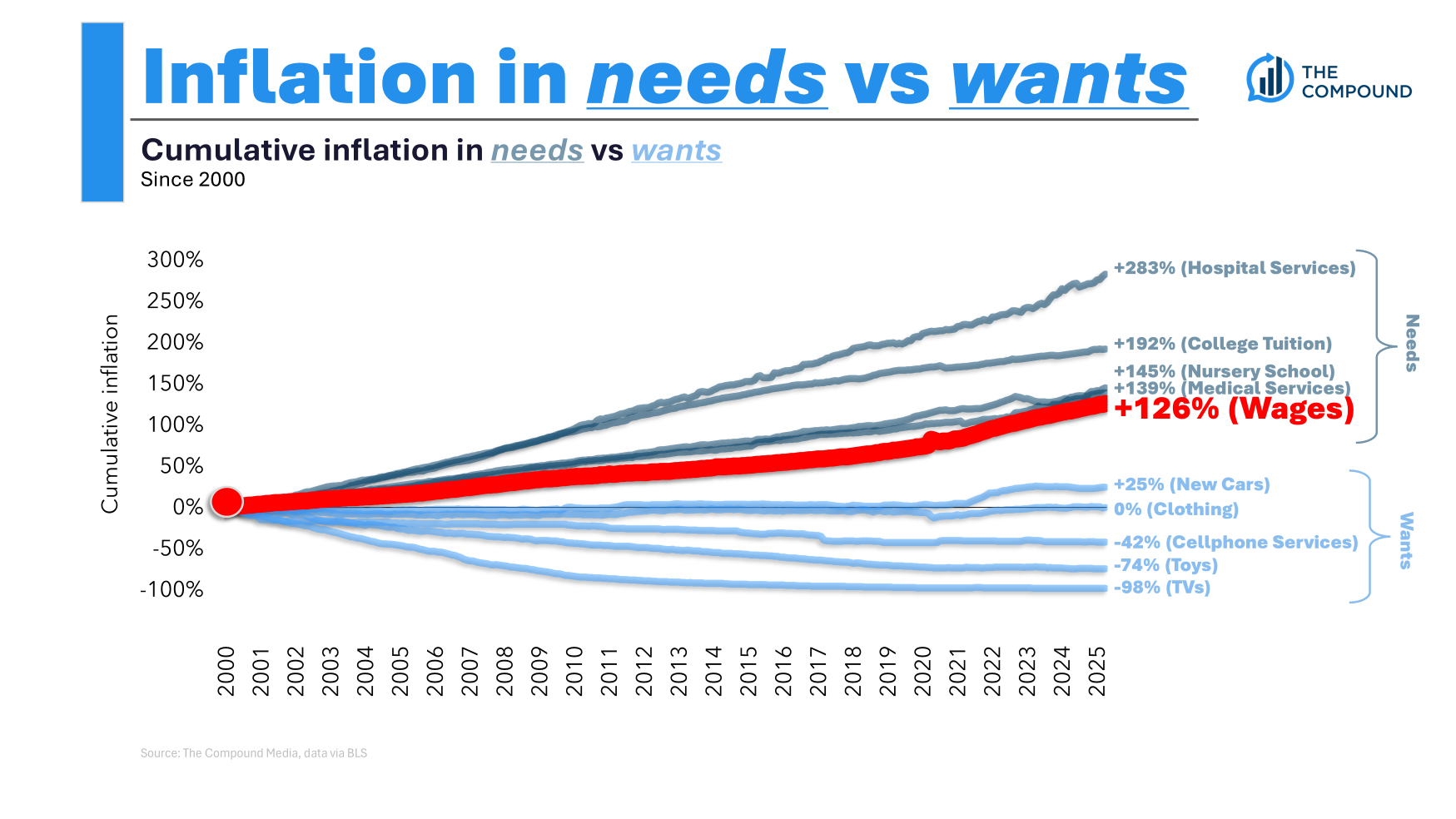

It’s also important to understand that inflation and deflation are not evenly distributed:

I’m interested to see how AI impacts the cost structure of services, considering that’s where the most inflation has shown up this century.

If AI really is deflationary because it disrupts the labor market your best hedge is going to be investing in stocks. Profit margins will go up. Profits will be greater. Corporations will win again. Own the companies that benefit from these developments.

Of course, even if this all happens, AI could also present a risk to the stock market in the meantime.

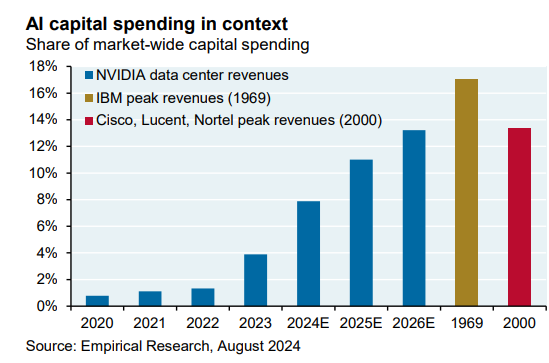

Michael Cembalest notes that the amount of investment the big tech firms are making in AI is approaching previous bubble highs during past cycles of excess:

That’s why it’s so important to understand how AI adoption pans out. As shown below, by 2026 NVIDIA’s share of all US capital spending will be close to the two 20th century peaks. Just as notable: the hyperscalers (Google, Meta, Amazon, Microsoft etc) would need $400-$500 billion in new revenues to earn their traditional 50% gross margin on ~$250 billion of annual data center spending.

Maybe AI adoption occurs much slower than people assume. Maybe companies will be hesitant to turn over important tasks to a computer-generated model for now. It’s not easy to predict how this will all play out.

If these investments don’t earn a return soon enough the stock market could see some hiccups.

But this is a real risk for workers to consider.

The best way to hedge the AI risk and turn it into an opportunity look like this:

(1) Own stocks. Profits will rise in an AI-dominated world. AI doesn’t sleep. It doesn’t have personal problems. It doesn’t get sick. Corporations will use it to mercilessly cut costs where they can.

(2) Use AI. This technology is going to make people’s lives easier and more efficient in many ways. We are already finding ways to use AI to help our advisors. It can take notes for you, offer real-time reminders and provide valuable scenario analysis and planning work. Workers who figure out how to integrate AI into their everyday lives are going to have a leg up on the competition.

(3) Be creative. Once everyone is using AI it will become a commodity. Figuring out how to stand out from the crowd through creativity and originality will be more important than ever in an AI-driven world. I’ve been using AI more and more on the research front. It’s helpful but bland. People who can effectively communicate in imaginative ways will be able to stand out from the crowd.

AI might be the biggest risk and the biggest opportunity of the 21st century.

I discussed this question in further detail on the latest edition of Ask the Compound:

We also answered questions from our audience about private equity in targetdate funds, how to diversify your individual stock picks, when you should hire a financial advisor and how buy the dip works.

Further Reading:

Mega Cap World Domination