Today’s Talk Your Book is brought to you by J.P. Morgan Asset Management:

See here and here for more information on J.P. Morgan Asset Management ETF research

On today’s show, we discuss:

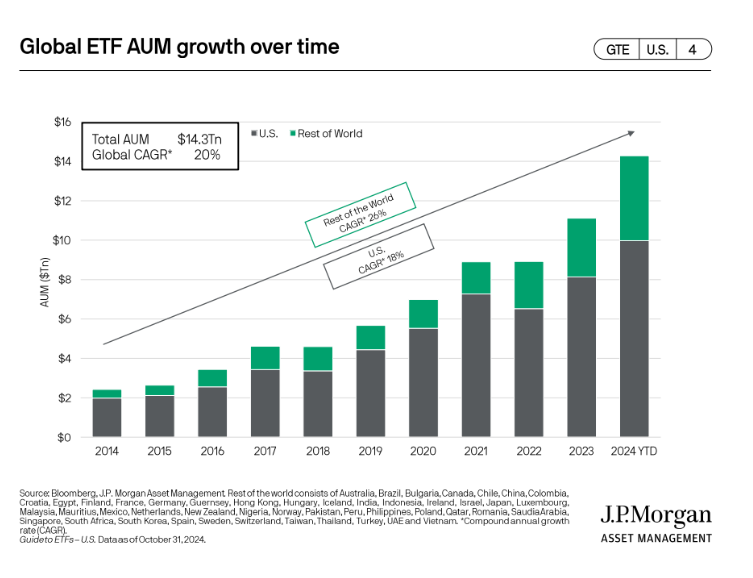

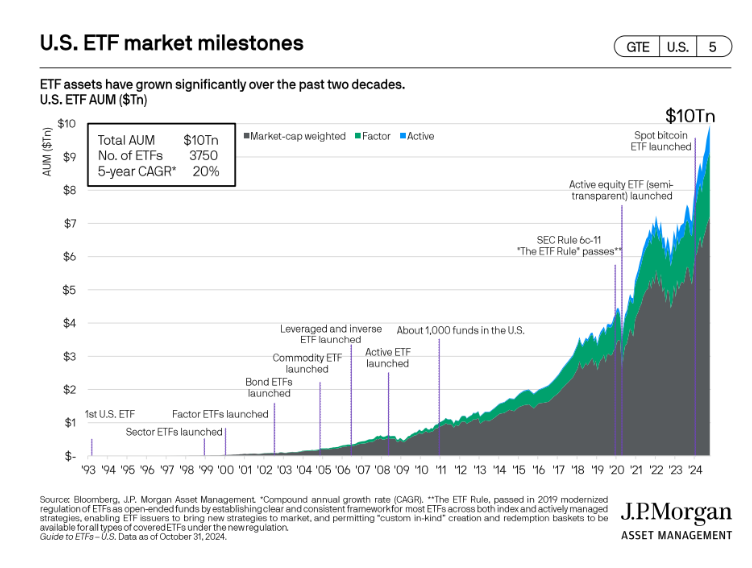

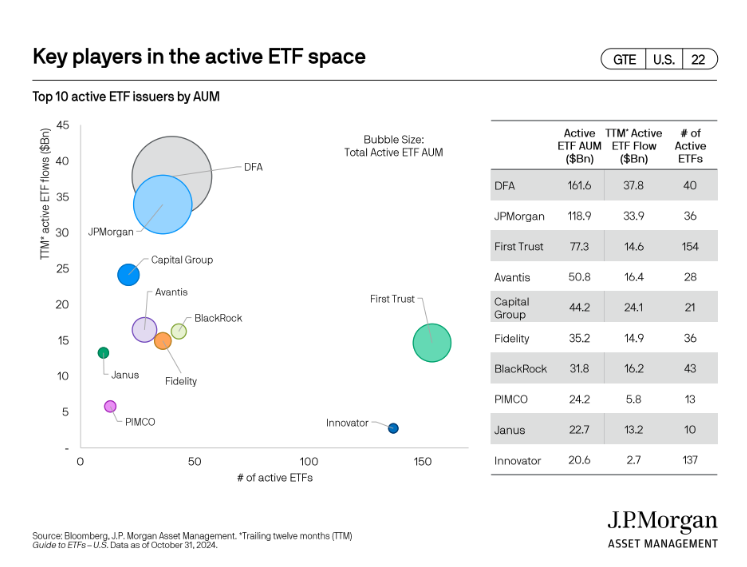

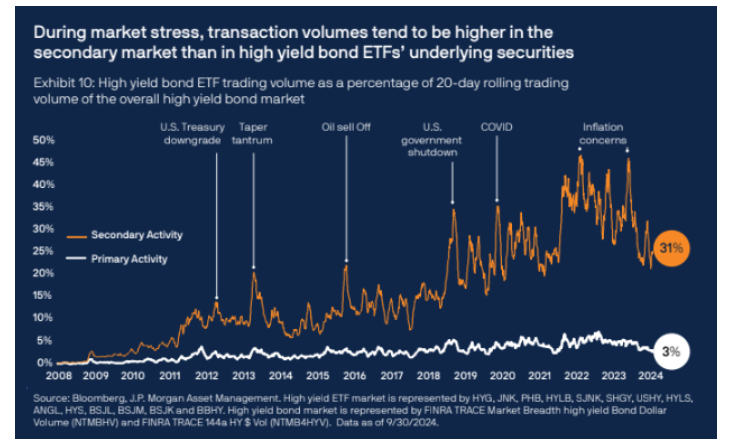

- Where the ETF flows are coming from

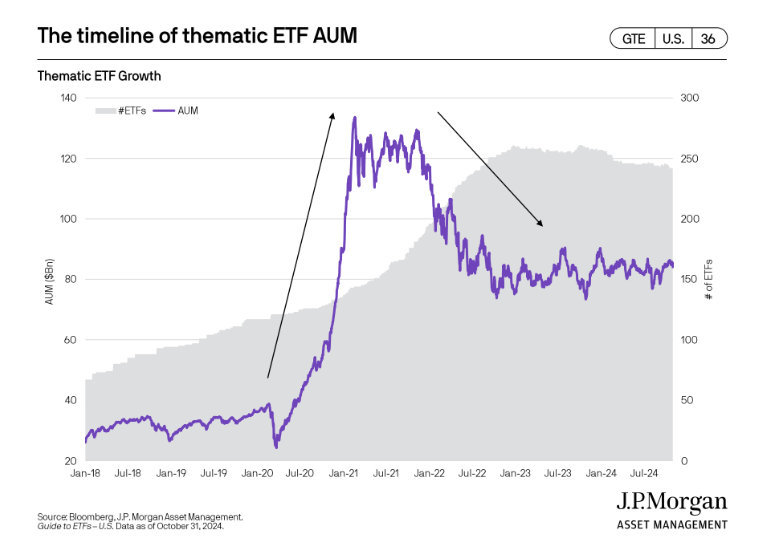

- The growth and decline of thematic ETF flows

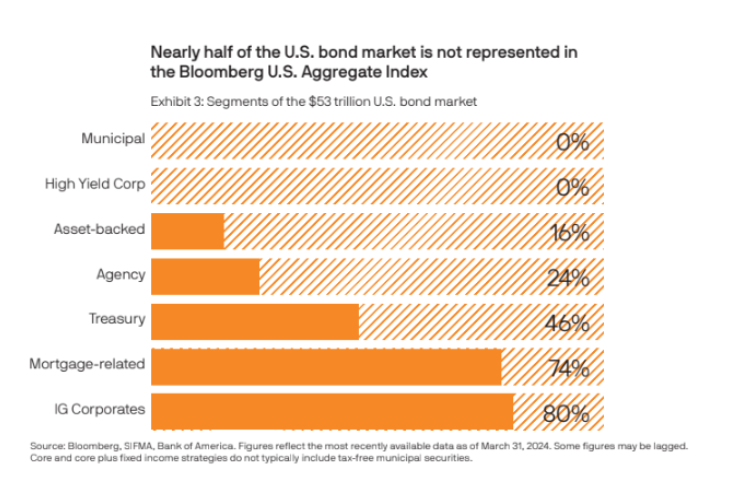

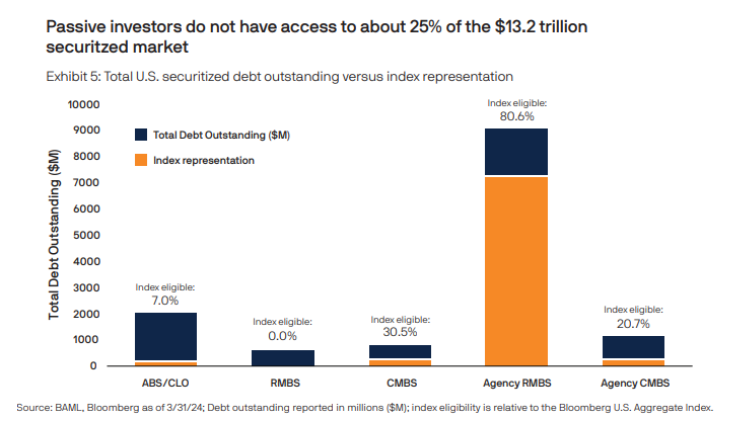

- Why the AGG does not include a variety of bonds

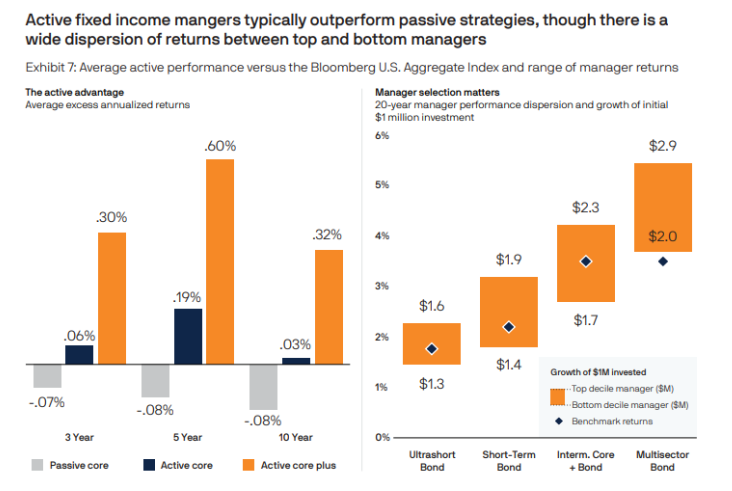

- Why fixed income indices are easier to beat than equity indices

- Thoughts on private assets within the ETF wrapper

J.P. Morgan ETFs are distributed by JPMorgan Distribution Services, Inc. is a member of FINRA. J.P. Morgan Asset Management is the brand name for the asset management business of JPMorgan Chase & Co., and its affiliates worldwide. JPMorgan is not affiliated with Ritholtz Wealth Management LLC and A Wealth of Common Sense.

Listen here:

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, stickers, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

Wealthcast Media, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.

Investors should carefully consider the investment objectives and risks as well as charges and

expenses of the JPMorgan ETF before investing. The summary and full prospectuses contain this

and other information about the ETF. Read the prospectus carefully before investing. Call 1-844-

4JPM-ETF or visit www.jpmorganETFs.com to obtain a prospectus.

Source: Morningstar. JEPI AUM based on 2023 Global Actively Managed ETF AUM as of 11/30/24.

Equity Premium Income ETF JEPI RISK SUMMARY: The price of equity securities may fluctuate rapidly or

unpredictably due to factors affecting individual companies, as well as changes in economic or political conditions.

These price movements may result in loss of your investment. Investments in Equity-Linked Notes (ELNs) are subject

to liquidity risk, which may make ELNs difficult to sell and value. Lack of liquidity may also cause the value of the ELN

to decline. Since ELNs are in note form, they are subject to certain debt securities risks, such as credit or

counterparty risk. Should the prices of the underlying instruments move in an unexpected manner, the Fund may not

achieve the anticipated benefits of an investment in an ELN, and may realize losses, which could be significant and

could include the Funds entire principal investment.

Investing involves risks, including loss of principal.

JPMorgan Distribution Services, Inc. is a member of FINRA.