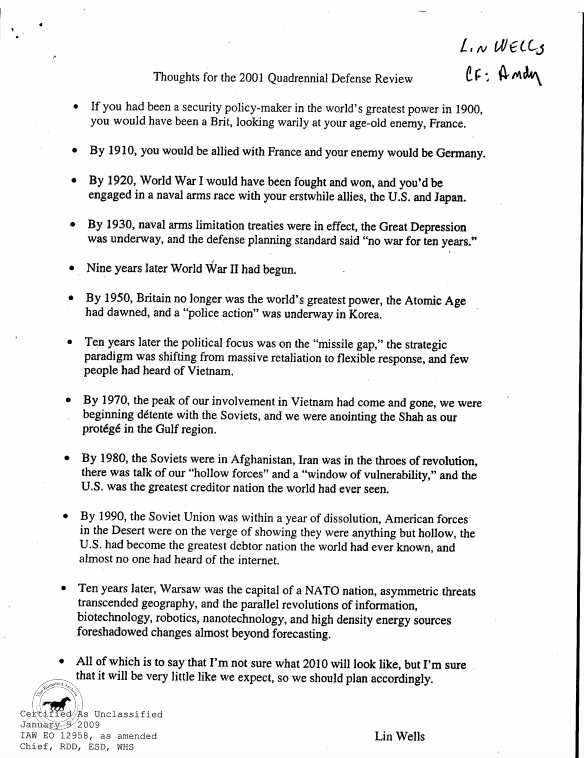

In April of 2001, Lin Wells from the Pentagon drafted a letter to President George W. Bush with a subject line that read: Predicting the Future. It was just one page in length:

His conclusion was as good of a prediction as you can make about the future:

I’m not sure what 2010 will look like, but I’m sure that it will be very little like we expect, so we should plan accordingly.

History is full of surprises. This letter was sent just months before the 9/11 terrorist attacks. That decade also included a massive housing market crash and the biggest financial crisis since the Great Depression.

Since then we have experienced multiple wars in the Middle East, Brexit, trade wars, the insurrection at the Capitol, the pandemic and now a war in Ukraine. I could have listed dozens of other geopolitical events and crises during this time.

I’m a big fan of reading history as a way to help understand the present. Unfortunately, history can be a terrible teacher. There are no counterfactuals. It’s much easier to play Monday morning quarterback when you already know exactly what transpired.

Making predictions about the future based on the past is like watching The Sixth Sense when you already know Bruce Willis was dead the whole time.

The past is easy because it seems so clean while the future is hard because it’s messy. But even the explanations about the past aren’t as clearcut as they seem.

Philip Tetlock has spent his career tracking the forecasting abilities of experts. He once wrote why it’s so difficult to learn from the past:

A warehouse of experimental evidence now attests to our cognitive shortcomings: our willingness to jump the inferential gun, to be too quick to draw strong conclusions from ambiguous evidence, and to be too slow to change our minds as disconfirming observations trickle in. A balanced apportionment of blame should acknowledge that learning is hard because even seasoned professionals are ill-equipped to cope with the complexity, ambiguity, and dissonance inherent in assessing causation in history. Life throws up a lot of puzzling events that thoughtful observers feel impelled to explain because the policy stakes are so high. However, just because we want an explanation does not mean that one is within reach. To achieve explanatory closure in history, observers must fill in the missing counterfactual comparison scenarios with elaborate stories grounded in their deepest assumptions about how the world works.

I wrote the following in Why History Gets Stuff Wrong All the Time:

People are continually re-writing history for the simple fact that history is hard to define, even for those who lived or studied it.

Abraham Lincoln has been the subject of some 40,000(!) books.

The Battle of the Bulge took place around 75 years ago. From 2014-2016 there were at least 8 books written on this one WWII battle.

World War I took place more than 100 years ago. There were a half-dozen books, each hundreds and hundreds of pages, published in 2014 alone about why the Great War broke out in the first place.

Historians have given more than 200 hundred theories about what caused the fall of the Roman Empire.

The 17th century Dutch Tulip mania is held up by some as one of the biggest bubbles in history. Others downplay what happened and think the entire event was overblown.

The SEC wrote an 840-page report to explain the 1987 Black Monday crash. Investors still argue about what actually caused the biggest one-day loss in stock market history.

Google gave me 374 million hits on ‘The Great Depression’ and experts still can’t fully explain why it transpired the way it did.

If we have a hard time explaining the past what chance do we have at consistently predicting the future?

The world is now a much different place than it was a week ago. Putin’s invasion of Ukraine has turned the geopolitical world on its head.

I have way more questions than answers right now:

- What is Putin’s end game here?

- How is it possible to move forward with Putin leading Russia no matter the outcome of the war?

- What will be the unintended consequences of crashing the Russian economy?

- Will the U.S. and other developed nations enter the war?

- What does this mean for the Fed and inflation?

- How will the stock market react to an ongoing war?

- Does Russia experience hyperinflation?

- Does this make it more or less likely for China to invade Taiwan in the future?

- When will this conflict end?

I don’t know how you can more or less destroy an economy like Russia’s and not have unintended consequences. I also don’t know how you can have a war between two countries with nearly 200 million people in them and have things just go back to normal when all is said and done.

I’m not going to pretend to know the answers to any of these questions right now. This situation is so complex and dynamic that it’s impossible to forecast how it will end. This is a situation where it’s almost impossible to handicap the potential outcomes.

The only prediction I can make at the moment is that things will be better in the long-term, hopefully for both countries, because most people get up in the morning looking to better themselves.

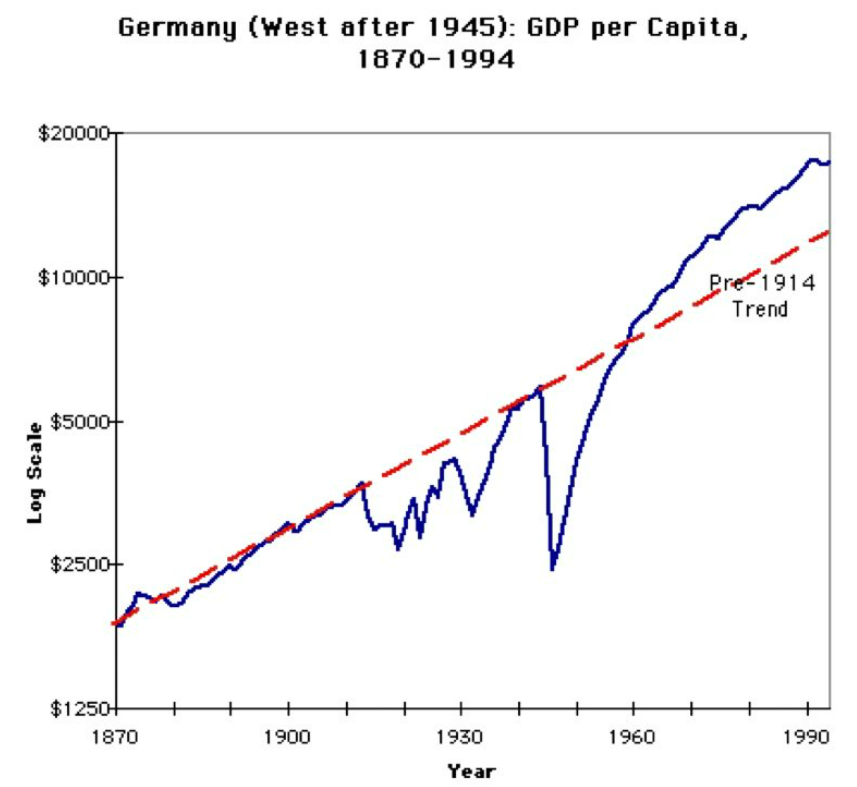

One of the craziest charts I’ve ever seen when it comes to economic data following war is GDP per capita in Germany following WWI and WWII:

Germany experienced hyperinflation following World War I and saw its economy get decimated following World War II. Yet they had the fastest growing economy in all of Europe following WWII. They were back on trend by 1960.

There are differences between how the rest of the world handled the aftermath of each war but I’m not sure anyone would have predicted this after seeing what happened to the German economy following WWI.

In the short-run it’s difficult to see an easy way out of the current geopolitical nightmare.

In the long-run it’s always a bad idea to bet against the power of the human spirit.

Further Reading:

Why History Gets Stuff Wrong All the Time