A reader asks:

I recently sold my condo for $400k and want to invest the money in the stock market. However, it appears the market is at an all time high. Should I invest elsewhere or wait for a market correction?

It’s understandable when investors get nervous about putting money to work at all-time highs.

One of those all-time highs will be the last one before a lengthy bear market! No one wants to put a big slug of cash to work right at THE peak.

It’s scary but if you’re an investor in stocks you have to get used to them new highs. They happen more often than you think.

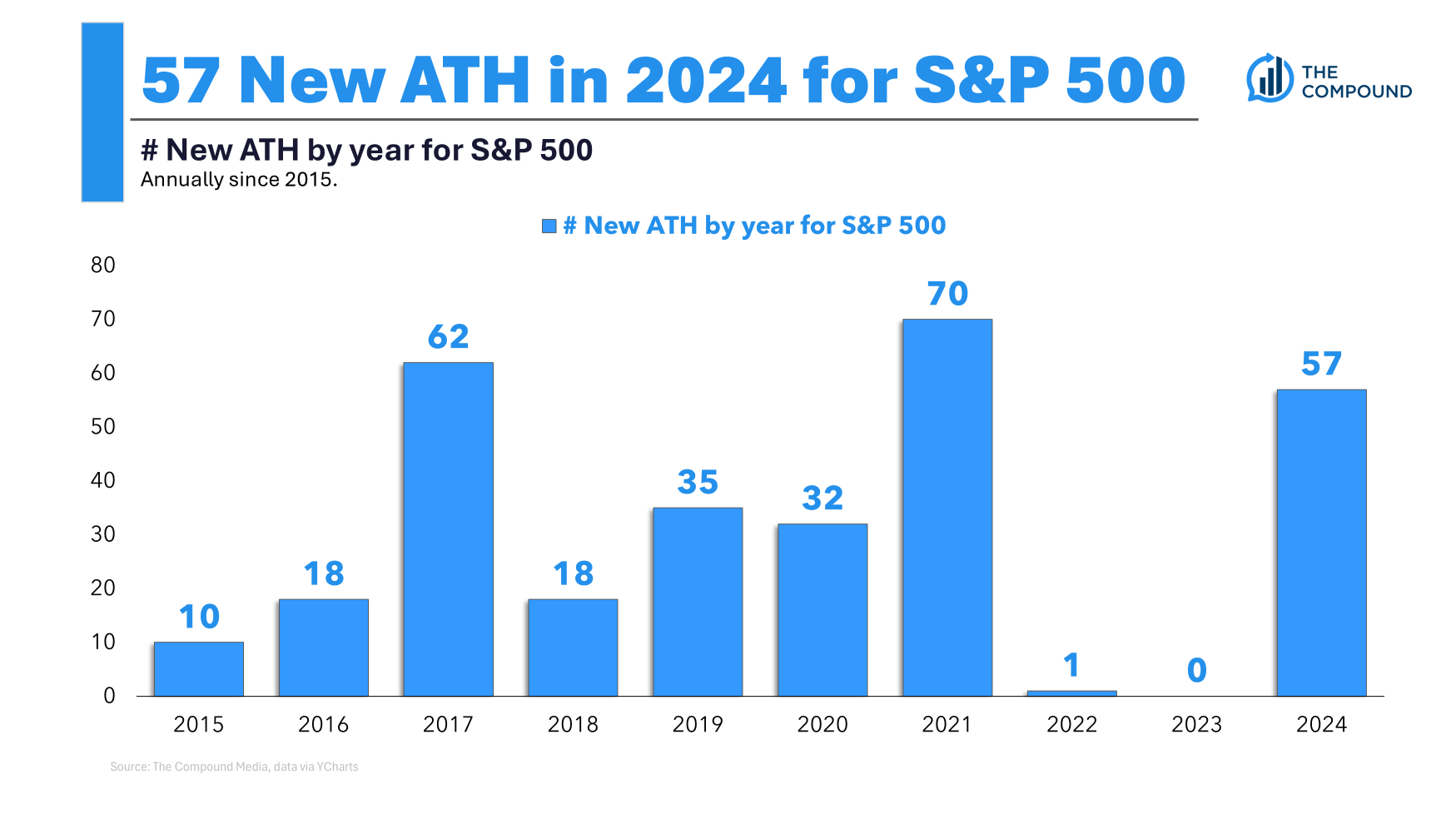

We’ve had a lot of new all-time highs this year:

We’re closing in on 60 this year alone. That means one of every four trading days has been a new high this year.

Over the past 10 years we’ve experienced just over 300 new all-time highs. That’s a lot.

I looked back at the number of new all-time highs over rolling 10 year windows for the S&P 500 going back to 1950. The average in that time frame was 170 all-time highs. Over 20 years the average was 319 new highs.1

So you have to get used to dealing with all-time highs. They happen regularly, around 7% of all trading days since 1950. On average, that’s one new high every 14 trading days or so.

To be fair, we’ve been on a heck of a run both this decade and since the end of the GFC. Market history is helpful but it needs to be put in the context of the present.

The hard part about investing is emotions tend to trump math when it comes to decision-making. New all-time highs add to the emotions, especially when you’re dealing with a big pile of cash after the market has experienced outsized gains.

If you’re nervous about investing at all-time highs, maybe you shouldn’t put all of your dry powder to work in the stock market.

My general rule of thumb is you should only invest in the stock market an amount you would be willing to hold through both bull and bear markets. No one can predict when stocks will take off or get crushed so your asset allocation should take that into account.

A more diversified portfolio of stocks, bonds, cash and other investments might have a lower expected return than an all-stock portfolio, but it also spreads your risks.

This is why it’s so important to have a pre-established asset allocation in place. That way you don’t have to think about it when you have cash to invest.

The perfect decision will only be known with the benefit of hindsight because every investor is forced to make decisions with imperfect information about the future. So It goes.

With that caveat out of the way, here are some reasonable options to invest your cash proceeds with stocks at all-time highs:

- Put all of your money to work in a lump sum and play the probability that most of the time the stock market goes up.

- Dollar cost average your cash into the market on a periodic basis to diversify your entry points and add a regret minimization hedge.

- Allocate your assets to a more broadly diversified portfolio of stocks, bonds, cash and possibly other investments.

Whatever you decide to do, the most important thing is you need a plan in place ahead of time so you’re not guessing about what to do next.

Josh Brown joined me on Ask the Compound this week to chop it up on this question:

We also covered questions about how AI will impact the financial advice landscape, timing the next market correction, factoring an inheritance into the house-buying process and using long-dated options in a portfolio.

Further Reading:

All-Time Highs in the Stock Market are Usually Followed by All-Time Highs

1The most over any 10 year time frame was 344. The least was just 9 (hello lost decade).