I’m trying something new for some of my more text-heavy posts by giving people an audio version as well. I will try to do this 2-3 times a week if readers like this option.

The hardest part about building wealth for the majority of the population has nothing to do with picking stocks or asset allocation or active vs. passive or the macroeconomy or any of the other stuff professional investors spend their time debating.

The hardest part about building wealth for most regular people is the process of saving their money on a consistent basis.

But it doesn’t take that much to make a big difference over time if you’re able to stick with a regular savings plan.

Even $20 a month could have an enormous impact if you give yourself a long enough runway.

The maximum contribution for an IRA in 2020 and 2021 is $6,000. That means maxing out your IRA would require you to save $500 a month.

If you were to diligently save that $500 every month for 30 years, assuming a 7% return on your investments, you would end up with more than $600,000 after 30 years of saving.

This is easier said than done for a variety of reasons but that’s not a bad haul.

But what if instead of saving the same amount every month of every year for 3 decades, you instead increased your savings by just $20 month each year. So in year one, you would save $500 a month. In year two you would save $520 a month. In year three you would save $540 a month and so on.

Twenty bucks a month can’t be worth that much, right?

Actually…

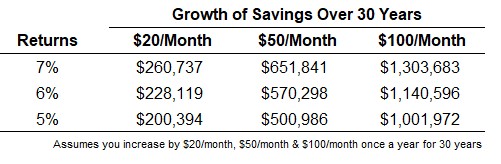

In this scenario, assuming the same 7% annual return, your ending balance after 30 years would jump from a little more than $606,000 to more than $867,000. That $20 a month would be worth more than $260,000!

Not bad.

Now maybe you think 7% is too high for risk assets over the next 30 years. At 6%, that $20 a month increase each year would be worth close to $230,000. At a 5% return it would be worth just over $200,000.

Maybe it’s not realistic for some households to save $500 a month and max out their IRA at the moment. But $20 a month? That’s a reasonable goal for most households, no?

Or how about $50 a month? Or $100 a month?

This is real money.

Now maybe people eventually hit a ceiling to how much they can save. Some people simply don’t have the bandwidth to increase their savings by a set amount each year.

But these examples show you can start small and slowly work your way up when building wealth over time. You don’t have to go all-in right from the jump.

Slowly working your way up to a higher savings goal can be done and it doesn’t necessarily take a lot of money.

What it does require is patience, discipline and a long enough time horizon to allow your assets to grow through the power of compounding and regular savings.

I’ve been thinking about the topic of saving money a lot lately since I just put the finishing touches on my next book called Everything You Need to Know About Saving For Retirement:

I decided to self-publish with Amazon on this one so there is no pre-order for the book just yet. But I will be giving the people on my email list a heads up before anyone else so pay attention to your email and I’ll let you know when it’s ready to go. I’m targeting the week after Thanksgiving for the release.

I’ll have more to say on the book and why I wrote it in the weeks ahead.

*******

This week’s Animal Spirits video is Michael and me talking the post-pandemic stock market, selling a stock right before a big gain and Warren Buffett on why bubbles happen:

Now here’s what I’ve been reading lately:

- The stuff economy (I’m Late to This)

- Alex Trebek was more than a game show host. He was family (The Ringer)

- When the dust settles (Irrelevant Investor)

- What a Biden Presidency means for your finances (Dollars and Data)

- Investing lessons from The Queen’s Gambit (Bull & Baird)

- The future shock of current purchases (Humble Dollar)