My personal finance pipedream for America is that we adopt something like Australia’s retirement system where workers are forced to save a certain percentage of their income for retirement.

That pipedream will never happen because Americans hate being forced to do anything.

You need to make people think that saving for retirement is their idea.

Luckily, behavioral psychologists have figured out enough about choice architecture that we can use plan design to encourage more people to save for retirement.

In recent decades, defined contribution plans have added features like default savings rates, automatic sign-up (opt-out instead of opt-in), default diversified investment selections and escalating savings rates over time to improve outcomes for retirement savers.

It’s a soft force that’s helped millions of people save more than they would have if they had made the choice on their own.

The problem is that the “forced” savings rates initially introduced by most companies were too low. A 3% savings rate was the initial default for most of these plans.

That’s just not going to cut it for most households.

Luckily, companies are now increasing the default savings rate.

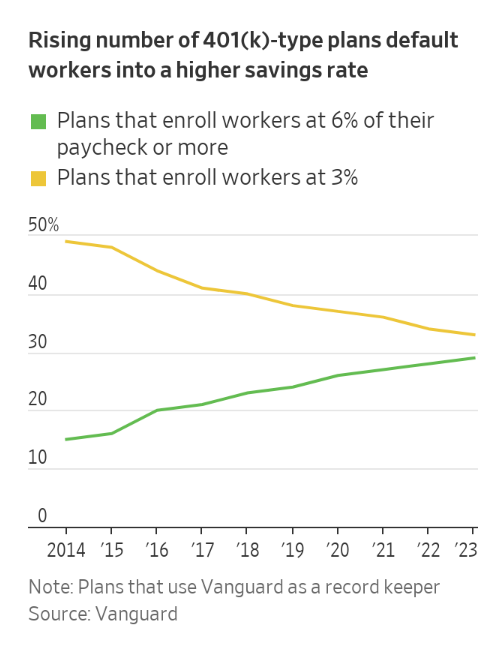

The Wall Street Journal had a recent piece that shows 6% is the new 3% when it comes to default savings rates:

I would prefer something closer to 10% but this is progress.

Here’s more color from the story:

Nearly a third of companies that use automatic 401(k) enrollment now start workers saving at 6% of their salaries or higher, about double the share of organizations that did so a decade ago, according to Vanguard Group.

About 60% of companies automatically enroll new hires, bringing 401(k) participation rates to 82% of eligible workers, up from 66% in 2007, according to Vanguard, which administers 401(k)-type accounts for nearly five million people.

Today 91% of the Verizon plan’s 68,000 participants are saving 6% or more, and receive the full match, up from 78% in 2020, before the switch, he said.

This is good news!1

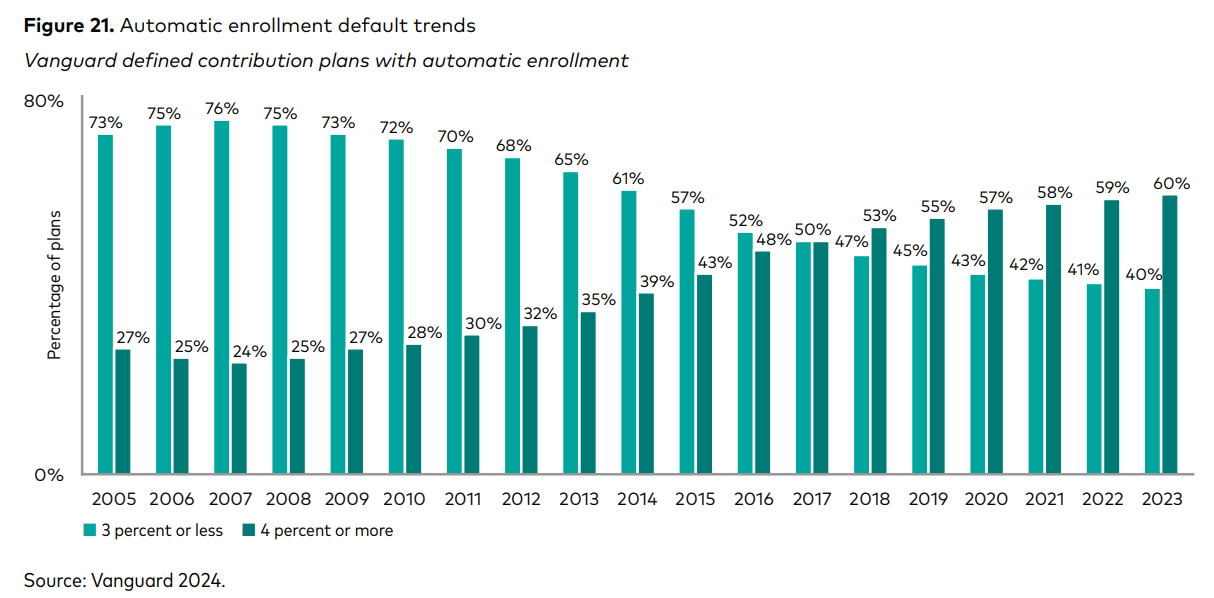

Vanguard’s annual How America Saves report, which covers 5 million defined contribution retirement plan participants, shows a similar trend in auto-enrollment savings rates:

We can build on this!2

Most people would prefer the old system where employees were given defined benefit pensions. Sounds lovely in theory but there is no way profit-seeking companies were going to put up with those costs what with people living longer and all.

Like it or not, it was never sustainable for employers to cover their employees’ retirement spending (or healthcare costs).

The 401k plan is far from perfect because there are still many plans that charge egregious fees and there are plenty of employers that don’t even offer their employees a retirement plan.

I wish the U.S. government would automatically enroll anyone who earns income (with an opt-out, obviously) in the TSP as a national retirement plan. Alas, yet another pipedream.

Regardless, defined contribution plans such as the 401k are much better than millions of people being completely on their own when it comes to saving for retirement.

All of the behavioral nudges 401k plans and the like have added are having a big impact on the financial markets at large as well.

Here are some things I believe but can’t prove for certain about these impacts:

Automatic investing increases valuations. There are many reasons valuations on the stock market have been slowly climbing for years.

Millions of people putting money to work in the stock market out of every single paycheck had to cause an upward bias in valuations.

This simply didn’t exist in the past.

Automatic investing makes investors better behaved. Targetdate funds are the default investment vehicle in 401k plans and now have something like $3.5 trillion in them.

These funds are generally low cost, diversified and automatically rebalanced. This is a win for investors who are overwhelmed, want to simplify or don’t know what to invest in.

Plus, there’s the fact that 401k plans let you to save automatically in a set-it-and-forget-it manner.

These features allow investors to automate good behavior.

Automatic investing won’t stop bear markets. Automated investing has played a role in the upward trajectory in the stock market the past four decades for sure.

But there are still plenty of investors who don’t automate their investments who freak out, get fearful when others are fearful and try to outsmart the market.

In other words, humans are still human.

While they can’t stop markets from going down on occasion, the trillions of dollars in defined contribution retirement plans have forever changed the markets.

Michael and I talked about the impact of 401k plans on the stock market and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

How the Individual Retirement Account Changed the Stock Market Forever

Now here’s what I’ve been reading lately:

- F*ck you money (Contessa Advisors)

- Lifting humanity out of poverty (Noahpinion)

- A cash obsession (Cautiously Optimistic)

- We live in a society (Money with Katie)

- How much does it cost to build a new home? (Sherwood)

- Age vs. appetite for allocation (Oblivious Investor)

- Inflation in retirement (Of Dollars & Data)

Books:

1My wife often tells me I’m not enthusiastic enough, so I’m doing my best to use more exclamation points here and there. It doesn’t feel natural, but I’m trying.

2OK that’s too much. I’ll stop now.