There’s an old saying that people don’t attend church on Sundays expecting to hear an eleventh commandment.

You go to reinforce what you’ve already learned or learn it all over again.

And so it is with the basic principles of finance.

Jason Zweig once wrote the following:

My job is to write the exact same thing between 50 and 100 times a year in such a way that neither my editors nor my readers will ever think I am repeating myself.

That’s because good advice rarely changes, while markets change constantly. The temptation to pander is almost irresistible. And while people need good advice, what they want is advice that sounds good.

Markets and macro are in a constant state of flux but the stuff people worry about is relatively consistent.

Am I going to be OK?

Do I have enough money?

What if markets fall?

What if rates/inflation rise/fall?

What if we go into a recession?

How do I maximize after-tax returns?

I could continue. These worries are cyclical depending on the environment and where you are in your lifecycle.

Like clockwork, every four years, investors worry about what the presidential election will mean for their portfolios.

Should we expect higher volatility in November?

What if this candidate wins/loses?

Is the stock market doomed if the democrat/republican wins?

These worries are nothing new. I’ve written a lot over the years about keeping politics out of your portfolio:

- Presidential Terms & Market Cycles

- Would the Stock Market Crash if Elizabeth Warren Became President?

- Does the Stock Market Care Who the President Is?

- Don’t Mix Politics with Your Portfolio

Sometimes you have to play the hits.

I’m not saying it doesn’t matter who the president is. Depending on who wins the White House in November, there will be different policies, reactions and unintended consequences.

But you can’t predict what will happen to the stock market or economy based solely on who wins.

Republicans called Barack Obama a socialist and claimed he would end capitalism as we know it.

Democrats predicted a calamity for the stock market and economy when Trump got elected.

Republicans said Joe Biden would crash the stock market.

Instead, the economy grew for each of these presidents. The stock market went up even though there were setbacks along the way.

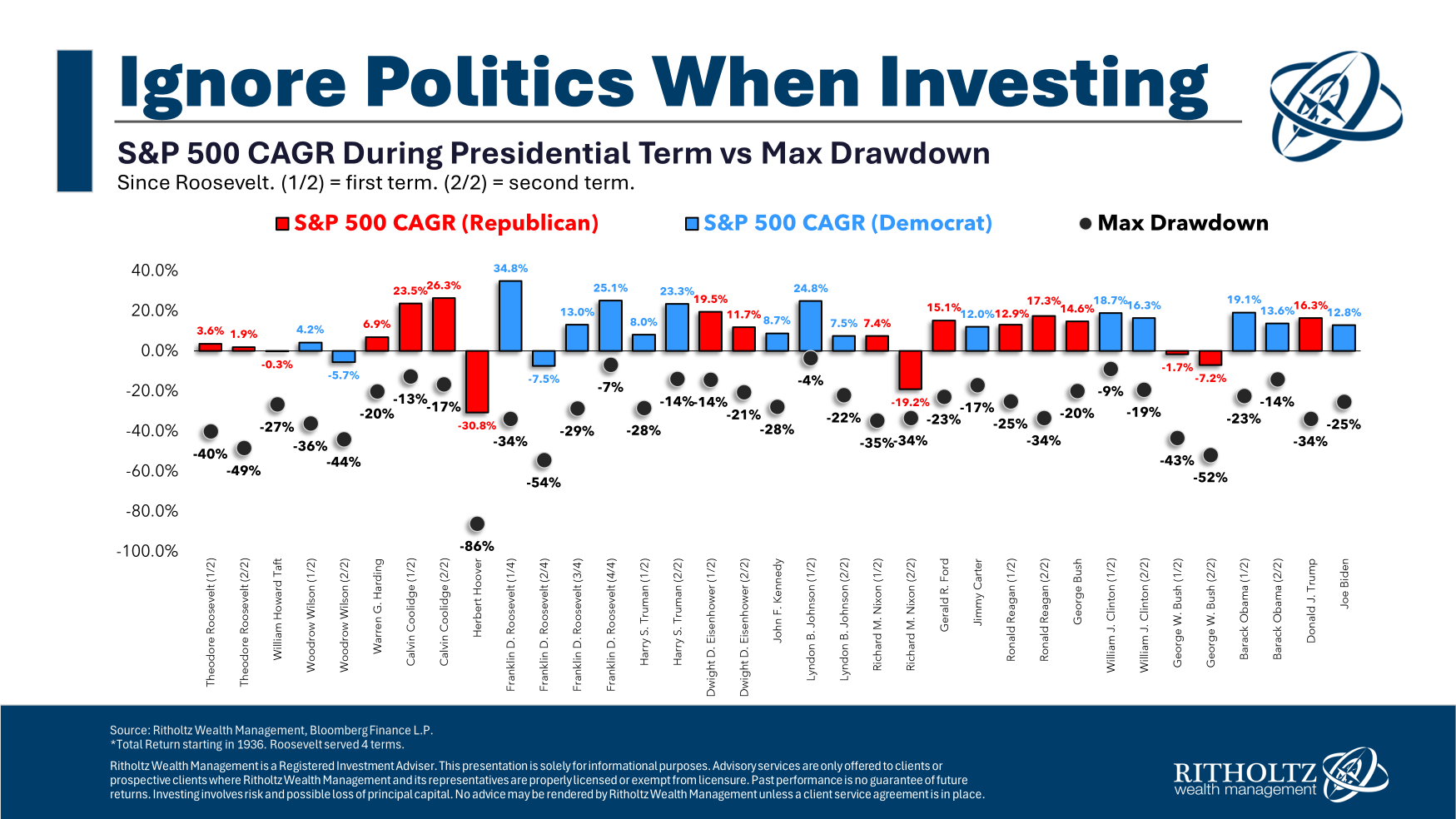

Every president in modern economic history has overseen drawdowns in the stock market:

Most of the time stocks went up but there were times they went down. The stock market goes up and down regardless of which party is in office.

The U.S. stock market is worth $50 trillion. The U.S. economy produces $28 trillion (and counting) in gross domestic product each year.

One person alone cannot control them.

I can’t predict how markets will react to Trump or Harris or whoever else ends up in the White House.

There will be volatility at some point, regardless of who the president is. The stock market will most likely go up but there is a possibility it will go down.

You can perform reasonable analysis about specific stocks or sectors depending on who wins. Maybe right, maybe wrong.

But you can’t make sweeping changes to your portfolio just because the person from the other party you don’t like wins.

Introducing politics into your investment process is toxic to your portfolio.

Michael and I talked about keeping politics out of your portfolio and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Now here’s what I’ve been reading lately:

- Not everyone needs a financial advisor (Wealth Found Me)

- How historical analogies can lead you astray (Optimisticallie)

- Lifestyle creep is mostly a myth (Of Dollars & Data)

- Debunking investment myths (Morningstar)

- Bob Newhart was a literary master (The Conversation)

Books: