Inflation went from 9% to 3% without a recession.

Some people want to give all the credit to the Federal Reserve.

I think they got lucky.

The soft landing, or whatever you want to call it, happened despite the Fed’s best efforts to cause people to lose their jobs and throw the economy into a recession.

It helped that corporations and households came into the rising rate environment prepared.

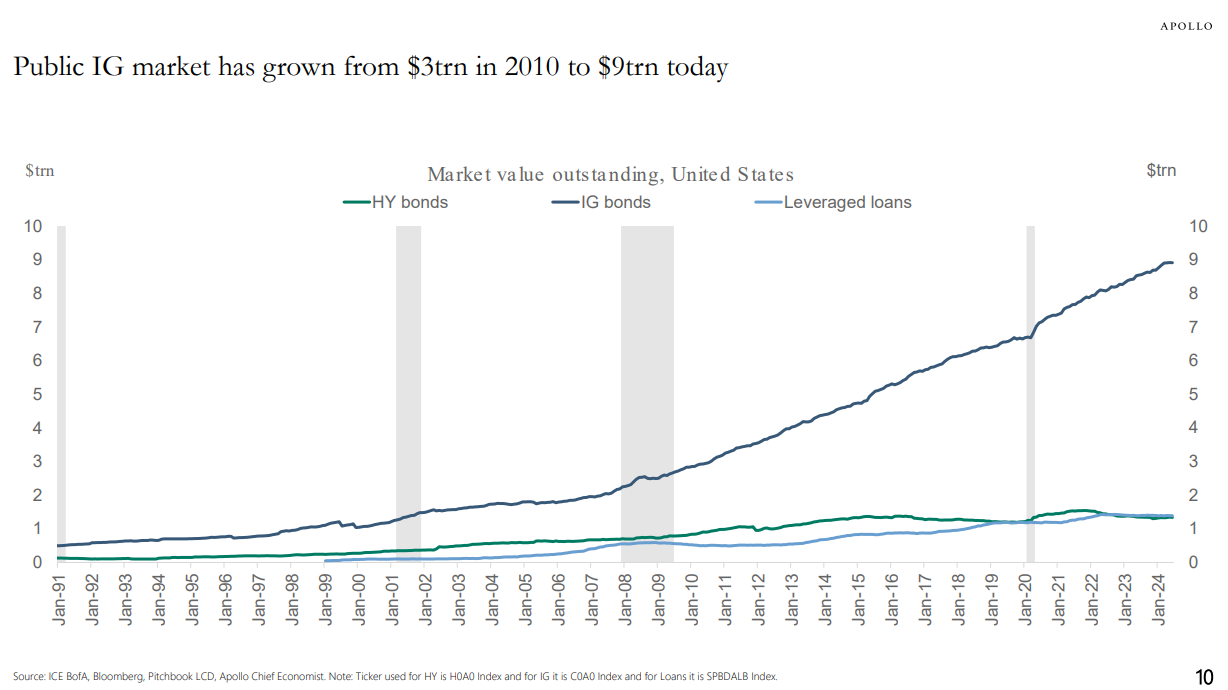

Corporations locked in low interest rates as you can see from the growth in investment-grade credit in the 2010s:

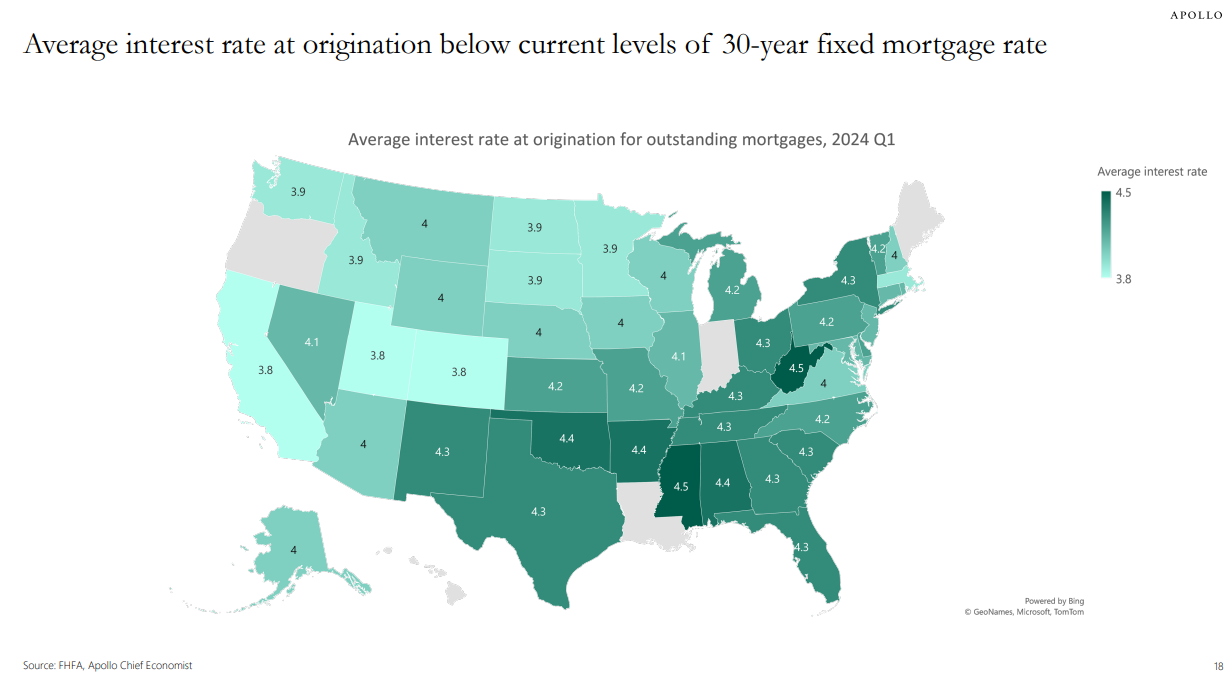

Households locked in low mortgage rates during the pandemic on their biggest line item expense:

The ZIRP era and the pandemic actually saved us from the pivot to an era with higher rates. Households have been able to wait it out.

Of course, this situation couldn’t last forever. The Fed Funds Rate has been above 4% for a year-and-a-half. It’s been over 5% for more than a year. Eventually, consumers need to borrow money at the prevailing rates, which are much higher now.

People are still buying homes, cars, and other items on credit, which is slowly but surely impacting household finances.

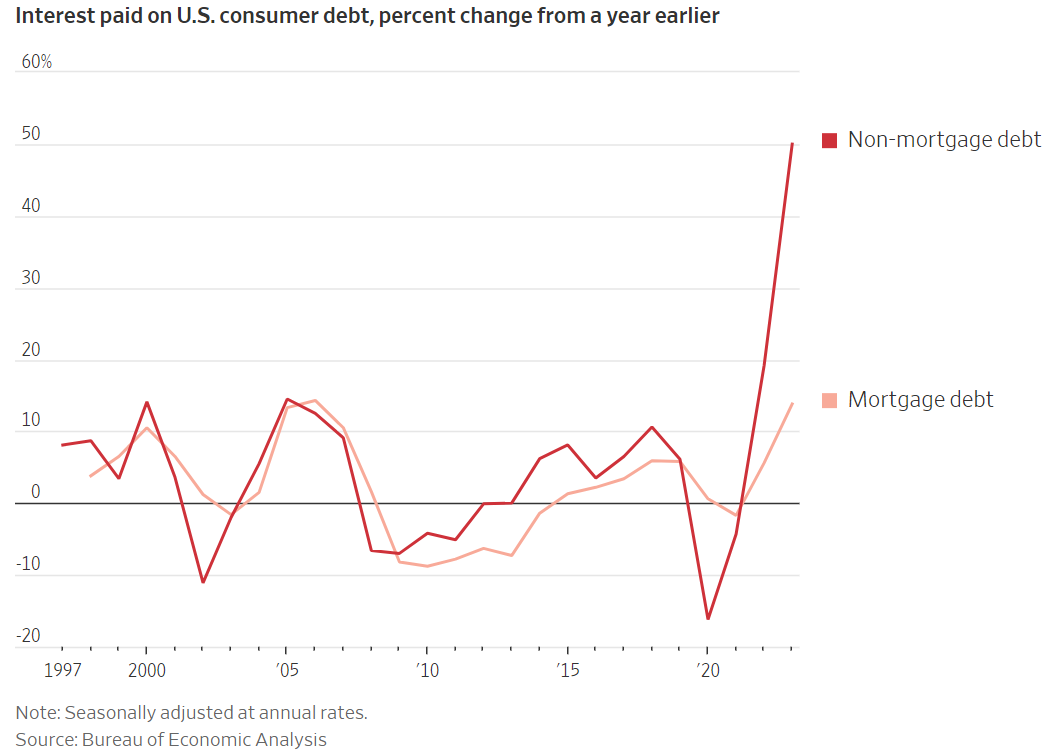

The Wall Street Journal put together some charts that show how these impacts are being felt:

Mortgage interest expense jumped 14% in 2023 from a year earlier. But look at the spike in non-mortgage debt — up 50% year over year. This is the interest people pay on auto loans, credit cards, etc.

That stings the monthly budget.

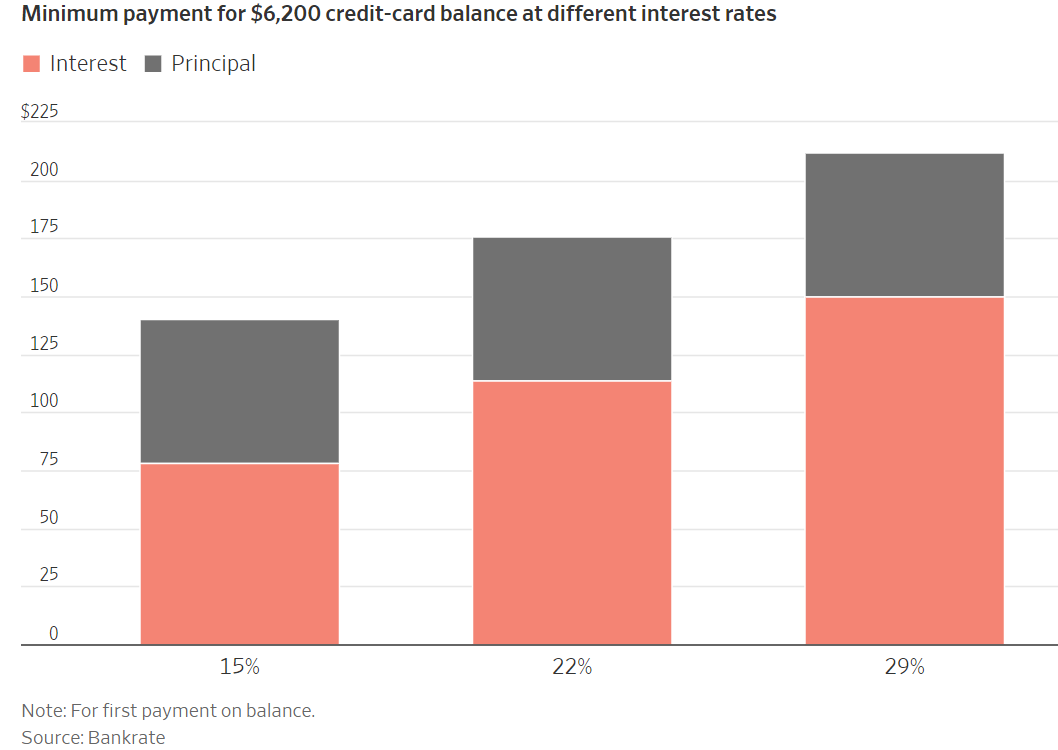

They also have a chart that shows the average credit card balance ($6,200) with minimum payments at various interest rates:

Holding a credit card balance from month to month is one of the worst financial decisions you can make. Making the minimum payments is even worse. Either way, higher credit card rates are surely impacting those in the unfortunate position of sitting on the worst kind of debt there is.

Auto loan rates somewhere in the 7-10% range, mortgage rates at 7% and credit card rates at 25%+ had to negatively impact some portion of the population eventually. And those who borrow at higher rates are also paying higher prices on vehicles, housing and all the other stuff people spend their money on.1

We Americans love to borrow money so higher rates haven’t exactly helped with the economic vibes these past few years either.

There will be a time to worry about the U.S. consumer. The economy will slow. People will lose their jobs. There will be an increase in delinquencies and bankruptcies.

I just don’t think we’re there yet.

The consumer remains in pretty good shape.2 There are people hurting from higher prices and borrowing costs, of course, but there are also plenty of households doing just fine, financially speaking.

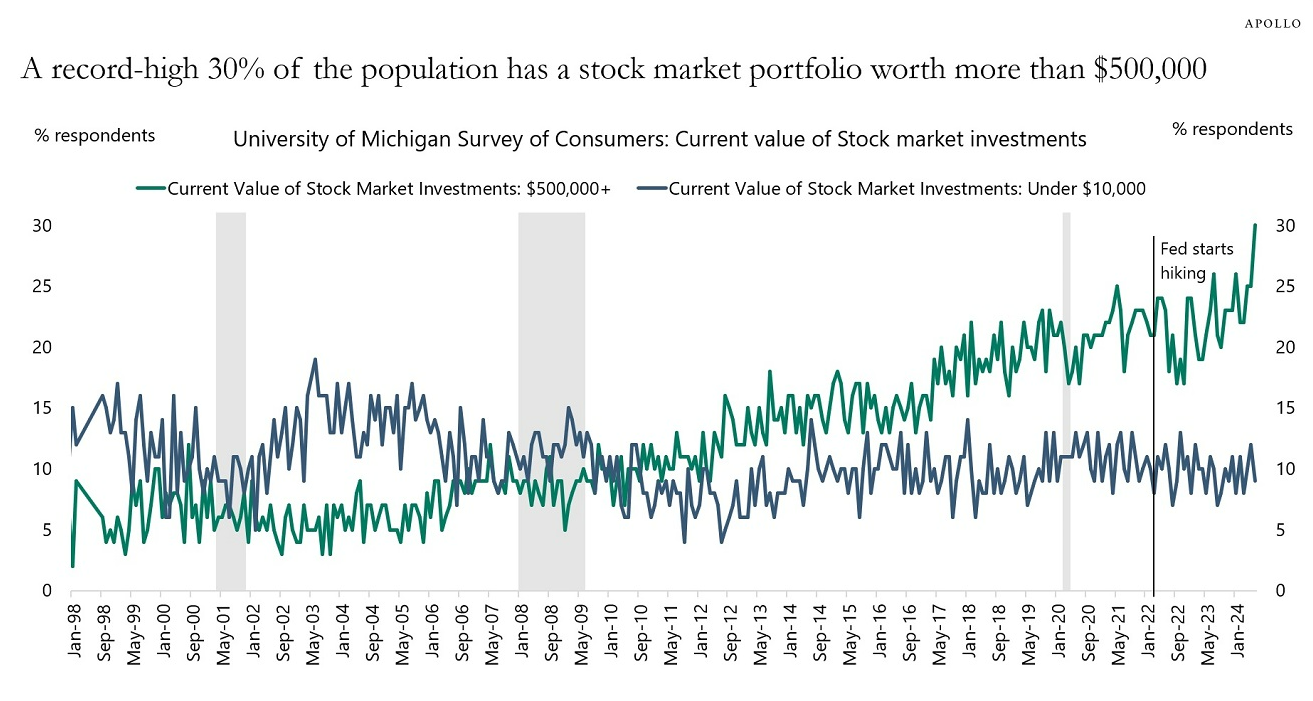

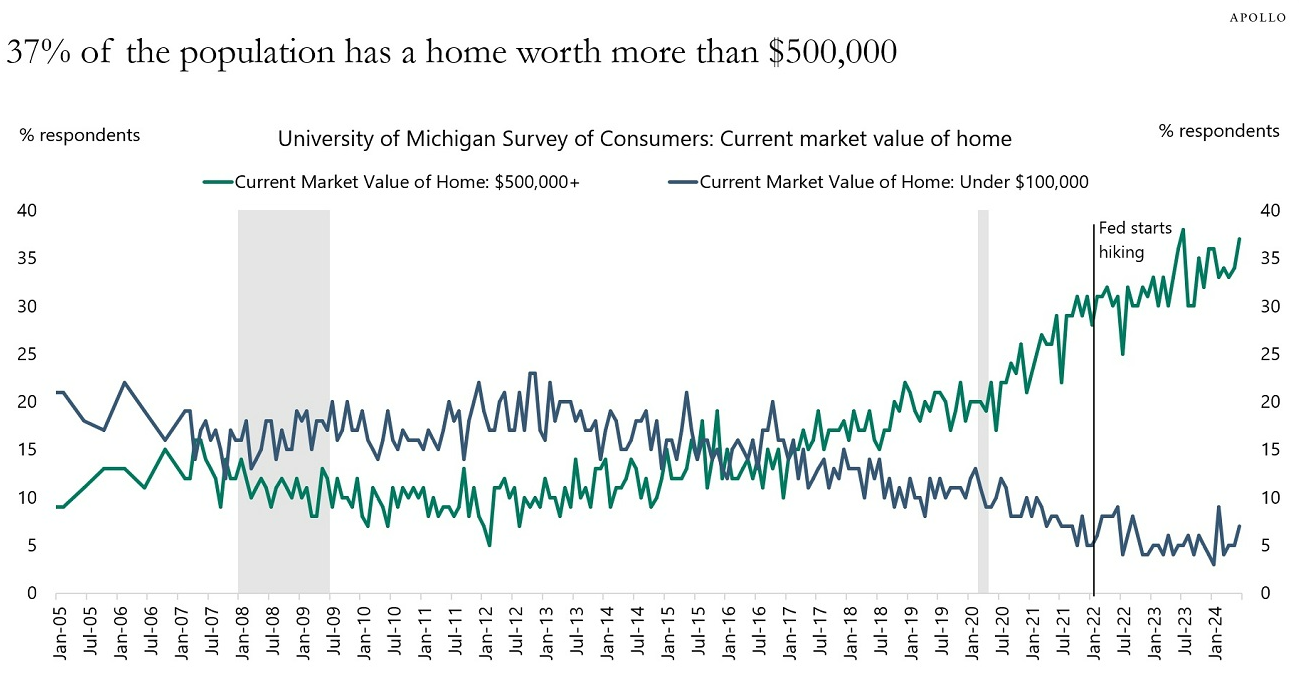

Look at this data from Torsten Slok3 at Apollo:

According to the University of Michigan, roughly one-third of the population has a stock portfolio worth more than half a million dollars, and close to 40% own a home worth $500k or more.

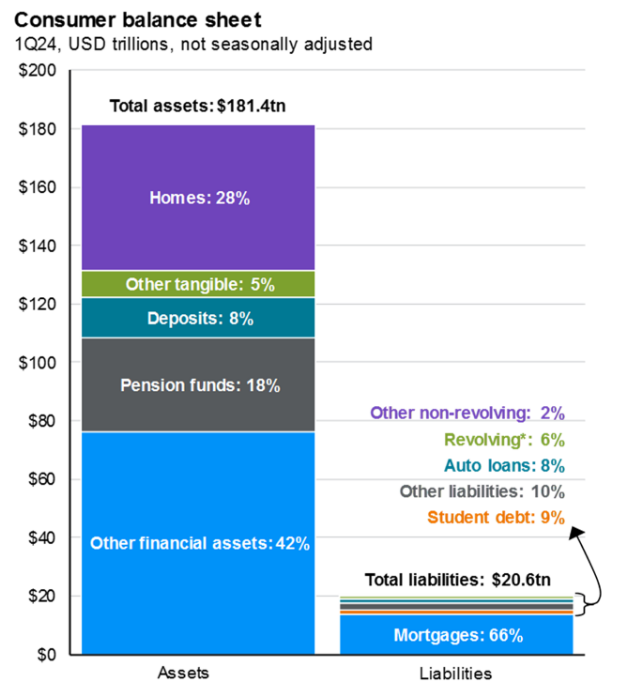

Households have never been richer than they are today.

JP Morgan does a nice job of breaking down assets versus liability on the consumer balance sheet:

It’s not even close — the assets dwarf the debts.

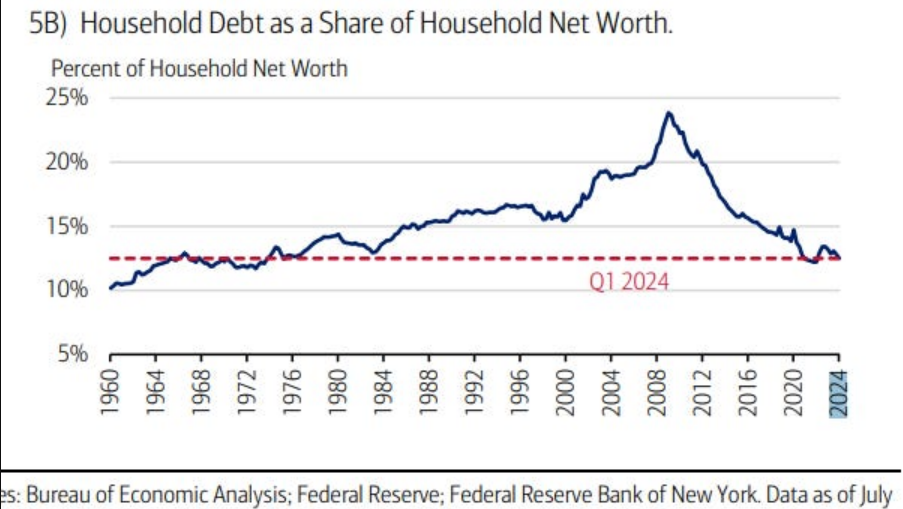

Debt as a share of net worth has been falling for years:

The ratio of debt-to-net-worth hasn’t been this low since the 1970s.

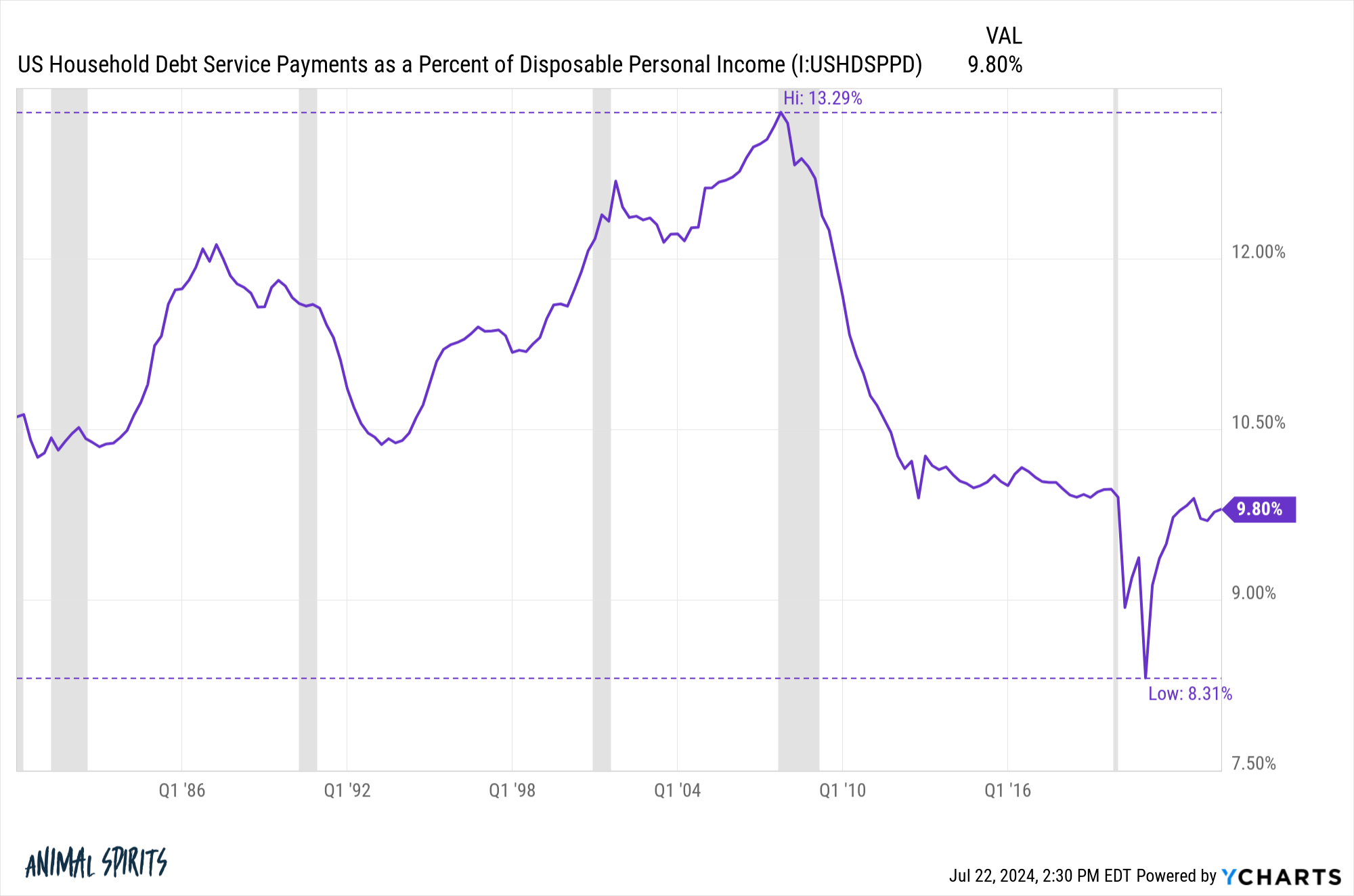

You can also look at debt service payments as a percentage of income:

So, while rising rates increase interest expenses, wages have been rising, too.

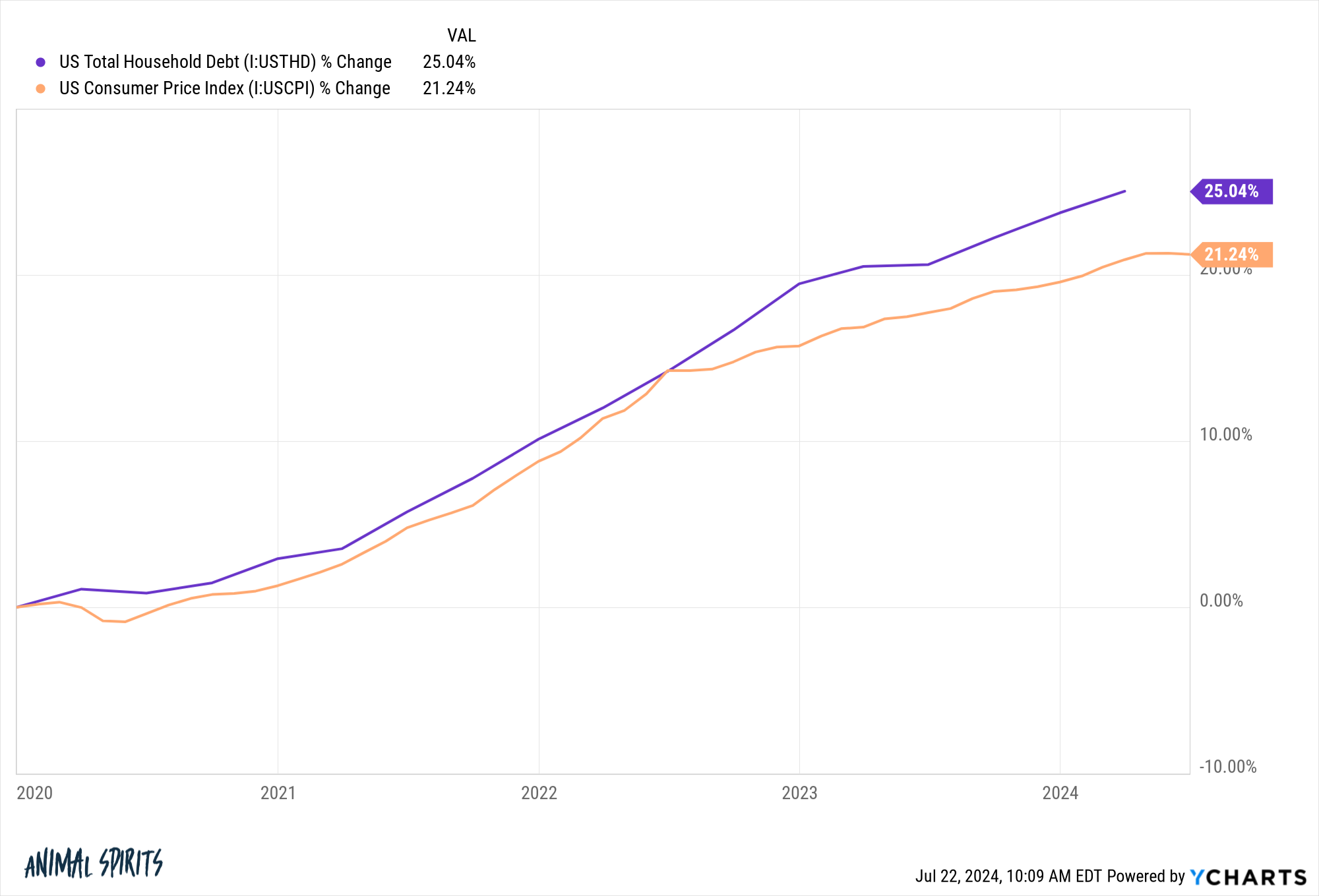

I also looked at the growth in total household debt and consumer prices since the end of 2019:

On a real basis, household debt is up less than 4% in total during the 2020s.

There are households are struggling in certain areas.

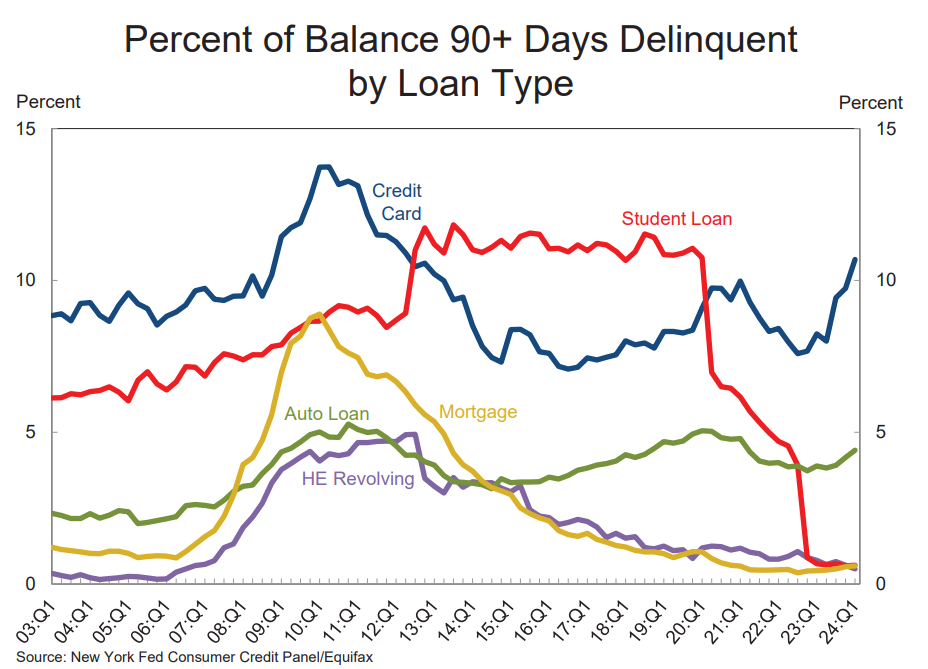

The New York Fed looks at delinquencies on different types of credit:

Credit card delinquencies are rising. Auto loan troubles have experienced an uptick as well. But the mortgage numbers are about as low as they’ve been on record.

Consumers will retrench at some point. The economy is cyclical.

For the most part, consumer balance sheets are still in a good place at the moment.

This is a good thing because consumers make up ~70% of the U.S. economy.

Further Reading:

The Bottom 50%

1Except TVs. TVs just seem to improve with quality by the year but also somehow get cheaper. One of the biggest unexplained economic phenomena of the past couple of decades.

2I’m speaking collectively here obviously. Every individual and household is different.

3Slok consistently produces the best charts in the finance content game. I constantly use and reference his work.