Here’s a scenario I was presented with recently:

Five years ago, a relatively conservative investor was sitting on some cash and seeking a more balanced portfolio.

To keep things simple, this investor split the difference between stocks and bonds by allocating 50% to equities and 50% to fixed income.

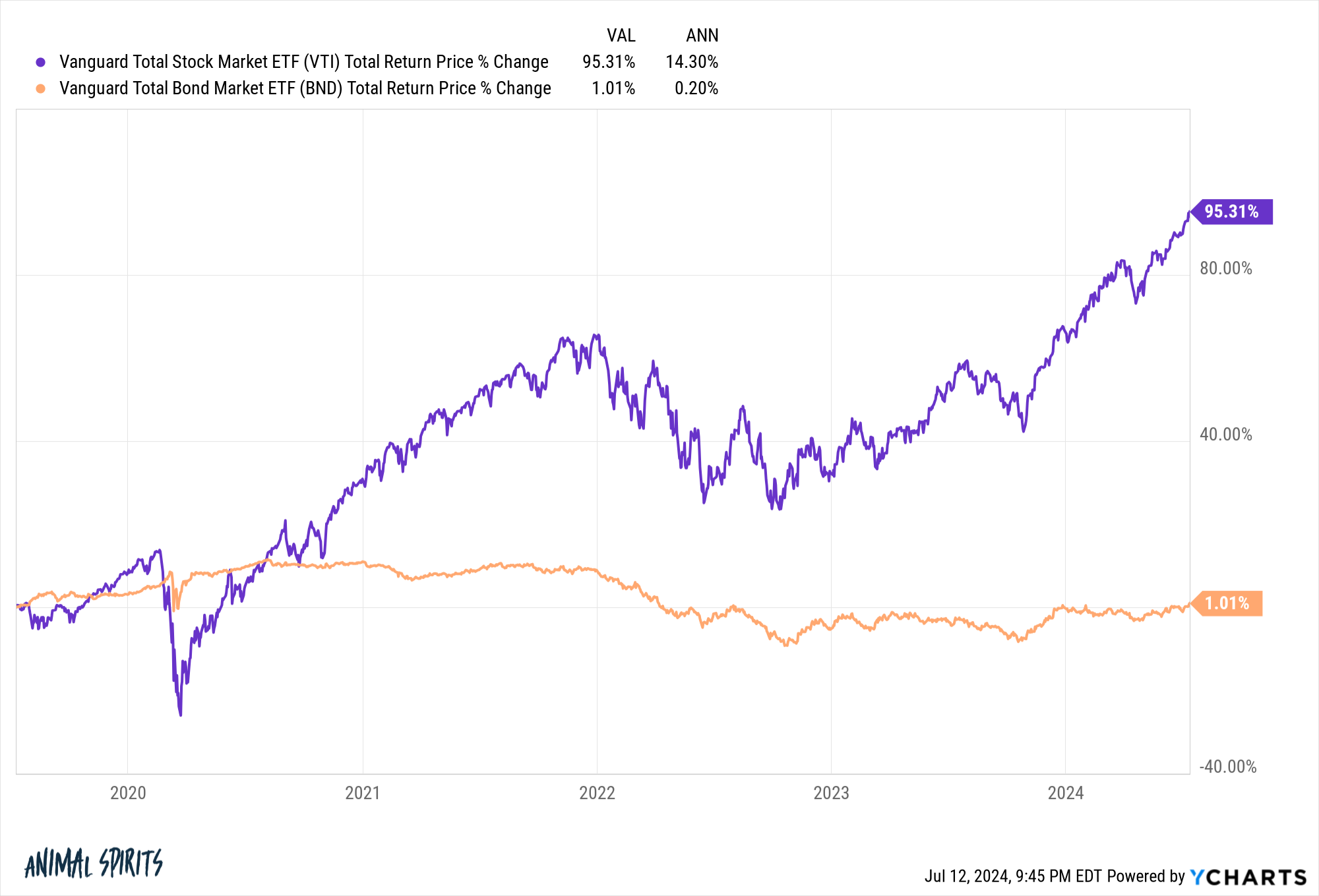

Five years later there is a clear winner in terms of performance within this 50/50 portfolio:

You basically doubled your money in stocks and earned nada in bonds.

This investor is now wondering if it’s time to sell bonds after they stunk up the joint.

I understand the frustration.

With stocks, risk was rewarded. Sure, you experienced drawdowns of 35% and 25% along the way but you earned annual returns of more than 14% for your troubles.

Bonds, on the other hand, experienced a drawdown of close to 20% and you still earned bupkis on your money.

All of the risk and none of the return.

To be fair to fixed income as an asset class, stocks have a higher expected return. They’re supposed to do better than bonds over longer time horizons.

Still, if you’re seeing such a large discrepancy in returns after five years, I wouldn’t blame you if you were tempted to sell your bond position and buy stocks.

That might be the right move going forward. I don’t know what’s going to happen over the next 5, 10 or 15 years. The future is unknowable.

But driving in the rearview mirror is rarely a useful investment strategy.

This is especially true when you consider we just went through the worst bond bear market in history.

You already lived through the pain of rising rates. Now those rising rates have translated into higher yields. The yield to maturity for BND is now 5.1%.

Stocks might beat that yield but it’s a much higher hurdle rate than it was just a few short years ago.

Regardless of the performance for either of these asset classes going forward, it’s important to understand that regret is an ongoing emotion when you have a balanced portfolio.

Investing itself is a form of regret minimization. Some investors regret missing out on the big gains while others experience more regret when they participate in big losses. Some people regret every time something goes wrong.

A balanced portfolio is a simple way to minimize regret by spreading it around but it never goes away completely.

Vanguard’s Jack Bogle split his portfolio evenly between stocks and bonds in a 50/50 portfolio. He once commented, “I spend about half of my time wondering why I have so much in stocks, and about half wondering why I have so little.”

In recent years investors with a balanced portfolio have wondered why they don’t have more money in stocks.

At some point that regret is going to shift and investors will wish they had more money in bonds and regret their stock allocation.

The bad news about diversification is that regret is a constant problem.

The good news is that by spreading your bets, you avoid taking that regret to the extreme.

Further Reading:

Diversification is About the Decades