I got a new credit card this week.

What can I say?

I’m a sucker for a good sign-up bonus and the free bags on American flights will basically pay for the annual fee.

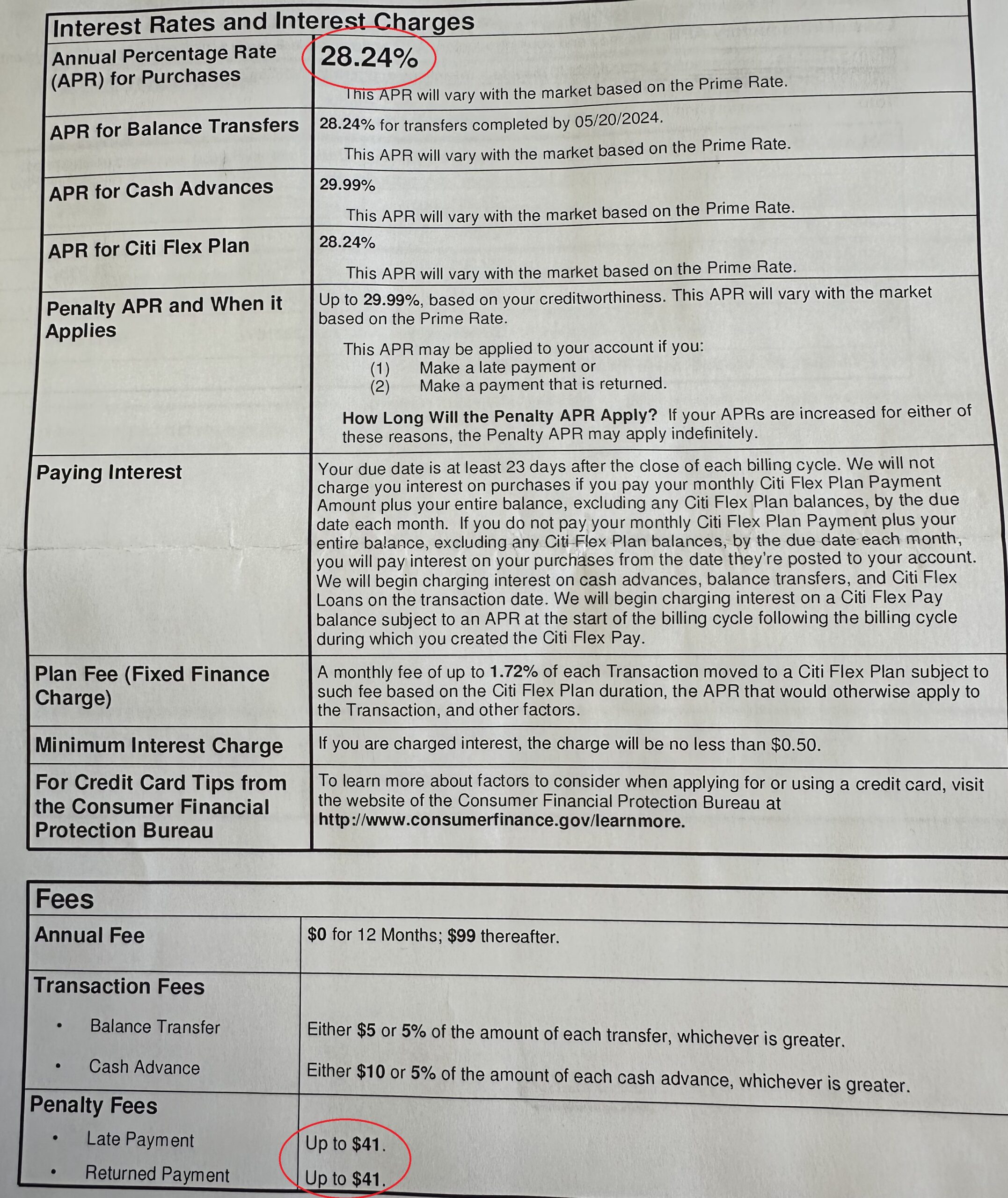

A new card always comes with a lot of paperwork. They have all sorts of numbers to run by you, along with plenty of fine print.

As a personal finance junkie, I always like to thumb through this stuff. This one caught my eye:

28%?!

Jeez.

I get it–unsecured debt and all. Rates are higher, but that’s a ridiculously high borrowing cost.

With rates that high it feels like credit card debt should be a massive problem in this country. Is it?

It’s not great but the situation isn’t terrible either.

Let’s dig into the numbers.

The Federal Reserve has all sorts of data on credit cards.

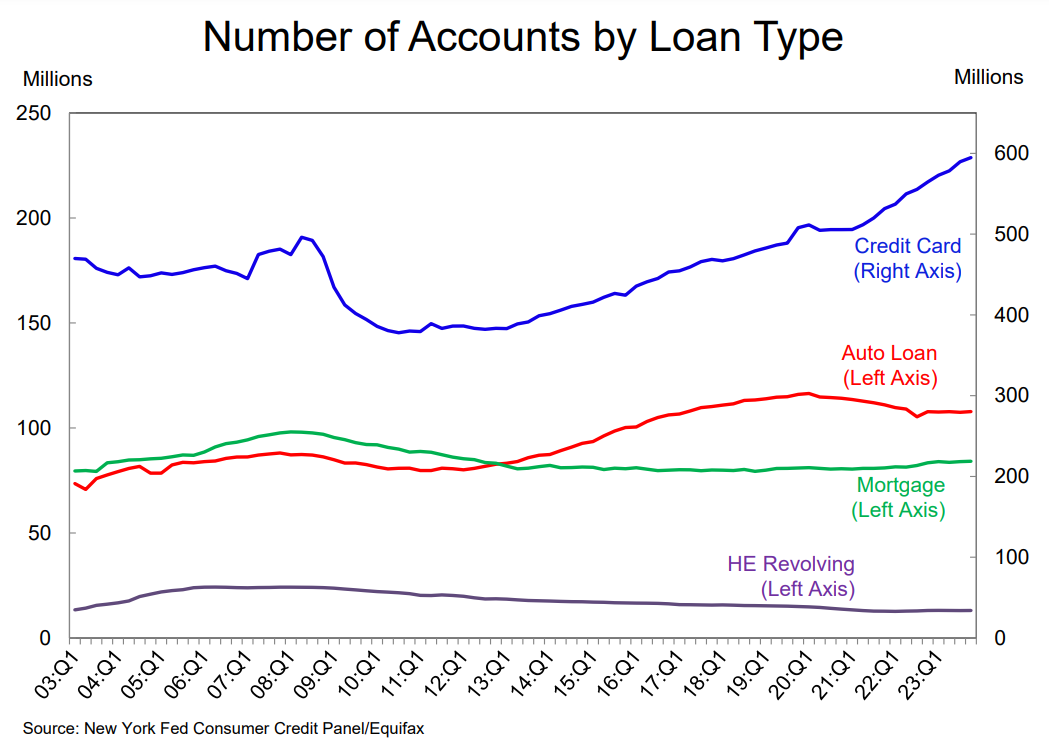

There is certainly more credit card usage of late:

While other types of debt are relatively stable, the number of credit card accounts continues to grow.

This could be because more people are going into credit card debt or people like me who open more accounts to earn rewards and deals.

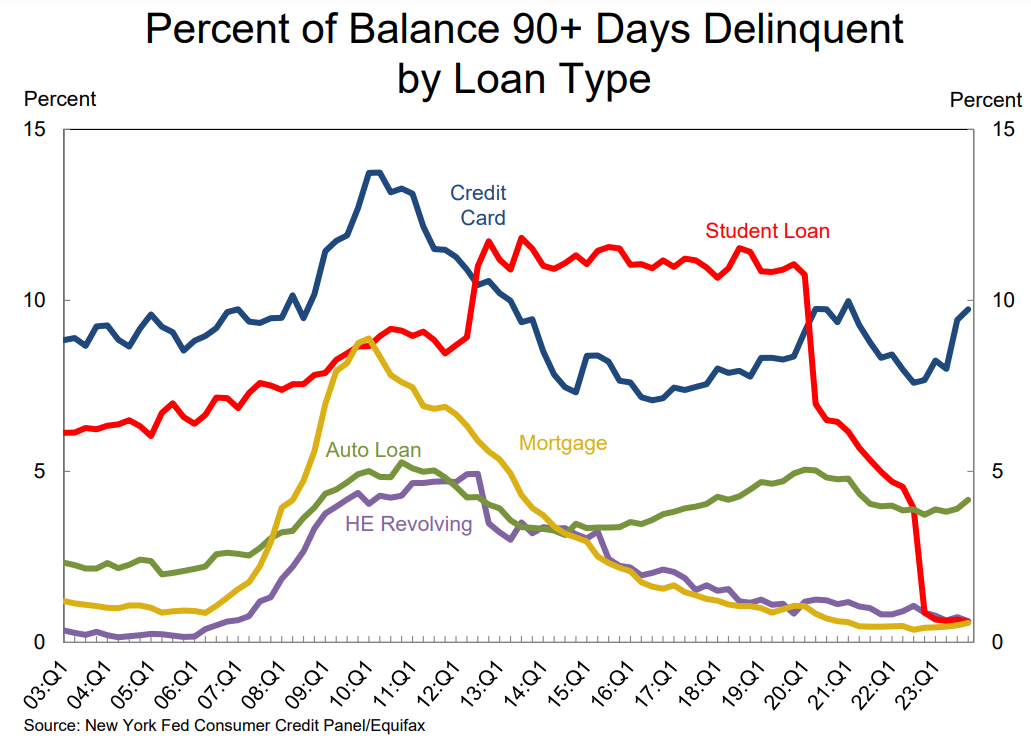

Credit card delinquencies are on the rise but not in panic territory by any means:

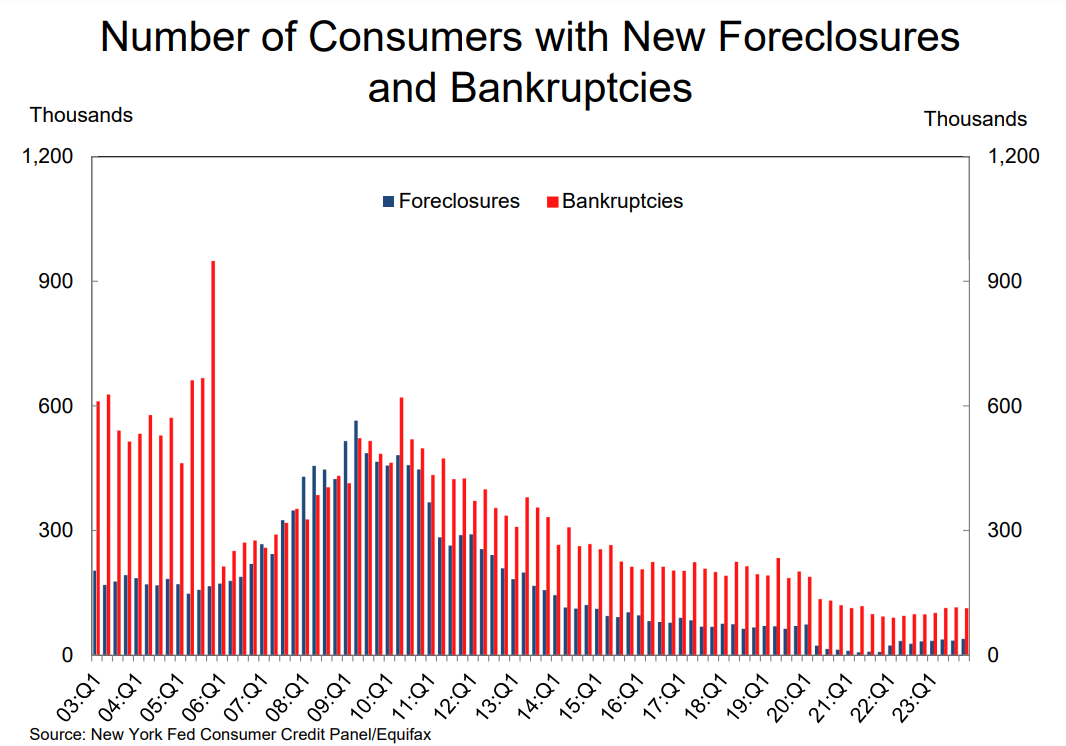

Credit card debt isn’t putting people in the poor house either judging from the low level of bankruptcies:

The number of bankruptcies is far lower than it has been this century.

There are, however, still plenty of people in credit card debt.

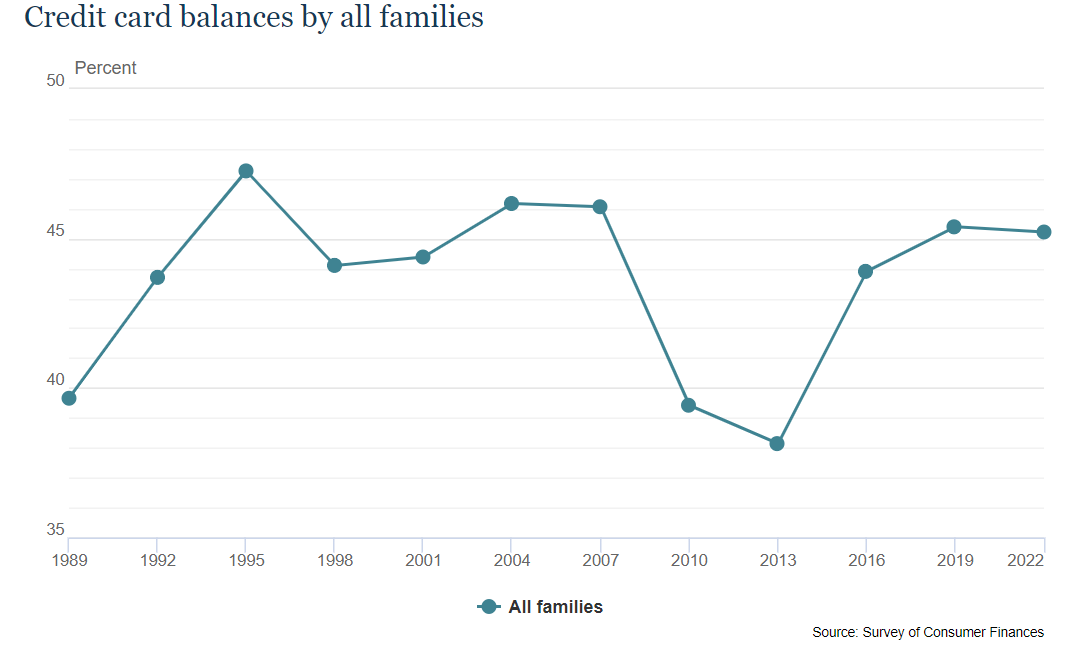

According to the Fed, 45% of American households have credit card debt. That number has been relatively stable over time:

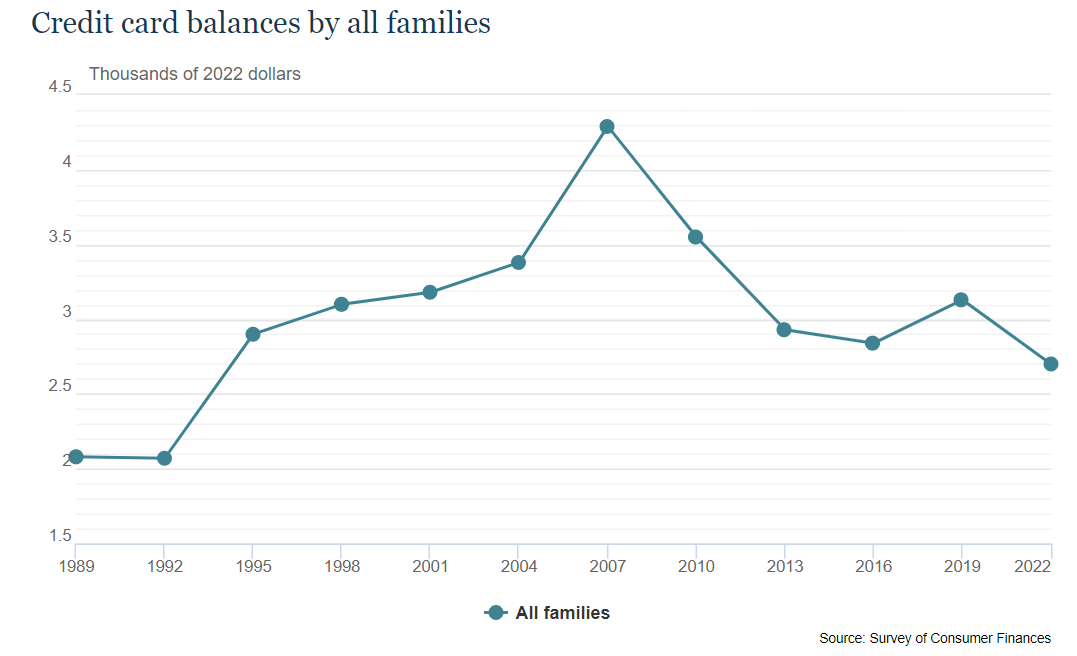

The median balance is around $2,700 (the average is $6,100). Again, not the end of the world but that can certainly add up when you consider how egregious the borrowing rates are.

Surprisingly, the median household balance has actually been falling for some time now:

The median household credit card balance was much higher heading into the Great Financial Crisis than it is now. Adjust that number for inflation, and things look even better right now.

We live in a bifurcated world when it comes to credit card debt.

The 45% of people who carry a balance are paying some of the highest borrowing costs imaginable. It’s the biggest form of anti-compounding in all of finance.

The other 55% of households use credit cards merely for their convenience and rewards and pay off their balance each month. The rewards they earn are essentially being subsidized by the 45% of people who pay interest.1

I pay off my balance every month and use the credit card companies for rewards and sign-up bonuses. It’s a pretty good deal.

But I understand how credit card debt can spiral out of control for certain households. It’s convenient. Swiping or tapping that card doesn’t feel like real money. Sometimes you have no other choice but it should be your last resort.

If you’re paying 20% on a $6,000 balance that’s $100 a month in interest charges. That might not seem like much but it adds up. Even if you make a $30 minimum payment, your balance after 12 months is nearly $6,900.

Holding a credit card balance from month to month is one of the worst financial decisions you can make.

The first rule of personal finance is you pay off your credit card balance every month.

The second rule is don’t forget rule number one.

Michael and I talked about credit cards and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Why I’m Not Worried About $1 Trillion in Credit Card Debt

Now here’s what I’ve been reading lately:

- Why are smart people so bad with money? (WSJ)

- How a kid who grew up in nightclubs became the voice of college basketball (The Ringer)

- 10 finance pet peeves (Discipline Funds)

- The rent vs. buy calculation (Of Dollars & Data)

- Opportunity costs are everywhere (Abnormal Returns)

- 4 considerations when investing in real estate (Morningstar)

- The riddle of happiness (More to That)

Books:

1Plus, the merchant swipe fees.