From the late-19th century through the early-1950s, the U.S. stock market was open Monday-Friday from 10 am to 3 pm and 10 am to noon on Saturdays.

In 1952, they decided to shut things down for good on the weekends and extend the trading day a half-hour until 3:30 pm. It wasn’t until the mid-1980s that the current 9:30 to 4:00 trading day was configured at the New York Stock Exchange.

I would be shocked if the current trading hours aren’t altered during my lifetime. I’m afraid to say it but the 24/7 stock market is coming.

The technology is there. The appetite is there. And the template is there.

Cryptocurrencies trade around the clock and never close.

Is 24/7 trading necessary? Would it be a good thing for investors?

Not necessarily but that probably doesn’t matter. Someone is going to figure out the regulations for this and make it happen.

In fact, there is a start-up already going down this road. This is from a recent profile of a company called 24 Exchange in the Wall Street Journal:

In an interview, Mr. Galinov said there is growing demand for round-the-clock stock trading from individual investors. Not only do such investors often want to buy or sell stocks outside of standard trading hours, but the 24/7 nature of crypto has raised expectations that stocks should work the same way, he said.

“If there is big news over the weekend, you can try to trade, but you really can’t,” the founder and chief executive said.

Currently, investors can trade as early as 4 a.m. ET and as late as 8 p.m. ET, thanks to premarket and post-market trading sessions offered by the New York Stock Exchange and other market operators. Because of thin liquidity, though, prices in these sessions tend to be volatile. And while TD Ameritrade and E*Trade both offer 24-hour trading five days a week in a limited number of securities, investors are largely unable to trade overnight or during weekends.

There is a case to be made that closing the stock market is a good thing, especially when things go haywire in the markets. Investors need to catch their breath during a crash.

I can’t prove this, but there is a case to be made the stock market would have fallen a lot more in March 2020 at the onset of the pandemic if there wasn’t an end to the trading day. The momentum can get out of control in a panic.

Crypto is an asset class that is almost designed to have heightened volatility because of the inherent scarcity but the 24/7 nature of these markets certainly increases the amount of volatility in the space. When crashes occur in crypto you often see big moves late at night or on the weekends.

Part of this stems from the fact that it’s a global asset class traded by people all around the world. But the fact that trading never stops surely has something to do with big moves at odd times.

And if the pandemic has taught us anything, it’s that people have an insatiable desire to speculate, gamble, hedge and invest in all sorts of markets.

Now that online sports betting is legal in Michigan, I am 72% addicted to gambling on sports. Having the apps on your phone just makes it all so easy. And I never would have thought this but gambling on the games makes it so much more entertaining to watch.

Markets are going to evolve into other areas as well.

One of the hardest parts about investing in the markets is you could predict exactly what’s going to happen when it comes to geopolitics, economic data, the timing of a recession or the outcome of an election and still not make any money depending on the reaction from investors.

You could have gone into 2020 Biff Tannen-style knowing all of the headlines in advance of the pandemic — the number of cases, quarantine rules, number of deaths, GDP contraction, etc. — and you probably would have gotten crushed in the markets.

Despite a nasty recession and a pandemic that impacted the world economy in ways that would have been impossible to predict ahead of time, the U.S. stock market was up nearly 20% in 2020.

Many people predicted the pandemic would get worse and it did. But not many of those same people predicted it would actually be a positive for the markets because of all the stimulus it led to.

But what if you could actually bet on the outcomes of the events themselves?

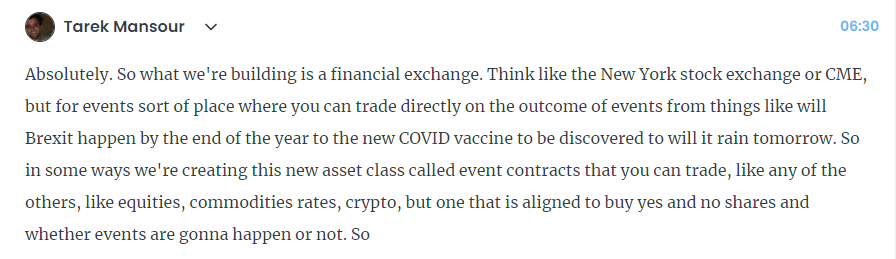

We had Tarek Mansour of Kalshi, a new binary outcome trading platform, on the podcast to discuss this very topic. He explained:

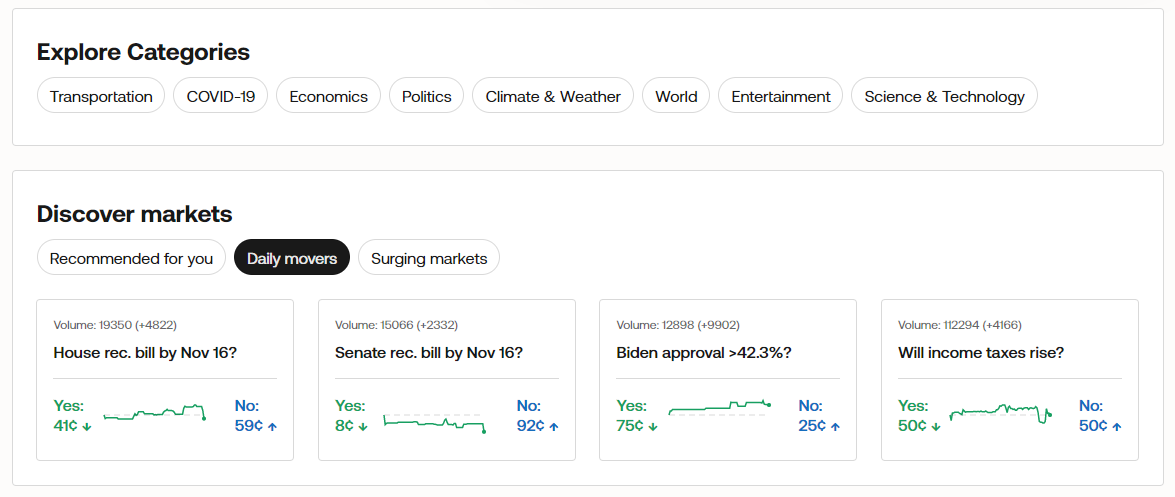

This exchange is still relatively new but I love the idea. You can bet on a wide variety of categories:

Here are some binary outcomes you can bet on currently:

- Will the CDC identify a variant of high consequence by March 1, 2022?

- Will the FOMC begin tapering by their next meeting?

- Will a recession start in the next year?

- Will the House pass a reconciliation bill?

- Will the owners of the MLB approve an Oakland Athletics move to a new city by March 15, 2022?

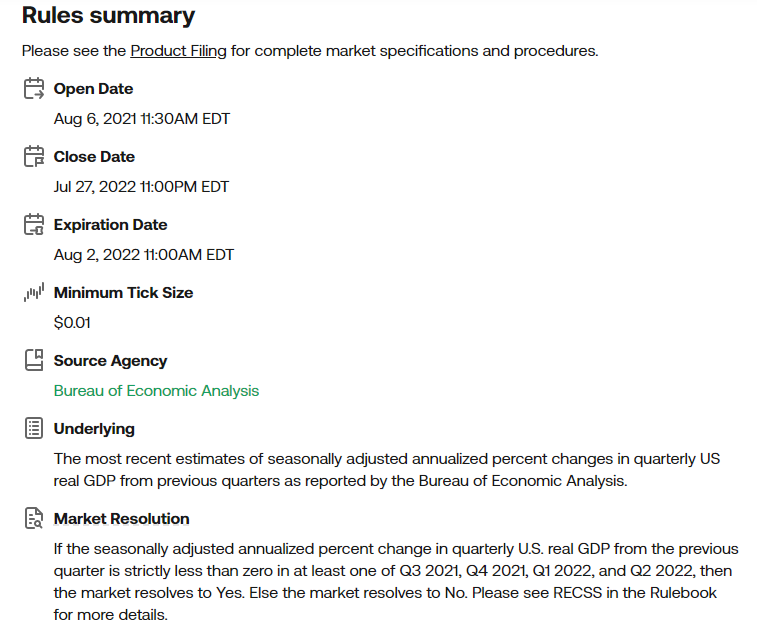

I was so intrigued by the platform, I placed a bet on the recession question. These are the stipulations:

I bet ‘no’ and could always be wrong but feel pretty safe about this one. The payout from the odds that were in place when I made the bet last week would give me a return of around 20% over the roughly 9 months of this bet.

Not bad.

The reason this idea is so exciting to me is it takes away the guessing games involved when trying to connect events to market reactions. There is no reason to use 2nd or 3rd or 4th level thinking anymore if you can simply bet on the binary outcome of an event.

I don’t know if this marketplace will get big enough to facilitate large pools of capital but the potential is there for more macro and event-focused people out there to hedge or make money if some of these bets have odds that are mispriced.

And because people have inherent biases and the future is hard to predict, there are bound to be mispricings on occasion.

We’re going to see more and more of this as well. Anything that can be turned into a market will be.

You can now invest in shares of art, sneakers, cars, sports cards, wine, guitars, comic books and probably a bunch of other stuff I’m missing.

It’s time to get ready for 24/7 trading and markets in everything.

Further Listening:

Real-Time Betting Markets