Robert Kiyosaki wrote one of the most-read personal finance books of all time — Rich Dad, Poor Dad.

I read it early on in my career. It never really did it for me but I can see why people latch onto the allegory he shares about learning the right financial habits.

It’s a good thing to get people interested in personal finance because no one teaches you this stuff. They make you take Spanish or French in school but never teach the language of money.

I wonder what Kiyosaki is up to these days…

Oh dear. That doesn’t sound good.

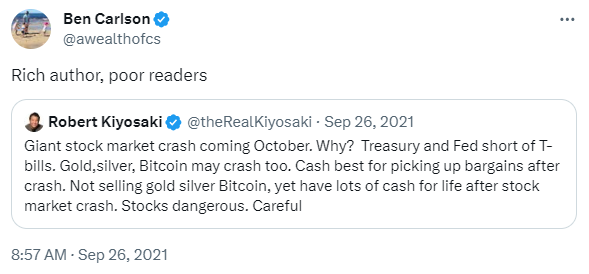

Wait a minute, I feel like I’ve heard this before:

Ah yes that’s right. Somehow he’s a personal finance expert-turned-doomer.

Luckily, the Internet makes it easy to keep track of charlatans and their terrible forecasting records.

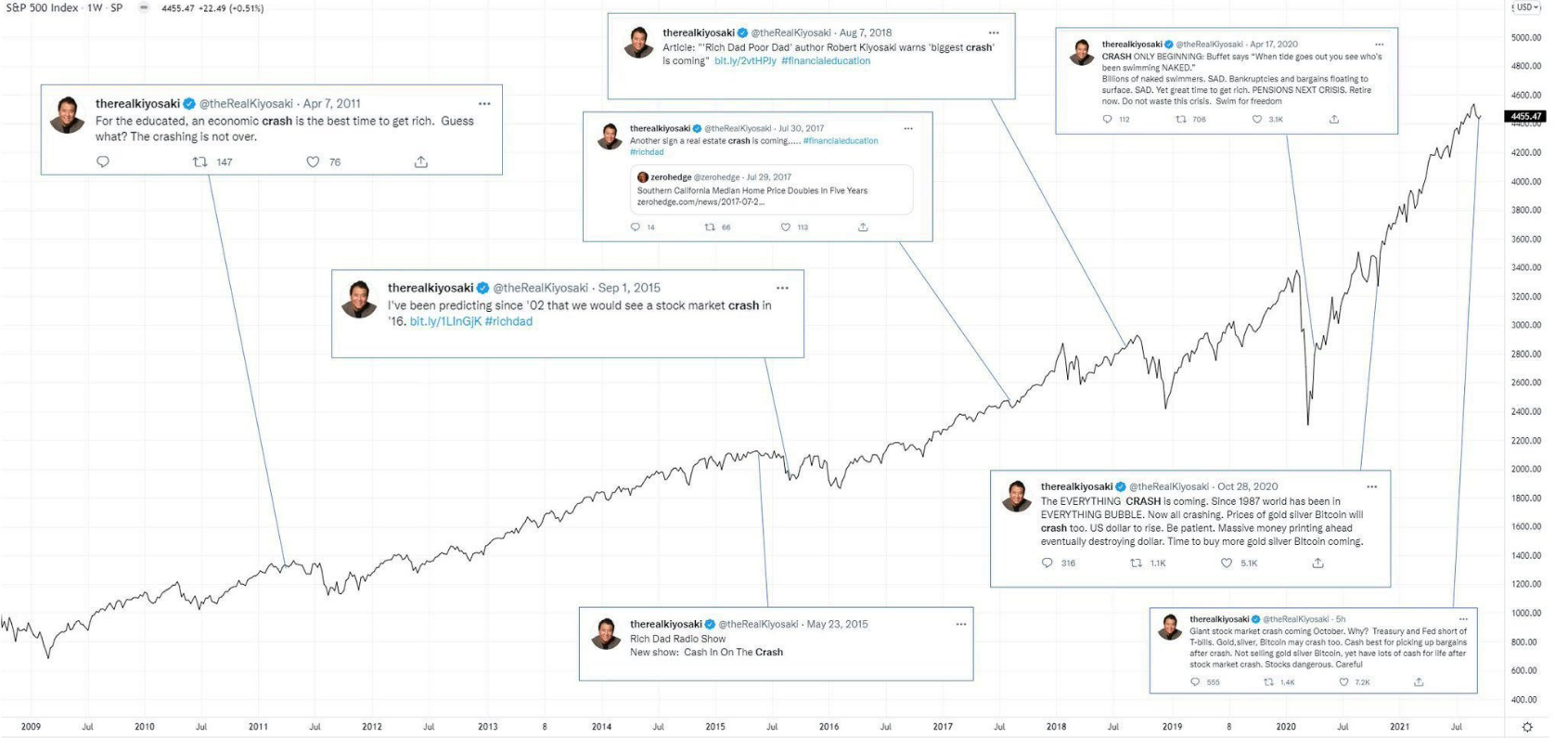

This guy has been predicting the end of the financial system as we know it for years:

I will never understand the permabear mindset – these people that prey on the fears of others for personal gain.

I don’t mind people who are rationally bearish from time to time. Sometimes the market is overvalued. It does crash. There are corrections and bear markets and recessions and black swan events from time-to-time.

As a long-term optimist, it’s helpful to hear a reasonable bearish argument to keep you grounded in reality. Most of the time things are getting better, but sometimes things go wrong.

However, there is a huge difference between bearish analysis and permabear doomers.

Doomers are my sworn enemies.

Fear always sells (just look at the news) but many of the financial doomers were born out of the Great Financial Crisis. Part of it is so few people predicted the 2008 crash ahead of time that many turned to the likes of Zero Hedge so they wouldn’t be caught flat-footed for the next crisis.

But there were also people who became famous for “calling” or profiting from the crash. People like Meridith Whitney, John Paulson and Michael Burry. These people had books written about them. They were paid massive amounts of money for speaking gigs. They created new companies or funds based on their newfound fame.

To this day, you still see headlines like this:

TRADER WHO PREDICTED THE 2008 CRASH THINKS SOMETHING ELSE WILL CRASH

These people are still living on being right once in a row, even though basically none of them have been right ever since. Seriously, how many of the people who “predicted” the 2008 financial crisis have been right about any market-moving events since?

Anyone? Bueller?

One of the main reasons I started this blog is because I was sick of all the doom and gloom following the financial crisis. Yes, that crisis was terrible, but we’ve experienced many terrible crises over the decades.

This kind of thing happens once every 10-20 years. But following 2008 people latched onto the idea that we should get one every other year.

The doomer, pessimistic, cynical mindset was like a virus. Social media and the Internet spread that virus like wildfire.

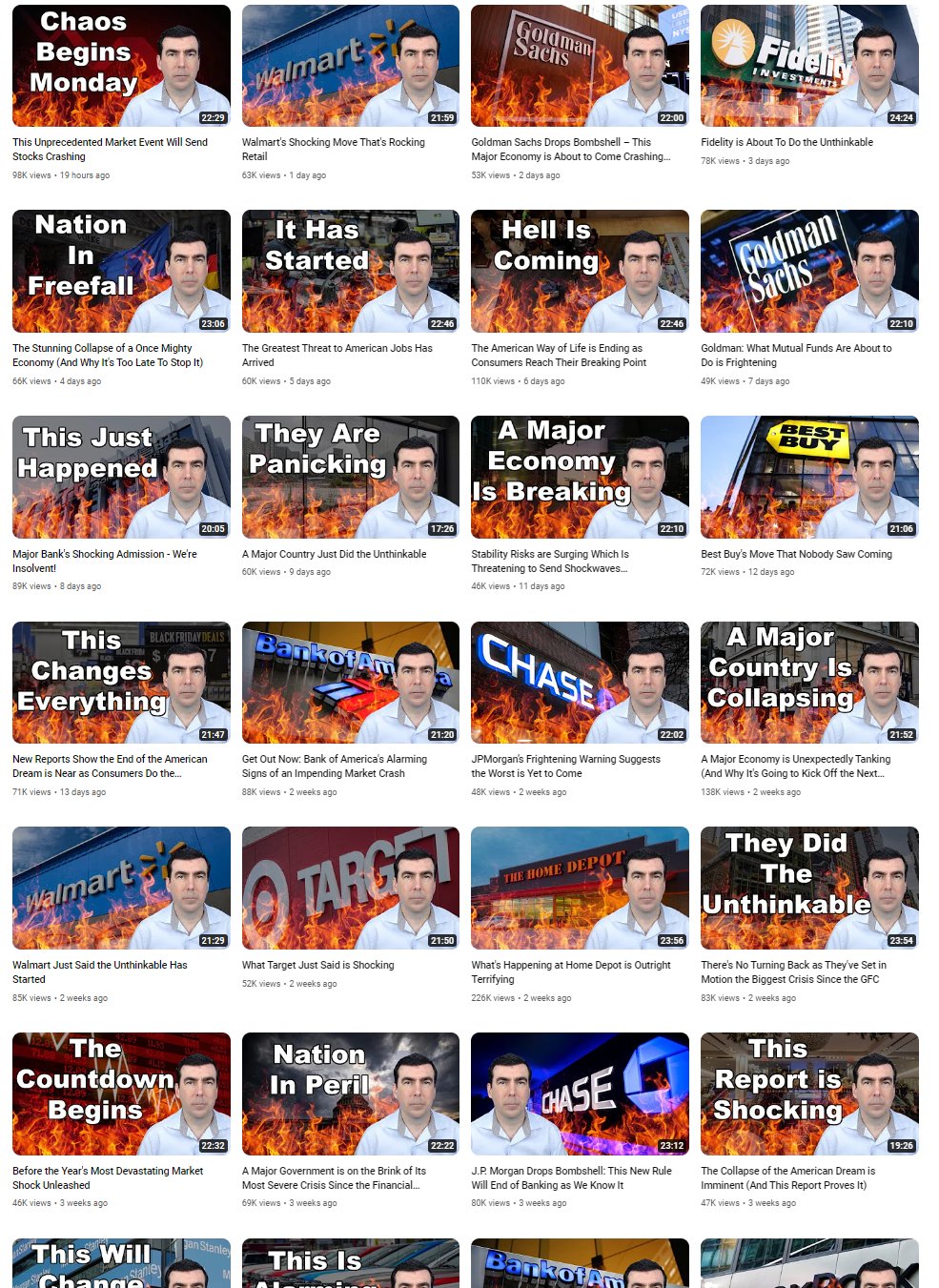

This kind of stuff:

This looks like AI created a doomer YouTube channel, but apparently, it’s real. This guy has hundreds of thousands of people who watch his videos every week. It’s disgusting.

I don’t know what someone like Robert Kiyosaki gets from predicting the worst crash the world has ever seen every six months. But I do know anyone following his advice will be poorer because of it.

The dollar is going to collapse! Buy silver coins!

The end of the financial system as we know it is here. Just wait!

Stocks are going to fall 90%! Canned food is your only hedge!

Sure, the world could end at some point but the permabears are not going to help you if that happens. All they care about is profiting on the fears of others.

Real financial advice doesn’t try to scare you. Real financial advice turns complex topics into simple explanations. Real financial advice doesn’t offer predictions; it offers perspective. It shows you the pros and the cons, the costs and the benefits.

William Bernstein once wrote, “The reason that ‘guru’ is such a popular word is because ‘charlatan’ is so hard to spell.”

Rich charlatan, poor readers.

Michael and I talked about doomers, bulls and bears on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

How to Sell Finance Books Like Harry Dent

Now here’s what I’ve been reading lately:

- How anxiety became content (The Atlantic)

- What moves the market (Irrelevant Investor)

- Risk and return are interchangeable (Oblivious Investor)

- Jamie Dimon’s $4 trillion machine (New York)

- Nick’s favorite investment writing of 2023 (Dollars & Data)

Books: