Today’s Animal Spirits is brought to you by YCharts and The College for Financial Planning:

See here to learn more about how advisors use YCharts to save clients money on taxes

See here to learn more about the Accredited Behavioral Financial Professional designation and here for a Master in Personal Financial Planning

Email us at info@ritholtzwealth.com to set up an in-person meeting with us while in Charlotte!

On today’s show, we discuss:

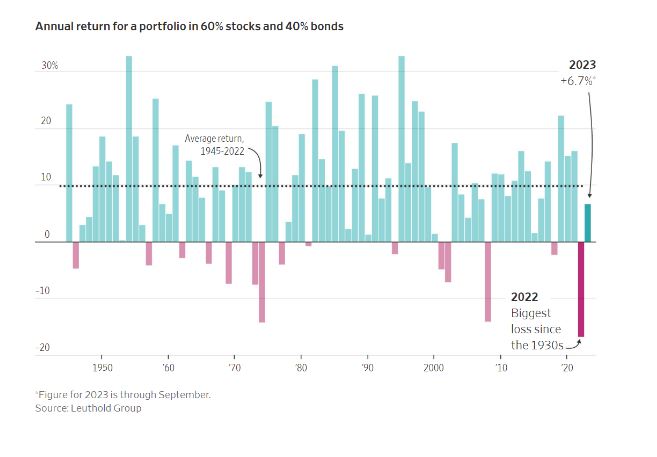

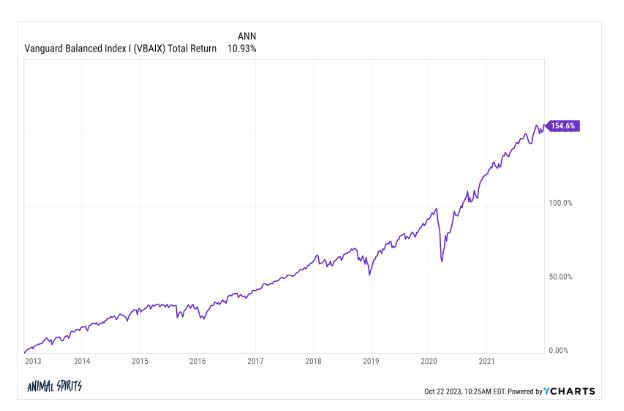

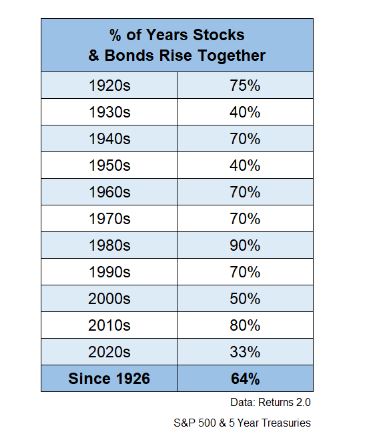

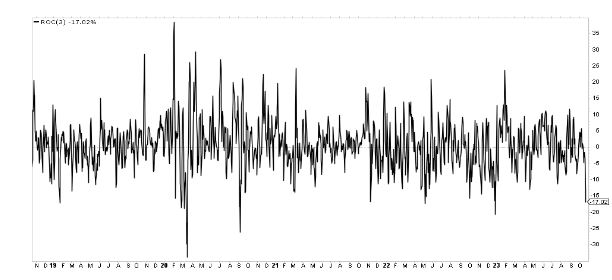

- The trusted 60-40 investing strategy just had its worst year in generations

- The 60/40 portfolio is alive & well

- The annoyance economy

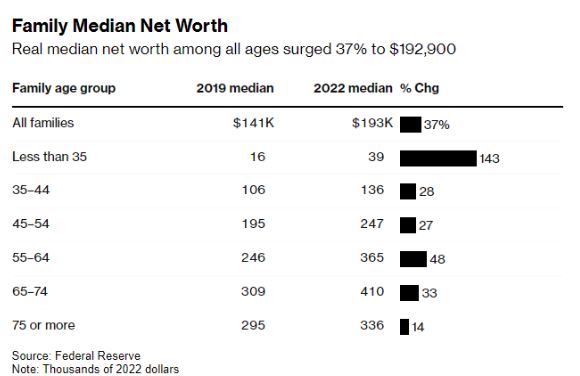

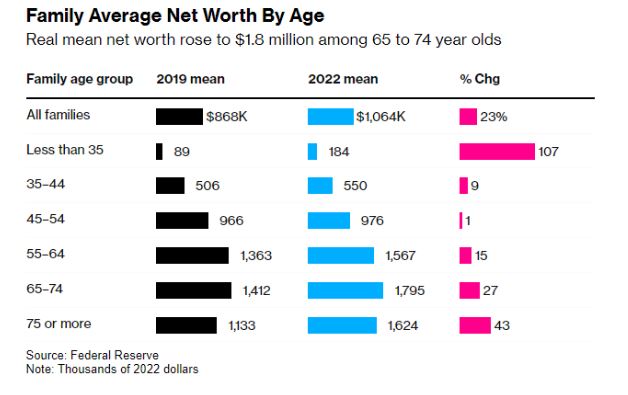

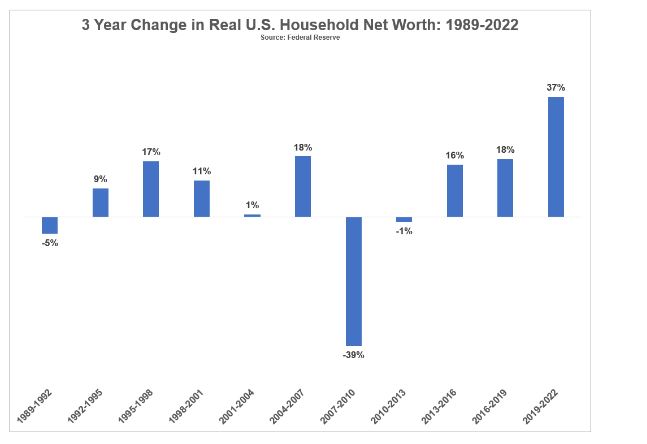

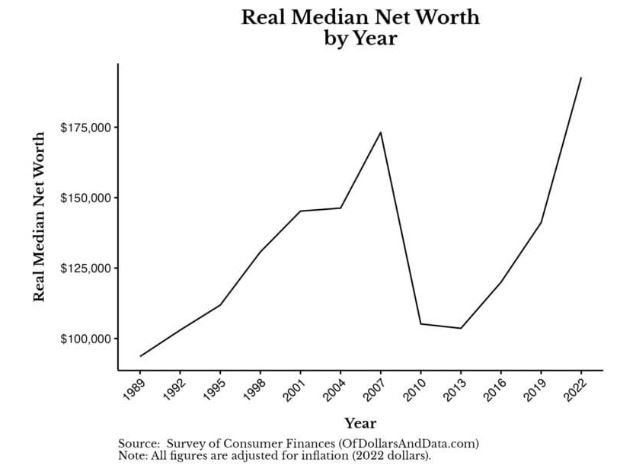

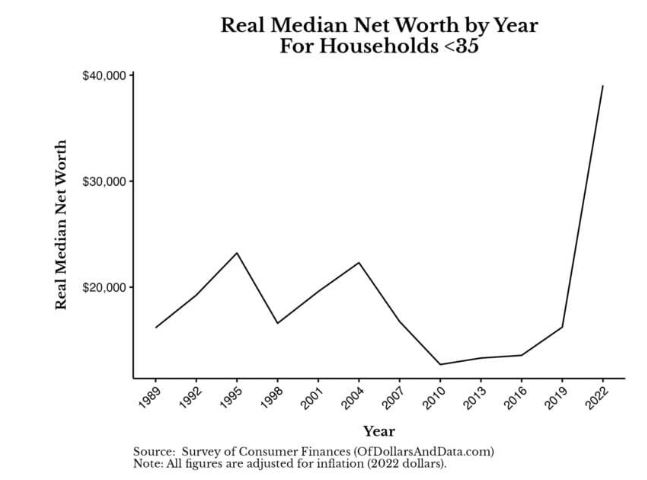

- Americans’ net worth surged by most in decades during pandemic

- Americans have never been wealthier & no one is happy

- Hussman: I would be remiss not to tell you that the stock market will probably crash

- Indexes finish lower after Powell signals further rate pause

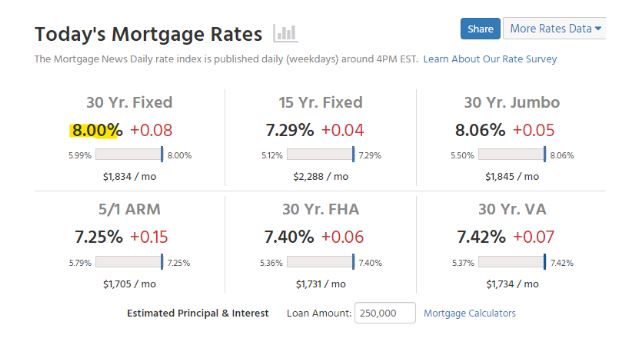

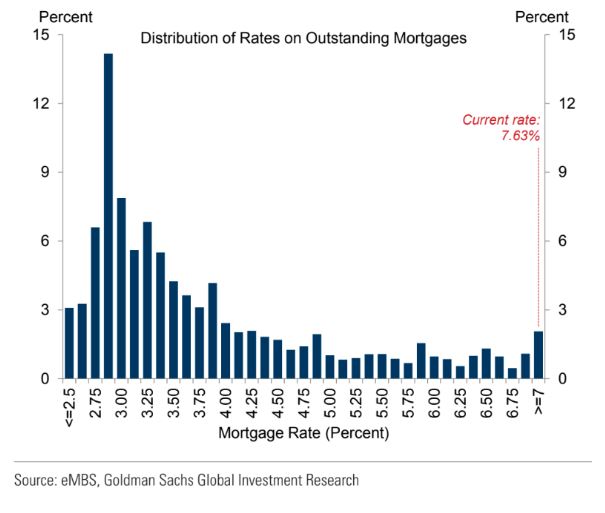

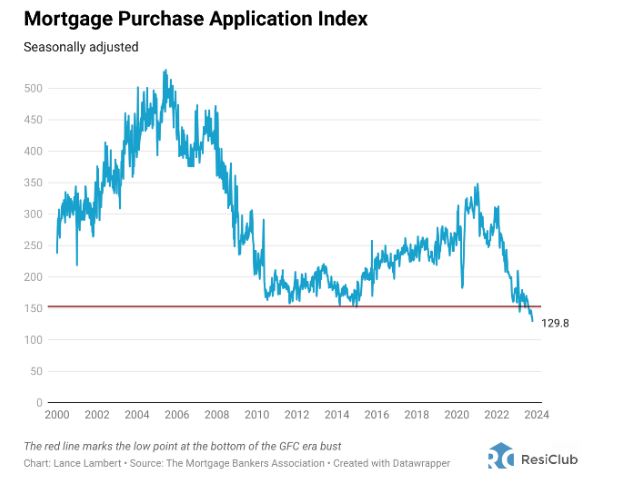

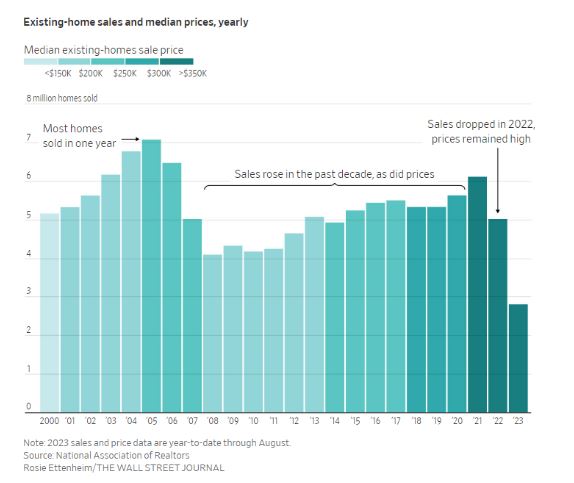

- Home sales on track for slowest year since housing bust

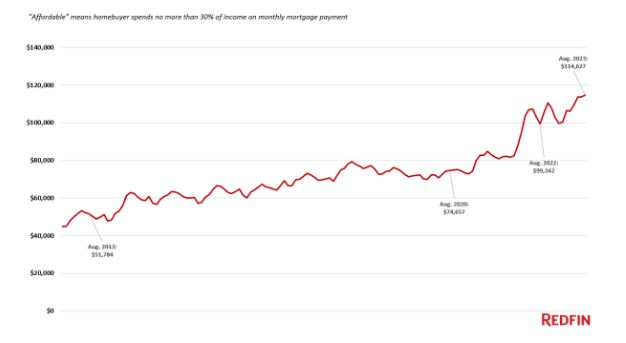

- Homeowners must earn $115,000 to afford the typical US home. That’s about $40,000 more than the typical American household earns

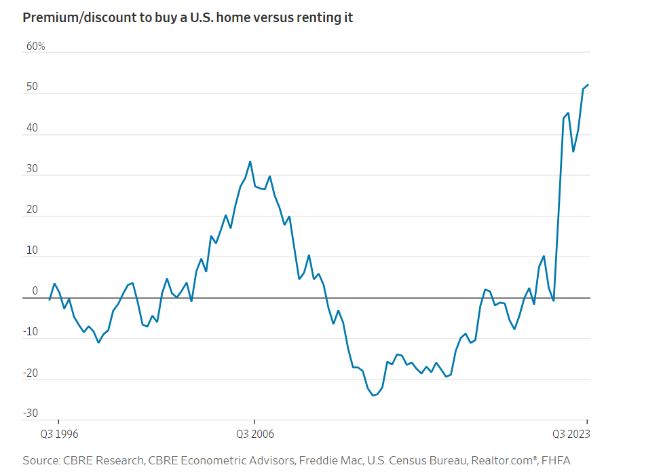

- There’s never been a worse time to buy instead of rent

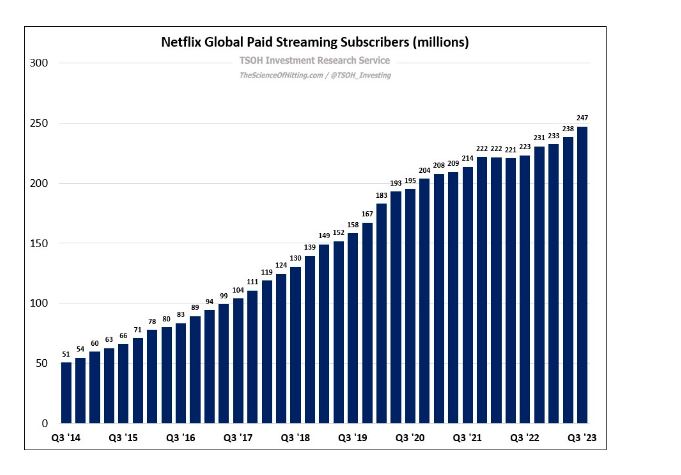

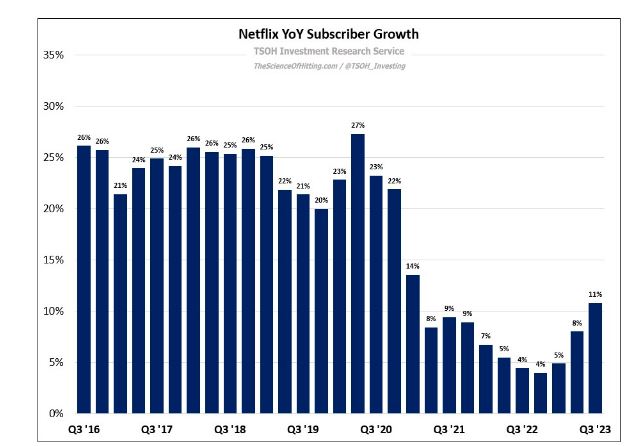

- Netflix earnings

- Netflix: Removing the ceiling

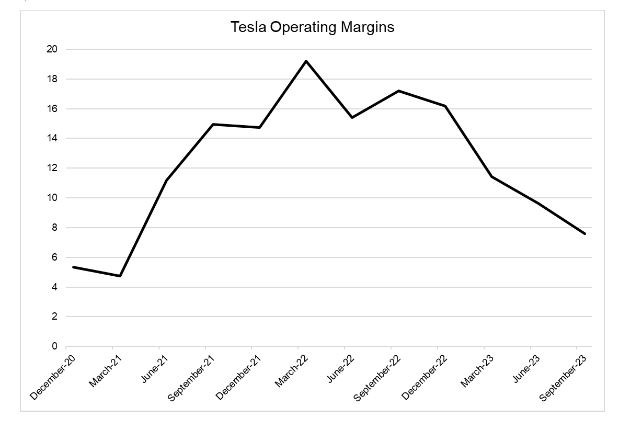

- Tesla earnings

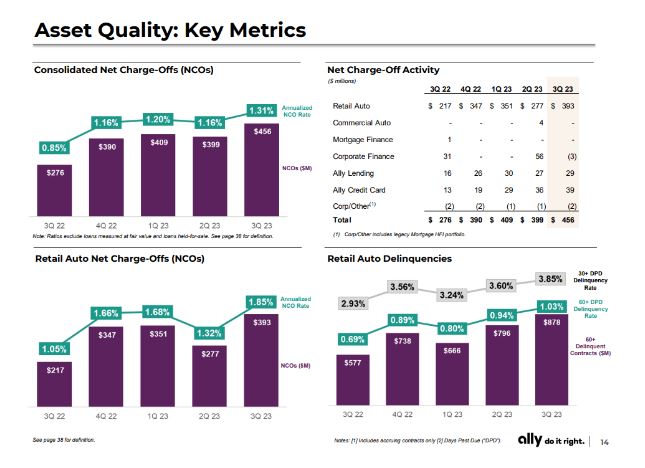

- Ally earnings

- Disney reporting changes

- Cameo to the moon and back

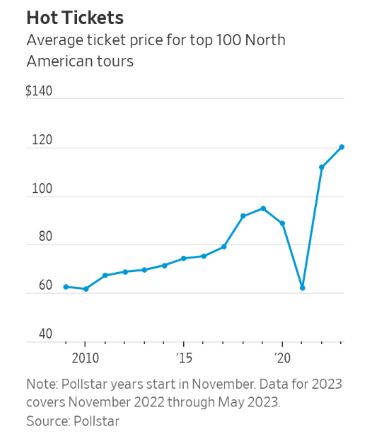

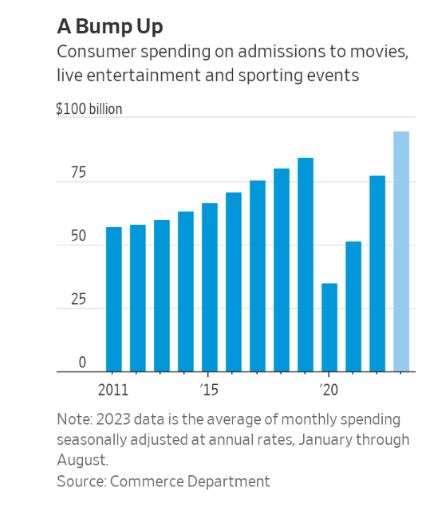

- It’s getting too expensive to have fun

- Trends in college pricing and student aid

- Taylor Swift concert film and ‘Killers of the Flower Moon’ top weekend box office

Listen here:

Recommendations:

Charts:

Tweets:

Make that 15 months of negative year-over-year readings for the @Conferenceboard leading economic indicators.

The longest stretch of YoY negative readings before a #recession was 17 months from August '06 to January '08. @Factset pic.twitter.com/cn0zBLf9By

— Matthew Miskin, CFA (@matthew_miskin) October 19, 2023

Despite a pandemic and an inflation surge, real (inflation-adjusted!) median family income was 2.6% higher in 2022 than in 2019, hitting an all-time high of $70k.

For comparison, between 2007 and 2010, median incomes fell by 7.8% and didn't surpass 2007 levels until 2019. pic.twitter.com/qxUMKzJVwA

— Steven Rattner (@SteveRattner) October 18, 2023

As heretical as it might be to say, there's a growing risk that Fed rate hikes risk *stoking* higher rent inflation in 2025, 2026, and 2027

How? The Fed's actions are currently reducing building permits for multifamily rental supply. Exacerbates structural housing shortage pic.twitter.com/JsQNCym081

— Skanda Amarnath (@IrvingSwisher) October 19, 2023

"Cash: largest weekly outflow ($108.9bn) ever."

– BofA Hartnett pic.twitter.com/1c0RPewkzi

— Daily Chartbook (@dailychartbook) October 21, 2023

Average household income of an American in the 35-44 age bracket was $170k/year last year https://t.co/gg09lkSTJo

— Matthew C. Klein (@M_C_Klein) October 20, 2023

"There's no reason that home sellers should be forced to pay a buyers agent," says attorney Michael Ketchmark as the DOJ probes real estate broker commissions. pic.twitter.com/OcLDgXFToG

— Last Call (@LastCallCNBC) October 18, 2023

Buffett on Apple $AAPL: "If someone offered you $10,000 to never buy an iPhone or Apple product ever again, you wouldn't take it. If someone offered you $10,000 to never buy a Ford again you'd take it and go buy a Chevy"

That Simple.

— Michael Graham (@MGStockTalk) April 12, 2023

🔸 Zillow survey finds 35% of prospective buyers would buy a haunted house if it cost less

More than two-thirds of prospective buyers (67%) say they could be convinced to buy a haunted house if it had appealing features, were in the right location, were more affordable or for…

— *Walter Bloomberg (@DeItaone) October 24, 2023

46% of opening night moviegoers for "Killers of the Flower Moon" were under 35 years old. https://t.co/CF4azmngUs pic.twitter.com/C6Gt5REftM

— Variety (@Variety) October 21, 2023

With 71 days left (+24%), the 2023 domestic box office has passed 2022

— Matthew Ball (@ballmatthew) October 21, 2023

Contact us at animalspirits@thecompoundnews.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Wealthcast Media, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.