A reader asks:

This is a difficult question to ask. My wife and I make about $220,000 combined and max out our 401k and 457b (she will get a pension if she stays in the job for 8 years). We are both 40 with a three-year-old daughter (expensive!). My parents are 72 & 70 and have a net worth of over $4 million. They are both fit and of course, I want them to live long healthy lives & we have a wonderful relationship, but purely mathematically speaking, how much can I expect to inherit? I’m the only child and they are retired but relatively frugal.

This is a question that will likely be coming up more and more in the coming years as the wealthiest generation retires.

Ten thousand baby boomers will be retiring every day between now and the end of this decade. The first boomer was born in 1946, meaning they are fast approaching 80 years old.

It’s morbid to think about, but this generation will die in the coming decades and some of them will pass down wealth to their heirs.

Fortune pegs the wealth transfer at $73 trillion (with another $12 trillion going to charity).

So how much should you expect to receive?

Fewer people get an inheritance than you would assume.

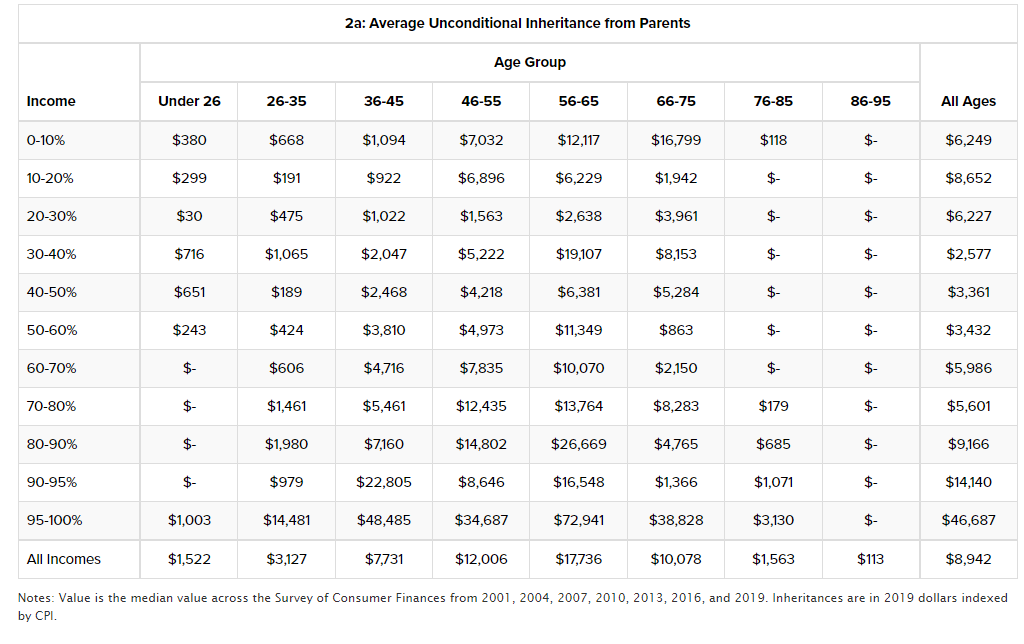

Researchers at the University of Pennsylvania broke down inheritances by age and income group in terms of when and how much the average person receives:

The reason these numbers are smaller than you’d assume is because only something like one in ten people actually receive an inheritance.

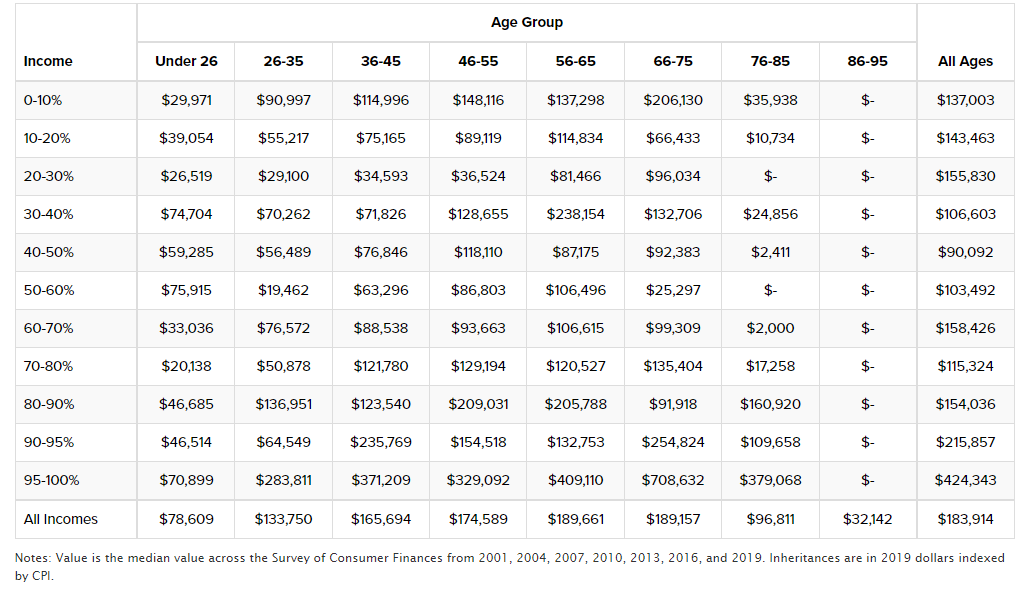

Here are the averages for those who are on the receiving end of some money from their parents or grandparents:

One of my least favorite inequality facts is that the top 10% owns something like 90% of the stock market.

A similar dynamic is at play when it comes to inheritances.

Households in the top 5% of the income distribution receive an inheritance that’s 4x to 12x larger than those in the bottom 80%. According to a New York Times piece on the coming wealth transfer, ultra-high net worth households — people with $5 million to $20 million in liquid net worth — make up 1.5% of the population but will constitute 42% of the money that gets passed down in the years ahead.

This is how the rich stay rich.

I have two other thoughts on the impact of the great wealth transfer in terms of what it means for the financial market:

The near-term market impact will be negligible. Some people are worried retiring baby boomers will crash the stock market when they begin spending down their portfolios. I am not one of these people.

There are two reasons for this.

One, the inequality in the stock market I already mentioned means most of that money will simply get passed down from one generation to the next. Most of the people in the top 10% won’t need to sell a huge chunk of their stocks because they have a bunch of other financial assets and will never come close to spending all of their wealth.

The second reason is this wealth transfer will be more of a stream than a tsunami. The money is going to be passed down slowly over time. The Penn data shows most the most likely age someone receives and inheritance is in the range of 66 to 75.

A married couple that is retiring today has a 50% chance of at least one spouse living into their 90s.

Those wealth transfer numbers assume these inheritances will happen between now and 2045.

It’s going to be more of a slow trickle rather than a wave of asset transfers.

There will be a bigger impact on the housing market than the stock market. The biggest problem with the housing market right now is a lack of supply. That could continue for some time but things should get better on that front in the 2030s.

A house is the biggest financial asset for the majority of the middle class. Nearly 40% of homes are owned outright with no mortgage. A lot of houses are going to get passed down in the years ahead as an inheritance.

My contention is many of them will get sold.

According to Census data, 75% of housing stock in America was built before 1999. Some young people might decide to live in their parent’s old house but I’m guessing many of them are going to sell (assuming their parents didn’t already cash out in the first place).

Again, this won’t happen all at once but this could be good news for people looking for more inventory. You just might have to wait until the next decade for it to happen.

As far as how much you should expect to receive, like most things in the financial planning process, it’s hard to put an exact number on a future date since there are so many unknown future variables.

You can’t plan out the exact amounts because it’s impossible to know how long your parents will live, how much money they will spend or what kinds of returns they will earn on their financial assets in the future.

If you are one of the lucky ones to be in line for an inheritance there’s nothing wrong with having a conversation about it with your parents.

I know it seems like an awkward conversation to have but as the old saying goes, nothing is certain except for death and taxes. It’s far more helpful to have that conversation now to let them know where you stand financially and get a sense of their feelings on the subject.

Talking about this stuff now can be helpful from a financial planning perspective because it could change how they invest their assets. If most of the money is earmarked for your family maybe they can take more risk since you have a longer time horizon.

Or maybe you can work something out where your inheritance is parsed out slowly over time so your parents can see you enjoy some of their money while they’re here.

Either way, count yourself lucky that your parents were able to save so much money.

We discussed this question on the latest edition of Ask the Compound:

Blair duQuesnay joined me again this week to tackle questions on paying off your adjustable-rate mortgage, the CFA vs. the CFP, how to tell if your financial plan is on track and the use of reverse mortgages in retirement.

Further Reading:

Will Baby Boomers Crash the Stock Market?