One of the hard parts about trying to focus on the long-term as an investor is the short-term toys with your emotions.

In years like 2022 when everything is going down, you’ll always wish you would’ve taken less risk.

In years like 2023 when everything is going up, you’ll always wish you would’ve taken more risk.

Long-term returns are the only ones that matter but you have to get through a series of short-term emotions to get there.

Short-run returns can play tricks on you.

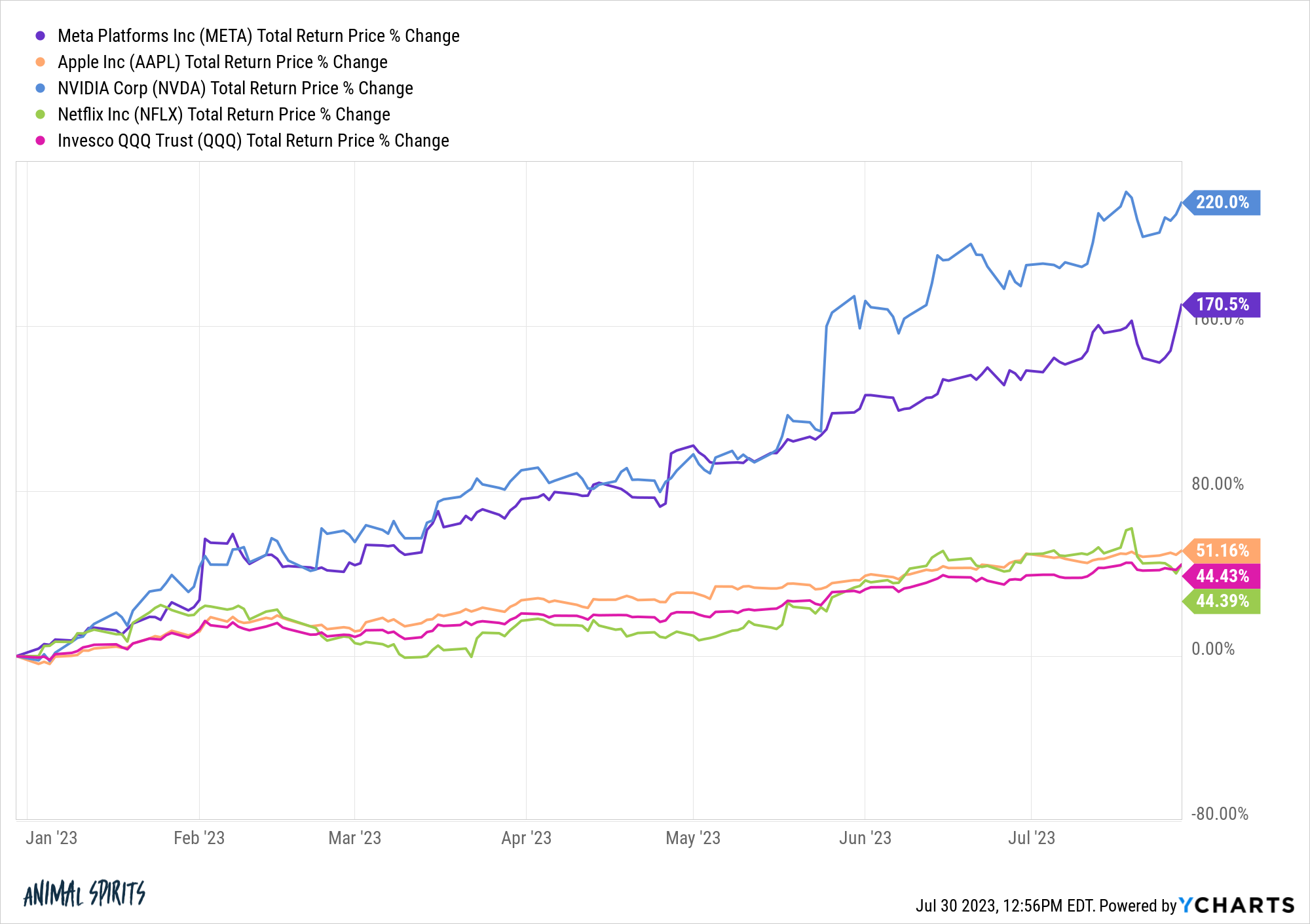

Look at the year-to-date returns for a handful of big tech stocks and the tech-heavy Nasdaq 100 this year:

Lights out.

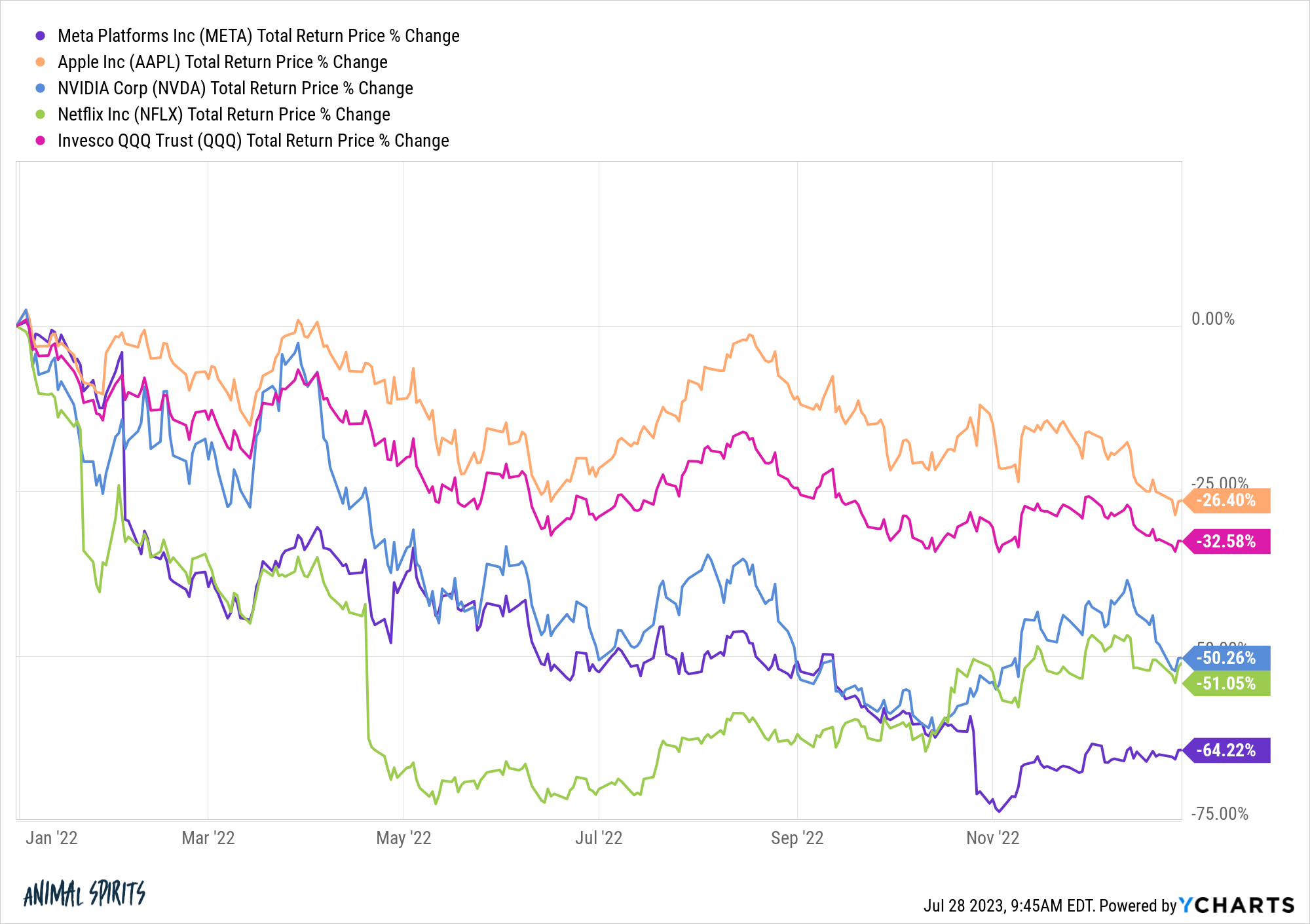

This could be an AI bubble or a return of speculation in the market after a brief pause but it’s also possible investors overestimated the chance for a recession and overly punished these stocks in 2022:

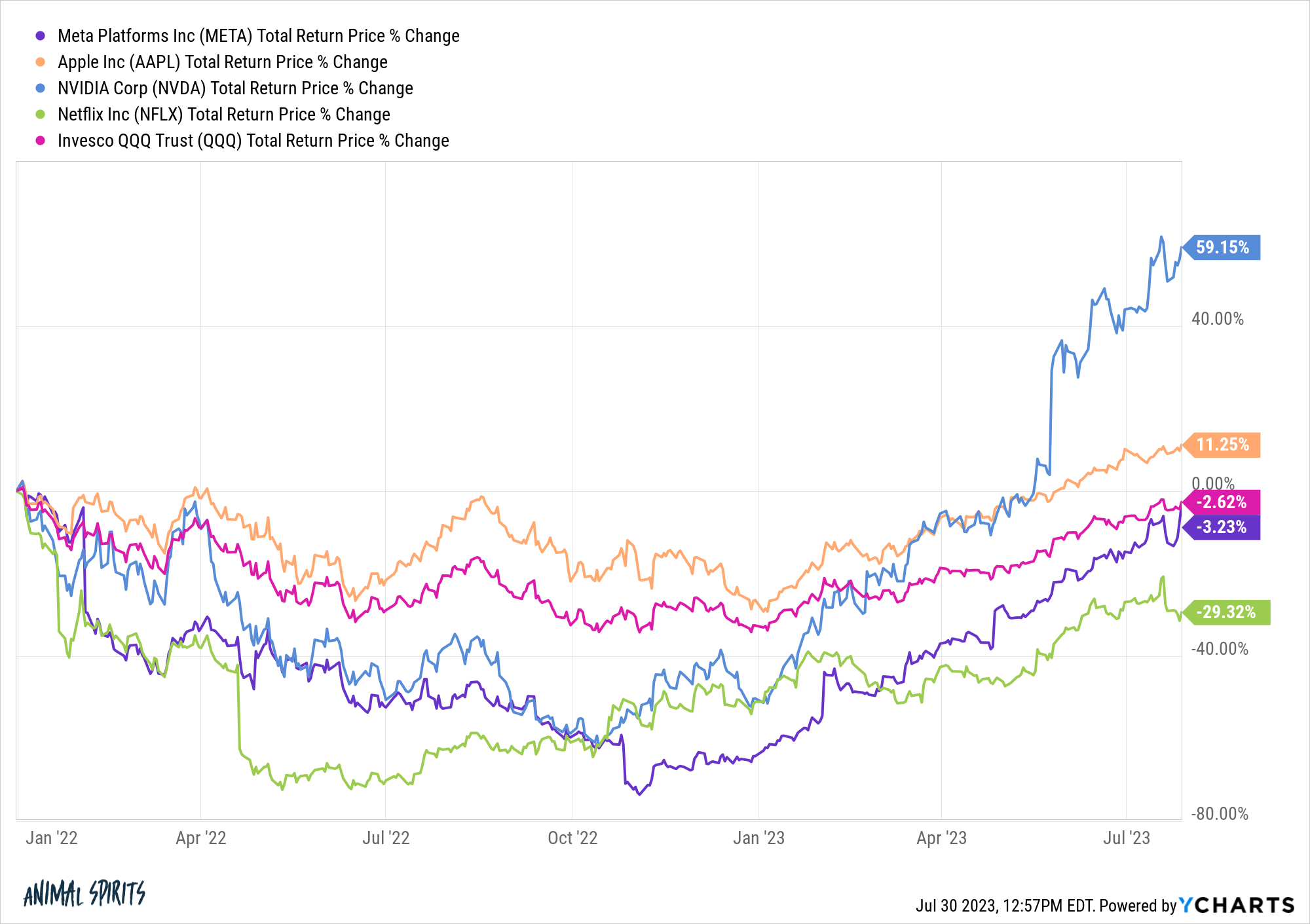

When you combine 2022 and 2023 things don’t look nearly as crazy:

Some of the stocks going nuts this year are still down since the start of 2022 (Nvidia is the obvious outlier here).

Ben’s rule of returns is you can win almost any argument about the markets by changing your start and end dates for performance purposes but it’s important to put the numbers into context.

Sometimes the reason the stock market goes up a lot is because it was down a lot and vice versa.

Another way to think about this is through the lens of how short-run returns impact long-run returns.

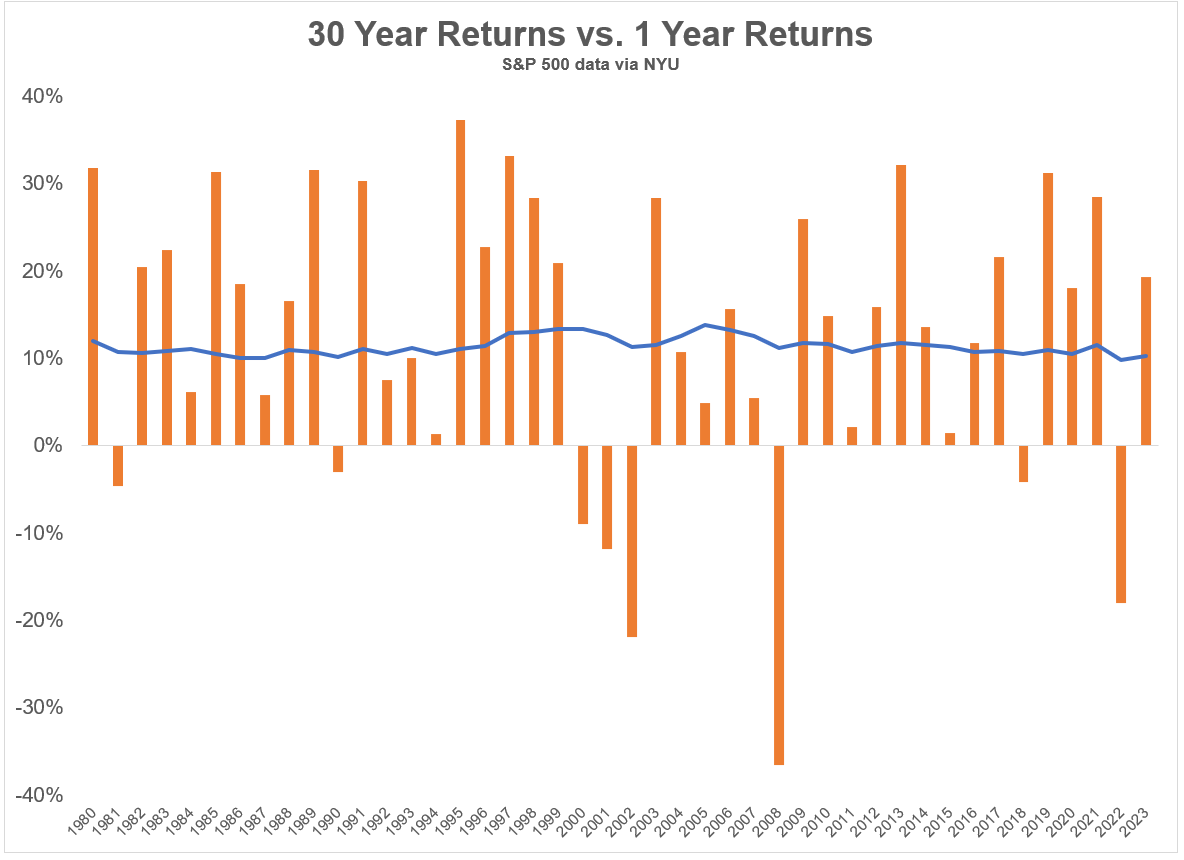

Take a look at the rolling 30 year returns1 on the S&P 500 since 1950 (the blue line) compared to the latest one year returns (the orange bars) for each 30 year period:

Returns in a given year are all over the map but 30 year returns don’t change all that much from year-to-year.

One year returns can make you feel wonderful or terrible but they’re not going to have a ton of bearing on your long-term results (assuming you don’t blow up your portfolio).

There will be good years and bad years.

Sometimes everything works. Sometimes nothing works. Other times there will be a wide dispersion in returns depending on the asset class, style, strategy or geography.

And there will always be something to worry about no matter what the markets are doing. Last year it was easy to worry the market would fall even further. This year the worry is we’ve risen too quickly and are due for a pullback.

It’s only human nature to pay attention to short-term results but investment enlightenment is only achieved once you realize long-run is the only time horizon that matters.

Successful investing is for patient people.

Further Reading:

Stocks For the Long Run

1Just for fun, I included year-to-date returns for 2023 here to show there wasn’t much movement from the bad year last year to the good year this year in terms of the 30 year numbers.