A reader asks:

I am a 34-year-old with a high risk tolerance. All of my investment accounts are 100% invested in stocks. The one thing I have a hard time finding a tried and true answer on when I do research is how to best allocate my stock investments among large-cap, mid-cap, international, emerging markets, etc. I’m not looking to get the highest return possible per se (although that would be nice), rather, I am looking to have a well-diversified portfolio that gives me exposure to the various aspects of the stock market so that my long-term return is 7%-10%. I have always utilized the following allocation for no other reason than it seems reasonable and is well diversified:

-

- 33% U.S. large cap

- 17% U.S. mid cap

- 16% U.S. small cap

- 20% developed international

- 14% emerging markets

Does this seem about right to you? Would love to know how you think about your stock allocation and what you utilize as a good benchmark.

I can’t promise anything when it comes to future returns for the stock market but a global benchmark for the stock market is fairly straightforward.

The world stock market is a good starting point to compare your 100% stock portfolio to because that’s the investable universe.

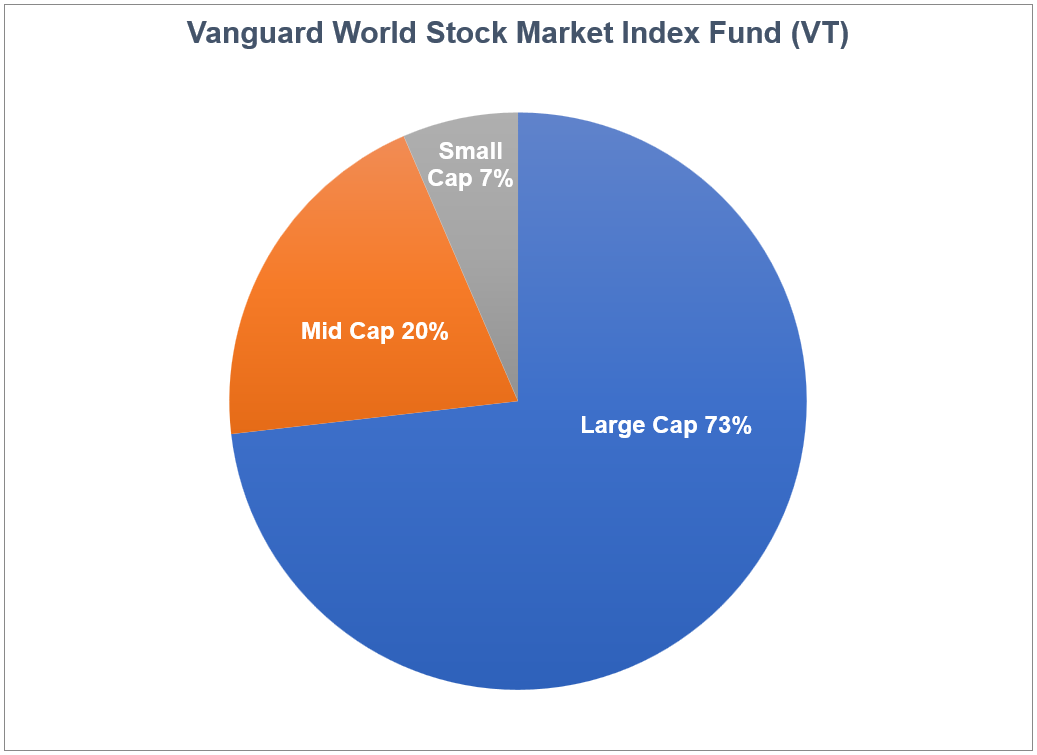

Here’s the current breakdown based on the Vanguard World Stock Market ETF (VT):

That’s nearly 60% in U.S. stocks, one-third in foreign developed stocks and just under 10% in emerging markets.

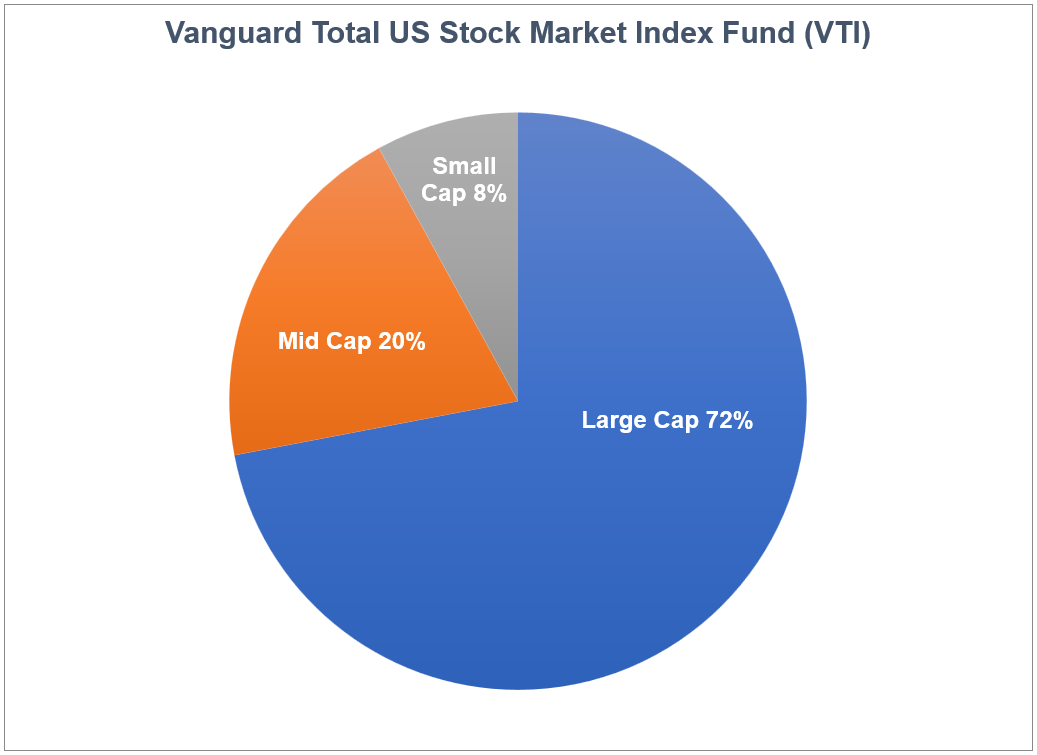

This is market cap breakdown on a global basis:

The large, mid and small weightings globally are basically the same as they are in the United States:

I’m not saying you have to follow global weightings (actually the portfolio in question is pretty close). I just think the global market cap is a good jumping-off point to see where you differ from the actual market.

If nothing else, you can use the world stock market as a benchmark for performance attribution and understand where your bets are being made.

Many investors probably assume the S&P 500 or a total U.S. stock market index fund should be the benchmark of choice. With the United States making up 60% of the total pie and getting all of the publicity when it comes to the financial media, I understand why this would be the case.

In fact, out of the top 25 holdings for the Vanguard World Stock Market Index Fund, just 4 are foreign companies:

America dominates the stock market.

I do, however, still think there is room for diversification if you’re going to invest your entire portfolio in stocks.

I know it seems like the S&P 500 always outperforms small caps, mid caps, international developed markets and emerging markets but you don’t have to go back that far to find a time when the biggest companies in America underperformed.

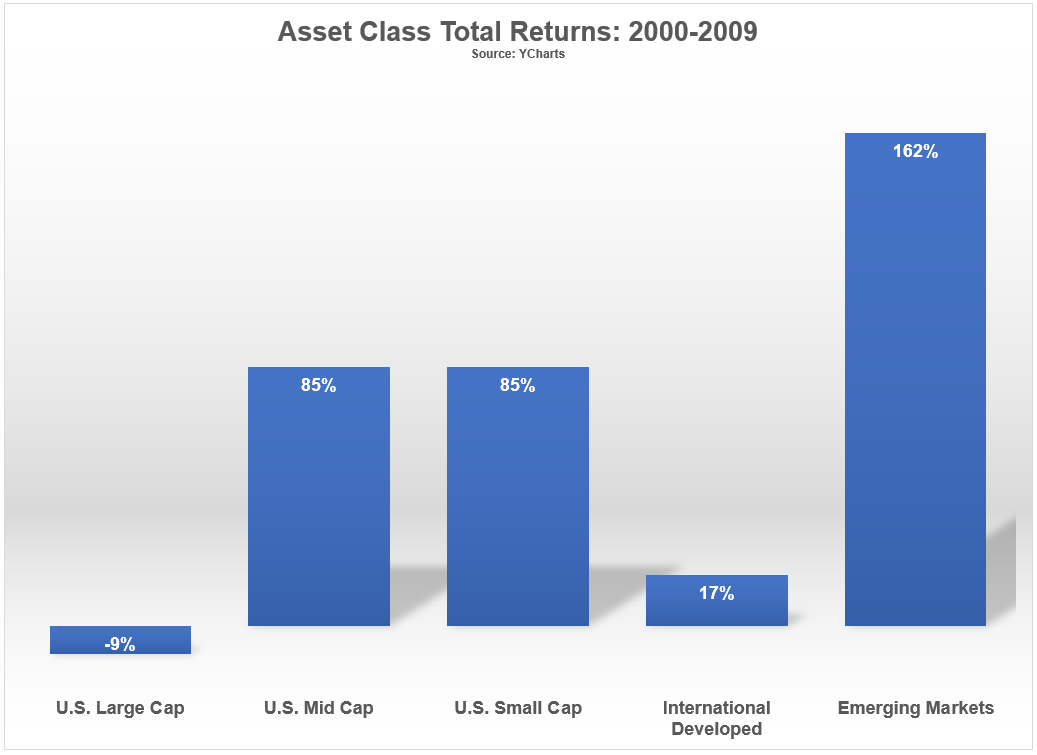

There are the total returns1 in the first decade of the 21st century:

It was a lost decade for the S&P 500. And diversification saved the day if you spread your bets among these other areas of the market.

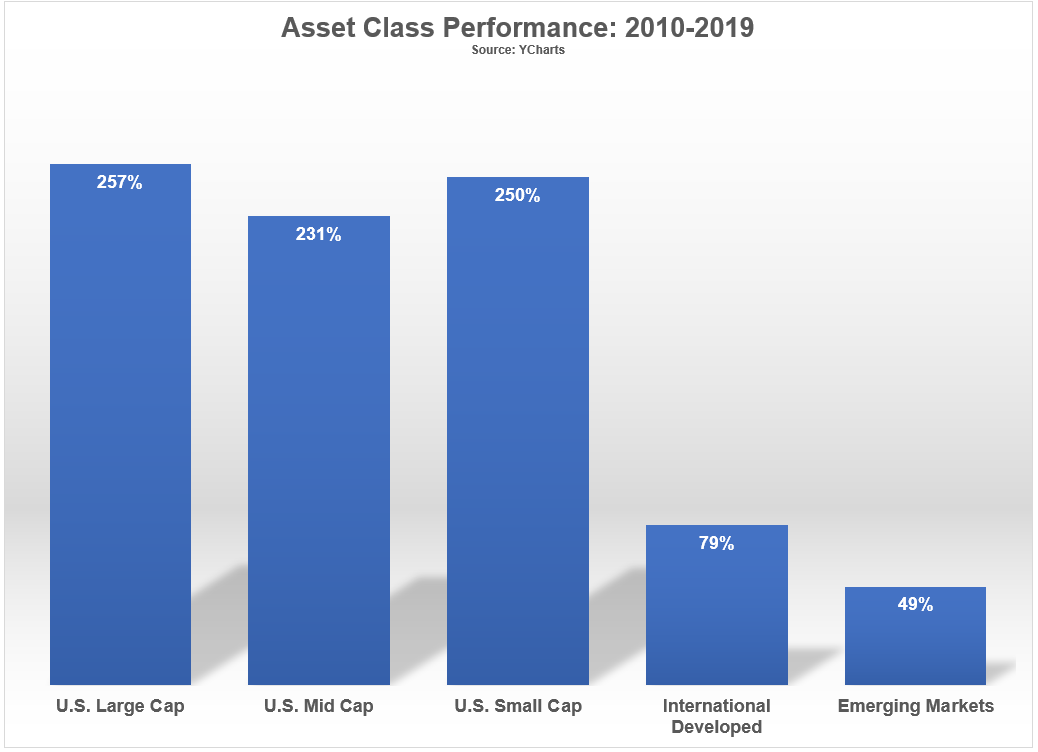

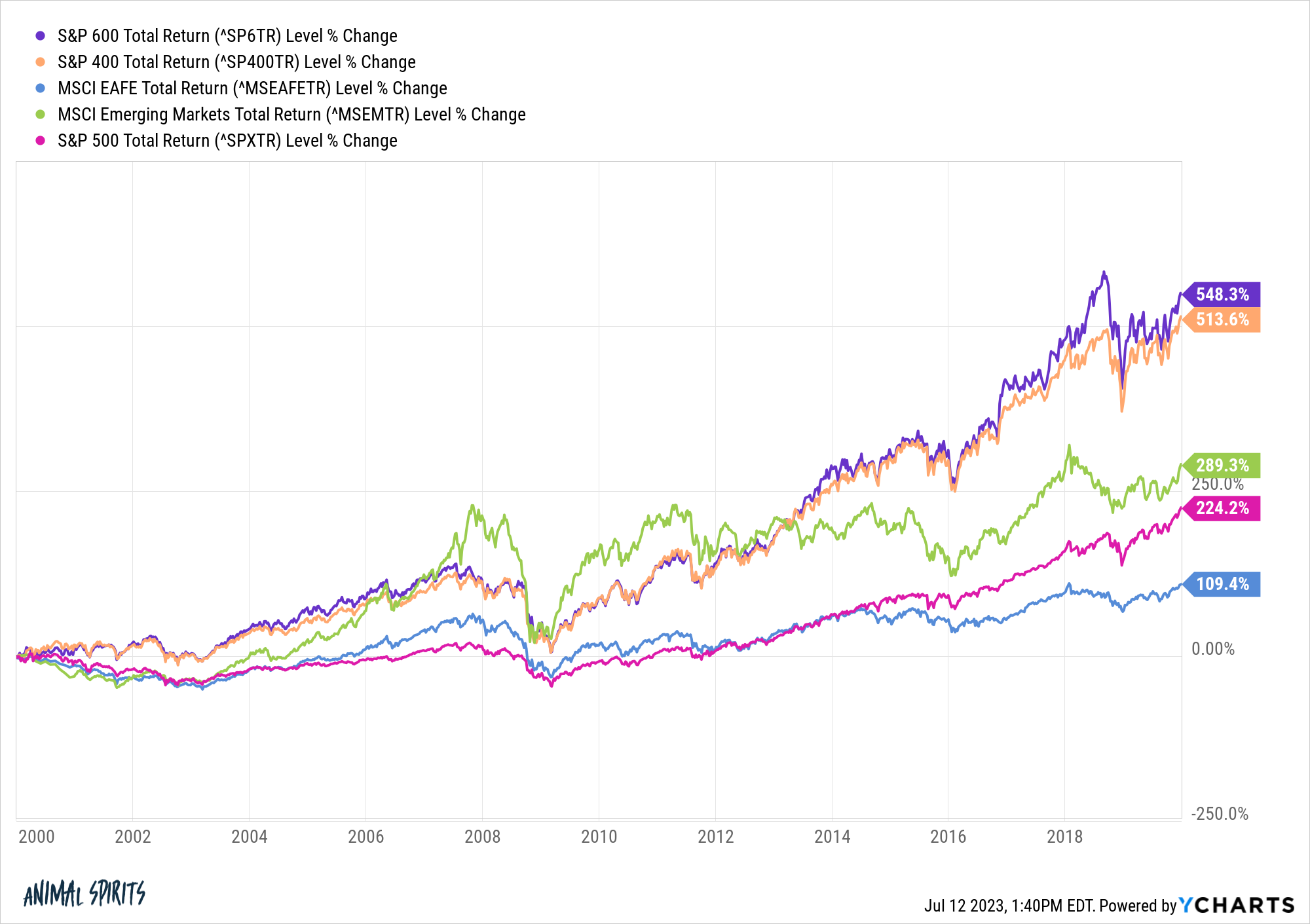

Now here’s what happened in the ensuing decade:

The S&P 500 came back with a vengeance while emerging markets went from first place to last place.

Now here’s what it looks like if we put it all together for both decades:

Surprisingly, the S&P 500 ranks second to last in terms of total performance from 2000-2019.

Some of this has to do with the start and end dates chosen here. The year 2000 was likely the worst entry point in modern U.S. stock market history.2 I could change the start date and the S&P would look at lot better than this.

But maybe that’s my point.

You just never know when certain markets, geographies, market caps or risk factors are going to knock the cover off the ball or strike out.

That’s why I think diversification is important, even if you plan on investing 100% of your money in the stock market.

We talked about this question on this week’s Ask the Compound:

Doug Boneparth joined me on the show this week to discuss questions about managing your finances in middle age, budgeting for RSUs, financial planning for families and how to allocate between investments and cash.

1Here’s what I used for each asset class here: S&P 500, S&P 600, S&P 400, MSCI EAFE and MSCI EM.

2September 1929 wasn’t great either.