A reader asks:

My target date fund does a lot worse than SPY. Should I just move to an index fund for my 403(b)?

The S&P 500 is the market we talk about the most frequently in the financial media so that’s the benchmark most investors use when trying to gauge performance.

This is a mistake, especially if you are a diversified investor.

Let’s look at an example to show why your targetdate fund might be underperforming the S&P 500.

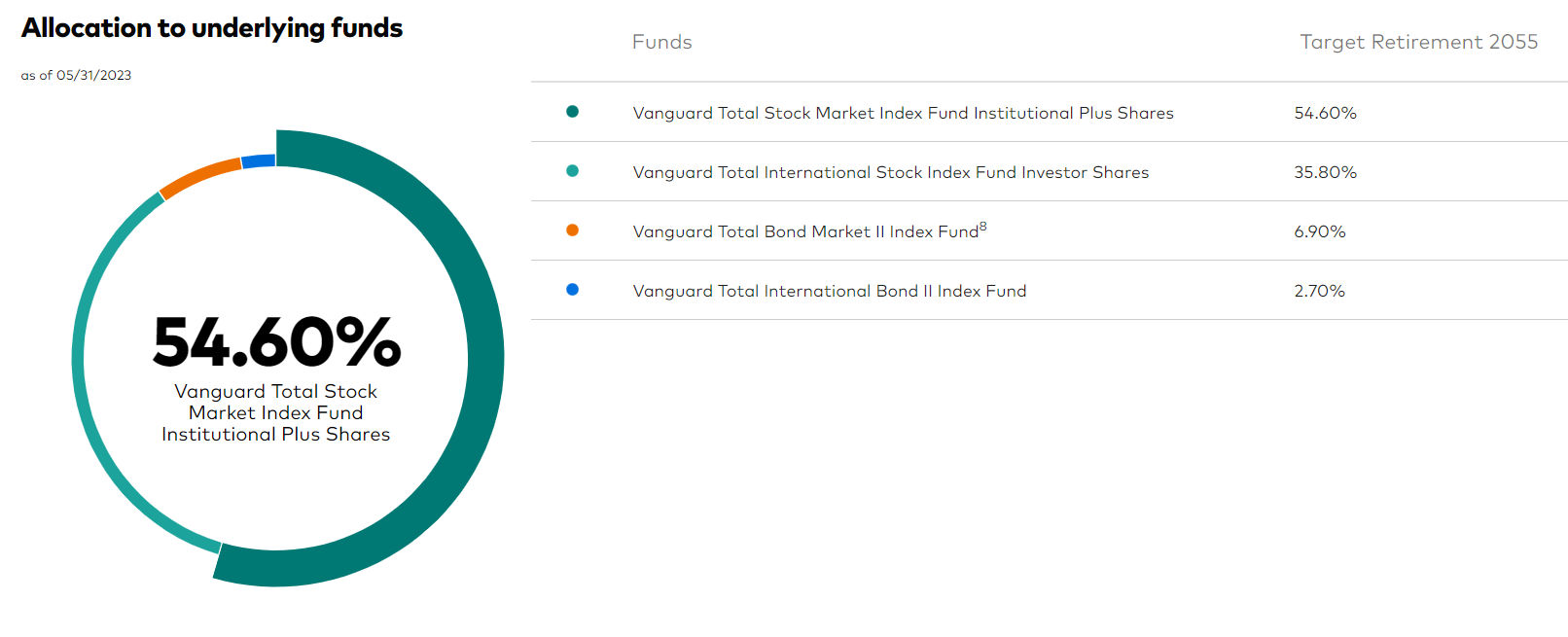

I don’t know which targetdate fund you’re using but let’s look at Vanguard 2055 targetdate fund to see what the allocation looks like:

More than 90% of this fund is invested in stocks, with a 60/40 mix between U.S. and international stocks (which is basically how the world market cap looks). The other 10% or so is invested in U.S. and international bonds.

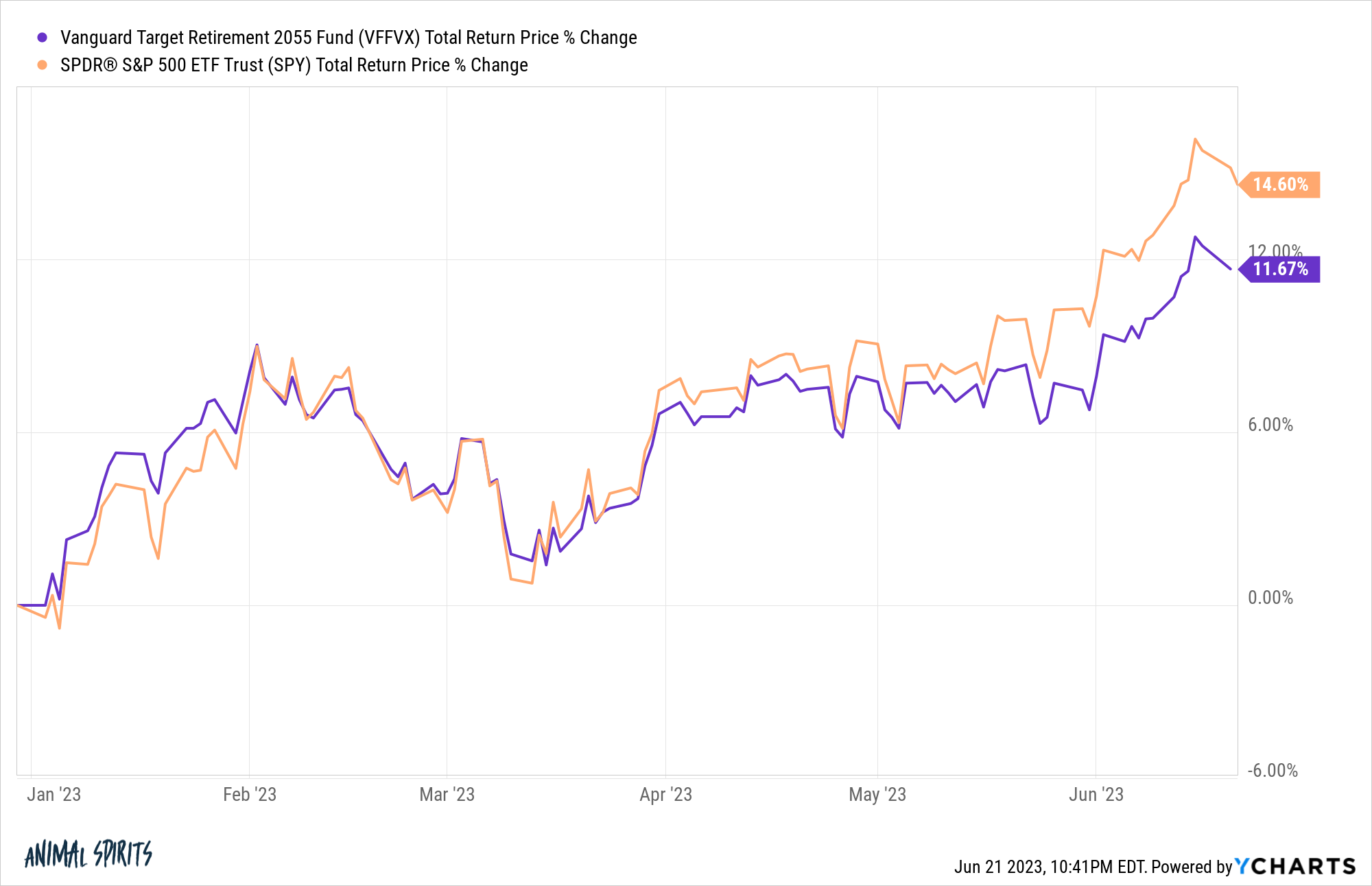

You can see this fund is underperforming the S&P 500 this year:

Why is this the case?

It’s pretty simple really.

U.S. bonds are up less than 3% while international bonds are up a little more than 3%. International stocks are up 10% on the year while the S&P 500 is up more than 14%.

If your target portfolio is a 100% allocation to the largest stocks in the United States and you are underperforming the S&P 500, that’s a problem. But if your target allocation is something more diversified then using the S&P 500 as a benchmark is comparing apples to oranges.

Early on in my investment career, I was taught the SAMURAI acronym to remember what constitutes a legitimate benchmark:

- Specified in advance (preferably at the start of the investment period)

- Appropriate (for the asset class or style of investing)

- Measurable (easy to calculate on an ongoing basis)

- Unambiguous (clearly defined)

- Reflective of the current investment opinions (investor knows what’s in the index)

- Accountable (investor accepts the benchmark framework)

- Investable (possible to invest in it directly)

I actually think a targetdate fund is a good benchmark for diversified investors. It checks all the boxes.

I’m a big proponent of targetdate funds because they are generally:

- Low cost

- Broadly diversified

- Rebalanced automatically on your behalf

- Simple (a single fund of funds)

- They are professionally managed

- They change the asset allocation for you over time

Now, it could be you don’t have your portfolio aligned with your tolerance for risk. If underperforming during raging bull markets is a problem maybe you need to be fully invested in stocks.

All of my retirement funds are 100% in stocks but that’s me. You also have to deal with the downside of being fully invested during soul-crushing bear markets too. There are always trade-offs involved.

Not everyone can handle that much volatility but for those with the intestinal fortitude it can make sense.

My worry here is the only reason you’re wanting to put all of your money into an S&P 500 index fund is because it’s one of the best-performing markets in the world, not only this year, but for the past 10+ years.

It’s one thing to make portfolio decisions based on changes to your circumstances, risk appetite or time horizon. Problems arise when you make portfolio decisions based on recent performance numbers that have nothing to do with your goals or emotional disposition as an investor.

The perfect portfolio will always look clear with the benefit of hindsight. Diversification means that your portfolio will never be fully invested in the best-performing asset class, strategy, factor or fund. But that’s a feature, not a bug.

This question really boils down to how you’re benchmarking your investment performance in the first place.

Benchmarking can be useful when it’s set up with good intentions, realistic expectations, and a system of checks and balances to ensure it’s incentivizing the desired behavior, not just a set of desired outcomes.

Benchmarking your performance to other investors or an investment that doesn’t match your portfolio’s allocation can be harmful because it can cause you to make decisions that go against your own best interest.

It’s always going to feel like you should’ve taken less risk during a bear market and more risk during a bull market. The goal is to pick a target asset allocation that can balance those feelings to allow you to survive both types of markets.

And the only true benchmark you should really care about is whether or not you’re on track to achieve your financial goals.

Real risk for investors has nothing to do with underperformance or black swans or recessions or market crashes or any of that stuff we obsess about all the time.

The real risk is that you don’t reach your financial goals. I’ve never met a single successfully retired person who got to that point by paying attention to alpha or Sharpe ratios.

You don’t judge your investment performance based solely on what “the stock market” is doing. You judge your performance based on your asset allocation.

And that asset allocation should be tied to your risk profile, time horizon and goals.

We discussed this question on the latest Ask the Compound:

Bill Sweet joined me yet again to discuss questions on long run stock market performance, the pros and cons of Roth IRAs, the benefits of HSA accounts and when to spend Roth money during retirement.

Further Reading:

The Case For International Diversification

Podcast version here: