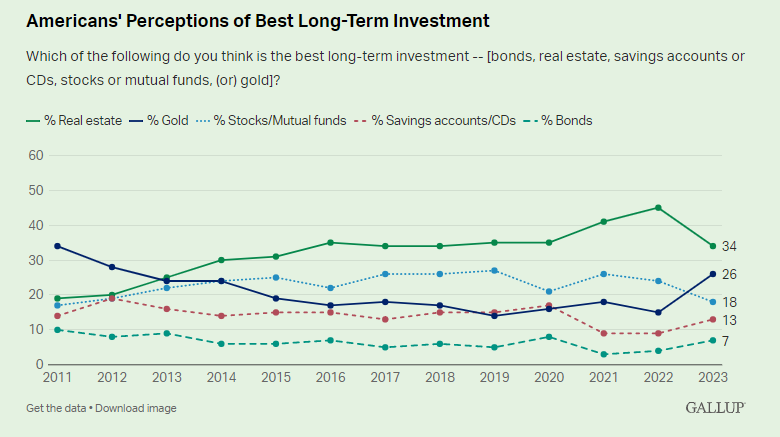

Each year Gallup performs a survey that asks a group of Americans what the best long-term investment is among the following options:

- Stocks

- Bonds

- Cash

- Gold

- Real estate

These are the latest results:

Real estate has been at the top of the charts for over a decade at this point but it saw a big drop from 2022 to 2023.

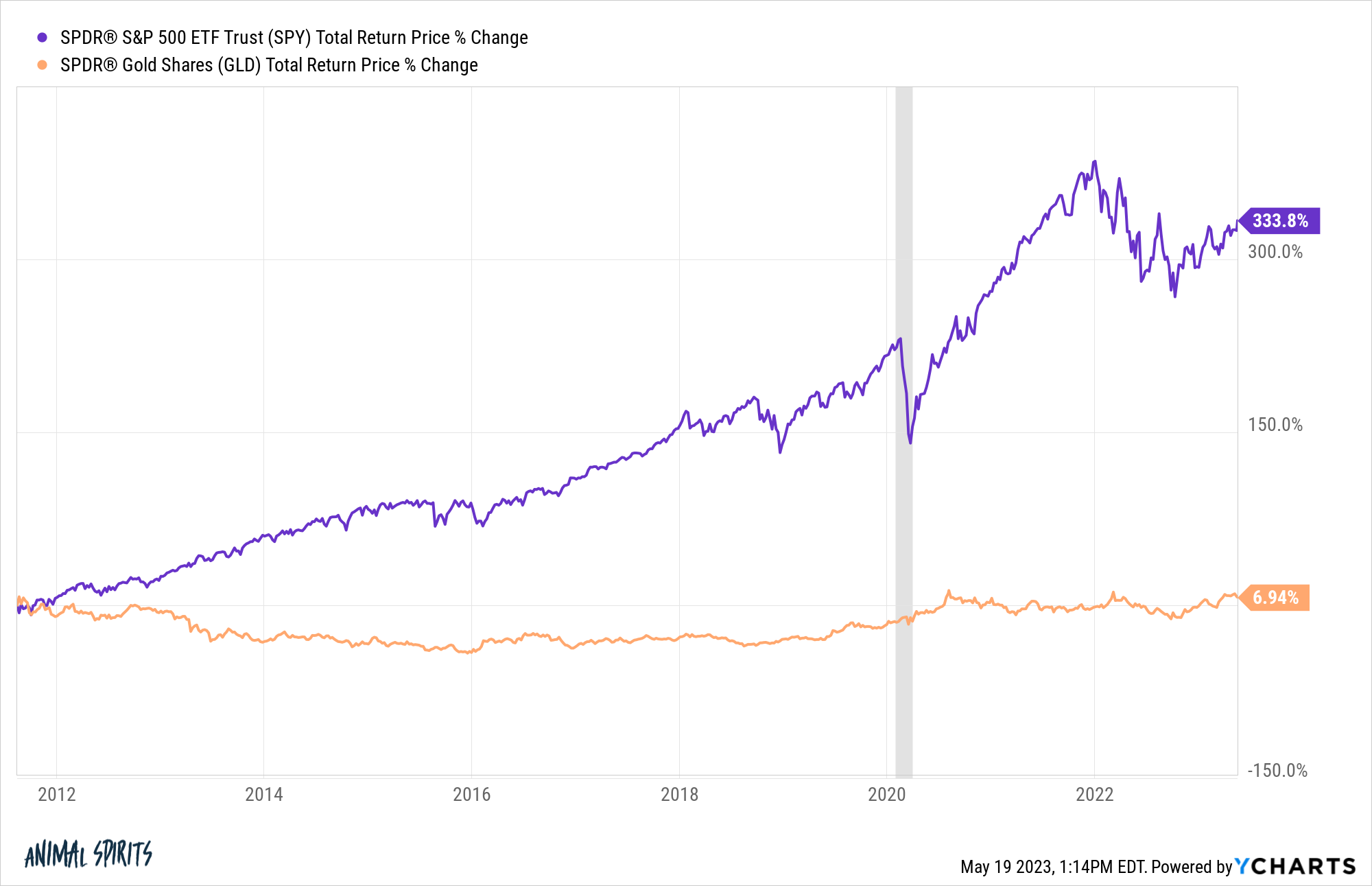

Following the 2022 bear market stocks fell to third place behind gold. Interestingly enough, gold was in the pole position in 2011:

This was a good contrarian indicator if there ever was one since gold peaked the very same month this survey was released. The yellow metal has basically gone nowhere ever since:

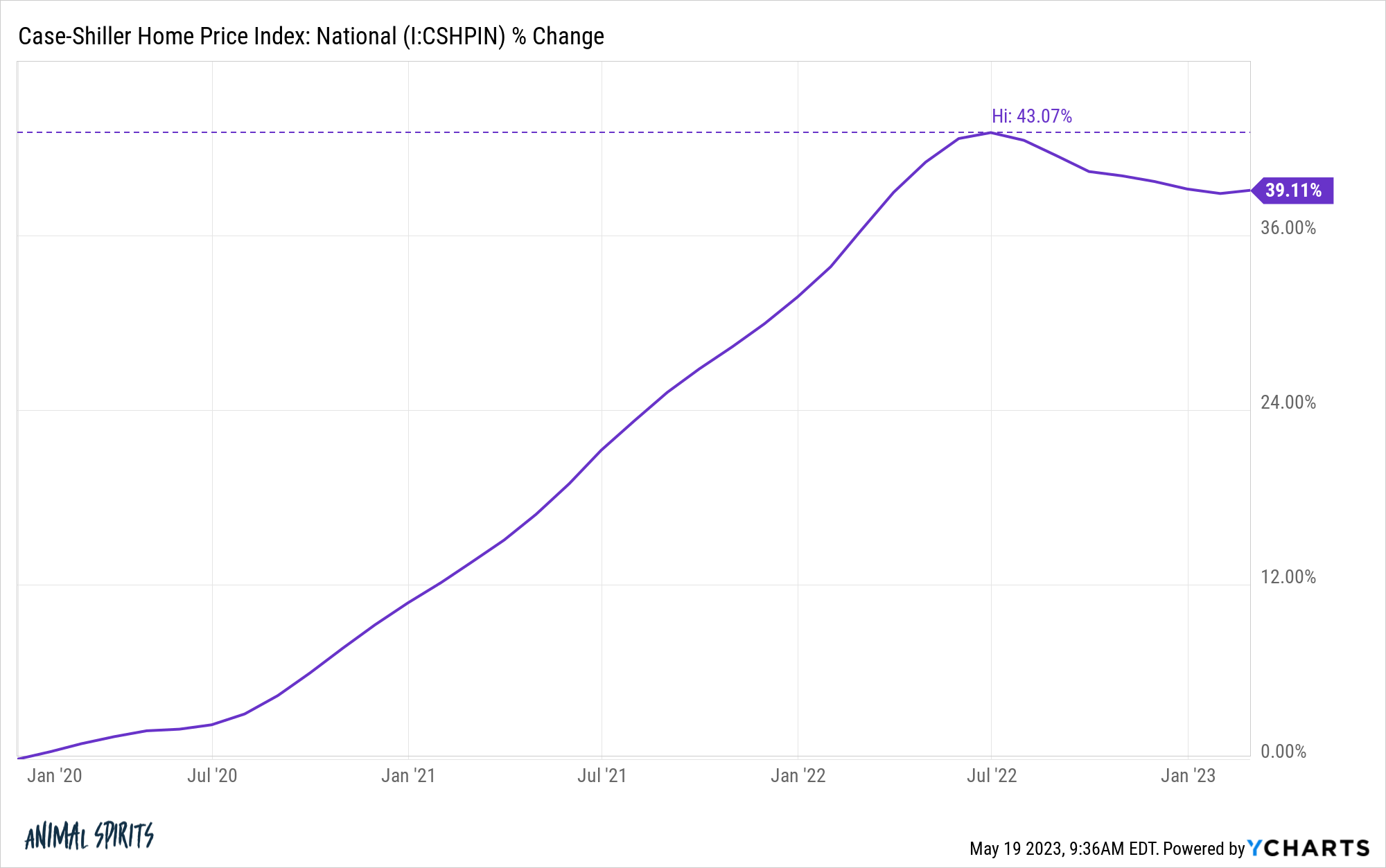

With real estate in the top spot will there be a similar comeuppance in the years ahead?

With affordability levels off the charts and the fact that we basically pulled forward a decade’s worth of gains and then some in 3 years, it would make sense.

I don’t know what future house price returns will look like but it’s hard to see massive gains from current levels of prices, mortgage rates and affordability levels.

It does make sense that so many people assume real estate would be the best long-run investment opportunity.

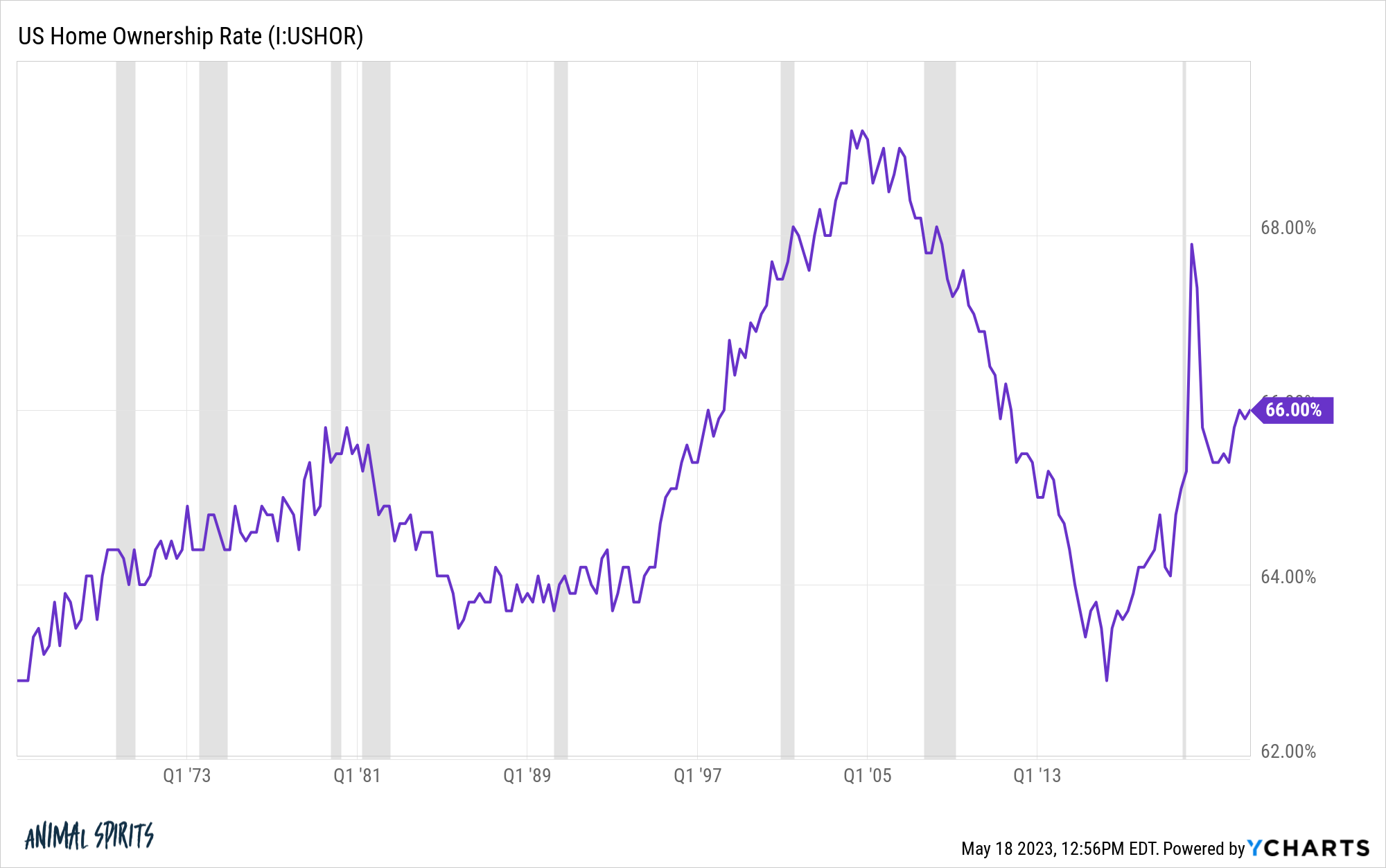

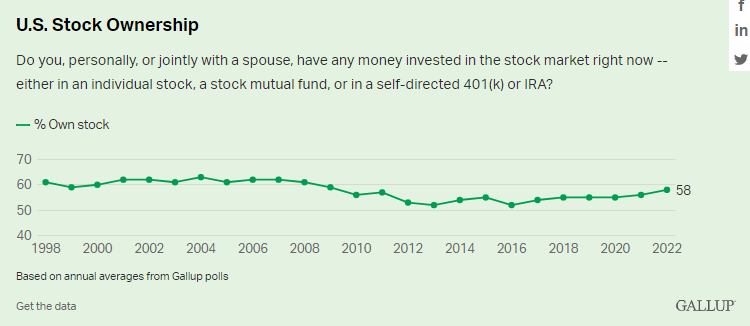

The home ownership rate in this country is higher than the stock ownership rate:

We’re all told from an early age that a house is the biggest investment you can make. Owning a home is a form of forced savings so it also makes sense that it becomes the biggest financial asset for most Americans.

Plus everyone has a parent or relative who bought a house for like $50k in the 1970s or 1980s that is now worth $500k.

Housing is the most personal of all assets since you can’t live in your shares of stocks.

The biggest problem with looking at a house as a financial asset is that it’s also a form of consumption. You have property taxes, insurance, maintenance, remodeling, upkeep, landscaping and all of the other things you have to buy as a homeowner to keep it functional.

There is also leverage involved since most of us cannot afford to buy a house with cash. This typically works in your favor but it’s worth mentioning. It would seem crazy if everyone put 5-20% down on their stock investments and borrowed the rest but that’s exactly what happens with most home purchases.1

The illiquidity involved in the housing can be a pro or con depending on how you look at it.

You can’t spend your house so the inherent illiquidity can be a downside if you need the cash for some other use. But the illiquidity of the housing market is a positive from the standpoint of forcing people to hold a financial asset over the long haul.

You can buy and sell a house in a short period of time but it’s not financially beneficial to do so considering all of the frictions involved in the process (realtor fees, moving costs, closing costs, inspections, etc.).

It is hard to believe stocks never got higher on this list during the 2010s bull market but investors have built a sturdy wall of worry about the stock market ever since the Great Financial Crisis.

I’m not so sure you can use these types of surveys for contrarian indicators like you could in the past. Sure, investors will always chase performance but the timing is always what gets you on these things.

The good news is you don’t have to pick just one asset class to invest in over the long-term. You can own stocks, bonds, cash, gold, real estate or anything else you want in a diversified manner.

And most investors do own a home along with a diversified portfolio of more liquid financial assets.

No one ever forces you to put all of your eggs in one basket like they do in a survey.

I prefer to remain diversified because I have no idea what’s going to happen in the future with any of these asset classes.

Michael and I talked about the best long-term investment and more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Why Housing is More Important Than the Stock Market

Now here’s what I’ve been reading lately:

- You can be successful without being insufferable (Young Money)

- How climate change and demographics could keep inflation high for years (Vox)

- Ben Graham saw that he was wounded (Beyond Ben Graham)

- How much does it actually cost to own a home? (The Long Game)

- ChatGPT is no threat to real advisors (Nerd’s Eye View)

- The greatest wealth transfer in history is here (NYT)

1Obviously, stock prices are more volatile than home prices but you get the idea.