Some random market thoughts after a nice long holiday weekend:

Tech stocks don’t need lower rates to go up. Tech stocks got crushed last year with the Nasdaq 100 falling more than 30%. The Fed raised interest rates from 0% to more than 4% so that didn’t help long-duration assets like growth stocks.

But there was this theory many people latched onto that tech stocks were only a rates play.

In the 2010s and early-2020s rates were on the floor while tech stocks went bananas so it seemed apparent that there was an inverse relationship. When rates were lower tech stocks would do well and when rates were higher tech stocks would do poorly.

However, this year the Fed has now taken rates over 5% and could continue raising rates one, maybe two more times before all is said and done. Meanwhile, the Nasdaq 100 is up more than 30% in 2023.

Does this mean easy money had nothing to do with tech stock gains? I wouldn’t go that far.

Low rates certainly helped long-duration assets.

But low rates alone didn’t cause Apple to increase sales from $170 billion to nearly $400 billion in 10 years. Low rates have nothing to do with the AI speculation currently taking place with NVIDIA shares.

Interest rates are an important variable when it comes to the markets and economy. But rates alone don’t tell you the whole story when it comes to where people put their money.

Tech stocks were also a fundamental play on innovations that have now become an integral part of all our lives.

The stock market still likes disinflation. Over the past 94 years the inflation rate has been higher from one year to the next 50 times and lower 44 times.1

On average, the stock market has much better returns in a year when inflation is lower than when it’s higher.

Since the late-1920s, the average annualized return for the S&P 500 when inflation is higher year over year is 5.5%.

The average return when inflation is lower year over year is 14.3%.

This doesn’t always work. Just like interest rates and tech stocks, no market relationship is set in stone.

But it looks like inflation is heading lower and that is probably a good thing for the stock market if that trend continues.

TV shows are the new movies. I saw this list of the summer’s most anticipated movies:

Oof.

I’ll watch the new Mission Impossible because it’s Tom Cruise and sign me up for Oppenheimer but the rest of these are retreads and sequels that don’t inspire a lot of confidence in Hollywood’s creativity.

On the other hand, I just got done watching the finale for Succession this weekend and it is easily the highest-quality show I’ve ever seen. The acting and writing were phenomenal.

The show is now on my Mount Rushmore with Breaking Bad, The Sopranos and The Wire (Mad Men and Six Feet Under are probably next in line).

I guess the people who used to make high-quality movies have moved on to TV.

The economy is more resilient than anyone thought. Betting against the stock market is usually a losing proposition. You could probably say the same thing about betting against the U.S. consumer.

We love spending money in this country and the pandemic seems to have accelerated this desire.

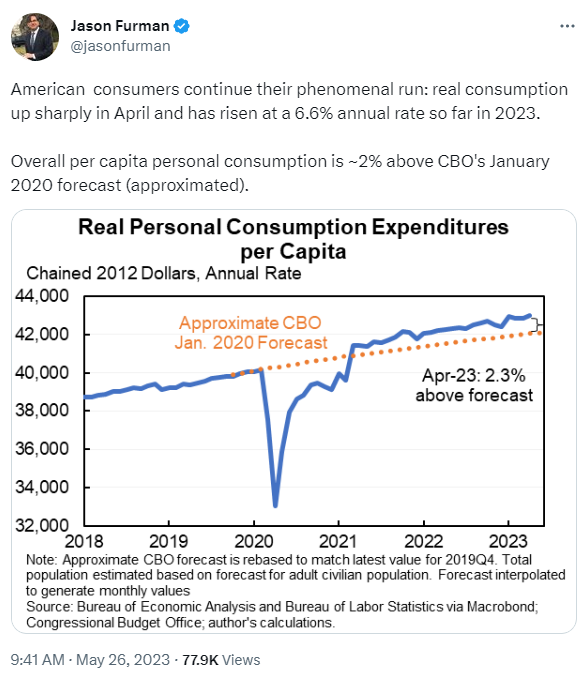

Jason Furman recently shared a chart that shows how far above-trend spending is:

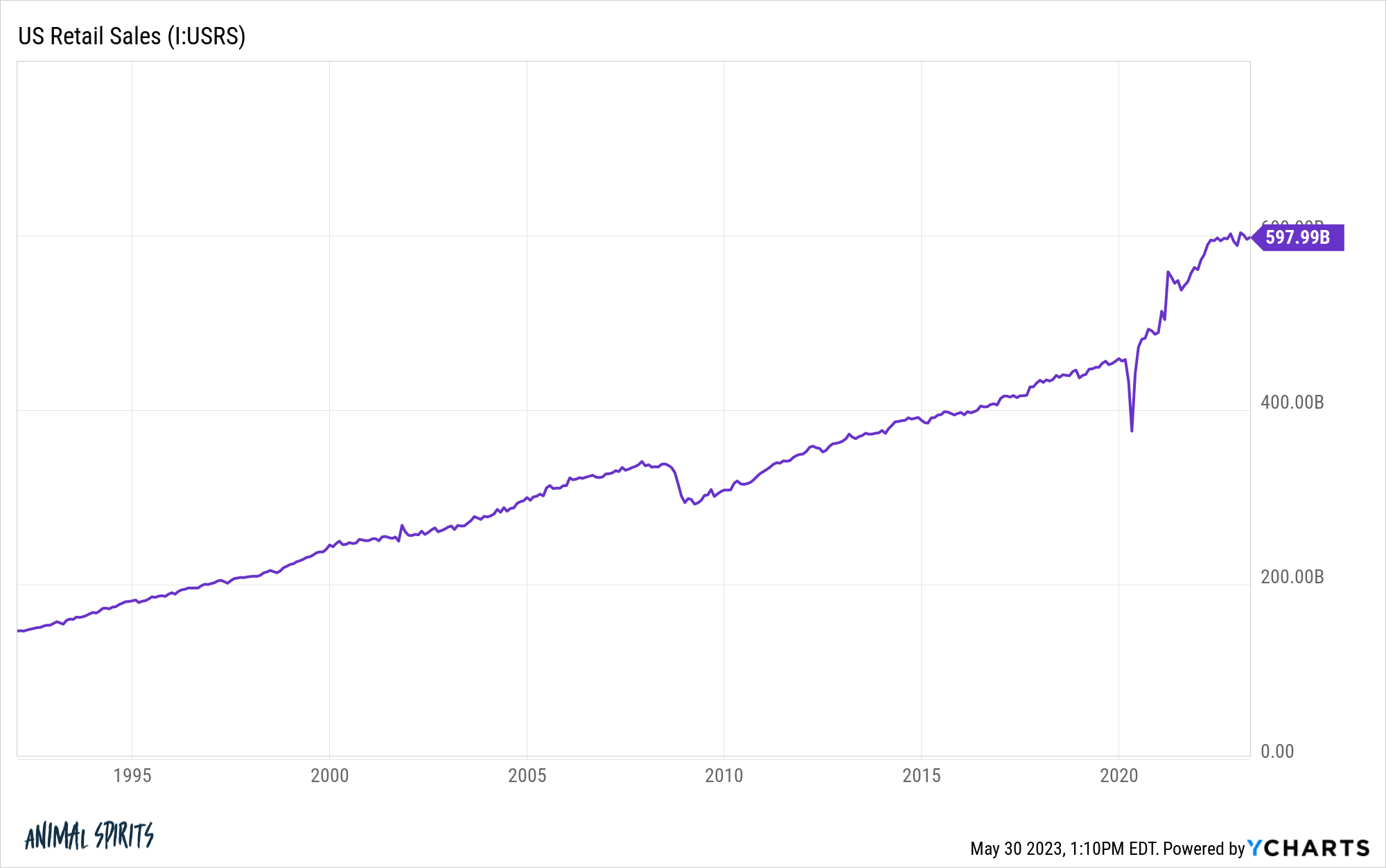

This one always blows me away too:

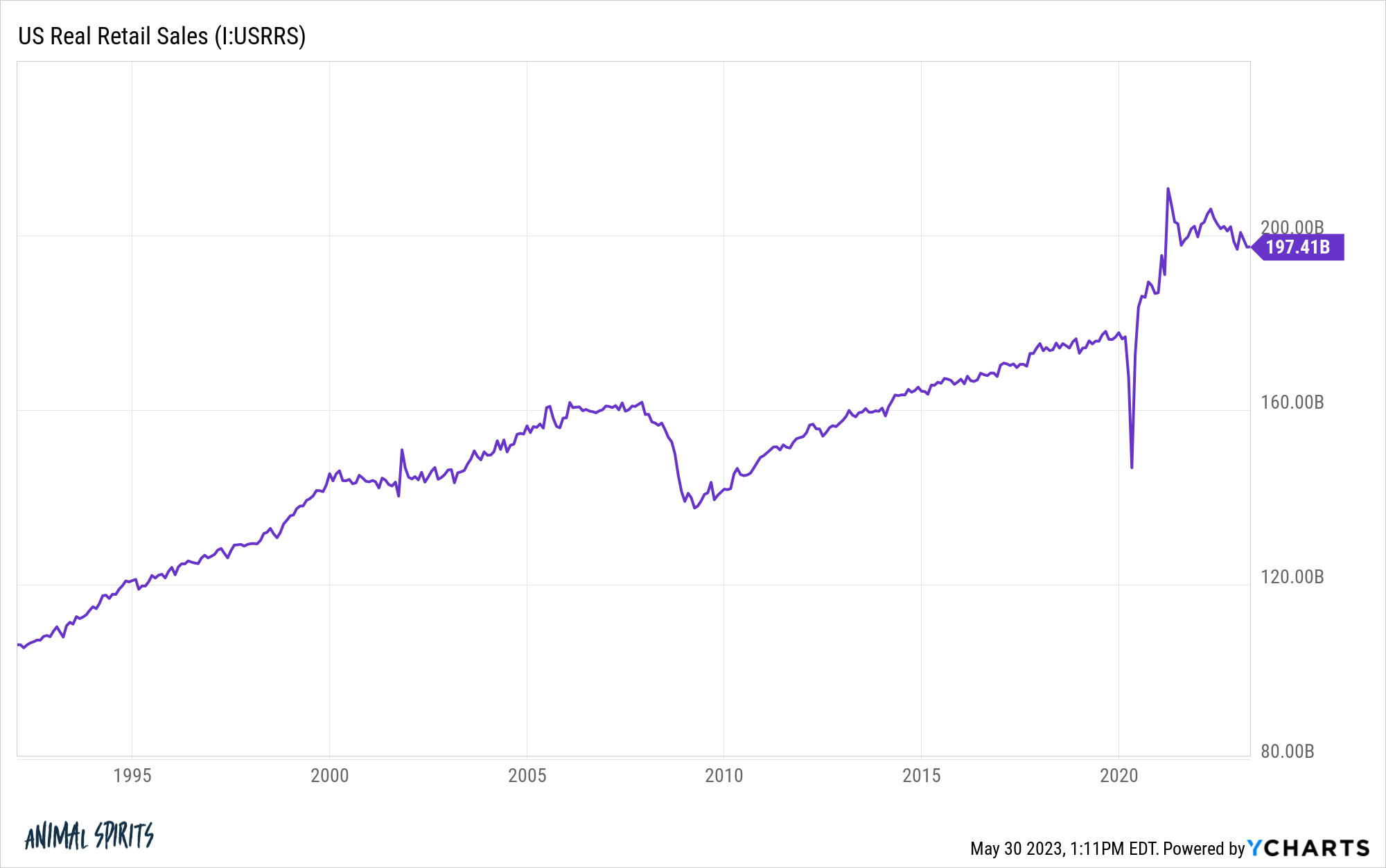

Sure a lot of this has to do with inflation, but even on a real basis the amount of money we’ve been spending is well above the previous trend:

There were plenty of people who assumed the economy was addicted to 0% interest rates. It felt like the Fed couldn’t possibly raise rates this high, this fast without breaking something.

A lot of people thought we were already in a recession in 2021 and 2022. Check out this headline from last July:

Maybe this stuff works on a really long lag but color me as surprised as the next person when it comes to the resiliency of the U.S. economy.

Higher rates and inflation don’t guarantee poor stock market returns. There are a lot of market/econ people who think we could be in a new regime of higher rates and higher inflation.

It’s a possibility worth considering.

Many of those same people assume this will be a bad thing for markets. After all, the past 40+ years of financial market returns are all of a product of disinflation and falling rates, right? Right?

Not so fast.

These are the average annual returns for the U.S. stock market over a 40 year period of rising inflation and interest rates:

- 1940-1979: 10.3% per year

And these are the average annual returns for the U.S. stock market over a 40 year period of falling inflation and interest rates:

- 1980-2019: 11.7% per year

The results are surprising.2

Things were better during the 1980-2019 period but not as much as one would think.3

I don’t know if we are entering a new regime of higher rates and inflation. But if we are it doesn’t necessarily mean the stock market is doomed.4

Things generally work out…most of the time. I tweeted this during the weekend of the SVB banking crisis when we still didn’t know if more bank runs were to come the following Monday:

I’m not naive.

Bad stuff does happen. The world can be a cruel place.

But most of the time the world doesn’t end. And if it does your portfolio positioning is not going to matter.

This is why I wasn’t too concerned about the debt ceiling discourse. Sure it could have led to a disaster and it might someday if a crazy politician takes things too far.

I just don’t see the need to default to a pessimistic view of the world just because things aren’t perfect all the time.

I know there were be another crisis in the future. We’ll have a recession. The stock market will crash. Things will look bleak.

‘Things don’t always work out but most of the time they do’ will continue to be my default stance.

After all, what’s the point of investing in the first place if you don’t think things will get better in the future?

Further Reading:

Can We Get Bubble with Higher Interest Rates?

1When I say lower I don’t necessarily mean deflation. It could be going from 3% inflation to 2% inflation. Still up but just at a lower rate of change.

2Obviously real returns were lower in the first 40 year period than the second. Inflation averaged 4.3% from 1940-1979 and 3.2% from 1980-2019. Still closer than you expected right?

3Bond returns had a much higher range. From 1940-1979 the five year treasury returned 3.4%. From 1980-2019 they returned 7.1% per year. But this had more to do with higher starting yields in 1980 and lower starting yields in 1940 than rising or falling interest rates.

4I know it seems like two inflation stats in this post are in conflict with one another but my takeaway is inflation matters more to stocks in the short-run than the long-run.