The Federal Reserve has a dual mandate — price stability and maximum employment.

Prices haven’t exactly been very stable these past few years so it’s no surprise inflation has been the main focus for Jerome Powell and team.

I’m sure the Fed wishes they could wave a magic wand that would keep the inflation rate and unemployment rate at their target levels.

If only it were that easy.

The Fed kept interest rates on the floor for most of the 2010s in hopes they could push up the rate of inflation to boost economic growth.

It didn’t work.

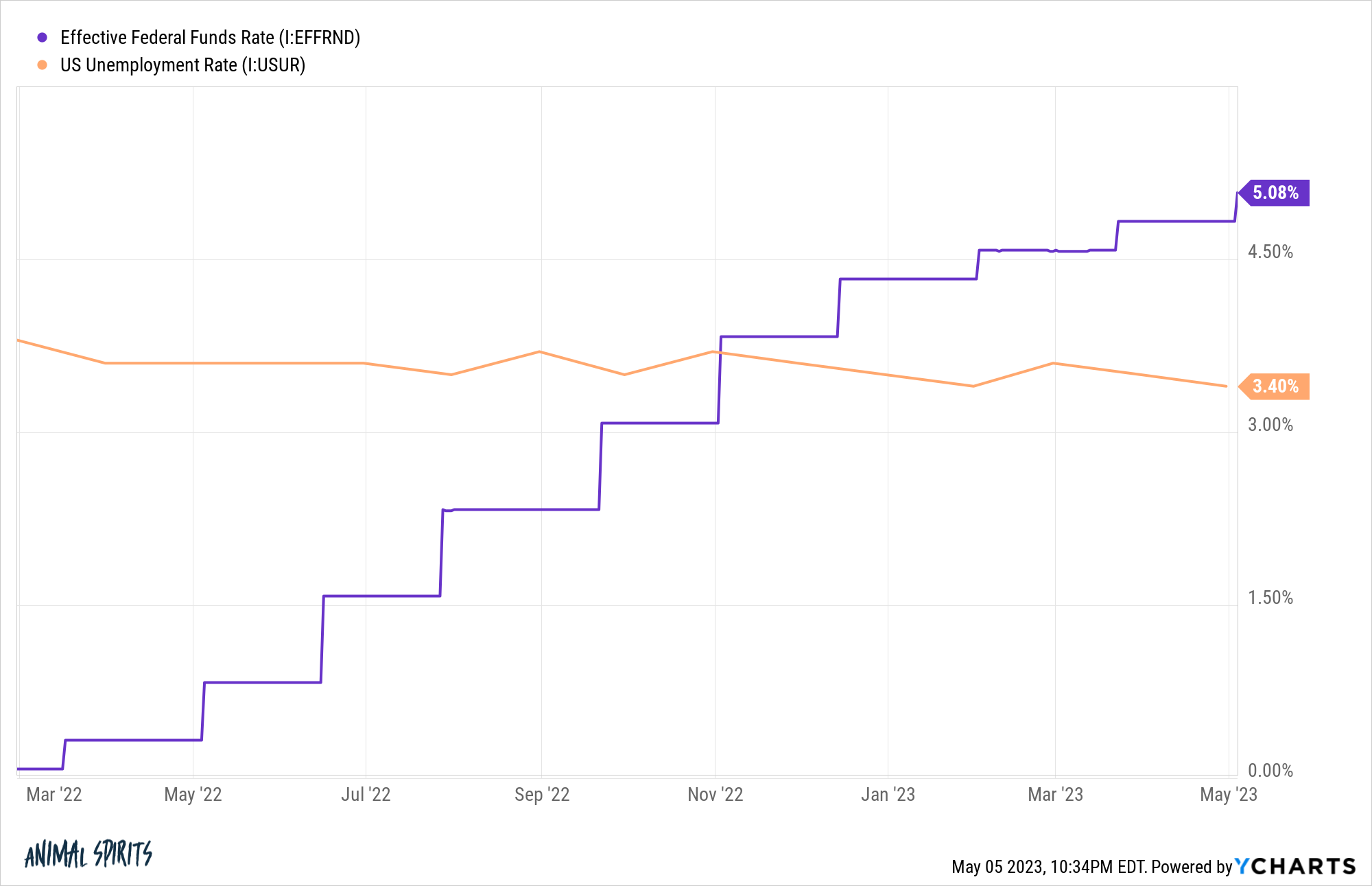

For the past year and change the Fed has gone on one of the most aggressive interest rate hiking cycles in history in hopes they could push up the rate of unemployment to slow the pace of inflation and economic growth.

Also not working.

Jerome Powell has basically said he wants millions of people to lose their jobs.

They want a higher unemployment rate and slower wage growth so the economy will take a breather and inflation will fall to more reasonable levels.

Inflation has been slowing but not because of a slowing labor market.

The labor market doesn’t seem to care about the Fed just yet:

The unemployment rate has actually fallen since the Fed went from 0% to 5% with rates.

The Fed is actively trying to get the unemployment rate to move up and they can’t make it happen.

Sure, if they keep raising rates like a bunch of lunatics and borrowing costs get out of control, yeah the economy is going to slow and people are going to lose their jobs.

But the past couple of cycles have proven that the Fed doesn’t control the labor market. And they certainly can’t control inflation as much as they would like.

They can raise or lower the cost borrowers pay on their debt or the yield savers earn on their cash. They can act as the lender of last resort during a banking crisis or keep the credit system afloat during a calamity.

But the Fed has been no match for one of the strongest labor markets we’ve ever seen.

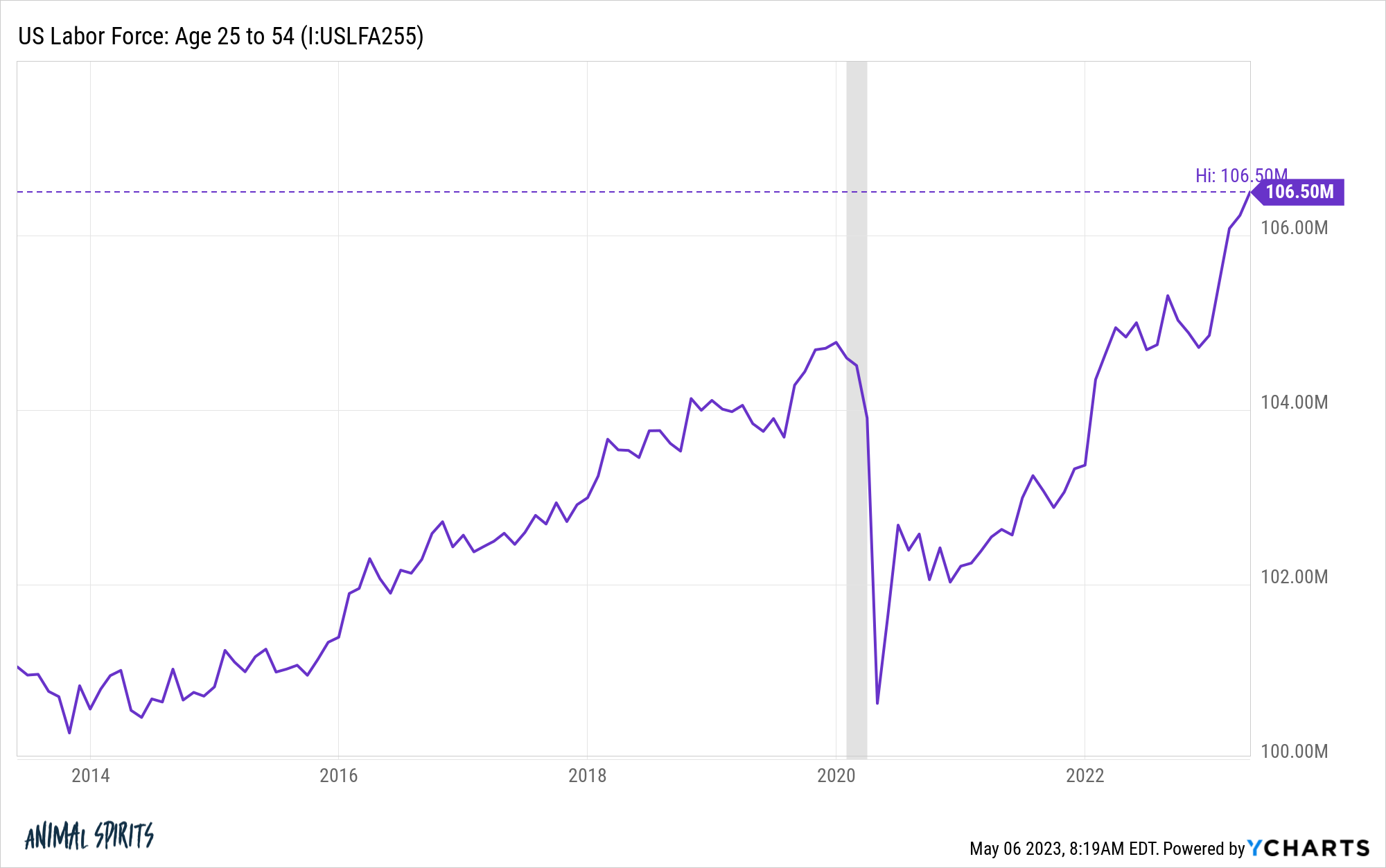

The U.S. economy added nearly 5 million jobs last year. This year we’ve added more than 1 million jobs. The stock market hasn’t hit an all-time high in a while but the prime-age labor force continues to reach new heights:

The Fed wants to control inflation and the labor market but it’s harder than it sounds.

It’s difficult to control a $26 trillion economy even when you have the ability to change short-term interest rates.

There’s a good lesson here for investors.

The Federal Reserve is one of the most powerful financial bodies on the planet and yet their policies have only a marginal impact on the two most important functions of their job.1

There are so many variables that are out of your control when investing for the future.

You don’t control what the Fed is going to do with rates or what returns the financial markets give you or how fast the economy is going to grow or when the next recession will hit or tax rates or corporate earnings or the timing of bear markets, bull markets and everything in-between.

Timing and luck often play a larger role when it comes to financial success in the markets than most people would be willing to admit.

Start your investing career in the early-1980s and the wind is at your back. Start in the 1930s and stocks for the long run takes on a whole new meaning.

You can always try harder as an investor and do more with your portfolio but it doesn’t guarantee you better results.

In fact, trying harder with your investments usually leads to even worse results.

This is one of the hardest parts of investing.

There are no guarantees.

The things you would like authority over are completely out of your control.

And the things you can control — your investment plan, asset allocation, portfolio strategy, risk profile and time horizon — don’t provide any 100% assurances for success.

You focus on what you can control and try to become comfortable with the irreducible uncertainty surrounding everything else.

This is both simple and seemingly obvious, but you figure out the things that matter to you as an investor and focus on those things.

Everything else is out of your control anyway.

Further Reading:

What Is the Fed Doing?

1I also think the Fed is nuts for raising interest rates while relatively large regional banks are failing at a pretty rapid pace. Maybe this is what they want but I think they’re playing with fire here.